For years, Crocs (CROX) has been the “King of Comfortable Shoes.”

But when it comes to the stock market, “what comes next” is all that matters.

After all, Crocs was once seen as a clunky “dad shoe,” not the hip staple even teens wanted to own – until brand perception shifted in a massive way.

Virtually overnight, Crocs went from just plain ugly to “ironically” ugly as a new generation of social media-addicted young folks discovered their undeniable comfort and high potential for customization, quickly catapulting the brand to “meme status.”

Those surges in social media chatter hit our radar when CROX shares were trading around $20.

The demand momentum for Crocs was so strong, it ignited shares as high as $180 by November 2021.

In fact, MegaTrends subscribers who acted on our May 2020 recommendation to buy CROX shares at $30 had a shot at 213% gains, making Crocs a “triple-your-money” winner.

We knew that was going to happen. It’s our specialty: Watching for shifts in brand perception in real-time by tracking consumer demand (Purchase Intent), Consumer Happiness levels, and major consumer macro trends.

By understanding these critical metrics, we can see that it’s getting crowded at the top of the footwear market – and best predict which brand is likely to be the “Next Crocs.”

That’s how we find great stocks before they soar.

And we’ve got a “secret weapon” that helps make that happen.

Let me take you behind LikeFolio’s velvet rope to show you how that secret helps you make money – and introduce you to our top two “Next Crocs” contenders…

Our Secret Weapon for Identifying the “Next Crocs”

When a consumer takes to Twitter to post about a product or a brand, LikeFolio’s data-crunching tech zeroes in on their message in real time…

Cross-references the 10,767 brands in our database…

And checks for thousands of keywords to tell us whether or not that person put their money where their post was – and actually spent their hard-earned cash.

And that’s just the beginning of what our proprietary analytics can do.

They can also reveal the most bullish and bearish opportunities in any given sector with a powerful analytics “grid.”

We call this secret weapon the “LikeFolio Outlier Grid” – and it’s one of our favorite tools for identifying potential opportunities.

In one picture-perfect image, the Outlier Grid sorts the winners from the losers in any given industry.

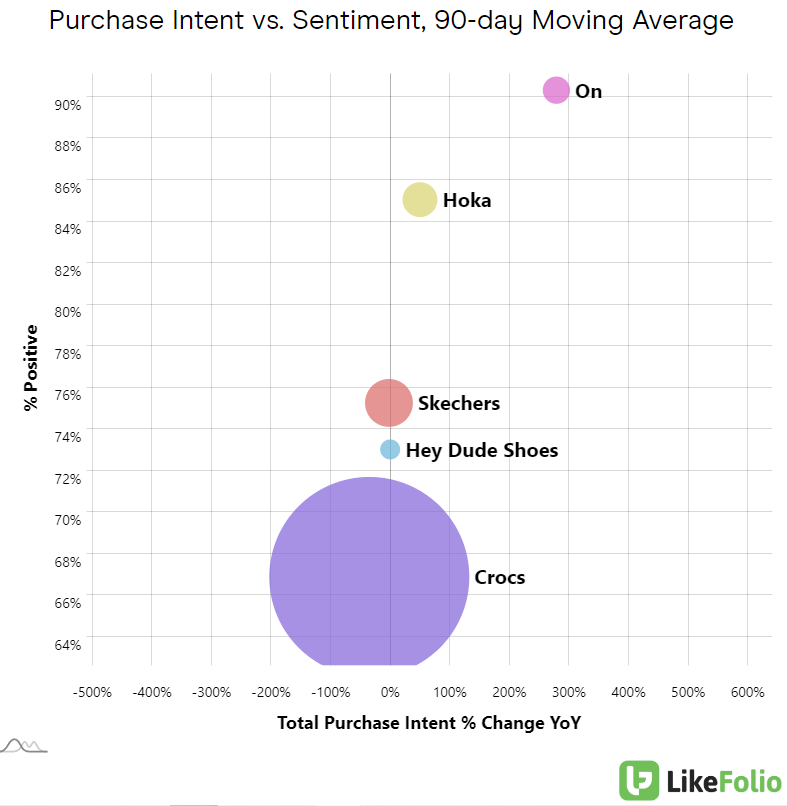

It’s an excellent tool to help visualize how different brands stack up because it displays:

- Which brands are most popular (size of the circle on the graph: larger circle = higher volume)

- Which brands are flying off the shelf (x-axis plots Purchase Intent growth year-over-year: further to the right = demand growth)

- Which brands are most loved (y-axis plots Consumer Happiness level: higher placement = more happy customers)

And that brings us back to our talk about the “Next Crocs.”

Take a look at the Outlier Grid below:

This Outlier Grid shows us that Crocs still commands a massive share of the market, as evidenced by the size of its circle (the big purple one).

