The setup going into Tesla’s (TSLA) first-quarter earnings report last night was what dreams are made of:

- TSLA shares were down more than 60% from 2021 highs…

- Short interest was the highest it’s been in three years…

- Perceived competition was mounting – in China from BYD Auto, domestically from electric players like Rivian (RIVN), and even from traditional automakers…

- The narrative surrounding CEO and Founder Elon Musk was increasingly skeptical, focused more on his compensation package than functional genius…

- Wall Street was expecting a big move (9%)…

- And most important: LikeFolio data was (and still is) heating up.

If you follow along with Derby City Daily, you know how much we love earnings trading. You also know we’re unapologetic Tesla bulls.

So you understand why this opportunity was too good to pass up.

Armed with LikeFolio’s real-time consumer insights, a powerful earnings algorithm, and 40 years of combined trading experience, we took a Very Bullish bet on Tesla with this week’s hand-picked earnings trade:

“With this trade, markets give us a 25% chance of success with a 3:1 reward-to-risk ratio… TSLA stock is beaten down and much of the bad news is priced in. It could rally on a “cover the news” type of report, or if there is any surprise to the numbers. Our data suggests a rally is very likely.”

That Earnings Season Pass alert went out on Monday, April 22, when TSLA shares were hovering at 52-week lows. Tesla reported its numbers Tuesday, April 23, after the bell. The stock rallied more than 12% on earnings. And by 10:00 a.m. today, April 24, our members were walking away with a 268% win.

Let that sink in: +268%. In two days.

The goal with these earnings trades is to get in on Monday, get out by Friday, park your cash, and enjoy that weekend.

Mission accomplished.

And by the way – Tesla was one of 59 earnings plays our members got access to in their Week 2 Earnings Scorecard. We’ve got another eight weeks of earnings season to go, which means there are hundreds of opportunities still to come for those of you who join today.

See, our bullish TSLA call wasn’t just hopeful. It was rooted in solid data reflecting real-time consumer behavior and sentiment…

The Bullish Case for Tesla in 3 Powerful Charts

With direct access to the firehose of consumer conversations happening every minute of every day – mentions from social media platforms such as X and Reddit (RDDT), Google (GOOGL) searches, company web traffic, and more – we have the kind of perspective hedge funds pay top dollar for.

And these three powerful charts paint a clear bullish picture for Tesla that lasts well beyond this short-term earnings rally…

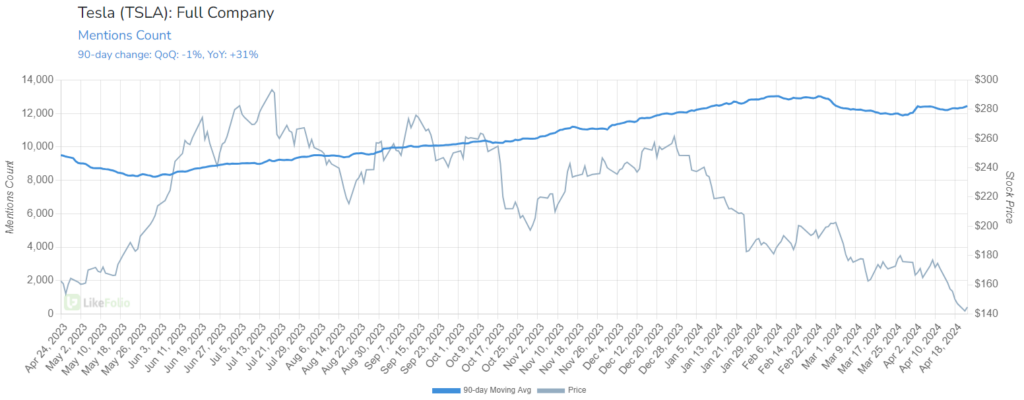

No. 1: Consumer Mentions Show Increasing Divergence:

Divergence in this instance means Tesla buzz is heading higher (+31% year over year) while its stock price trends lower. If history is any indication, this growing gap between stock price and mention volume will likely narrow – and we are betting the stock will follow mentions higher.

