Remember last fall, when Walmart (WMT) CEO John Furner warned that his customers were purchasing “less units, slightly less calories” due to the soaring popularity of weight-loss drugs like Ozempic?

It sent Wall Street into a tizzy, a sure-fire sign that demand for junk food was on the outs and snacking giants would soon be in trouble.

Furner was onto something: Those weight-loss drugs – GLP-1’s – are on track to become the best-selling drug type by the end of 2024. And they’re causing real, measurable behavioral changes for millions of Americans, diets included.

“People who are on (GLP-1 drugs) eat less calories. That’s, high level, not good for people who sell calories,” said Donny Kranson, a portfolio manager at Vontobel Asset Management.

But we didn’t just ditch our favorite “eetos” munchies altogether. We simply started shopping for better-for-you options to satisfy those cravings.

And the savvy snack food makers have found new ways to make profits…

A New Kind of “Fast Food”

Nestlé (NSRGF), one of the biggest names in the fast-moving consumer goods (FMCG) industry – that’s industry jargon for snacks – seized the opportunity to capitalize on this expanding market.

The maker of KitKats and Hot Pockets is making a shift to products in the pharmaceutical-focused nutrition realm through strategic acquisitions of new brands aimed at enhancing consumer wellness.

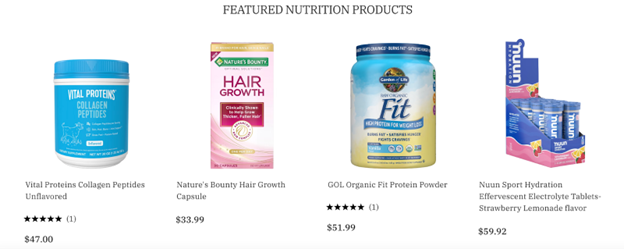

Premium labels like Puravida (“clean label” nutritional food), Orgain (protein powder), and Nuun (hydration powder) now fall under Nestlé’s brand portfolio, bringing diversity to the company at a much-needed time.

It’s no secret that Nestlé’s results have been disappointing as of late. Shares have fallen nearly 15% in the past year as leadership cites one-time factors as the cause, like a decrease in government payments to low-income families and rising manufacturing costs.

But its CEO is confident the company will have a rebound in sales. And if GLP-1 drug adoption continues as we expect it to, we think Nestle’s move to take a bite from nutrient-dense “fast” foods will be lucrative.

Let’s break it down…

Shifting Tastes

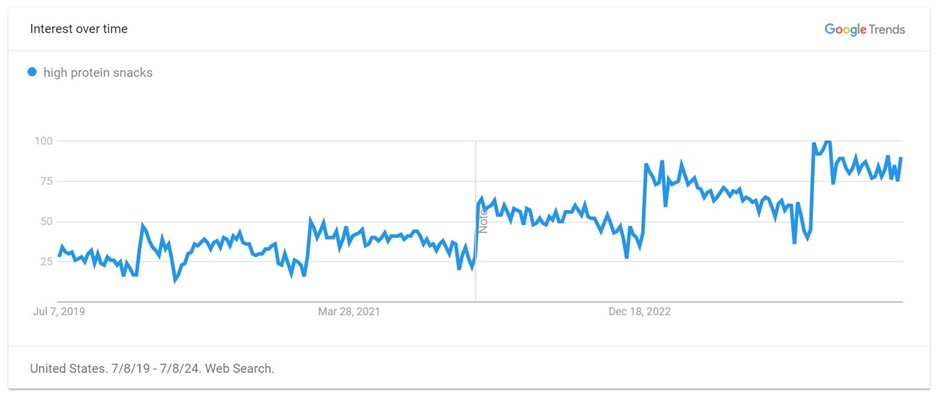

Online searches for high-protein snacks are surging.

And in-demand GLP-1 drugs are a major driver of this increased interest as consumers seek out nutrient-dense snack options to align with their weight-loss plans.

This opens the doors for Nestlé, who has stepped in with new products designed to accompany the GLP-1 drugs. The high-protein, low-calorie products are being marketed to consumers as an aid in their weight management journeys.

“You can expect a continued new stream of [weight loss-focused] products to address that need,” says CEO Mark Schneider.

Shifting Platforms

Along with changes in Nestlé’s target audience, the company is making additional adjustments to better suit its customer base, including meeting them where they are: online.

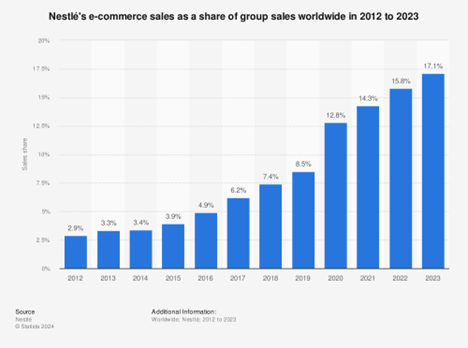

Nestlé saw an 8% increase in e-commerce sales from 2022 to 2023 and expects more improvements to come:

The company plans to drive more consumers to its products with strategic advertising. For example, it rolled out a dedicated website, “GLP-1nutrition.com,” as a resource for GLP-1 users that funnels customers directly to Nestlé-owned products.

Nourishing Satisfaction

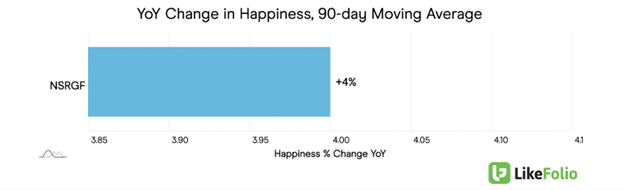

We’re seeing these improvements in LikeFolio’s most helpful metric when gauging long-term growth prospects: Nestlé’s Consumer Happiness is up an impressive 4% year over year.

Bottom line: As Nestlé continues to innovate and expand its footprint, it is poised not only to regain market momentum but also to lead the charge in shaping the future of health-oriented consumer goods.

Keep an eye out for other names like this one that stand to benefit from changing consumer diets.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed from Derby City Daily this week…