Nvidia (NVDA) has our attention right now.

I know what you’re thinking: When does it not?

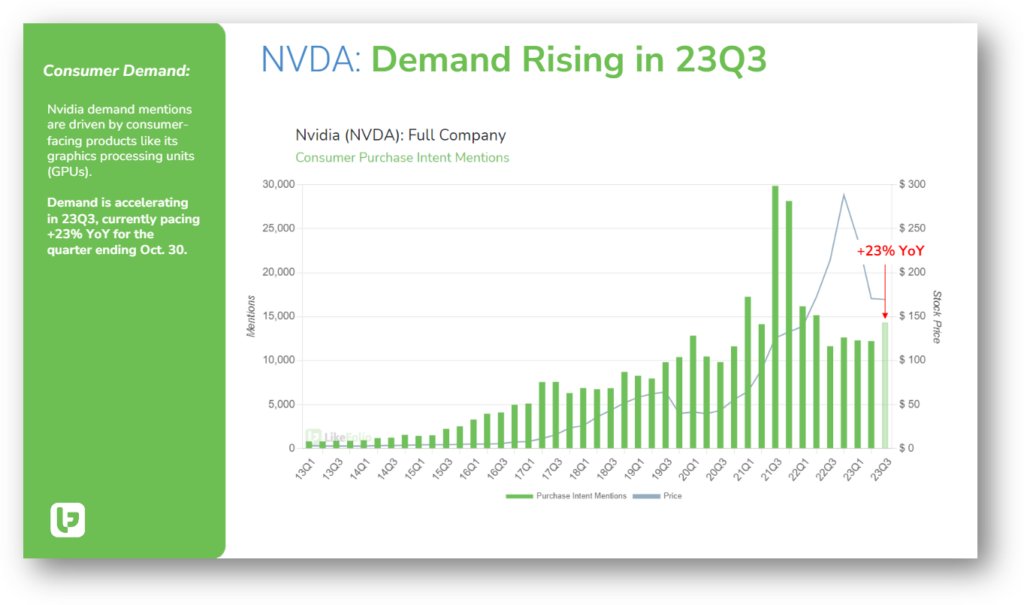

We’ve hammered the table about NVDA countless times over the last two years, most famously when we officially deemed it oversold in September of 2022…

When the stock was trading at just $129. (Shout-out to our MegaTrends subscribers who acted on that “trade of a lifetime.”)

NVDA has been on a tear ever since.

But after closing at a high of $950 in March, NVDA has pulled back ~13% – opening a potentially rare window of opportunity for those paying attention.

AI Spending Ramps up

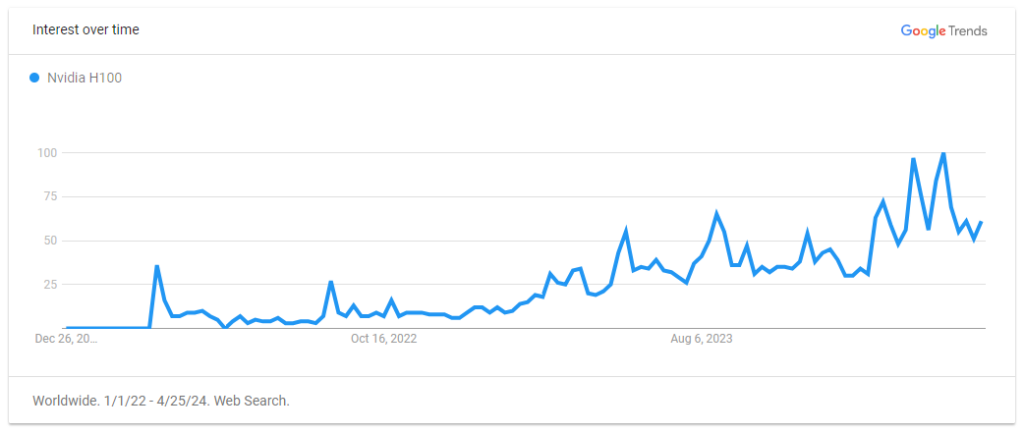

Two of the largest players in artificial intelligence (AI) are talking about increasing their spend on Nvidia products – notably, its H100 GPU (graphics processing unit).

Nvidia H100 interest is surging this year:

So, what is this coveted processor?

Think of it like this: If a regular computer chip is a bicycle, the H100 GPU is a rocket ship.

It can perform a mind-boggling number of calculations in a short amount of time, allowing computers to learn and process information at a much faster rate. That comes in handy for tasks such as understanding human speech, recognizing faces in photos, or even predicting the weather.