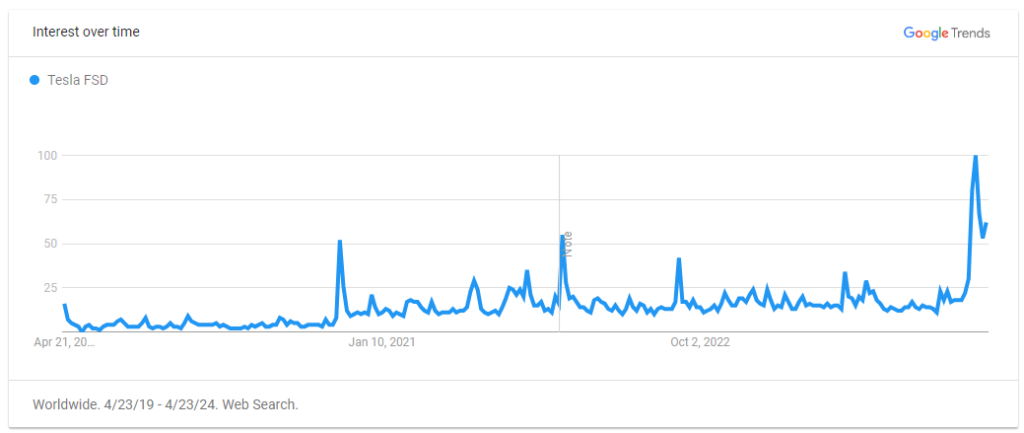

No. 2: Tesla FSD Searches at All-Time Highs:

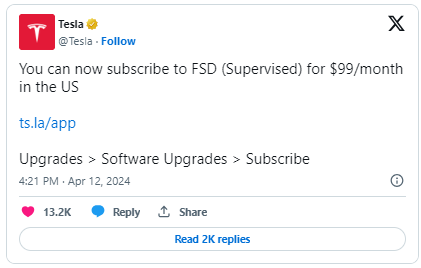

Consumer searches for “Tesla FSD,” its Full Self-Driving feature, hit all-time highs last month as Tesla pushed updates and improvements to its self-driving platform and slashed the price of a monthly subscription in half.

It’s important to note that during this massive adoption of a new and futuristic technology, Tesla sentiment only moved by -3 points. That’s impressive, considering the mention buzz growth displayed above – and bodes well for future FSD upgrades down the road.

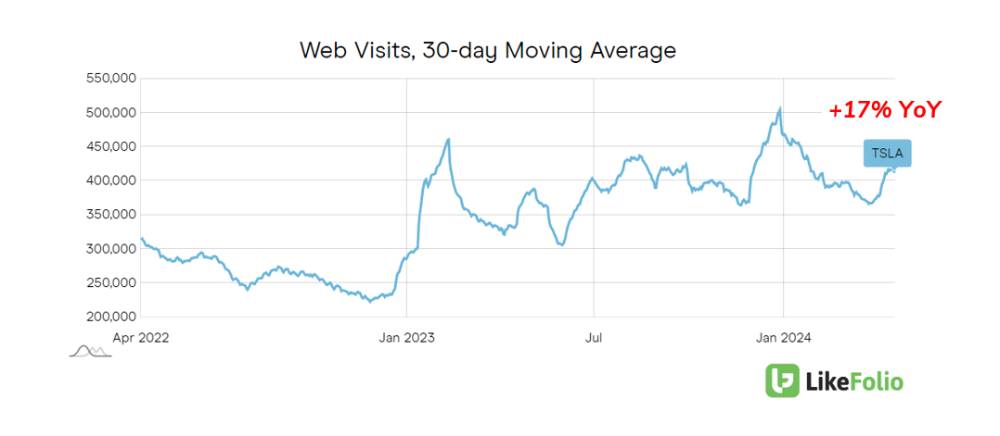

No. 3: TSLA Web Traffic Is Accelerating:

Consumer visits to Tesla’s website to check out its vehicles (and other product offerings) are rising at an increasing rate: +10% year over year on a 90-day moving average and +17% on a 30-day moving average. This is an excellent gauge to use for future purchases.

The takeaway: Trusting the data pays off. While others focused on the noise around Tesla, we tuned into the signal – real, measurable consumer behaviors and trends that foreshadowed Tesla’s rebound.

And the best part? This opportunity is far from over.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. Elon Musk is working on a new AI project that, in his own words, “will be even bigger than Tesla.” Our colleague traveled all the way to the Tesla Gigafactory in Texas to investigate the opportunity for himself. Here’s what he found.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Ad Spend Could Be a Boon for These Big Tech Stocks

Here’s a look at the early winners and losers of the digital ad spending spree…

Trend Watch: Tesla, Uber, and the Driverless Future

Opportunities abound as autonomous driving interest surges to all-time highs…