General Motors (GM) has been a dominant presence in American culture for over a century now. Its roots trace back to the days of horse-drawn carriages. A long-running ad campaign boasted that its Chevrolet lineup was the “Heartbeat of America.”

But today, GM finds itself at a crossroads.

The electric vehicle (EV) revolution is forcing traditional automakers to reinvent or get left behind, and Tesla’s (TSLA) emerging dominance has only accelerated that “do or die” necessity.

On top of that…

If GM and the rest of the Detroit Three can’t sweeten the pot for their unionized workers by 11:59 p.m. Thursday, a 10-day strike could lead to an estimated $5.6 billion in losses.

On one side, you have workers trying to secure their place in an electric future. EV factories don’t need as many bodies. They want job security. Better pay.

On the other side, you have traditional automakers struggling to keep up with the new industry titan: Tesla handily leads the auto industry in profits per vehicle, bringing in four times as much as GM in the third quarter of 2022. And its labor costs are significantly lower in the $45 to $50 an hour range.

Compare that to $64 to $67 for the Detroit Three, and you can see how pay raises would squeeze profit margins even further.

But we’re not here to predict the outcome of those negotiations.

On the eve of a critical inflection point, we’re putting our “edge” to work – and gauging the pulse of GM consumer demand and sentiment as it navigates the road ahead.

Find out how GM stacks up against the competition today – and if it’s an emerging “EV play” that deserves a spot in your portfolio…

Electric Dreams or Nightmares for GM?

GM planted its flag in the EV revolution with the Chevy Bolt in 2017 – a small-but-mighty four-door hatchback with a 200-mile range to rival the traditional gas guzzlers.

It was a hit – named 2017 Motor Trend Car of the Year, among other accolades, and initially trailed only Tesla’s Model S in sales.

But like we saw with Ford Motor Co. (F), GM’s EV ambitions quickly ran into speedbumps.

High-profile recalls have dented GM’s image – one involving 9,423 power cords posing electric shock risks and another back-tracking 140,000 Bolts due to fire hazards.

These roadblocks have forced GM to reroute its journey for the Bolt, even signaling its discontinuation by the end of 2023.

But whispers in the industry hint at a potential revival powered by cutting-edge battery tech.

And based on its latest earnings results, GM seems to be cruising along.

Stellar vehicle sales, aggressive pricing, and strategic cost-cutting helped GM drive 25% year-over-year revenue growth, while net income of $2.54 billion surged a commendable 52% year-over-year.

CFO Paul Jacobson lauded GM’s $52,000 average U.S. sale price because it meant consumers were spending more on GM vehicles – an average of $1,600 more than they did last quarter, to be exact.

The Consumer Perspective

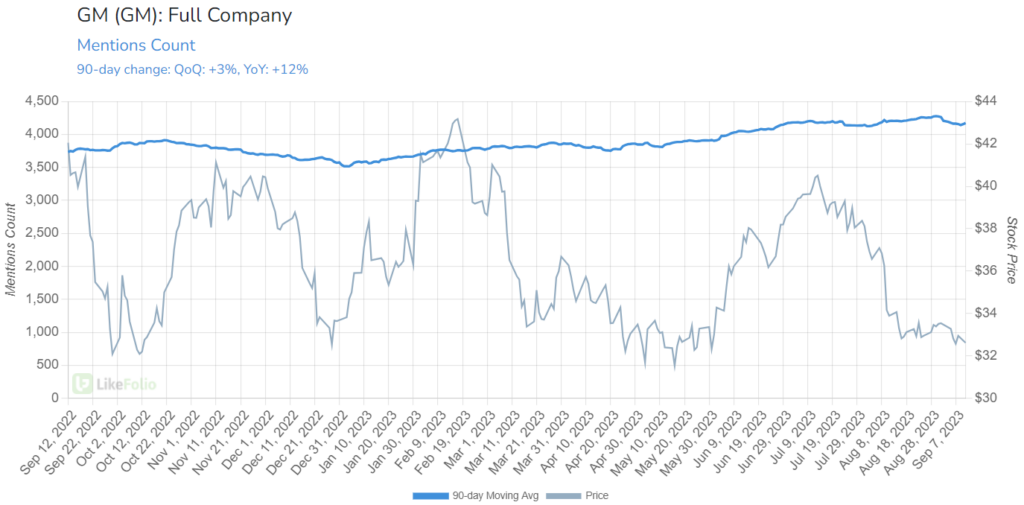

LikeFolio data shows consumer buzz revving up by 12% year-over-year, even as GM’s stock takes a pit stop.

