The mainstream media has latched onto Tesla (TSLA) for all the wrong reasons.

News that CEO Elon Musk’s pay package is once again at risk has caught fire…

Reports from The Wall Street Journal point to intensifying EV competition in China weighing on Tesla’s sales…

Reuters suggests that Donald Trump’s incoming administration could slash the $7,500 federal tax credit on electric vehicles (EVs)…

A new study by iSeeCars claims that Tesla has “the highest fatal accident rate by brand…”

And commentary from UBS Group analysts paints the recent rally in Tesla shares as driven by “animal spirits,” rather than real fundamentals.

Tesla has a target on its back.

No doubt about that.

The onslaught of politically based opposition to Musk would have you think Telsa’s brand is at risk.

When the noise gets deafening, there’s only one way to get to the truth: by following the data.

LikeFolio Data Conflicts with the Media’s Narrative

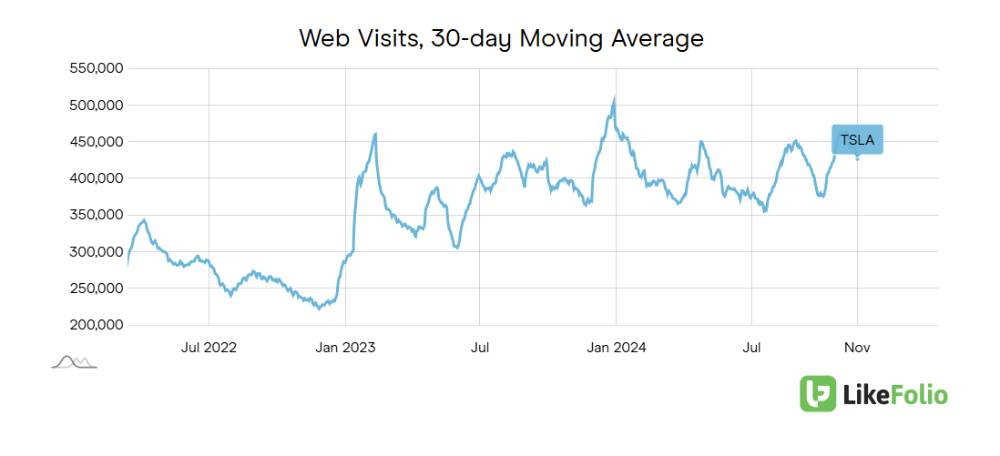

Despite the overwhelmingly negative headlines, LikeFolio’s real-time consumer data suggests something bigger may be brewing behind the scenes.

Consumer interest in the Tesla brand is rising – and quickly.

Tesla web visits are accelerating, trending 8% higher on a 90-day moving average and +17% higher on a tighter, 30-day moving average:

Our digital insights suggest that Musk’s political activism may not be having the adverse impact the media is reporting.

Quite the opposite.

In fact, many consumers may be considering a Tesla (or its services) for the first time.

New visitors to Tesla’s website jumped by 35% month over month in October, with some traffic likely generated by the company’s robotaxi event.

A qualitative review of social media mentions shows consumers and investors alike calling out Tesla in a positive light – particularly when it comes to innovation.

At LikeFolio, we continue to view Tesla as much more than a car maker. And the digital traffic data you saw today confirms rising consumer interest in Tesla’s EVs.

Cutting Through the Noise

Despite the negative narrative from the media, we believe Musk’s ties to Trump could benefit the company in a big way going forward.

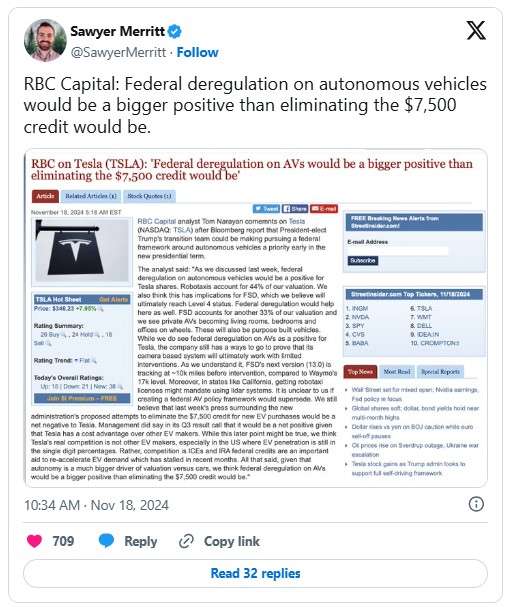

Deregulation in autonomous driving could allow Tesla to deploy its Full Self-Driving (FSD) software more widely, enhancing its competitive position in the self-driving car market.

As it stands, the National Highway Traffic Safety Administration currently permits manufacturers to deploy 2,500 self-driving vehicles per year. But reports suggest a new Trump administration may develop a framework for regulating self-driving vehicles that would provide clarity and streamline widescale adoption of autonomous driving technology.

This would allow Tesla to expand its offerings beyond EVs into broader mobility services, including robotaxis, which could generate income around the clock.

The company plans to introduce a fleet of robotaxis, including Cybercab and Robovan models, as soon as 2026. Regulatory changes could remove barriers, accelerate Tesla’s rollout, and strengthen its lead over competitors facing fragmented state rules and stricter limits.

We’ve been on the bullish Tesla train for a while now – and that conviction has consistently paid off.

Bottom line: Savvy investors may consider Tesla’s near-term road bumps as accumulation opportunities in disguise.

Until next time,

Andy Swan

Founder, LikeFolio

Is This Set to Become Musk’s Most Powerful Venture Yet?

As new allies, Trump and Musk could reshape America’s technology landscape – and Tesla won’t be the only Musk venture to benefit. We’re talking about xAI, which could soon gain the edge it needs to dominate the industry. A shift in government support, fewer barriers, and a potential “backdoor” into the AI race are just the beginning. Click here to uncover this opportunity before it’s too late.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Black Friday Special: 3 Early Holiday Shopping Winners

From traditional retail to department stores to specialized gift brands, LikeFolio data sorts the winners from the losers this holiday season…

Spotify Is Riding a Surprising New Tailwind

Here’s how consumers’ growing mistrust of institutions could benefit Spotify for the long haul…