At LikeFolio, we’re keeping close tabs on the rise in digital wallets – especially as adoption increases during the 2024 holiday spending season.

A record 92% of American consumers used some form of digital payment method in the last year, according to McKinsey’s annual survey. And projections indicate they will surpass debit cards in North American point-of-sale (PoS) transaction value by 2027.

As this digital wallet “mega” trend accelerates into 2025 (and beyond), separating the winners from the losers will be critical for investors to maximize their gains.

This is where LikeFolio’s consumer insights give you an edge.

One of the major players in this space, Block (SQ), caught investors’ attention when it reported record-breaking Black Friday and Cyber Monday activity in 2024.

For the holiday weekend, Block saw a 17% year-over-year increase in global transactions, which totaled over 144 million.

The digital payments provider noted positive holiday trends, including a 10% increase in transactions for its buy now, pay later (BNPL) service, Afterpay, along with larger online cart sizes (twice that of in-person).

It also saw an unexpected boost in restaurant spending. Food and beverage was the top industry for gift card purchases.

Analysts have been busy upgrading SQ’s price targets, citing growth in Block’s Square merchant business and Cash App platform.

And SQ shares are riding that positive momentum, trading 53% higher over the past six months.

But LikeFolio data suggests SQ may not be the “winner” Wall Street thinks it is…

New Data Raises Concerns

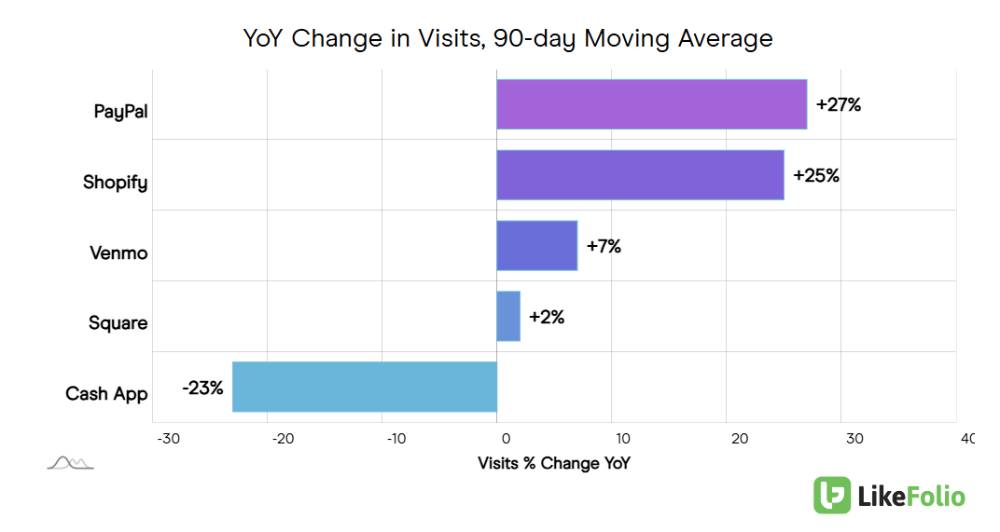

One red flag we’re tracking is underperformance in Block’s merchant business, Square, which is only recording a 2% year-over-year increase in website visits:

Plummeting web activity from Block’s digital wallet arm, Cash App, is another area of concern for us.

As you can see from the chart above, Cash App site visits have dropped off by as much as 23% year over year, while its main competitor, Venmo, logs a 7% increase in traffic.

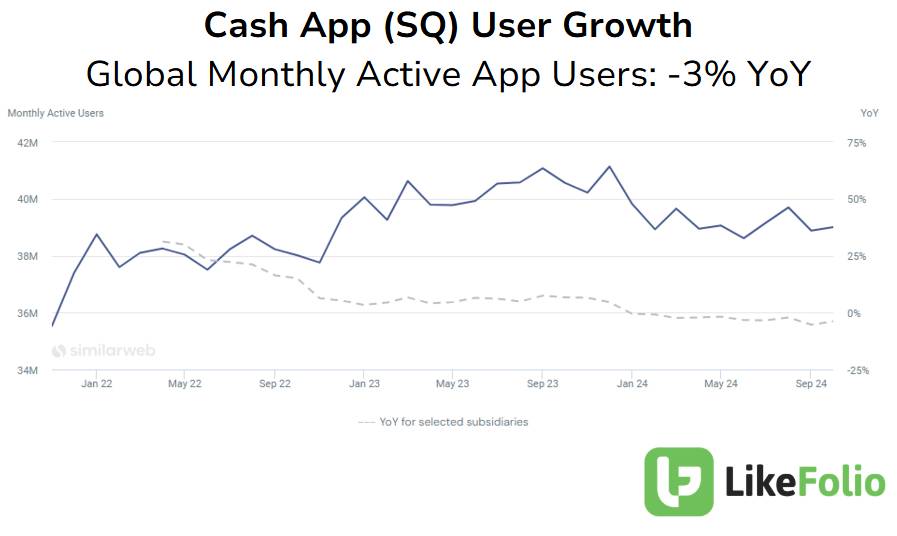

Unfortunately, Cash App’s monthly active user growth is also slowing, trending 3% lower year over year:

Our take: While Block’s holiday numbers are a bright spot, the recent performance is likely already reflected in the stock’s valuation.

