Lululemon (LULU) started the year with a stark warning about falling profit margins and slowing sales in 2024.

“As you’ve heard from others in our industry, there has been a shift in the U.S. consumer behavior of late, and we’re navigating what has been a slower start to the year in this market,” explained Calvin McDonald, CEO of Lululemon.

Analysts were quick to count LULU out – and stick to their guns – looping the high-end retailer in a no-longer-cool club with fallen sneaker king, Nike (NKE).

Just this week, Jeffries noted:

“We suspect the company has maximized its core category total addressable market and is attempting to find growth in other areas, but it isn’t working.”

Naysayers cited growing competition from smaller, newer brands like Vuori and Alo Yoga, pointing out that about 90% of Vuori stores and 84% of Alo stores are located within half a mile of a Lululemon location across the United States.

This is when it’s important to listen to what real consumers are saying.

LikeFolio’s Data Engine was built to do just that, analyzing millions of social media posts every single day in real time to give us critical insight into the products, services, brands, and trends gaining momentum on Main Street – before Wall Street has a chance to catch on.

And just before the biggest holiday shopping spree of the year, our data signaled LULU demand was on the rise.

Despite the market’s overwhelmingly dour outlook, we named LULU one of our top three early holiday winners in a special edition of Derby City Daily.

Here’s how that contrarian call worked out…

We Called It: Lululemon Is Back on Top

Real-time social media insights confirm that malls were absolutely packed on Black Friday… and consumer spending surged.

We saw this first hand – and you can bet those lines spilling out of Lululemon bode well for in-store purchases.

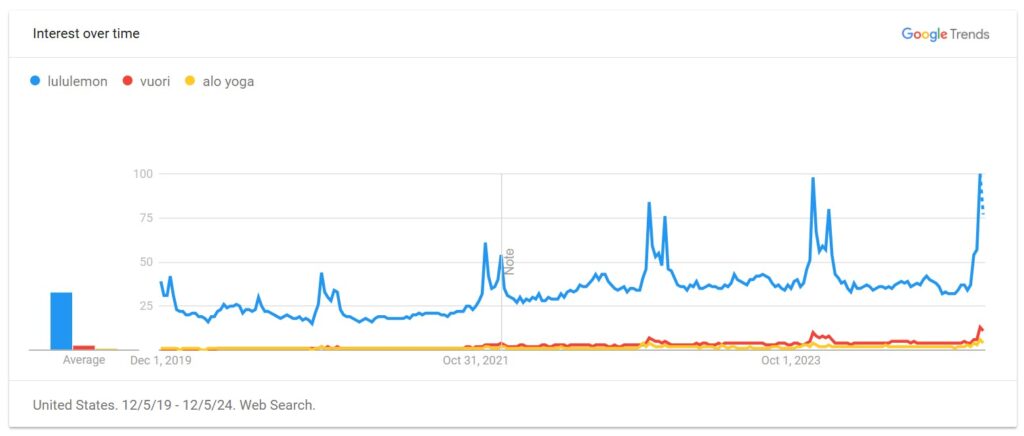

At a higher level, consumer searches indicate that while LULU competitors Vuori and Alo Yoga are growing brand awareness, they still have a way to go to catch up to Lululemon… which looks like it had a solid holiday shopping weekend (its highest on record):

