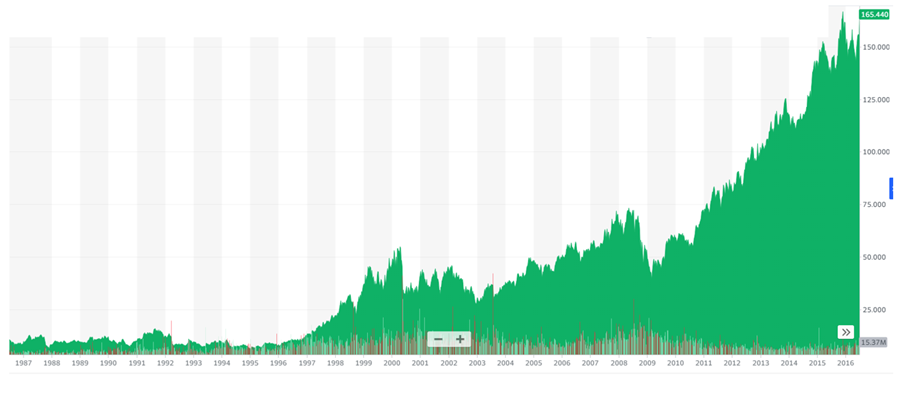

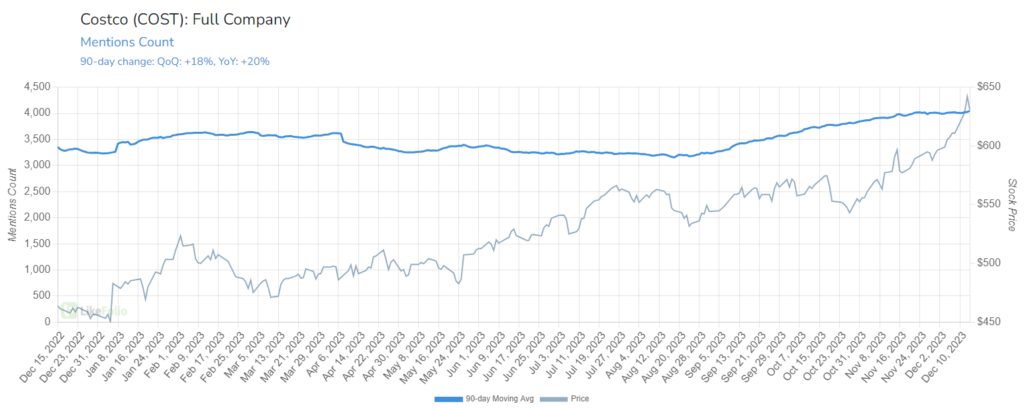

Take a look at this chart:

That might look like a rising star tech stock. But it’s actually an American classic: Costco (COST).

This “Steady Eddie” portfolio staple that’s been padding investor profits year after year is now soaring into 2024 on a fresh wave of investor momentum.

Shares rallied this week ahead of earnings with investors speculating about a potential price increase.

And no, we’re not talking about its iconic $1.50 hotdog – we’re talking about a hike in its membership fees.

The last time Costco raised the price of membership was in June 2017, so it’s due for another.

An anticipated hike would serve as a sort of double punch, building on previous efforts to crack down on membership sharing through an extra ID check at self-checkout.

While last night’s earnings results didn’t deliver the membership fee increase Wall Street was expecting, what we got might’ve been even better.

Along with a 6.1% year-over-year boost in net sales to $56.72 billion, a 7.6% increase in paid household members, and strong earnings beat, Costco announced a special cash dividend – just in time for the holidays.

Any investor holding COST as of December 28 will receive a special dividend payout of $15 per share on January 12, 2024.

That was enough to send COST soaring another 5% today to a new intra-day high of $661.88 (as of this writing), putting it on track for another record close to top off a week-long rally.

From an execution standpoint, Costco is firing on all cylinders.

But what about from a consumer standpoint? That’s where our data offers unique insight.

Here’s the full story on whether Costco could sustain this growth into 2024, even with a membership fee increase still looming…

Betting on an American Classic

Costco is known for doing just about everything in its power to avoid raising prices for members. That’s why folks love it so much. So we’re not surprised we haven’t seen one yet.

“We haven’t needed to do it,” Chief Financial Officer Richard Galanti said. But it’s very much still inevitable – calling it “a question of when, not if.”

Costco tends to raise its fee every five to six years, so folks are now speculating it could come this summer.

When the membership crackdown was first announced, LikeFolio logged a dip in Costco’s Consumer Happiness levels.

But we’re confident that most consumers will willingly accept a fee increase.

Costco’s retention rate in its core markets (U.S. and Canada) impressively hit 92.8%, even slightly up from the previous quarter. That means 92.8% of its members renew every year… a stunning rate.

