“The best way to predict the future is to invent it.”

That time-tested adage from computer science legend Alan Kay perfectly encapsulates the journey of Celsius Holdings (CELH)… A company that didn’t just predict the future of the energy drink sector – but actively shaped it.

Instead of sugary drinks that wreak health havoc, Celsius pitched itself as a healthier, pre-exercise boost: Its drinks come in a variety of tasty flavors, are infused with vitamins, and use ingredients for “stimulation” over “jitters,” like ginseng and green tea.

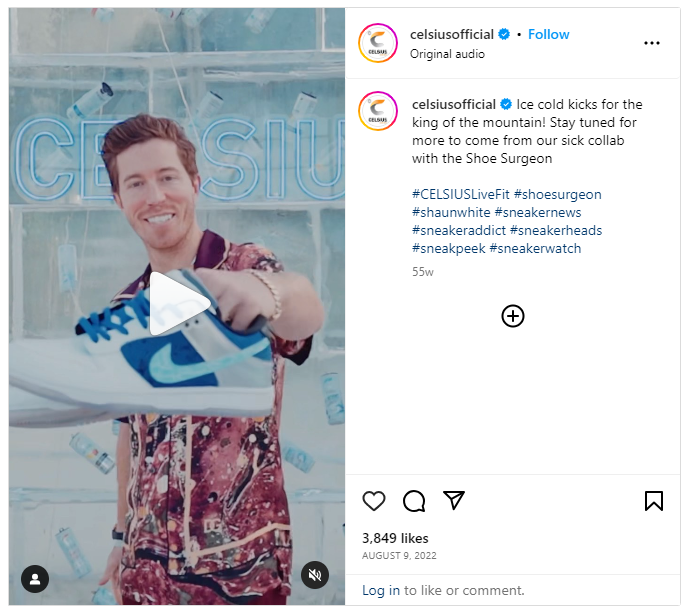

The brand has gained a celebrity following with A-listers like Jonah Hill singing its praises, while strategic collaborations with high-profile athletes like Shaun White help boost Celsius’s cred in the fitness realm.

Celsius is also a hit with the everyday consumer…

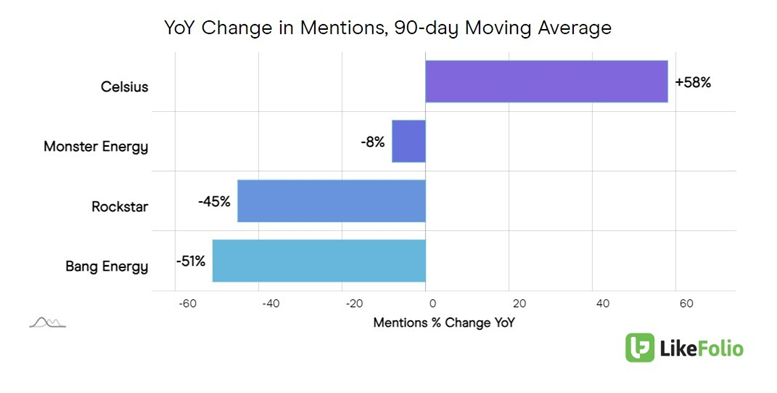

Social media buzz around Celsius has doubled year-over-year, according to our data – even as growth stagnates for its larger peers.

Sure, Monster Energy (MNST) still claims the lion’s share of mention volume at 80%, thanks in part to its recent Bang Energy acquisition, while Celsius stands at 11%.

Then again, just two years ago, Celsius barely claimed 2%.

That’s some serious market share stealing – and it’s likely understated.

The thing is, we saw this coming a mile away… issuing a buy alert on Celsius last January to our LikeFolio Investor subscribers when it was trading at just $43.92 per share.

The stock has gone on to hit record high after record high – reaching $187.81 as of this writing for an astonishing 327.62% return in under two years.

(Want to get alerted as soon as our database IDs the next potential quadruple-your-money winner? Join LikeFolio Investor today to unlock real-time trades, and we’ll also let you in on a $2 AI moonshot we love.)

Our secret to picking a quadruple-your-money winner like Celsius? A powerful system that helps us spot emerging opportunities when three key things line up in favor of a company:

- Strong Consumer Demand

- High Consumer Happiness

- Macro Trend Tailwinds

Compared to those competitors I mentioned – Monster and Bang – Celsius was showing higher levels of growth in consumer buzz and Consumer Happiness while overall energy drink demand ticked higher.

Celsius nailed the Trifecta back then.

The key question is if Celsius can maintain growth at such a powerful clip.

Find out whether this proven moneymaker still has gas in the tank right here, right now…

Still Leading the Pack

Celsius saw a niche opportunity to position itself as the healthy drink for wellness and health-focused consumers, contrasting its brand with Monster’s reputation as the high-octane caffeine hit used by gamers.

