Fast-casual restaurant stocks are on a wild ride in 2025.

The sector was once a high-growth favorite, with restaurant stocks surging on momentum-driven valuations that at times rivaled tech giants.

Now, as investors scrutinize growth sustainability, volatility is taking hold. Companies delivering strong results are rewarded, but even minor earnings misses are punishing stocks.

This pattern has played out across the food space this earnings season.

On the bearish side:

Wingstop (WING) plunged 24% last week after missing Wall Street’s sky-high expectations, bringing in $161.8 million for the quarter (vs. estimates of $165.13 million). Earnings Season Pass members who played this report with our bearish Coin Flip trade walked away with a quick triple-digit win.

Meanwhile, Sweetgreen (SG) has lost nearly half its value since November.

On the bullish side:

Shake Shack’s (SHAK) fourth-quarter report lifted its stock ~13% last Thursday, showing that fast-casual still has legs when the numbers back it up.

The takeaway? Massive moves are happening in this sector that we can capitalize on, thanks to LikeFolio’s predictive insights.

We drilled down into our forward-looking consumer demand data and found two exciting trade ideas in this sector that investors can take advantage of today. Take a look…

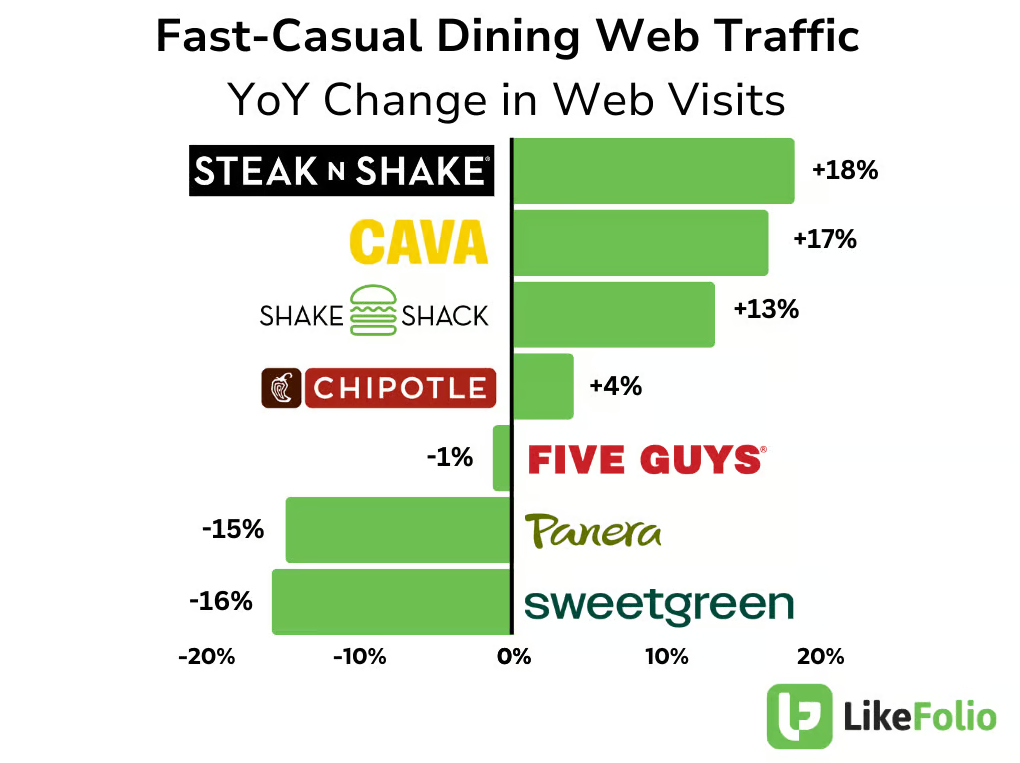

Web Traffic Trends Separate the Winners and Losers

Web visits serve as a powerful indicator of consumer interest and potential sales momentum. Below is a year-over-year percentage change in web traffic for major fast-casual brands, giving insight into shifting consumer engagement:

Shake Shack’s strong report and stock jump confirm demand for fast-casual concepts. Investors rewarded its latest earnings, and our data backs up the momentum – confirming Shake Shack’s web visits are accelerating 13% year over year.