Crocs accounts for the majority of demand mention volume for all the brands listed on that chart. (Also included: Hey Dude Shoes, Skechers, Hoka, and On.)

But from a happiness and demand growth perspective, Crocs is starting to fall behind.

Consumer mentions of purchasing a pair of Crocs (including its owned-brand Hey Dude Shoes) have slipped by 49% year-over-year.

Enter the two brands in the top right corner, each recording extremely high levels of demand growth. (We’re talking double digits or higher.)

These brands are actively stealing market share from Crocs, making them our top brands to watch – and the most likely contenders to become that “Next CROX” we talked about a moment ago.

Here’s a look at who they are – and which has the best shot at Crocs-level supremacy…

Contender No. 1: On Running (ONON)

On Holding (ONON) first caught our eye at the end of 2021, shortly after the company’s IPO.

And if you caught our “three favorite stocks for 2023” video earlier this year, you’ll recognize this as our data guru Megan Brantley’s personal pick. (You can watch that video here.)

On is best known for its proprietary “cloud” technology that translates to extreme comfort and performance for active consumers, or those embracing the “athleisure” lifestyle.

Demand in the current quarter is on pace to cap off the highest level in LikeFolio tracking history:

Purchase Intent, our way of measuring demand for a company’s products, is up a remarkable 441% year-over-year.

With retail prices of $150 and more, On shoes live at the “high end” of what consumers will pay.

But On – and this next contender – seem to be, well, holding “on” – and actually holding strong…

Contender No. 2: Hoka (DECK)

Hoka – owned by Deckers Outdoor Corp. (DECK) – makes shoes that are also beloved by runners. The brand has an awesome backstory that starts with two passionate adventurers and seasoned runners who reimagined what running shoes could be, set amid the stunning vistas of the French Alps.

With extra-thick soles that provide shock absorption and encourage natural running motion, Hokas deliver maximum cushioning without sacrificing comfort for less weight.

Their design stood in stark contrast to the thin-soled shoes that filled the market when they launched in 2009. Hokas were dubbed “clown” shoes. At first.

But they’ve since experienced a shift in perception – much like Crocs – and became a fashion statement, donned by celebrities like Britney Spears, who’s been sporting Hokas on social media for years.

And that’s helping to propel demand well beyond athletes: Purchase Intent mentions are currently up 34% year-over-year.

Deckers recently reported its fourth-quarter earnings, where Hoka brought in the highest portion of Deckers’ sales with $397.7 million. It also grew those sales at the fastest clip of any of Deckers’ other brands at 40.3% year-over-year.

Deckers’ leadership expects Hoka to be a $2 billion brand “pretty soon.”

Sounds aggressive. But according to LikeFolio consumer data, this brand has plenty of room to run.

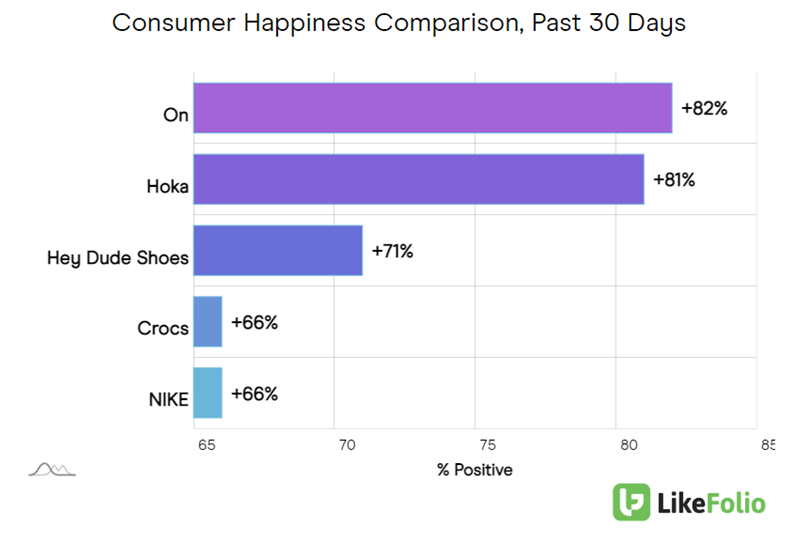

Our social media machine places Hoka in an elite group – right alongside ONON – with an 80%-plus Consumer Happiness score:

And that bodes extremely well for Hoka’s – and DECK’s – long-term growth prospects.

You can get the full story on this superstar brand right here.

By harnessing social insights, it’s possible to understand in real-time how players in different segments stack and where momentum may be shifting.

That’s what we do here at LikeFolio – and we bring those insights straight to you in Derby City Daily.

Until next time,

Andy Swan

Founder, LikeFolio