Sifting through endless pages of fine print legalese has got to be one of the most painstaking processes most of us can think of.

Good thing e-signature leader DocuSign (DOCU) figured out how to simplify this notoriously dreadful task with artificial intelligence (AI).

Its “Agreement Summarization” feature, which leverages Microsoft’s (MSFT) Azure OpenAI, does the hard work for you – using AI to identify and summarize only “the most critical components” of a contract.

Its “Liveness Detection for ID Verification” feature instantly and accurately confirms the identity of signers with AI-enabled biometric technology.

And that’s just the start.

DocuSign plans to incorporate AI into just about every step of the signing process.

Whether it’s searching agreement libraries, extracting agreement details, or suggesting language edits based on best practices, the strides this company is making with AI could revolutionize the way business gets done.

DocuSign’s big-picture vision: “Ultimately we are headed toward a world where agreements are made of computable code, and can think, act, communicate and even make decisions autonomously,” says Inhi Cho Suh, President of Product, Technology, and Operations.

Sounds impressive.

But is it enough to bring DOCU shares back to life?

DocuSign was a $300 stock in 2021. Now it’s barely reaching $50.

We’ve seen AI reverse fortunes before.

So today, we’re taking a look at whether DocuSign’s AI overhaul is enough to turn it into our next big winner…

DocuSign’s AI Reality Check

DocuSign’s impressive AI initiatives were a key driver in its first-quarter earnings beat – when revenue exceeded market expectations and propelled its shares 12% higher after hours.

The reaction to last week’s earnings report was a different story.

Despite reporting 11% year-over-year revenue growth, beating earnings per share (EPS) expectations, and raising its full-year outlook, DOCU shares have slid nearly 10% from where they closed on Thursday (the day of the report).

CEO Allan Thygesen provided one key caveat to those otherwise positive results, saying “While we are pleased with our results, like many others, we are seeing continued macro pressures tempering expansion rates.”

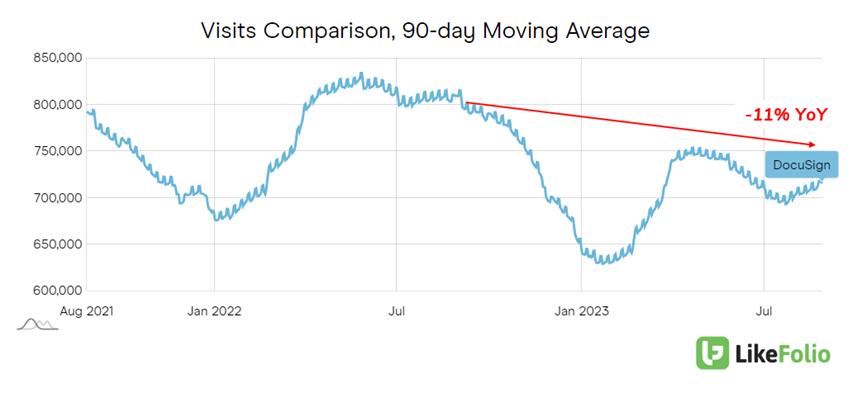

And we’re seeing that in our consumer data as well: Web visits have declined by 11% year-over-year, adding evidence to a potential slowdown in expansion.

DocuSign usage mentions remained relatively flat over the last quarter. And other e-signature players are threatening DocuSign’s dominance.

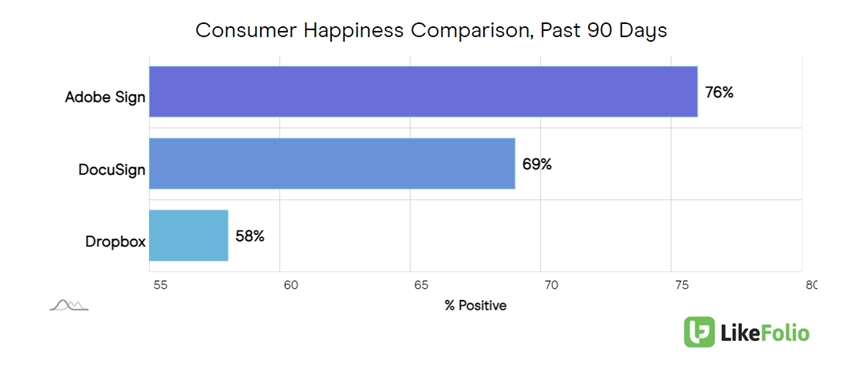

Adobe (ADBE), one of its biggest competitors in the space, is handily beating DocuSign in Consumer Happiness: 76% versus 69%, respectively.

That’s a big gap to make up… especially while Adobe’s own AI initiatives become increasingly popular among consumers.

Beyond AI, DocuSign is diversifying its portfolio by launching Web Forms across various sectors, including financial services and real estate.

The company is also making strategic inroads into highly regulated markets like health care, aligning with industry standards through integrations with software platforms like Epic and Cerner.

Bottom line: DocuSign’s innovation and diversification strategies are promising. And at the end of the day, we’re optimistic about this company’s long-term prospects, especially if it continues to innovate in AI. But LikeFolio metrics paint a more nuanced picture, suggesting a significant turnaround may still be down the road.

We’ll be keeping a close eye on web traffic, sentiment, and usage mentions, alongside AI advancements. And paid-up members will be the first to know if and when we see any significant shifts that put DOCU in the buy zone.

But I won’t leave you hanging: I’ve got another AI stock for you right here.

Unlike DocuSign, this “hidden gem” is a flashing buy hitting all the marks we look for in an opportunity ready to take flight:

- Rising Demand: Purchase Intent mentions are up 104% year-over-year as of this writing.

- Happy Customers: Consumer Happiness is at 81% and rising.

- Macro Trend Tailwinds: AI buzz is exploding by 486% year-over-year.

You can still grab shares under $3, but not for long.

Until next time,

Andy Swan

Founder, LikeFolio

Trending Now in Derby City Insights: Stocks for the #AIRevolution

Once a Laggard, This Could Be the Next “AI All-Star” Stock

Most folks think of Nvidia when we talk about “AI All-Stars.” But markets are always in flux. And new data says this “OG” tech player could soon have a seat at the table. Read now.

No. 1 AI-Powered Stock of the Decade?

It’s a bold claim — but this tiny $2 stock has everything we look for in an opportunity ready for liftoff… And it’s climbing higher as we speak. Don’t get caught on the sidelines on this one. More here.

This Company’s AI Knows What You Want Before You Do

Take a look at how the seismic shift from traditional TV to streaming has opened up the opportunity of a lifetime for this company – and for the folks who own shares today. Full story.