Not many could’ve anticipated the meteoric rise of the fast-casual chicken wing restaurant, Wingstop (WING).

This chain specializing in chicken wings (and otherworldly ranch dipping sauce) has seen its shares rocket nearly 400% over the last five years alone:

What’s this secret sauce Wingstop seems to have figured out? The recipe comes down to:

- A straightforward menu offering classic wings, boneless wings, or crispy tenders in a variety of craveable flavors

- More than 2,000 locations around the world

- Strong, easy-to-use digital ordering and sales channels

- Innovative store concepts like ghost kitchens and cashless, off-premises-only formats

- A laser focus on efficient operations

- And seriously, the ranch is that good (consumer applause is off the charts)

But as you learned earlier this month, the fast-casual dining sector is in trouble. Persistent inflation is eroding purchasing power, particularly for lower-income consumers, and making dining out less affordable.

First Signs of a Slowdown

Until now, inflation seems to have worked in Wingstop’s favor:

It’s benefitted from a major consumer preference shift from beef to chicken, driven by both the perceived health benefits and affordability of poultry. (The average price of chuck roast has soared beyond $7 per pound.)

It’s also been among the restaurant chains effectively passing on commodities and wage inflation to consumers. Price increases and a favorable shift towards higher-priced menu items helped deliver 22% domestic same-store sales growth in the first quarter.

The problem? At LikeFolio, we are seeing the first signs of a slowdown.

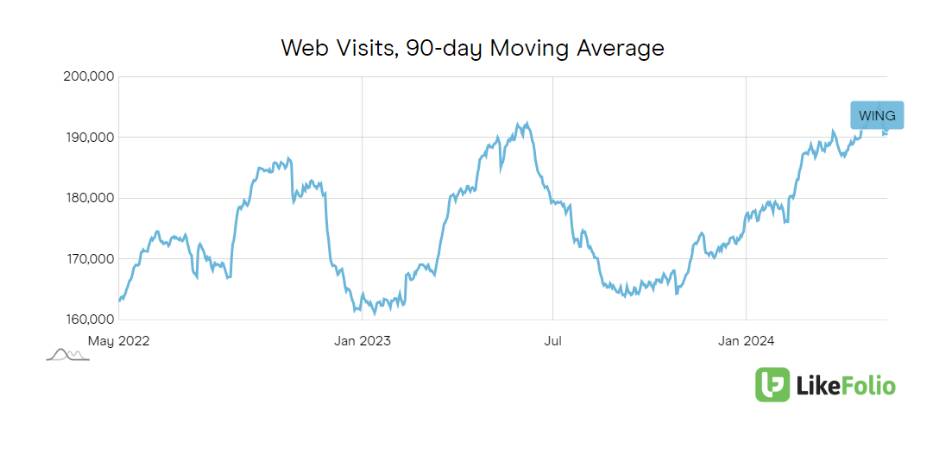

Wingstop web visits are plateauing:

While visits are up 3% year over year on a 90-day moving average, volume is flat on a tighter, 30-day moving average.

This suggests the company may be facing a pullback in demand – something that will be critical to monitor moving forward, especially as its stock trades near all-time highs.

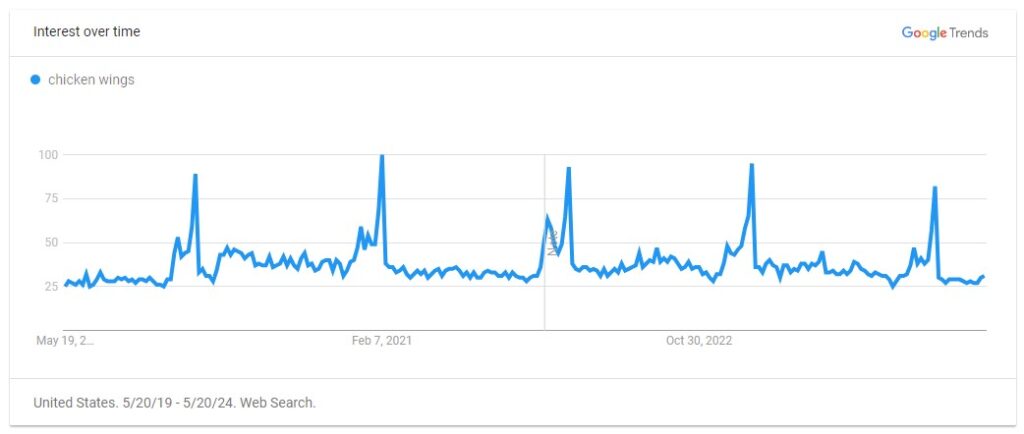

In addition, consumer interest in chicken wings is unseasonably low, with searches dropping off significantly following an annual Super Bowl spike.

We believe this could be the first sign of shifting consumer tastes in favor of healthier meal options, especially heading into summer. This, coupled with plateauing web metrics, give us room for pause regarding WING growth prospects near-term.

Wingstop believes it can reach over 7,000 global restaurants long term, including 4,000 domestic locations. Management plans to open 270 net new restaurants in 2024, marking an acceleration from the 255 net new locations opened last year.

However, if the company reports a slowdown in growth next quarter, it may be unable to clear a high bar. We’ll be monitoring WING closely through its next earnings event, which is expected at the end of July.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

These Are the Hidden Opportunities in AI, EVs, and Crypto

Here’s where we’ll find the next wave of profits lurking just beneath the surface…

How Walmart Is Capitalizing on America’s Streaming Obsession

The next episode you stream could soon contribute to Walmart’s bottom line…