As you sit back to stream that new episode you’ve been looking forward to all week, consider the brand of the TV you’re watching it on. Is it a Vizio (VZIO)?

If so, every advertisement you see will soon be contributing to Walmart’s (WMT) bottom line.

On average, we Americans spend a whopping three hours and nine minutes per day streaming digital media. With its $2.3 billion acquisition of Vizio, Walmart aims to monetize that captive audience.

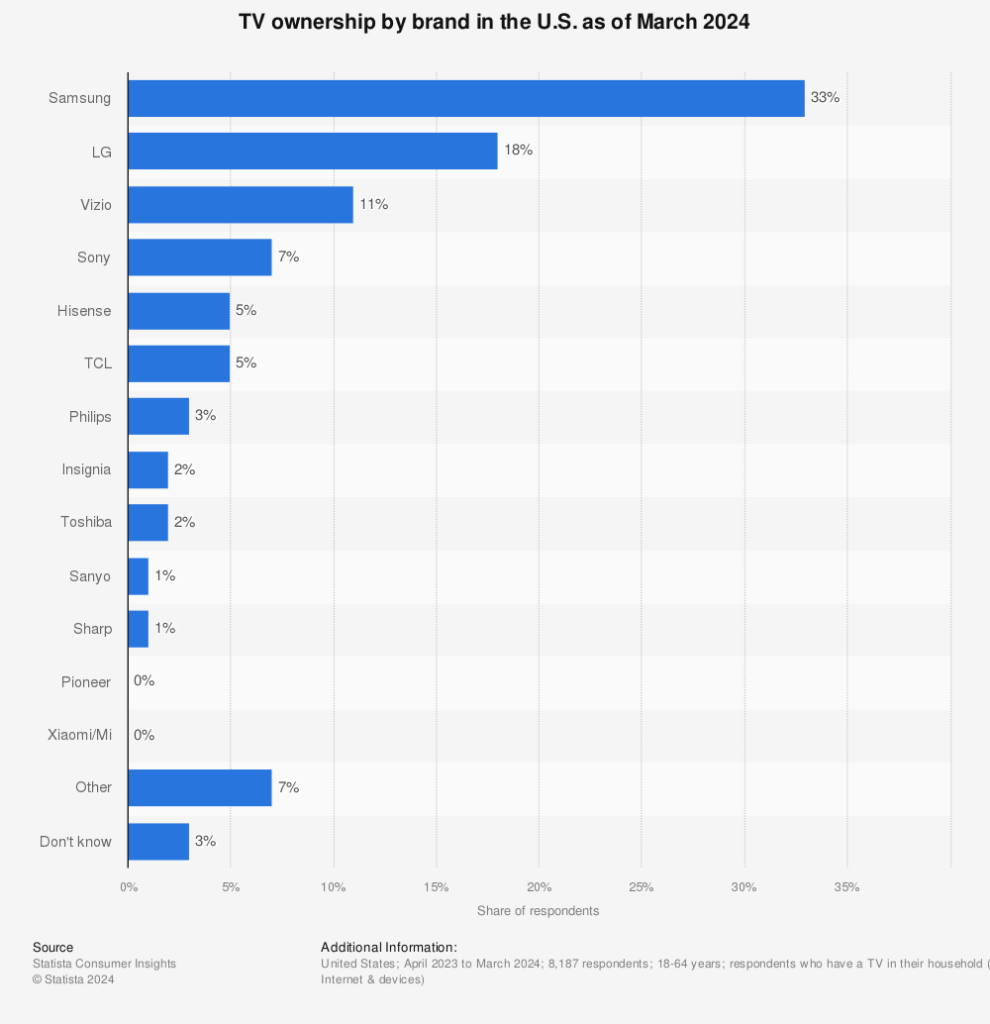

It’s a brilliant strategy: Vizio is the third-most popular TV brand in the U.S., according to recent surveys, behind only Samsung and LG…

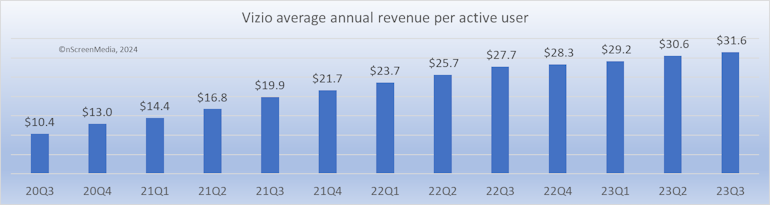

It boasts 18 million active users, each of which has become increasingly more valuable over time – with average annual revenue per active user at $31.60.

And if it goes through as planned, this deal will launch Walmart straight into the lucrative advertising arena.

Why Advertising?

