At this point, we’ve nearly lost count of how many times we’ve played Crocs (CROX) to the upside.

Our most recent bullish alert went out in August 2022. We’re currently up 61% on that call, with a max gain of 71% when the stock rallied ahead of its fourth-quarter earnings release:

For years, Crocs has been the “King of Comfortable Shoes.” But we’re always looking ahead to what’s next.

After all, Crocs was once seen as a clunky “dad shoe,” not the hip staple even teens wanted to own – until brand perception shifted in a massive way.

And that’s our specialty: Watching for shifts in brand perception in real-time by tracking consumer demand (Purchase Intent), Consumer Happiness levels, and major consumer macro trends.

By understanding these critical metrics, we can see that it’s getting crowded at the top of the footwear market – and best predict which brand is likely to be the next Crocs.

That’s how we keep you ahead of market rallies.

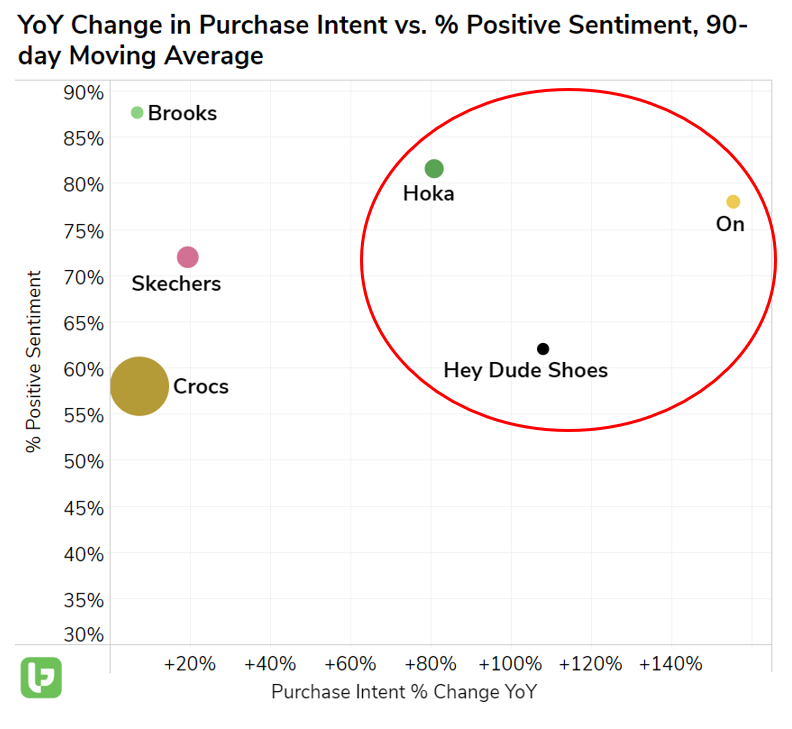

One tool you’ll see us use over and over again to spot opportunities is our Outlier Grid, like the one below:

It’s an excellent tool to help visualize how different brands stack up because it displays:

- Which brands are most popular (size of the circle on the graph: larger circle = higher volume)

- Which brands are flying off the shelf (Purchase Intent Growth YoY, x-axis: further to the right = demand growth)

- Which brands are most loved (Consumer Happiness level, y-axis: higher the placement = more happy customers)

This one shows us that Crocs still commands a massive share of the market, as evidenced by the size of its circle.

Crocs comprises 73% of demand mention volume for all the brands listed on that chart. But from a happiness and demand growth perspective, Crocs is starting to fall behind.

Enter the three brands in the top right corner, each recording extremely high levels of demand growth. (We’re talking 80% or higher.)

These brands are actively stealing market share from Crocs, making them our top brands to watch – and the most likely contenders to become “The Next CROX.”

Here’s a look at who they are – and which has the best shot at Crocs-level supremacy…

Contender No. 1: On Running (ONON)

On Running (ONON) first caught our eye at the end of 2021, shortly after the company’s IPO.

And if you caught our “three favorite stocks for 2023” video earlier this week, you’ll recognize this as my personal pick. (You can watch that video here.)

On is best known for its proprietary “cloud” technology that translates to extreme comfort and performance for active consumers, or those embracing the “athleisure” lifestyle.

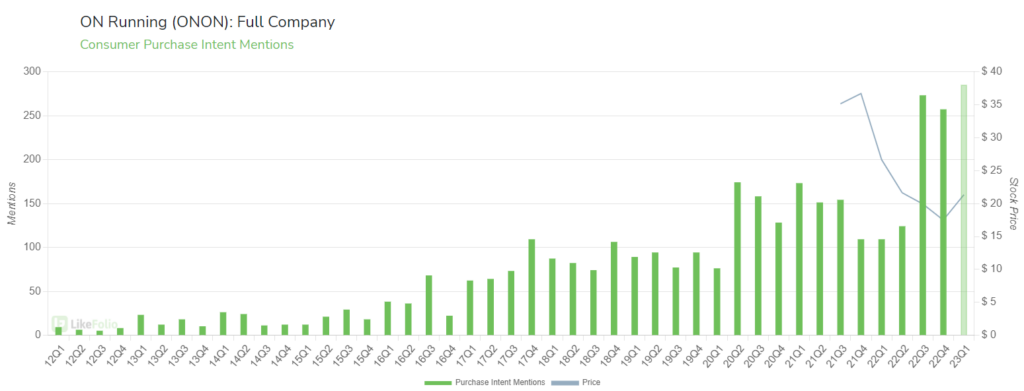

Demand in the first quarter is on pace to cap off the highest level in LikeFolio tracking history:

Purchase Intent (PI), which is our way of measuring demand for a company’s products, is up a remarkable 129%.

