Up, Up, Down, Down, Left, Right, Left, Right, B, A, Start…

To most folks, that’s nothing more than a random string of words. But to us ‘80s kids, that series of commands was the cheat code to winning “Contra,” one of the coolest video games of our childhood.

Contra (video game) 1987

byu/LIGHTNING-SUPERHERO innostalgia

This cheat code was a gamechanger for two boys between the ages of 8 to 12-ish, like Landon and I were back then.

It unlocked 30 lives instead of three – extending game play and giving you a leg up on your noob friends.

But the concept of a cheat code is also a great way to understand LikeFolio insights.

By leveraging consumer mentions on social media and actions on the web, LikeFolio can craft custom “cheat codes” for companies in our coverage universe.

These cheat codes – aka insights – give investors a major leg up on the market.

And during earnings season, these codes are our Earnings Scores.

The LikeFolio Earnings Score

The LikeFolio Earnings Score is a simple -100 to +100 metric that lets us know how bullish, bearish, or neutral we should be on a company’s earnings event.

It’s calculated from an ever-evolving equation that leverages artificial intelligence (AI) to factor in millions of individual data points, pulling from demand mentions, sentiment, web visits, macro trends, investor expectations, and more.

Negative scores are a bearish indication while positive scores are a bullish indication. The larger the number, the stronger the indication.

Calculating LikeFolio’s “Cheat Code”

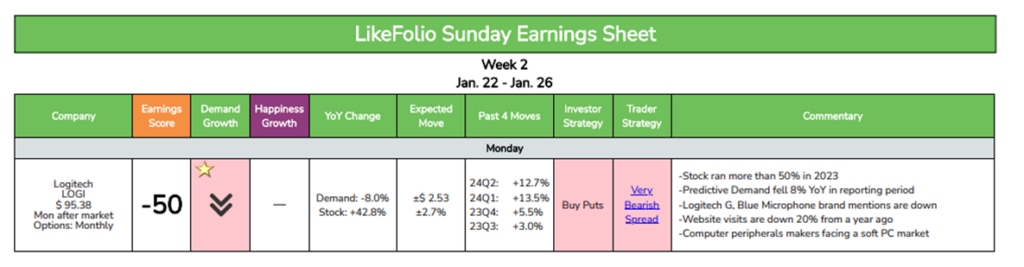

Take an example from this week’s Earnings Season Pass Scorecard: Logitech (LOGI).

LOGI’s -50 Earnings Score was decidedly bearish – and informed by the cumulation of LikeFolio’s Logitech data points.

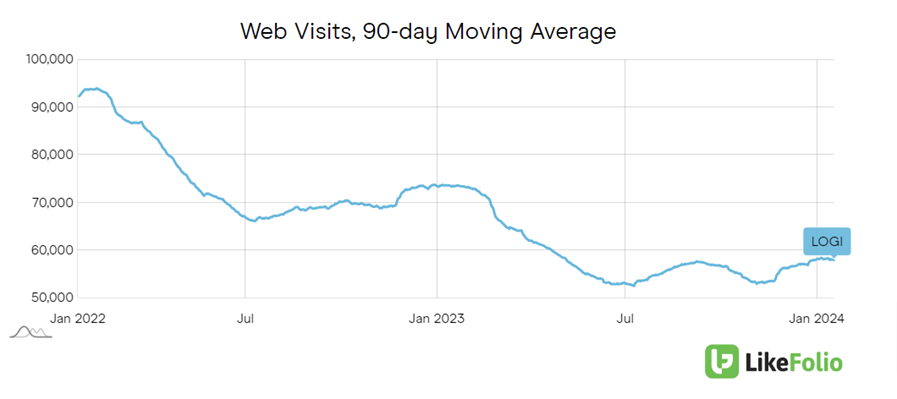

- LOGI Web Visits: Down 🔽

With our x-ray view into company website data, we knew Logitech’s web visits were down 20% from a year ago.

- LOGI Mentions: Down 🔽

We also knew Logitech demand mentions fell 8% year over year during the period it was set to report on… and that this metric had been particularly predictive of LOGI’s earnings moves in the past.

- LOGI Consumer Happiness: Down 🔽️

And sentiment around Logitech and its brands was losing steam, down 3% on a year-over-year basis.

- LOGI Investor Expectations: High 🔼

Heading into Monday’s earnings report, LOGI shares were trading near multi-year highs after the stock ran more than 50% in 2023.

Our calculations on the backend carefully weigh each metric to expected revenue – a formula custom created for each company at hand.

The result was clear: Logitech was unlikely to surpass Wall Street’s true expectations.

We were right.

Logitech shares dipped by more than 11% in response to company earnings that failed to impress.

LikeFolio’s Earnings Score was the “cheat code” that secured us this win – and a perfect example of how we give investors an edge during earnings season.

Our childhood selves would be proud.

You can find out how to access our AI-powered earnings “cheat codes” for yourself right here.

Until next time,

Andy Swan

Founder, LikeFolio

New in Derby City Daily This Week

Stay ahead of the investing curve with free consumer demand insights from Derby City Daily. Here’s what’s new this week…

PayPal Wants to “Shock the World” – But This Data Doesn’t Lie

Bold statements from PYPL leadership have investors betting on a turnaround – is it too good to be true?

As Airlines Falter, One Stock Has a Clear Runway

A series of unfortunate events is sending airline sentiment plummeting… leaving consumer dollars up for grabs.