Almost a decade ago, Dollar Tree (DLTR) won an ENORMOUS battle against a much larger competitor when it secured Family Dollar over the reigning goliath, Dollar General (DG).

Back then, Dollar Tree was much smaller than those rivals. But the company made an $8.7 billion bet to acquire Family Dollar and make sure its footprint dominated.

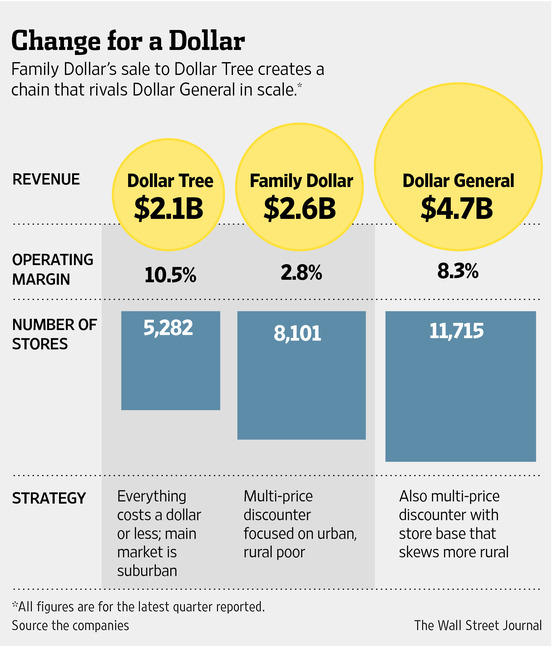

Here’s an infographic published by The Wall Street Journal at the time:

It was a hard-fought battle. Dollar General had been courting Family Dollar, even making a $9.1 billion all-cash counteroffer in the hopes of beating out Dollar Tree’s. But Family Dollar shareholders went with the safer bet, fearing a Dollar General acquisition would face regulatory hurdles.

Now, nine years later, what felt like a big win for DLTR has turned into a massive loss.

After years of struggle, the company announced yesterday that it’s looking at “strategic alternatives” to salvage the Family Dollar banner it strived so hard for. A sale could be on the table.

And it looks like Dollar General dodged one heck of a bullet.

What Went Oh-So-Wrong

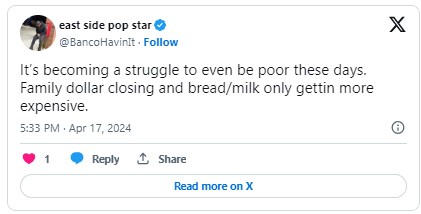

Dollar stores in general are facing challenges right now due to a shift in consumer spending towards lower-margin essentials, increased competition from rivals like Walmart (WMT) and the Chinese e-commerce platform Temu, and the ever-present issue of theft (aka “shrink”).

A stunning percentage of Gen Z shoppers (31%) admit to shoplifting from self-checkout kiosks, according to one recent survey, with many targeting expensive items. Last week, Dollar General announced it would virtually eliminate self-checkout stations in its stores.

But Family Dollar’s problems are… unique in their scope and severity.

The Family Dollar brand caters to lower-income consumers with a focus on urban locations throughout the U.S., while the Dollar Tree brand tends to draw middle-income consumers with its more rural and suburban locations.

At first, this seemed like a good match. But it hasn’t worked out that way.

In an inflationary environment, Family Dollar has seen major categories like apparel, home decor, electronics, and general merchandise weaken as its main demographic pulls back on spending.

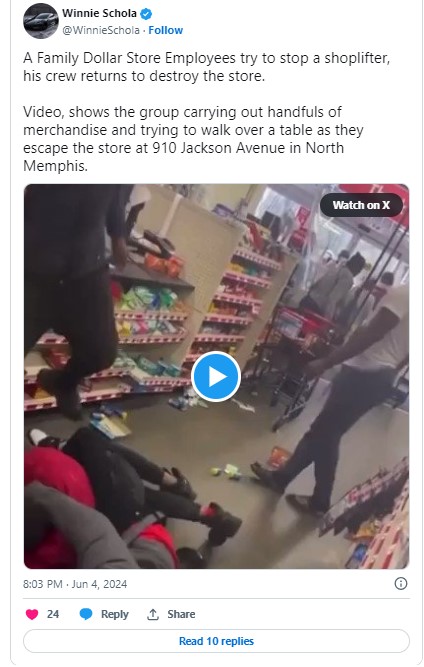

Family Dollar stores can be deceptively expensive: Despite its dollar-store moniker, items can run up to $10 apiece – if you can even find them in the jumbled mess.

It’s also poorly managed: Family Dollar was recently hit with a $41.6 million fine when a rat infestation in one of its warehouses caused hundreds of stores to shutter temporarily.

And, quite frankly, Family Dollar has earned a terrible reputation with consumers, who often report dangerous conditions at its stores.

