It was the world’s first trillion-dollar company… and the world’s first $2 trillion company.

Its smartphone may just be the most widely used electronic device in the world. More than half of Americans own one.

And its stock is the top holding in the S&P 500 Index – the benchmark financial analysts and investors rely on to gauge the health of our entire economy.

Those of you screaming “What is Apple (AAPL)?” are right on the money.

It’s one of the single most influential, ubiquitous brands of our lifetime.

More important for investors like you: Apple is a veritable goldmine. Especially when you have LikeFolio’s predictive consumer insights in your corner.

With a real-time read on social media data telling us when Apple demand spikes, we keep you ahead of the investing curve – alerting our followers to a rise or fall well in advance of Wall Street.

MegaTrends subscribers can tell you that firsthand after taking a 20% gain on AAPL in November, and an incredible 122% win on an early call in 2022.

(Want in on our next big call for 2024? At less than $10, this small-cap stock has even bigger upside potential. Just make sure you act soon – because a catalyst could send it rallying before the year is up. Details here.)

Don’t worry if you missed out on those profits, though. Because our system just triggered another significant momentum shift for Apple that we’ll show you here today.

Remember the 2023 Apple Investor Report we issued after its September Keynote event?

We told you we’d keep a close eye on Apple’s products ahead of the critical holiday season.

And we’ll deliver on that promise today with an exciting update you simply can’t afford to miss…

Apple Momentum Ramps in Time for the Holidays

Apple is heading into the holidays with a glimmer in its eye.

Despite reporting a consecutive fourth-quarter sales decline on November 2, the tech behemoth’s recent earnings beat analyst expectations.

And LikeFolio’s insights paint a more optimistic picture, especially for Apple’s non-services segment, which is crucial for driving its ecosystem and service revenues.

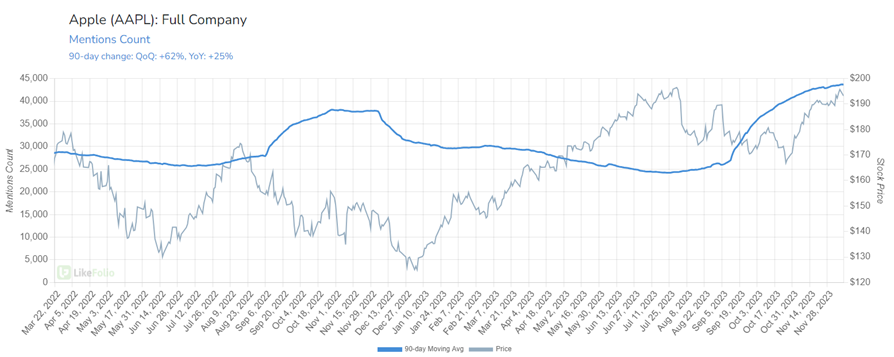

To kick off, check out how Apple mentions are surging – by more than 25% year over year:

Behind that drive in demand is its single most important product: the iPhone.

iPhone Continues to Shine

In our 2023 Apple Investor Report, we noted that Apple’s tricked-out, titanium-clad, USB-C equipped iPhone 15 lineup was turning heads. Just a couple of months later, the iPhone remains a strong performer.

Sales aligned with Wall Street forecasts last quarter, posting a 2% year-over-year increase.

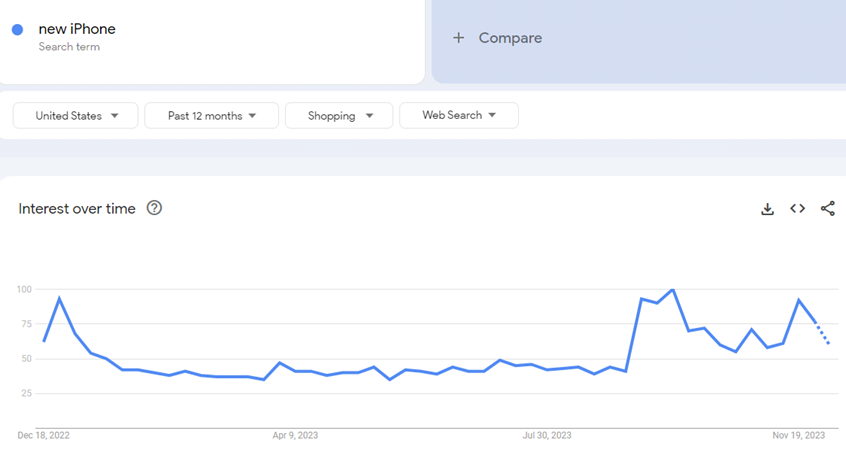

Google Trends data highlights a surge in “new iPhone” searches, peaking during Black Friday and rivaling last Christmas’s interest levels:

The success of the iPhone is key – in fiscal 2023, this one product segment made up 52% of the company’s overall sales. We’re expecting plenty under the tree this holiday.

The Return of the Mac

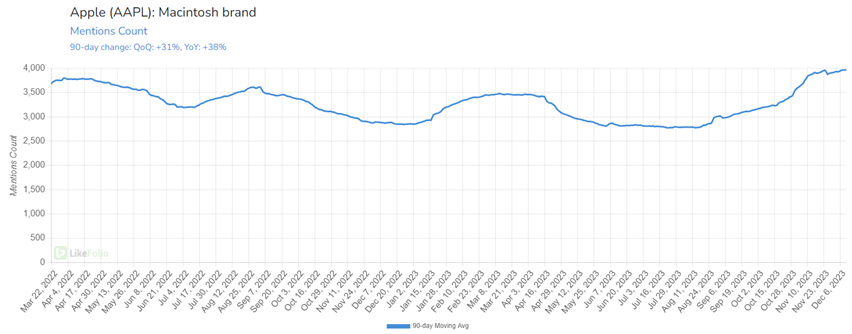

Interest in the “new Mac” is also rising, in line with an expected rebound in the overall PC market. Inventory is expected to return to normal by the end of 2023 as long as holiday sales do not collapse.