Now, take a look at who’s leading the competition: Steak ‘n Shake (BH), with 18% year-over-year digital traffic growth. Consumers are showing more interest in the Midwest steakburger chain, likely tied to its turnaround efforts and new marketing strategies.

Better-for-you Mediterranean chain CAVA (CAVA) also looks strong here despite cooling slightly. With web traffic up 16.6%, this suggests the company continues to attract attention, even as its stock pulls back.

Other players are struggling: Sweetgreen, Panera, and Five Guys have all seen significant traffic declines, pointing to headwinds in keeping customer engagement high.

Fast-Casual Opportunity No. 1: CAVA

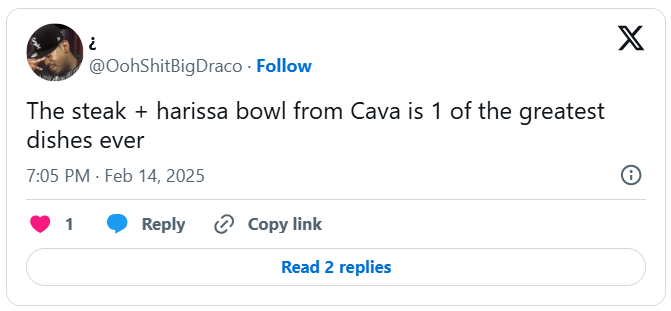

CAVA is growing fast, both in store count and customer traffic. The restaurant chain introduced grilled steak to its menu last summer, and the offering was an instant hit, helping drive an 18% same-store sales increase in the third quarter.

CAVA’s fourth-quarter numbers, reported yesterday, showed a strong end to the year: Same-store sales continued to accelerate – up more than 21% year over year – while revenue powered 28.3% higher to $225.1 million. For the full fiscal year, revenue grew 33.1%.

Yet, the stock has pulled back 31% from its December highs. Investors are recalibrating expectations, but this could be an entry point for those betting on CAVA’s long-term expansion.

With a loyalty program on the way and 62 to 66 new restaurant openings planned for 2025, CAVA’s growth trajectory remains intact.

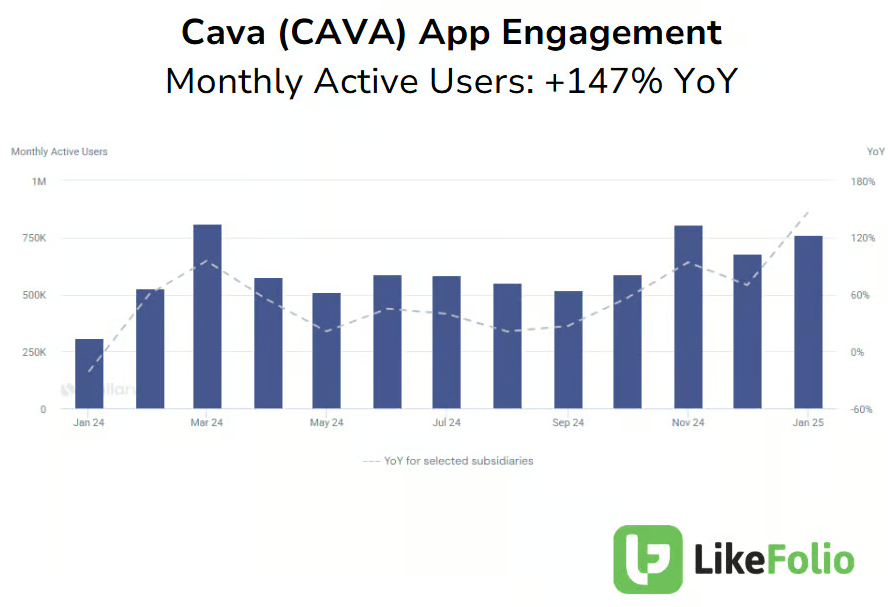

LikeFolio app usage data also supports an uptick to kick off the new year (+147%):

The fast-casual space has been volatile, but companies that continue expanding efficiently are rewarded. While the market was mixed on CAVA’s latest earnings report, this pullback could be a great entry point for investors betting on the long-term opportunity.