In short, when people talk about the H100 GPU, they’re talking about an incredibly powerful tool that helps computers understand and interact with the world in more human-like ways.

This makes even more sense when you learn about the two companies talking about seriously upping spend: Tesla (TSLA) and Meta Platforms (META).

Here’s what each company said on its respective earnings call:

- Tesla: Increasing from 35,000 H100 GPUs to 85,000 H100 GPUs by the end of the year.

“We are, at this point, no longer training-constrained, and so we’re making rapid progress. We’ve installed and commissioned, meaning they’re actually working 35,000 H100 computers or GPUs. GPU is wrong word. They need a new word.

I always feel like a wince when I say GPU because it’s not. GPU stand – G stands for graphics, and it doesn’t do graphics. But you know, roughly 35,000 H100S are active, and we expect that to be probably 85,000 or thereabouts by the end of this year and training, just for training.”

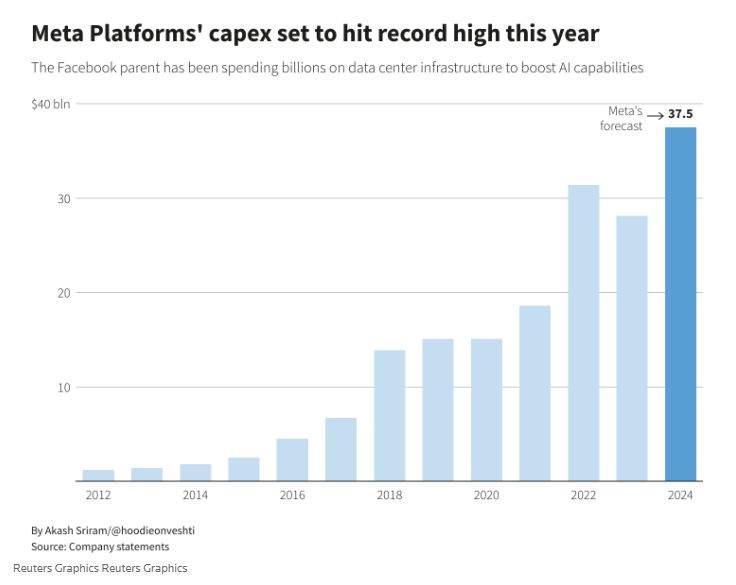

- Meta: Feverishly spending to boost its AI capabilities.

META stock was punished for raising the lower end of its 2024 expense forecast by $2 billion, and raising the top end of its capex (aka capital expenditure) outlook as it invests in AI.

While the company didn’t explicitly call out Nvidia technology like Tesla did, we know from last quarter that Meta planned to spend billions on NVDA’s AI chips. CEO Mark Zuckerberg stated that by the end of 2024, Meta’s infrastructure will be equipped with 350,000 Nvidia H100 graphics cards:

And this recent tone shift only appears to reinforce (or even accelerate) that investment.

Room for Upside? Absolutely. Here’s the Proof.

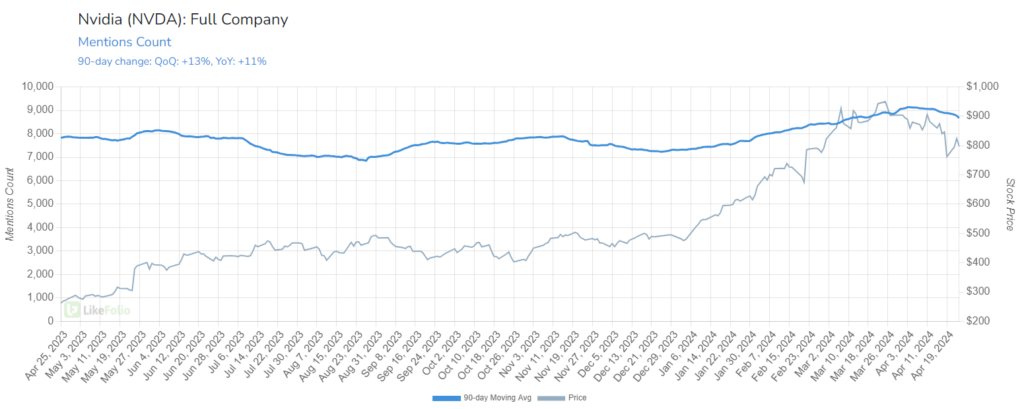

We’ve got a close eye on the near-term pullback – because LikeFolio data suggests plenty of room for upside.