Block also reported weaker-than-expected revenue in its third quarter. Gross payment volume came in at $62.4 billion, missing the $64.3 billion target analysts were looking for.

Looking ahead, some analysts wonder if SQ will follow in the footsteps of competitor PayPal (PYPL) and expand into the advertising business. (Wonder being the key word here.)

However, we don’t like to speculate with the talking heads. Our expertise is following the data.

And for now, Block appears to be playing catch-up to PayPal and other fintech providers.

Given the mixed signals, investors may want to approach this stock with caution.

The holiday performance is positive, but the longer-term trends in the core business and Cash App platform warrant careful consideration before betting to the upside.

We see more appealing plays in the digital wallet space emerging…

Watch These Digital Wallet Stocks Instead

No. 1: The Comeback Classic

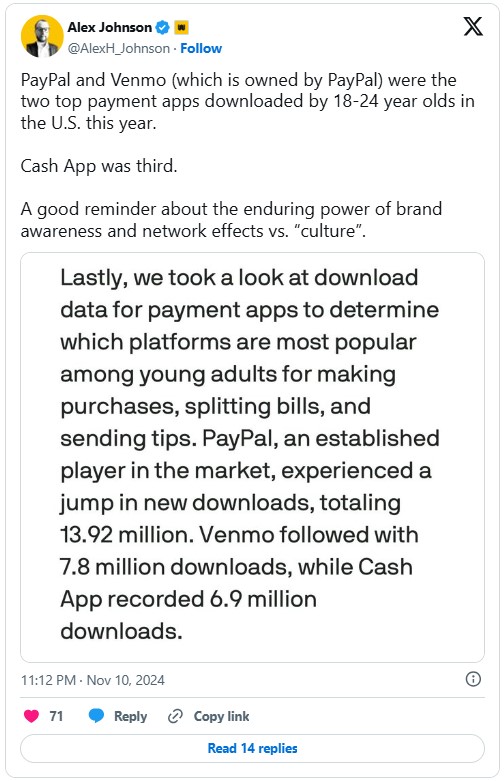

In November, we saw PayPal pull away from the pack when it comes to consumer momentum. Digital traffic has only accelerated since then – from +24% to a now-27% year-over-year increase in site visits.

What PayPal is doing right: Simplifying spending through new products and partnerships.

For example, its recently launched “Pool Money” feature allows users to contribute to shared expenses and spend the pooled funds, kind of like a GoFundMe for everyday needs. And a debit card integration with Apple Wallet (AAPL) is expanding PayPal’s exposure beyond online-only transactions.

PayPal is also moving into the advertising space, as we mentioned earlier, with “PayPal Ads” creating a new source of revenue.

Check out our recent PYPL coverage for the full details.

PYPL shares are up nearly 10% in the less than 30 days since that report.

No. 2: The BNPL Stock with a Big Lead

According to a 2024 study by Talker Research, 53% of holiday shoppers plan to lean on flexible payment options that allow them to pay for gifts over time.

That’s where buy now, pay later (BNPL) providers come in. Block has its own BNPL offering with Afterpay.

But we believe competitor Affirm (AFRM) could be the real winner.

It’s leading in market share, besting competitors in growth, and meeting consumers where they are, offering its BNPL services online through one of the world’s largest digital ecosystems and in-store through the world’s leading retailer.

We brought AFRM to our Derby City Daily readers at the end of October as our favorite BNPL pick for the holiday spending rush.

Here’s the compelling data that led to that call.

AFRM has gained a whopping 60% since then.

The Bottom Line

Following the data pays off.

You saw the proof today.

Stick with LikeFolio and we’ll help you sort the winners, like PYPL and AFRM, from the losers like SQ – before the market even has a chance to catch on.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Reddit: From Digital Ads to AI Data, This Stock Is Still Heating Up

$315 million in advertising revenue is just the tip of the iceberg for this rising social media star…

How We Spotted Lululemon’s “Surprise” Holiday Comeback Ahead of the Market

The market counted Lululemon out. But LikeFolio saw a comeback brewing – and boy, did we nail this contrarian call…