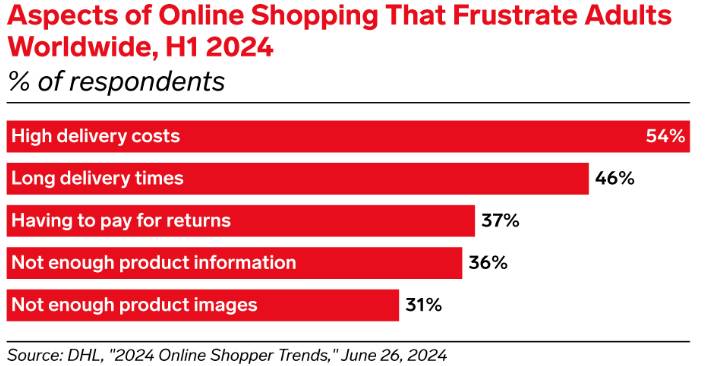

Retailers are facing a delivery problem.

Consumer expectations for deliveries are sky high…

- 25% of consumers will go to other retailers if delivery times are longer than three and a half days.

- 92% of consumers expect compensation for delayed orders.

And according to retail executives, meeting these expectations is costly:

- 47% can’t meet the timing expectations

- 76% claim the per-package delivery costs have risen in the past year

- and 72% don’t find home deliveries to contribute to profit

The most expensive part of a parcel’s journey is in the “last-mile delivery,” which refers to the delivery leg from the transportation hub – for example, a regional Amazon.com (AMZN) warehouse – to its destination, whether a personal residence or small business.

A whopping 53% of shipping costs are incurred during last-mile delivery.

It’s also the point in the process where consumers feel the most pain. Ever get an email with one of those proof of delivery pictures of your package at someone else’s house? Or get an “out for delivery” notification at 8:00 a.m., only to finally receive the delivery at 10:00 p.m.?

As customers’ expectations increase, shipping and logistics companies are feeling the pressure.

United Parcel Service (UPS), for example, saw last-mile delivery fall in market share from 35% in 2023 to 25% in 2024.

Not because there were fewer packages to deliver – with the rise of e-commerce in U.S. retail sales, there are more parcels en route than ever before. It’s because shippers and retailers are turning to more cost-efficient and faster last-mile delivery options.

Take a look…

The Solution to Retailers’ Delivery Woes

The gig economy – the movement of independent contractors and freelancers who take on short-term jobs with low overhead and startup costs, like grocery and takeout delivery – could offer some relief to customers and companies frustrated with the last-mile delivery process.

One of the new entrants helping with the delivery diversification is DoorDash (DASH).

Already a dominant player in the third-party restaurant delivery market, DoorDash is rapidly expanding its offerings to capitalize on the shifting last-mile delivery landscape.

The company recently added Lowe’s (LOW), Pet Supplies Plus, and Ulta Beauty (ULTA) to the roster of merchants its customers can order from. Dashers can now also collect and deliver packages straight from warehouses and stores of companies like Macy’s (M) and Uniqlo (FRCOY).

DASH is working with supply-chain expert Flexport to handle delivery for Shopify (SHOP) vendors. The company has hired Parisa Sadrzadeh, a former Amazon.com (AMZN) and Flexport executive, to spearhead growth in its last-mile delivery business.

DASH’s Winning Formula

DoorDash is showing impressive growth. In the second quarter of 2024, reported August 1, DASH reached 635 million orders – up 19% year over year.

The company has consistently grown its revenue every quarter since its IPO nearly five years ago, increasing revenue 23% year over year in the most recent period.

DoorDash is operating at a loss – but it’s closer to profitability than ever before. It also operates without any debt obligations, relying solely on shareholder funding.