The engines driving this buzz are GM’s iconic Chevy and luxurious Cadillac brands.

Despite this positive momentum on social media, when it comes to the digital highway, GM is lagging behind.

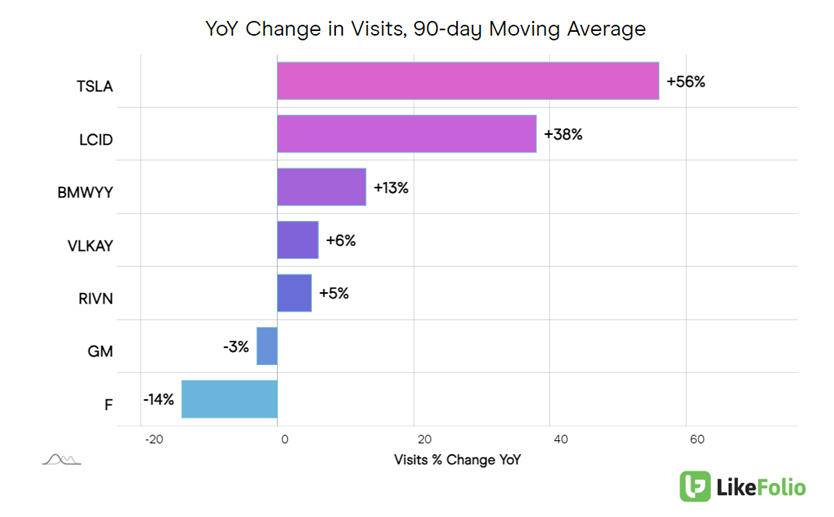

LikeFolio’s x-ray view into website traffic shows EV maestro Tesla and other premium auto giants gaining; in Tesla’s case, web visits are up as much as 56% year-over-year.

Meanwhile, GM’s have slid by 3%, placing it alongside Ford at the bottom of the pack.

Some might argue that GM’s clientele favors the tactile experience of a dealership. But this digital decline could also flash warning lights for future growth.

GM showcased its prowess in cost optimization last quarter, and the consumer buzz is undeniably on the rise. But it faces tough challenges.

The Macro View

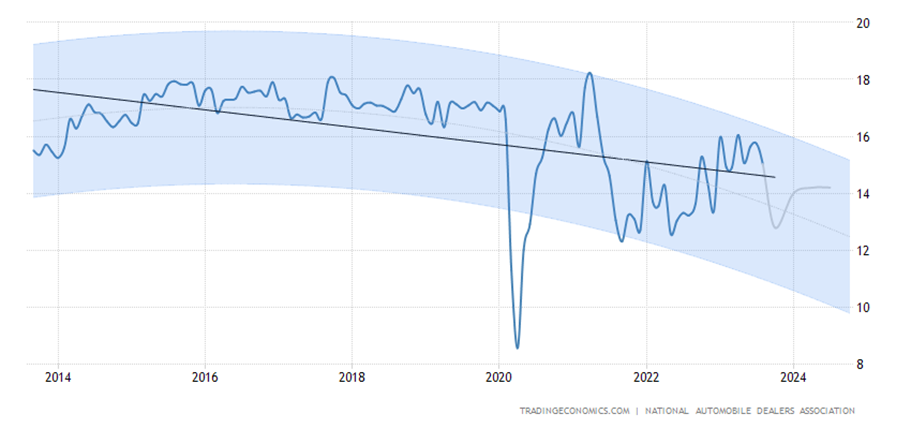

On-trend for the season, new vehicle sales are on the decline – decelerating from 15.75 million in July to 15.04 million in August.