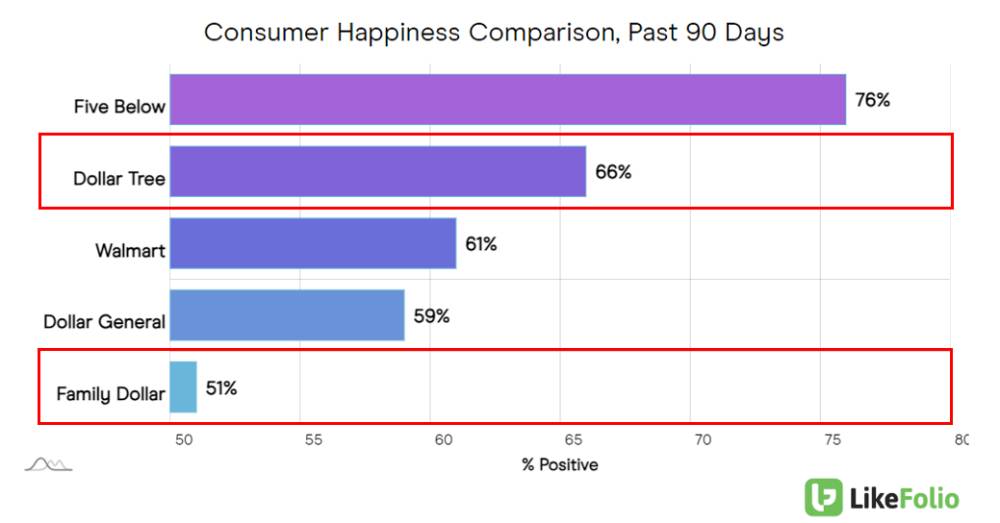

LikeFolio’s consumer metrics put a fine point on the issue. Family Dollar’s Consumer Happiness stands at an abysmal 51%:

How Is DLTR Combatting Headwinds?

Dollar Tree isn’t just giving up. It already planned to close 970 Family Dollar stores to revamp its struggling business after missing holiday-quarter sales and profit expectations in March. During the first fiscal quarter, it made progress, closing more than 500 locations.

Now, it’s looking to potentially offload Family Dollar entirely – if it can find a buyer. (And that’s a big if.)

Dollar Tree also has acquisitions underway of 99 Cents Only stores in Arizona, California, Nevada, and Texas following the latter’s bankruptcy. This acquisition allows Dollar Tree to expand its footprint in the western U.S., with conversions to begin this fall.

(99 Cents Only blamed inflation and previously mentioned theft for its closure, reflecting the broader economic challenges faced by these retailers.)

The company is also working to attract higher-income shoppers, noting it added 3.4 million new customers in 2023, mostly from households earning over $125,000 a year.

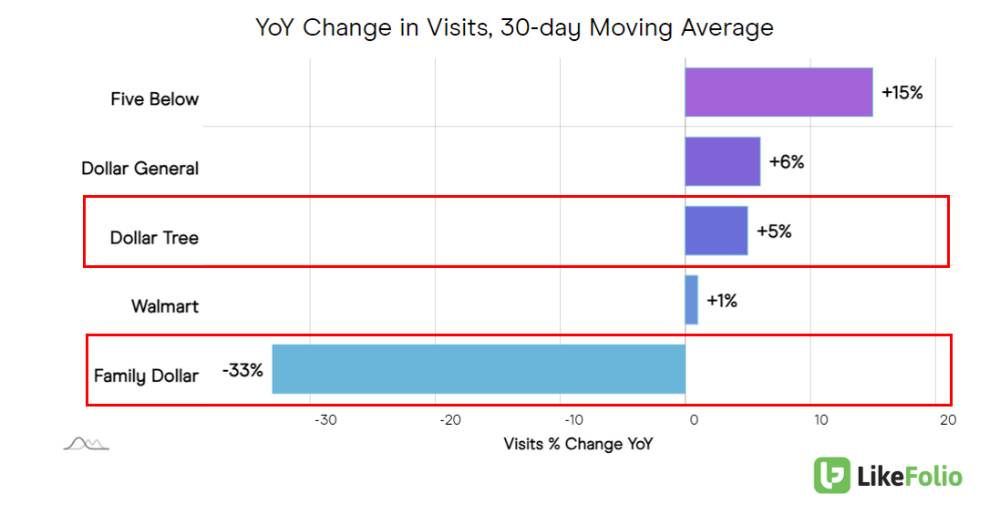

LikeFolio data shows some traction for Dollar Tree specifically – web visits are up 5% year over year on a 30-day moving average. But as you can see, Family Dollar is seriously dragging it down…

In this economy, where consumers are looking for savings, you’d think a discount retailer like Dollar Tree would thrive. The reality is much more nuanced. And unfortunately for DLTR, Family Dollar has proven to be its Achilles heel.

The Better Way to Play

I can show you a better way to capitalize on America’s demand for discounts. Our social media machine is picking up a 27% year-over-year surge in buzz around one name that’s helping Americans save on a top cost concern: prescription drugs.

For the 82% of adults in the U.S. who find the price of their medications “unreasonable,” this company provides the solution.

It’s a small-cap trading under $10 right now. I believe it could more than double by 2026. And shares have already gained 17% since our system triggered a buy alert on May 29 – just one week ago.

The stock I’m talking about is one of the top three profit plays we’re making for a small-cap election surge.

You’ll also find out about four more massive opportunities aligning with the 2024 presidential election:

- A moonshot trade with +387% gain potential…

- An alternative investment at the center of one candidate’s campaign, plus the stock that could rocket with it…

- A sub-$1 play that could 10x your money…

- And a speculative play that comes with high risk – and high reward.

Go here now for the details on how you can access all five reports, and the eight investment opportunities contained within them, in one fell swoop.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

84% Gains and Counting: This Spotify Call Keeps Paying Off

Spotify is proving why it’s one of our top stocks for 2024, and the latest consumer data suggests…

This Kentucky Derby Stock Is Worth a Bet in 2024

Here’s why Churchill Downs is set to have its best year yet. Plus: What the Trump verdict means for investors…