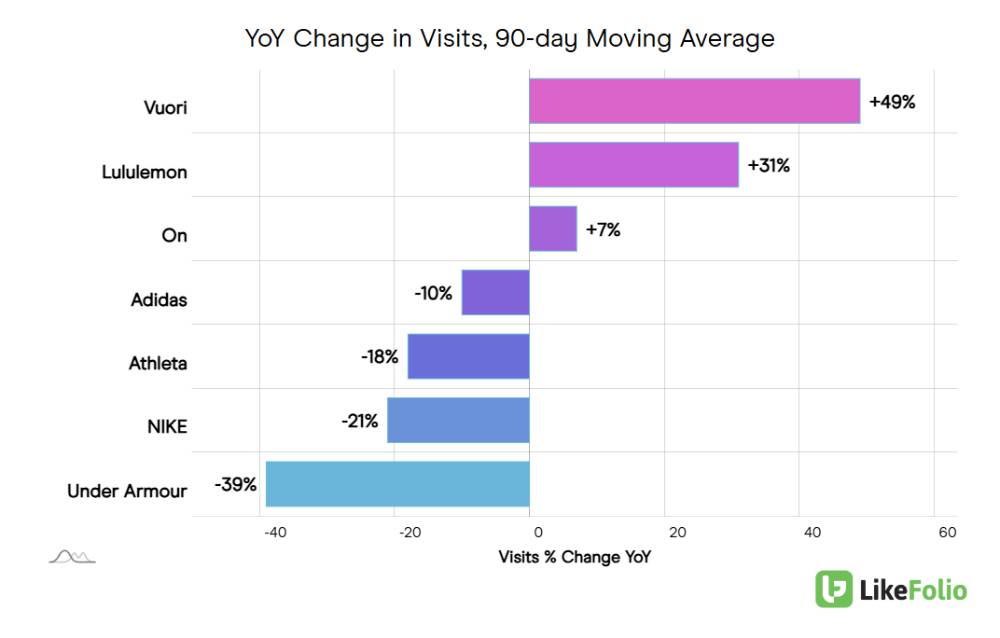

If you zoom out on the entire athleisure picture, you can see LULU is actually beating most other brands.

LikeFolio digital insights show visits to Lululemon’s website gaining by 31% year over year, outperforming the major players like Nike, Adidas (ADDYY), and Under Armour (UA) by a wide margin:

For reference: We don’t traditionally cover Alo Yoga, but if it were on this chart, it would be below Lululemon with +23% year-over-year growth in website traffic.

One other important factor here is that Lululemon is working to expand its international exposure – and that strategy is working in its favor.

A month ago, Chinese e-commerce giant Alibaba (BABA) called out strength in Lululemon’s brand, specifically on its annual Singles’ Day shopping spree.

And wouldn’t you know it – international sales growth drove LULU’s third-quarter earnings beat yesterday, jumping 33% year over year, with noted success in China.

“Our performance in the third quarter shows the enduring strength of Lululemon globally, as we saw continued momentum across our international markets and in Canada,” said McDonald in his statement to shareholders. (A strikingly different tone from LULU’s first-quarter woes.)

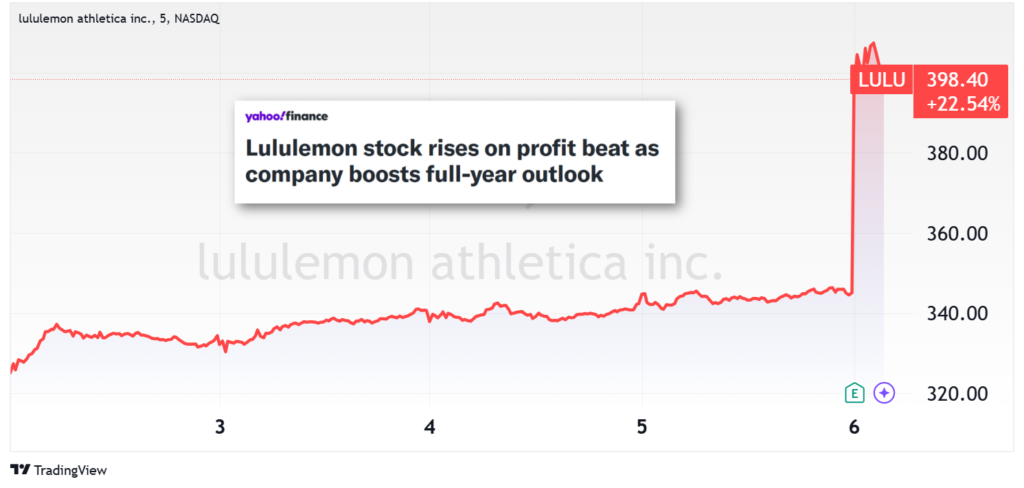

Sales beat expectations, growing 9% year over year to $2.4 billion, earnings surpassed estimates at $2.87 per share (versus the anticipated $2.69), and the company provided upbeat guidance on holiday demand.

The Lululemon Comeback We Saw Coming

Lululemon had a tough start to the year, but Wall Street was premature to count this retailer out. They didn’t have our unique insight into what’s really happening on Main Street. And that’s where LikeFolio – and our followers – have an edge.

Our data signaled that LULU’s website visits were picking up steam ahead of the most important spending weekend of the year. And yesterday’s earnings report proved our early call right.

Bottom line: LULU is a favorite with consumers this holiday – domestically and abroad.

Hopefully, you watched our Black Friday video special and took note. LULU burst nearly 20% higher on that positive earnings surprise today…

And with LULU’s digital traffic only improving since our Black Friday coverage, we wouldn’t be surprised to see more gains from here.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Walmart and Temu Are Killing Dollar Stores

Dollar stores are losing their grip. Here’s what to know…

Cut Through the Tesla Noise with This Real-Time Data

Tesla has a target on its back. But conflicting LikeFolio data suggests something bigger is brewing behind the scenes…