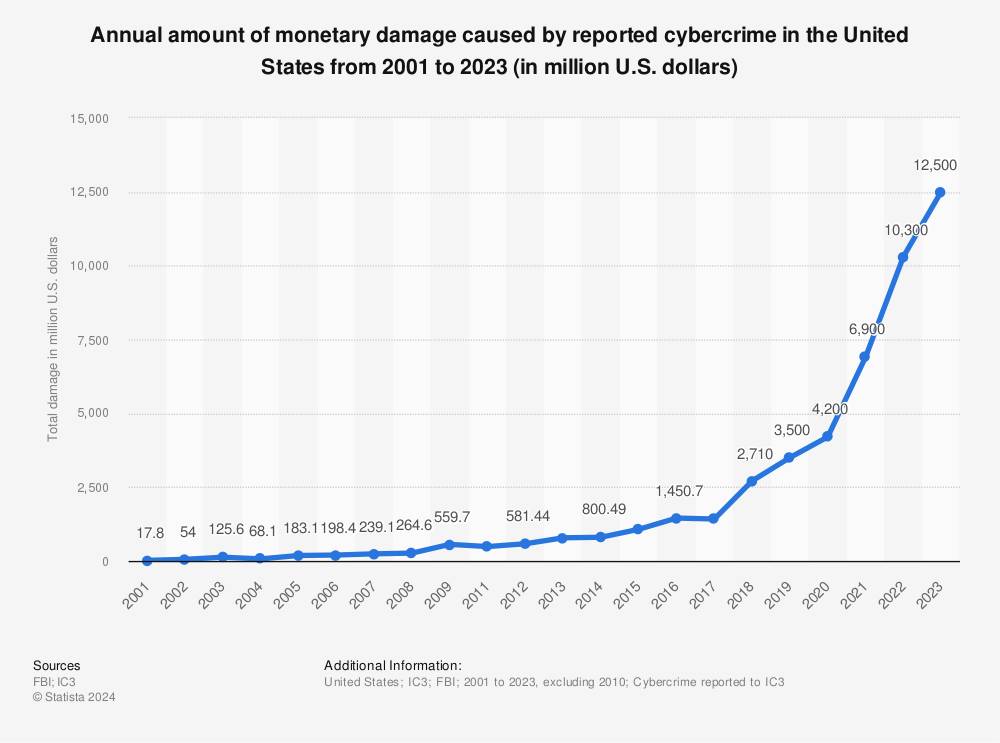

U.S. companies are losing billions of dollars every year to cybercrime – and the costs are rising at an alarming rate, reaching $12.5 billion in reported damages in 2023.

Ransomware attacks grew by 18% last year, and data breaches increased by 72% in the same timeframe.

These nefarious events have a hefty price tag… Aside from time and security risks, the cost of a cyberattack is at an all-time high of $4.9 million in 2024, according to IBM (IBM). But the truth is, these incidents can end up costing businesses MUCH more than that.

As the cybercrime problem escalates, companies are allocating more and more of their budgets to cybersecurity solutions like CrowdStrike (CRWD), one of the largest and best-known names in the industry.

As of July, CrowdStrike had nearly 60% of Fortune 500 companies under its umbrella of protection.

But CrowdStrike made a disastrous mistake recently when a faulty update to its security software hit an estimated 8.5 million systems around the world.

This single CrowdStrike outage on July 19, 2024, grounded thousands of planes; global banking screeched to a halt; critical U.S. government operations from the Department of Homeland Security to NASA were disrupted; U.S. border crossings were stalled… heck, even some hospital care had to be paused as providers lost access to patient records. And we’re just scratching the surface of the ripple effects.

While the outage wasn’t caused by a cyberattack, hackers swiftly exploited the ensuing confusion. In the aftermath, they employed “social engineering” tactics aimed at deceiving individuals into actions that could compromise their safety or that of their organization.

All told, CrowdStrike caused an estimated $5.4 billion in damages in what’s now considered the largest outage in IT history.

If rising cybercrime wasn’t enough of a problem, CrowdStrike’s outage created an even bigger one – forcing businesses and investors to seek out alternatives.

One of those alternatives has caught our attention, with strong footing in a unique position in the cybersecurity market – and plenty of room to grow…