CEO John Fieldly describes Celsius drinkers like this: “They consume Celsius… but they don’t consider themselves an energy drink consumer.”

And they’re not just fitness buffs anymore, either.

An incredibly successful distribution partnership with PepsiCo (PEP) has taken Celsius to the mainstream.

As of March, Executive VP Toby David said the Pepsi deal helped Celsius go from eight to 13.6 SKUs (stock-keeping units) per retail location in a year.

And the company’s second-quarter earnings report proved yet again what a game-changer Pepsi has been.

Among the highlights:

- 112% year-over-year revenue growth (bringing in $325 million, an all-time quarterly record)

- 168% year-over-year increase in gross profits

- 357% boost to adjusted EBITDA

Celsius is still crushing it with consumers. Clearly.

But as Celsius saturates new markets, we’re seeing signs that growth may be slowing a bit.

A look behind the curtain shows Consumer Happiness leveling out: At 71%, Celsius is now just a point above Monster in this metric.

And while brand mentions have grown by more than 50%, that pace was over 100% a quarter ago…

What’s Next

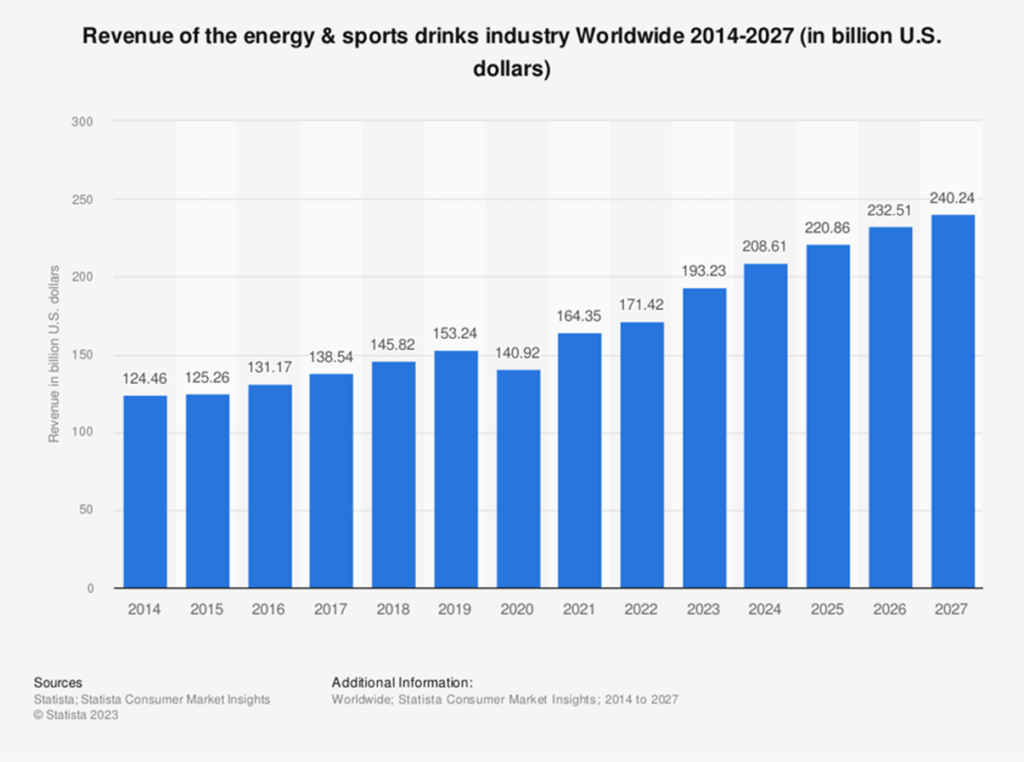

Overall, the global revenue in the energy & sports drinks segment of the non-alcoholic drinks market is forecast to continuously increase between 2023 and 2027 by $47 billion (+24.32%).

But with its Pepsi partnership, Fieldly believes he has an opportunity to turn Celsius into a “total beverage” player that eventually reaches beyond energy drinks.

That could open up entirely new revenue streams for Celsius, in turn, creating more opportunities for shareholders to profit.

Meaning this growth story is far from over.

Celsius investors – and especially LikeFolio Investor subscribers who got in early – have a lot to be happy about with CELH in their portfolio.

We wouldn’t be surprised to see some temporary pullbacks if Celsius reports a slowdown in growth, or if a new entrant to the energy drink field spooks the growing market.

It’s always wise to remain risk-defined.

But in the world of investing, data is king: And the data on Celsius is overwhelmingly positive.

I’d love to be able to deliver big winners like Celsius straight to your inbox before they break out so the next time we’re having this conversation, those 300%-plus are yours.

Let our edge become your edge – starting here today.

Until next time,

Andy Swan

Founder, LikeFolio