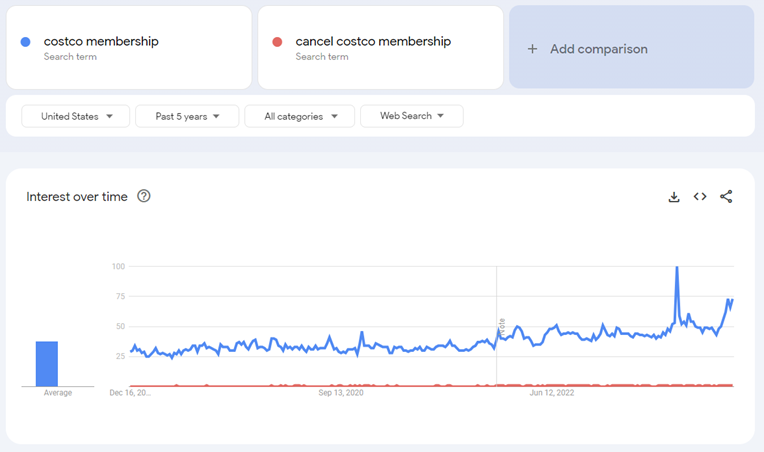

Google Trends confirms this retention train is still on the track, even as new membership searches spike:

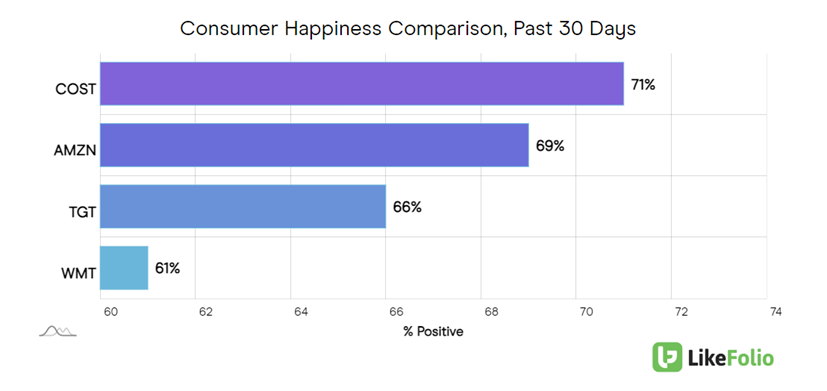

In addition, LikeFolio’s data indicates that Consumer Happiness remains strong at 71%, beating out peers like Amazon.com (AMZN), Target (TGT), and Walmart (WMT), suggesting continued pricing power.

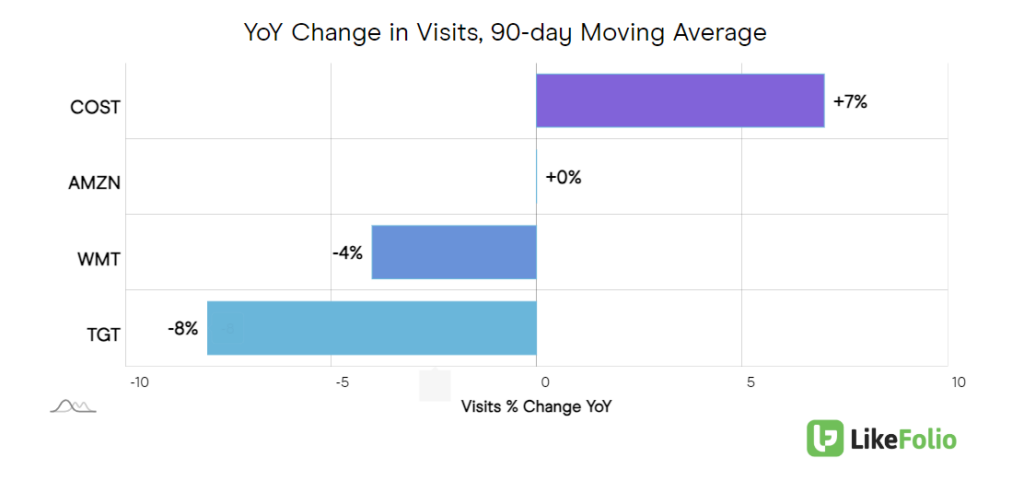

Costco is also outperforming that group of heavy hitters in web traffic growth, with visits gaining 7% on a year-over-year basis while AMZN stagnates (0%) and WMT (-4%) and TGT (-8%) see drop-offs:

And when it comes to consumer buzz, momentum looks strong, with mentions up by 20% year over year:

Costco reports monthly sales updates, which usually removes much of the uncertainty and surprise of quarterly earnings reports…

Aside from big announcements like special dividends or membership price increases, of course.

We’re excited to see COST zooming. And from a longer-term view, our data supports the stock’s recent upward trend, with Costco outperforming competitors in every metric that matters to us.

We anticipate continued growth for Costco in 2024, bolstered by a strong membership offering and happy customers.

Costco makes a great bet on an American classic. But there’s always room in our portfolio for another kind of bet – a moonshot.

You know, one of those lesser-known stocks trading for just a few bucks… but with the potential to skyrocket?

Well, we’ve got our eye on a $3 pick that fits the “moonshot” bill to a T. Not only is it riding the AI profit train – but it’s set to benefit from a political ad spending spree in the new year.

Check out this gem today while it’s still flying under the radar.

Until next time,

Andy Swan

Founder, LikeFolio