Walmart aims to harness Vizio’s smart TV technology to enhance its targeted advertising capabilities, driving higher revenue from ad sales and monetizing consumer data more effectively.

This household name is already the largest retailer in the world, bringing in well over half a trillion dollars in revenue last year ($611.3 billion).

Getting Vizio under its belt is a savvy move that fits into Walmart’s broader strategy to diversify beyond groceries and staples… while bolstering both segments simultaneously.

Long-Term Implications

- Ad Revenue Growth

With Vizio’s platform, Walmart expects to significantly boost its advertising revenue, potentially turning its retail media network into a $100 billion business.

- Data Utilization

The acquisition provides Walmart with a wealth of consumer data, allowing for more personalized ads and improved ad performance, which can be monetized through various partnerships and services.

- Market Dominance

This deal positions Walmart to compete more aggressively with giants like Amazon.com (AMZN) and Google (GOOGL) in the advertising space. However, it also raises concerns about data privacy and market competition, prompting advocacy groups and lawmakers to call for regulatory scrutiny. (Walmart is reportedly refiling its Vizio acquisition to give regulators ample time for review.)

More Than a Retailer

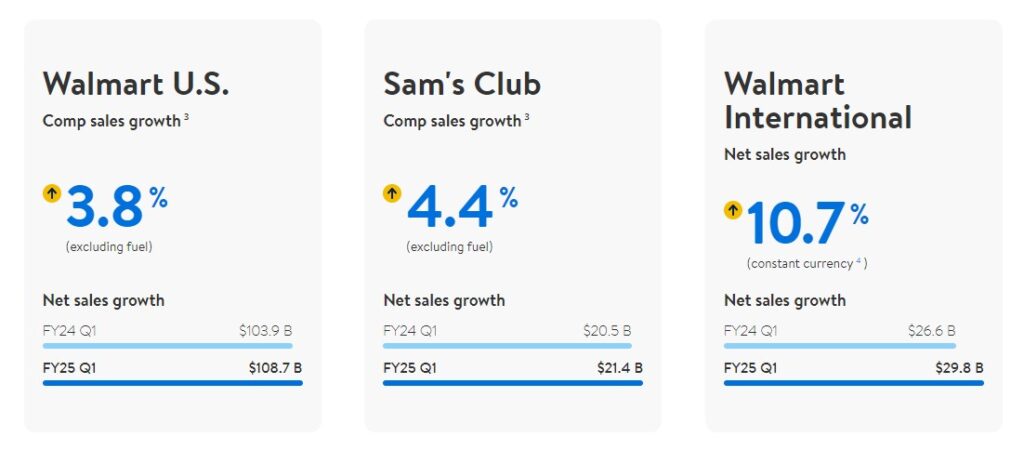

Walmart’s recent earnings highlight its successful diversification strategy. In Q1 FY25, Walmart reported expectation-beating revenue of $161.5 billion. Notably, global e-commerce sales surged by 21%, driven by initiatives like curbside pickup and home delivery. And earnings per share got a 200% year-over-year boost.

A significant factor in Walmart’s earnings growth is its expansion into more profitable areas beyond its traditional reach. The company has diversified into logistics, packing, and shipping online orders for third-party sellers, as well as operating a delivery service for major companies and local businesses.

Additionally, Walmart’s advertising business is thriving with global gains of 24% and U.S. gains of 26% year over year. CFO John David Rainey has described the Vizio acquisition as a major catalyst for this “high-margin, fast-growing” segment, providing better data tracking and ad performance.

Bottom line: Walmart’s acquisition of Vizio is a bold move in retail media, if completed and approved. We’ll be watching closely to understand implications for key competitors in advertising, like Roku (ROKU), and in retail – from AMZN to Target (TGT).

The Bigger Picture

One prominent theme we’re noting this earnings cycle is that both companies and consumers are prioritizing value – and the brands that manage costs effectively, provide high-quality products and services, and adapt to changing preferences are better positioned to succeed.

Earlier this month, we showed you how this trend poses a major threat for mid-priced fast-casual businesses.

Persistent inflation has left a large swath of consumers scrambling for enough money to pay for their lifestyle, and it could get worse by June. (In fact, my colleague issued a warning about the financial panic he sees coming and how you can protect yourself. Watch it here so you don’t get caught by surprise.)

Walmart has effectively won over many of these high-income, value-seeking consumers and is seeing the benefits in its bottom line. It’s on the winning side of this shift. And it won’t be the only one.

Stick with us as this trend unfolds, and we’ll keep you ahead of the curve.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

For Zoom, the Return to Office Trend Isn’t the Only Problem

Whether or not Zoom can overcome these headwinds could depend on this…

A Surge in Retail Investment Is Creating New Opportunities

Here’s what’s driving an influx of retail capital – and how you can capitalize on the trend…