The Cybersecurity Player in Line to Benefit from CrowdStrike’s Disaster

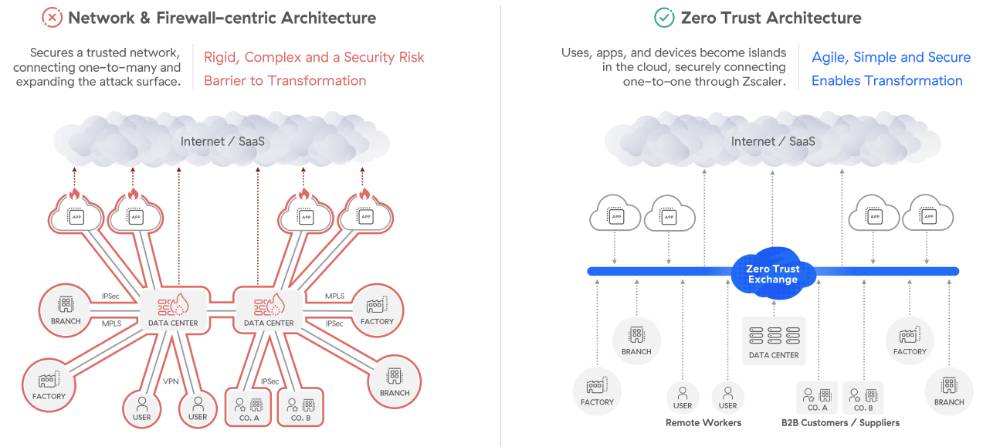

This alternative cybersecurity firm is Zscaler Inc. (ZS), whose focus on cloud-based solutions allows it to avoid the restraints of private data centers and on-site necessities, as well as grant access to greater protection data.

Due to its unique position of focusing on cloud services and Zero Trust architectures, Zscaler can appeal to a niche $96 billion addressable market, without having to compete directly with giants in the cybersecurity market.

Zscaler’s cloud-first approach provides flexible, scalable security infrastructure and avoids on-site data centers. With cloud adoption accelerating, especially in sectors like finance, health care, and retail, Zscaler is well-positioned to capture significant market share, especially within its niche.

As artificial intelligence (AI) continues to rise in prevalence and become a tool for threat actors, Zscaler is prepared to fight AI with AI by training its own security models with its trove of unique data.

The company has a solid record of continuous revenue growth, consistently beating expectations, with the most recent quarter reporting its revenue up 30.3%, beating expectations by nearly 5%.

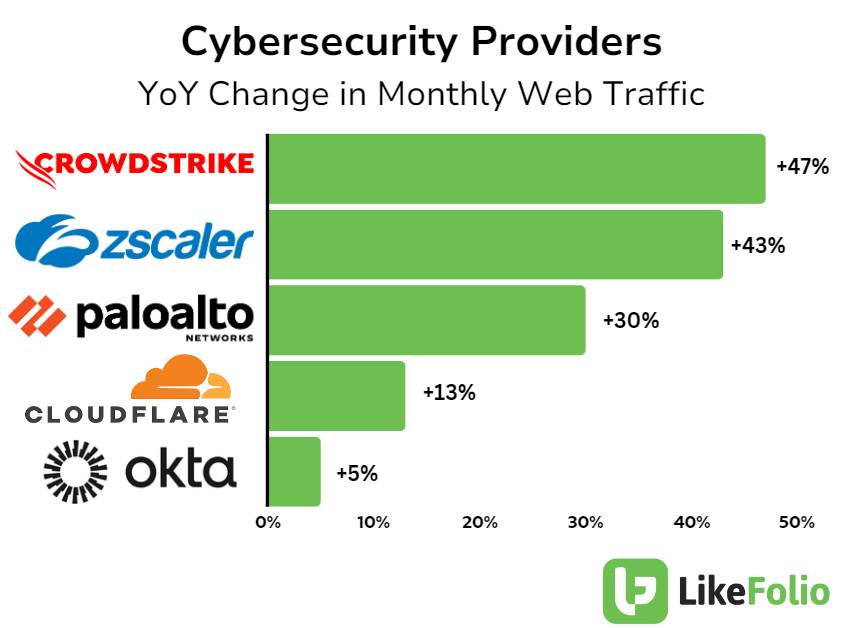

Zscaler web traffic data is also compelling, as it sits significantly higher on a year-over-year basis compared to many competitors in the cybersecurity market:

As you can see, Zscaler is close on CrowdStrike’s heels, logging an impressive 43% year-over-year gain in monthly website traffic.

The stock is trading lower in 2024 – and that’s one reason ZS caught our eye.

Zscaler’s bottom line has not made it out of the red as is continues to make significant R&D (research and development) investments and keeps up with operating costs.

However, this loss has shrunk 85% in the past two years, with the most recent fiscal year’s net loss only being 3% of total revenue. As Zscaler expands its consumer base and increases efficiency, a profitable year is likely on the horizon.

The company also posted lower-than-expected guidance last quarter.

But we believe this pullback could serve as an ideal entry point for long-term investors. It’s why this company is on our watchlist.

Bottom line: The cybersecurity market is ripe for disruption on the back of a CrowdStrike disaster that spurred some distrust. With notable improvements in LikeFolio data, Zscaler looks best positioned to capitalize over its cybersecurity peers.

For another must-watch stock in this sector, check this out – it’s a cybersecurity firm (not CrowdStrike) using AI to combat AI-powered cybercrime.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

PayPal’s Turnaround Story Is Finally Underway

Strategic partnerships put PayPal in the fast lane… See the data that has us feeling bullish.

Forget Starbucks – This Rising Coffee Chain Roasts the Competition

While the market bets on Niccol to save SBUX, we’re betting on a lesser-known up-and-comer…