And Apple may be ahead of the game here, with Mac mentions trending 28% higher year-over-year (and 31% quarter-over-quarter) after a multi-year decline:

Could this be “The Return of the Mac?” We think so.

Responses to Wearables and Other Products Still Mixed

Searches for the “new Apple Watch” are trending positively, hinting at its potential as a top holiday gift. However, AirPods and Apple TV searches show less enthusiasm, remaining flat or slightly lower on a year-over-year basis. This is consistent with the initial reaction we recorded post-keynote event.

Services Segment Remains Robust

Apple’s services continue to excel, with last quarter’s revenue hitting a record $22.31 billion, a 16% increase from the previous year. This growth highlights the importance of Apple’s hardware as a gateway to its services, which include Apple Music, Apple TV, Apple News, Apple Books, Apple Podcasts, and the App Store.

In other words, when Apple’s hardware sales grow, its services revenue is sure to follow.

Market and Consumer Sentiment Shift

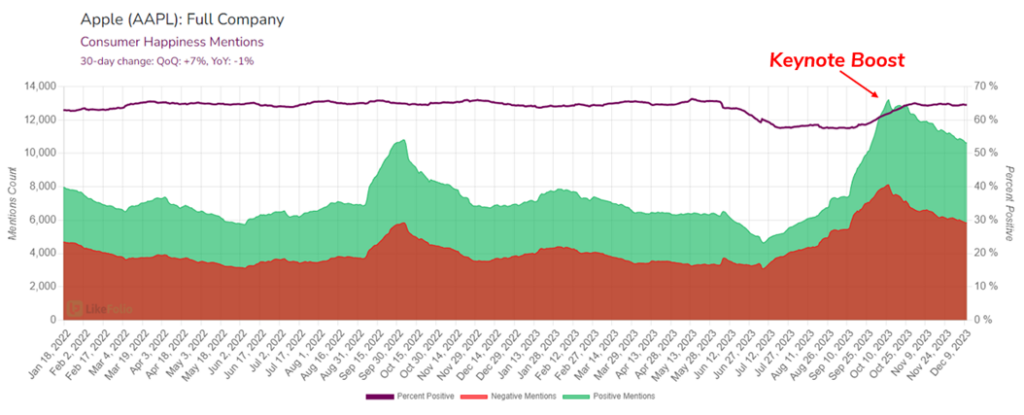

Despite an initial 3% drop in its stock post-earnings, LikeFolio data reveals a positive shift in consumer sentiment around Apple.

Consumer Happiness levels for iPhone and Mac users are also up by three points month-over-month as consumers shop for holiday gifts.

Overall, Apple’s Consumer Happiness rating stands at 65%, which is consistent with last year and up 8%, thanks to a post-keynote event boost:

Forward Outlook

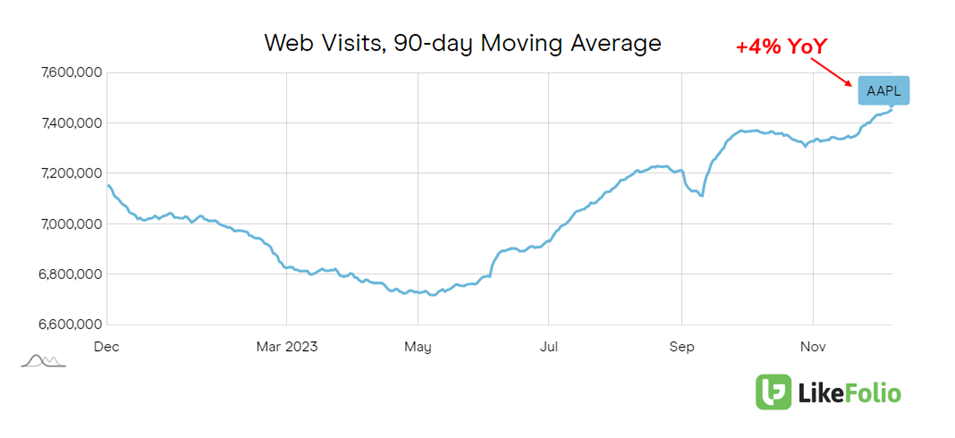

Apple’s performance this holiday season hinges on the iPhone and Mac. LikeFolio suggests a strong quarter ahead, particularly if Mac sales complement the iPhone’s success, and web visits continue on their current trajectory higher.

With shares slightly below year-to-date highs and expectations set lower, Apple is well-positioned to surpass market predictions.

LikeFolio Investor subscribers got the first look at this Apple opportunity yesterday in a members-only Founder’s Call, where we revealed our specific investment recommendations for capitalizing on Apple’s bullish momentum.

Those paid-up members also received an urgent buy alert to their inbox earlier today on a stock with 50%-plus profit potential.

And considering our last five buy recommendations are up between 5% and 38%, just since the end of September, it may be time for you to check out what we have to offer.

Learn how you can get started with immediate access to all those opportunities and more, and set yourself up for investing success in the new year, right here.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. Miss yesterday’s issue of Derby City Daily? We explore how cooling inflation is putting retailers to the test in a “Clash of the Titans” that pits Walmart (WMT) against Target (TGT). Find out who comes out on top right here.