Check out these charts and you’ll see why we’re so confident…

Nvidia mention buzz continues to rise, up 11% year over year:

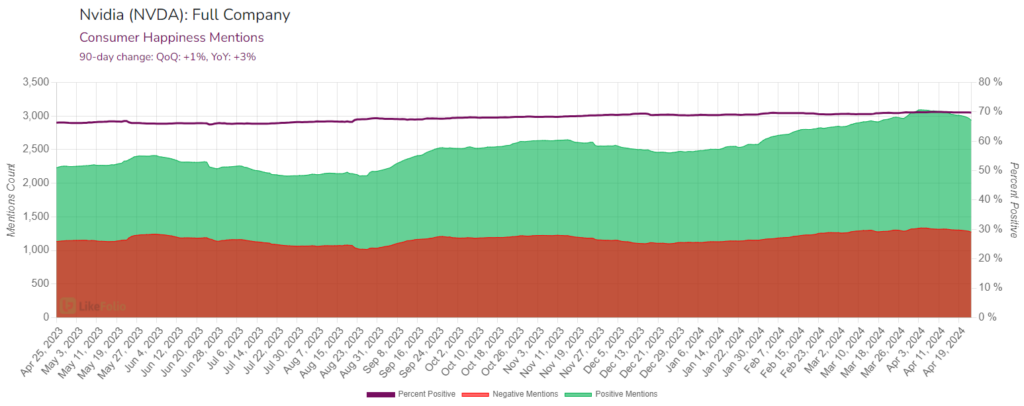

At the same time, even as volume has doubled, Nvidia’s sentiment levels have steadily marched higher (+3%). This is rare to see – typically as volume increases, so does criticism. But Nvidia’s Consumer Happiness remains strong:

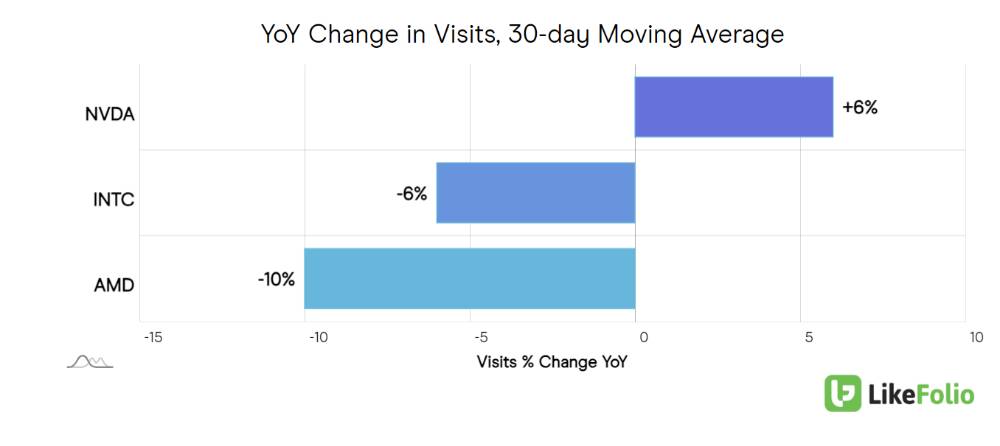

And web visits confirm that Nvidia is still trouncing peers – and garnering interest from consumers:

Bottom line: Nvidia is benefitting from nearly every major macro trend on our radar right now: AI, autonomous driving, crypto interest, etc. Dips look extremely appealing – and this one might just be your moment.

Our data pointed to the opportunity in NVDA way back in September 2022, and the stock went on to soar more than 600%, turning a single buy alert into the opportunity of a lifetime for our MegaTrends subscribers.

Those kinds of legacy-making trades are rare. But we have a knack for finding them:

- +611% on At Home Group (HOME) in 2021…

- +213% on Crocs (CROX) in 2022…

- +217% on DraftKings (DKNG) in 2023…

- And +289% on Coinbase (COIN) here in 2024.

With a stock-picking system powered by real-time consumer insights, we’ve delivered our members some truly incredible wins over the years. And there’s plenty more where those came from.

In fact, we triggered a brand-new buy alert earlier today on a $3 stock that we believe could surge 200% in the next two years.

You can get your hands on that pick, and dozens more active recommendations, right now. Simply click here to get started.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

How Tesla’s Post-Earnings Surge Led to a 268% Profit in Two Days

The opportunity isn’t over yet. Here’s proof that trusting the data pays off…

Ad Spend Could Be a Boon for These Big Tech Stocks

Here’s a look at the early winners and losers of the digital ad spending spree…