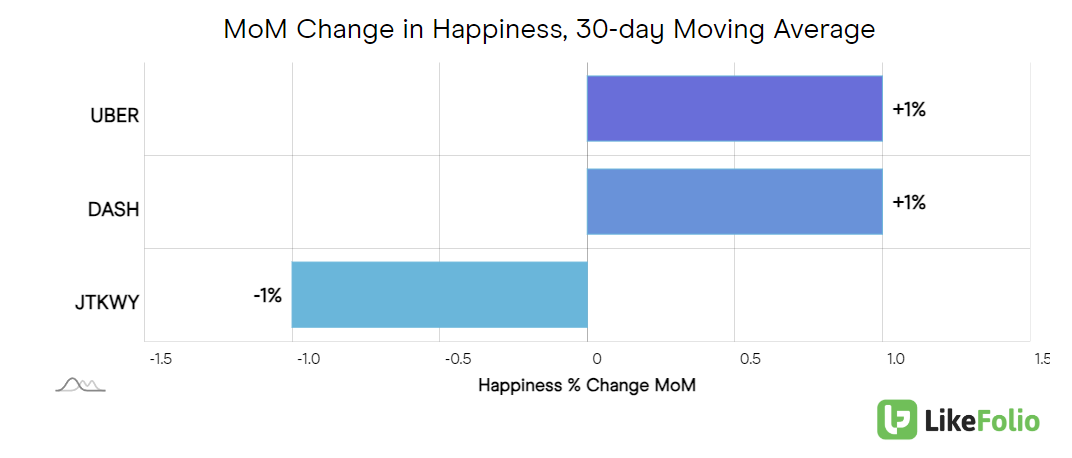

LikeFolio data does reveal one cause for concern: DoorDash Consumer Happiness levels underperform competitors like Uber and GrubHub (JTKWY). However, on a month-over-month basis, sentiment is improving:

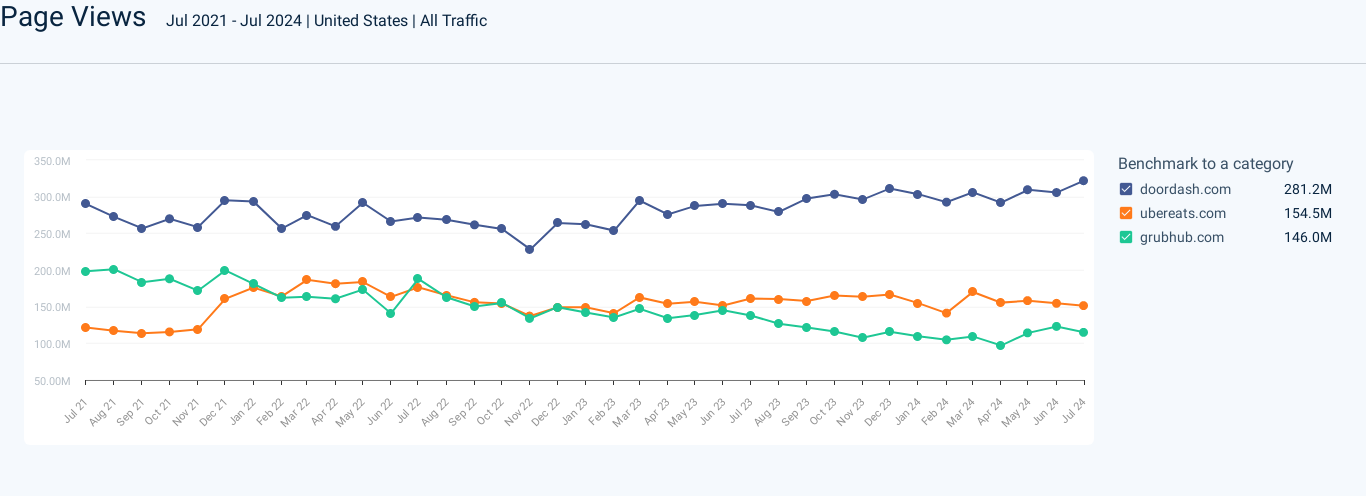

And DoorDash web traffic has performed much better, with solid growth over the past year compared to those competitors:

The Bottom Line

The delivery market is changing, presenting both challenges and opportunities for retailers and last-mile delivery service providers like DoorDash.

DoorDash’s aggressive expansion and strategic moves indicate its potential to become a significant player in this space. Keep an eye on this one.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

One Stock Dominating the Digital Ad Resurgence

Meta’s ambitious ad plans are paying off – and there are more profits to come…

The Next 3 Stocks to Watch After Walmart’s Earnings Triumph

These consumer favorites could be the next to soar…