Fast-Casual Opportunity No. 2: Steak ‘n Shake (BH)

Steak ‘n Shake was a mess a few years ago – with shrinking store counts, weak same-store sales, and declining profitability. But Biglari Holdings (Steak ‘n Shake’s parent company that also has exposure to restaurant holdings, insurance premiums, and oil and gas) made a bet: Strip down the business model, ditch full-service dining, and hand operations over to franchise partners who have real skin in the game.

It worked. Productivity per employee has more than doubled. And after years of losses, Steak ‘n Shake is turning a profit again, posting $26.2 million in pre-tax earnings in 2023.

Recent financials confirm Steak ‘n Shake remains profitable. In the third quarter of 2024, same-store sales grew 5.4%, pushing net sales up 1.2% year over year to $39.66 million. While franchise partner fees saw a slight dip, the company continues to operate at a profit, even with rising labor costs.

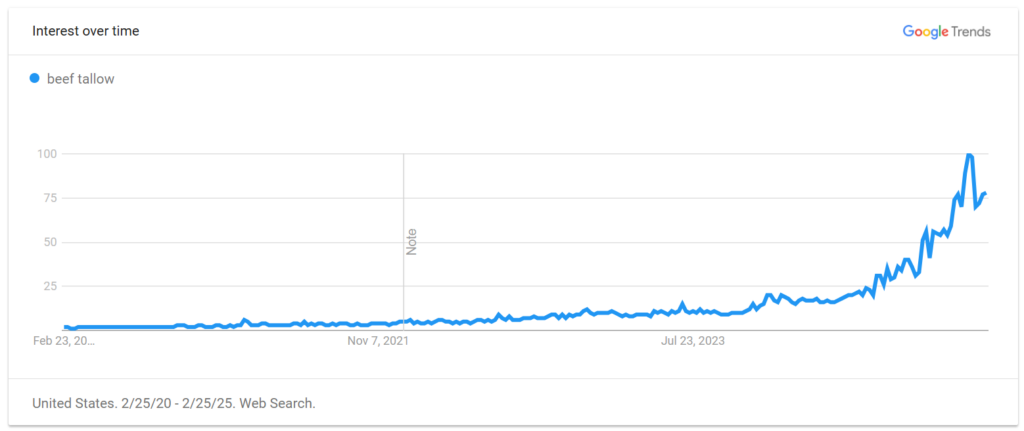

Now, Steak ‘n Shake is going full tilt on a surprising food trend: Consumers’ growing appetite for beef tallow, a throwback to how fries used to be cooked before seed oils took over.

Consumer search trends point to a significant uptick in beef tallow interest on Main Street:

This unique ingredient is catching consumers’ attention, helping Steak ‘n Shake stand out in a crowded market.

Meanwhile, Biglari’s investments in automation and digital ordering are keeping costs down. The company’s next earnings report is due in mid-March 2025 – franchise expansion and cost management will be the key metrics to track.

The Bottom Line

CAVA is leveraging consumer demand for better ingredients, while maintaining a scalable model with a strong unit expansion pipeline. Its recent pullback could be a compelling opportunity for investors taking the long view.

Steak ‘n Shake is executing on a simplified, high-margin strategy, shifting toward a franchise-led model that lowers corporate risk while keeping operators motivated. Consumers are turning away from seed oils in favor of natural cooking methods, a shift that Steak ‘n Shake is capitalizing on with its beef tallow pivot.

If you’re after a long-term turnaround that’s just getting started, Steak ‘n Shake’s transformation under Biglari Holdings is worth tracking.

Either way, the volatility in fast-casual stocks is creating real opportunities – and these two names could be next in line for a move higher.

There’s no better way to play earnings season volatility than by becoming a member of Earnings Season Pass.

With our Weekly Earnings Scorecards delivered every Sunday, you’ll know every company set to report in the week ahead, whether they’re in for a bullish, bearish, or neutral move, based on LikeFolio’s predictive earnings algorithm, and the best way to trade them – all in one easy-to-read report. Click here to get started now.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Is Target the Best Undervalued Retail Play Right Now?

The retail boom left Target behind, but this major retailer is pulling off a quiet turnaround…

xAI’s Grok 3 Challenges AI Giants and Redefines the Game

DeekSeek Who? Grok 3 just redefined the AI race. Here’s a look at how it’s sweeping the competition – and the opportunities it’s creating…