This shoe falls on the high end of the consumer price range with sneakers upward of $150, which might sound counterintuitive, considering we’re in a “trade-down economy.”

But as you learned earlier this week, consumers are still increasingly seeking out high-end apparel. In fact, “high-end apparel” mentions have increased 146% year-over-year – making it a major macro trend that’s creating big opportunity in 2023.

And On is reaping the benefits.

Contender No. 2: Hoka (DECK)

Hoka (DECK) makes shoes that are also beloved by runners, but now, you’ll even see them sported by celebrities off the track.

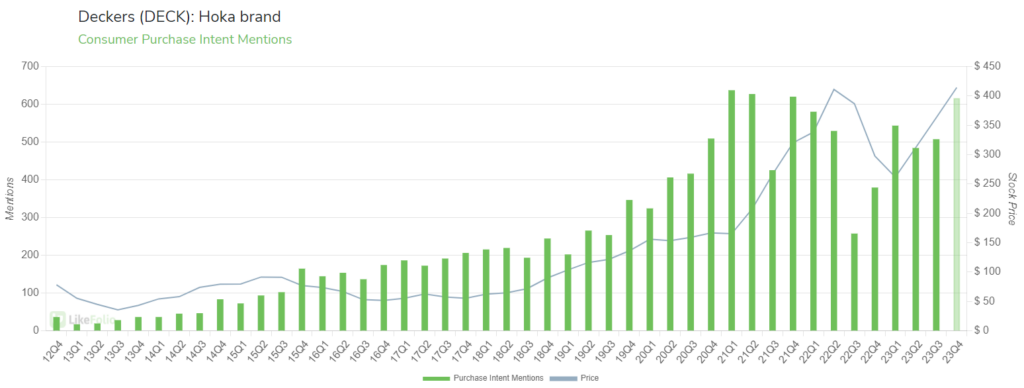

Its “ugly,” “chunky” shoes have become a kind of ironic fashion statement, and that’s helping to propel demand well beyond athletes:

In the third quarter of 2022, Hoka delivered record revenue of $352 million and more than doubled its direct-to-consumer business.

Based on current demand momentum in Q4, we expect Hoka to be a major driver of revenue growth in Q4 for the Deckers company, which also owns names like UGG, Teva, and Sanuk.

Contender No. 3: Hey Dude Shoes (CROX)

Yes, that’s right: A subsidiary of Crocs may be “The Next CROX.”

And that’s thanks to its savvy acquisition of Hey Dude Shoes at the end of 2021, a move that may prove to be critical to staying relevant and ensuring continued explosive growth.

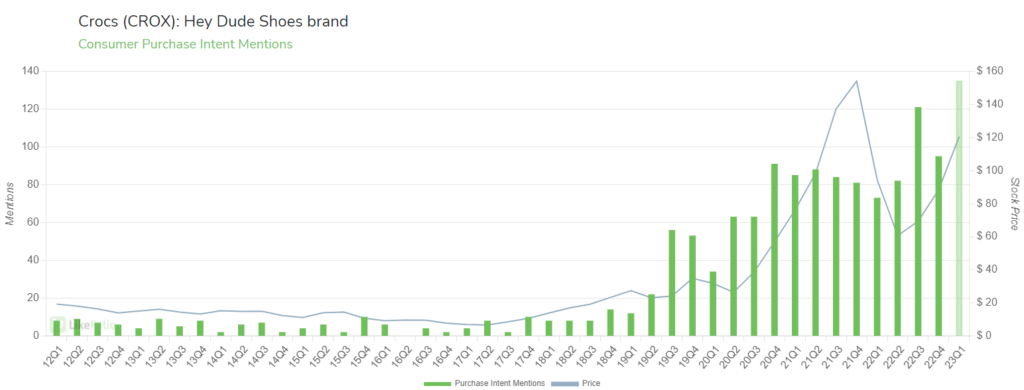

Hey Dude Shoe demand is following the same trajectory as ONON, putting it on pace for all-time highs in the first quarter of the year.

This brand is operating in a unique (but growing) space as many consumers return to the office and seek comfy but professional options for their feet.

CROX is working through margin headwinds during the brand integration (inventory handling costs, unfavorable pre-acquisition freight contracts, etc.), but the brand still generated more than $275 million in operating income in the fourth quarter of 2022.

We expect this brand to be a significant driver of growth for Crocs, even enough to keep it at the top.

The Bottom Line 💰

By harnessing social insights, it’s possible to understand – in real-time – how players in different segments stack and where momentum may be shifting. That’s what we do here at Derby City Daily – and bring those insights straight to you.

Looking ahead, ONON, DECK, and CROX are all well-positioned for continued growth and outperformance in footwear.

Enjoy,

Andy Swan

Co-Founder, Derby City Daily