While there’s been a rebound from the 2020 slump, numbers still lag behind pre-pandemic figures.

Supply chain hiccups and climbing interest rates are taking their toll. And forward-looking projections skew to the downside (sales charted below).

The Road Ahead

This is a critical week for GM. The threat of UAW worker strikes looms large: With union contracts expiring on September 14, the clock is ticking for GM to build a bridge with its workers into an EV future.

Any ensuing strike could have a devastating ripple effect on sales, while any positive turn in negotiations could turbocharge GM shares – especially given the 11% dip in its stock price that contrasted with its robust second-quarter performance.

Our stance on GM is cautiously optimistic, but we’re not running out to buy shares any time soon.

Because there’s a much better profit play to make…

Your EV Profit Roadmap

No doubt about it: Tesla is closing in on the competition.

Where GM led Tesla in sales volume 85 times over in 2017, it now leads by just 5x.

And you better believe that every time Tesla slashes prices on its EVs, GM execs are shaking in their boots.

Tesla shares have more than doubled here in 2023.

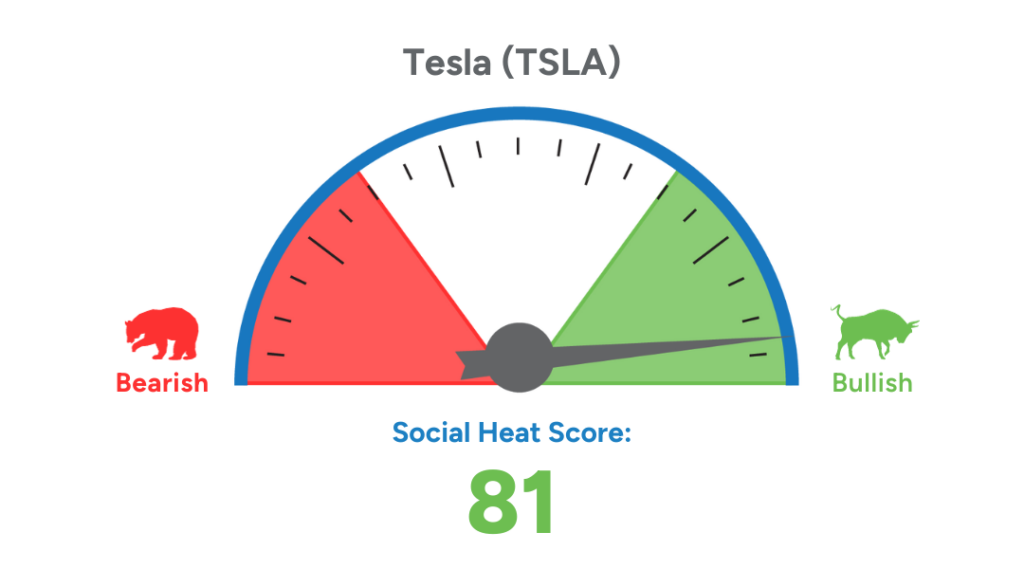

And if we weren’t bullish enough on the EV leader before, the recent rise in gas prices did the trick – pushing Tesla’s Social Heat Score over 80 to a bullish 81 out of 100.

For context, everything scoring above 70 signals a “buy,” meaning there’s plenty more upside to come for TSLA investors.

And we can show you the next five stocks our Social Heat Score is targeting for even bigger profit potential right now – with one pick registering a high score of 90.

Until next time,

Andy Swan

Founder, LikeFolio

Member Bonus: 5 More Ways to Play the EV Revolution 🔒

In our MegaTrends “EV Pin Action” report, we go beyond Tesla with five equally exciting opportunities harnessing the potential of EV technology to propel their growth and efficiency.

Current MegaTrends subscribers: Access your report here for ticker symbols, price targets, and actionable trade ideas (must be logged in to view).

Non-members: Go here now to learn how you can join for immediate access.