Today’s Consumer Price Index (CPI) report came in at 6%, marking the eighth-straight month of lowering prices since the U.S. inflation rate hit a boiling point at 9.1% in June 2022.

That’d be all well and good, if not for last week’s stunning collapse of Silicon Valley Bank…

Which failed because of its heavy-handed investment into government bonds that lost significant value amid the very same interest rate hike campaign meant to rein in inflation.

Volatility is the name of the game this week.

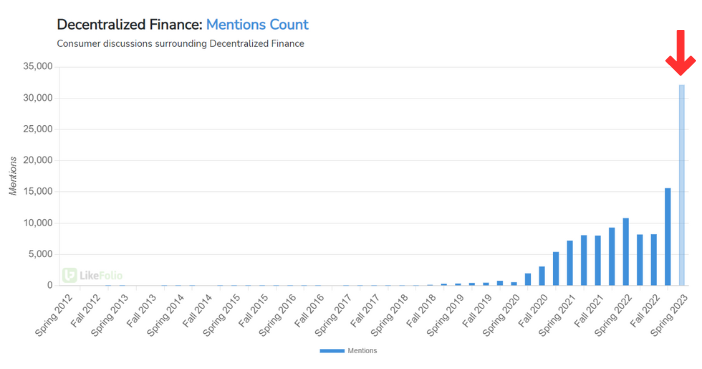

But one thing we do know is that once Signature Bank (SBNY) became the next bank to fall on Sunday, folks started high-tailing it away from centralized banking in favor of its very antithesis: decentralized finance (aka cryptocurrency).

LikeFolio data shows interest in DeFi has surged by triple-digits so far in Spring 2023:

While bank stocks like First Republic Bank (FRC) tanked around 60% over the past five days, crypto bellwether Bitcoin (BTC) had other ideas – soaring 20%-plus in the other direction.

In fact, just this morning, BTC surpassed $26,000 to hit a nine-month high.

And that’s fantastic news for one of my favorite stocks for 2023…

Keep Your Eyes on Coinbase (COIN)

Despite some talking heads blaming crypto for the current banking failures after crypto lender Silvergate Capital (SI) went down last week, shares for the industry’s leading exchange, Coinbase (COIN), have gained double-digits since then.

Coinbase has been on my moneymaking watchlist for some time because it has uniquely positioned itself as a “safe haven” for crypto investors.

It’s already the most widely-used crypto exchange in the U.S. But it’s also the only publicly-traded one of its kind… Which means Coinbase’s financial statements are audited by a Big Four accounting firm – even as these firms have been “unwilling” to audit peers like Binance.

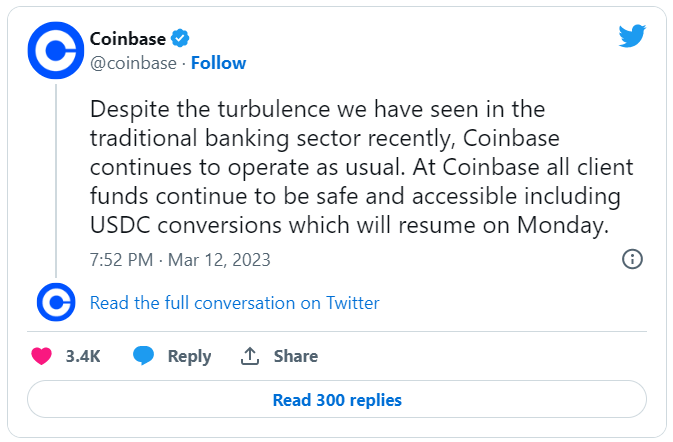

That kind of transparency and accountability gives Coinbase a leg up with consumers, especially after the FTX collapse in early November of last year.

Now, it’s using these most recent bank failures to once again reiterate its “safe haven” status:

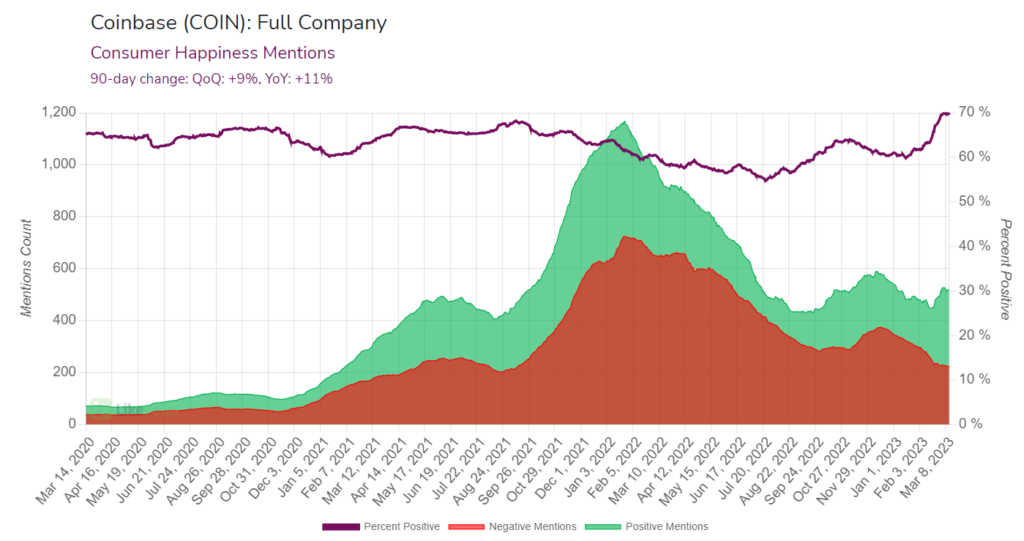

We’re already seeing this translate into increasingly happy customers, with Consumer Happiness Mentions for COIN trending 11% higher from the year prior, and 9% higher just since last quarter:

Since Bitcoin and Ethereum are major drivers of trading volume and transaction revenue for COIN, last year was rough for the company: Revenues fell from $7.4 billion in 2021 to $3.1 billion in 2022.

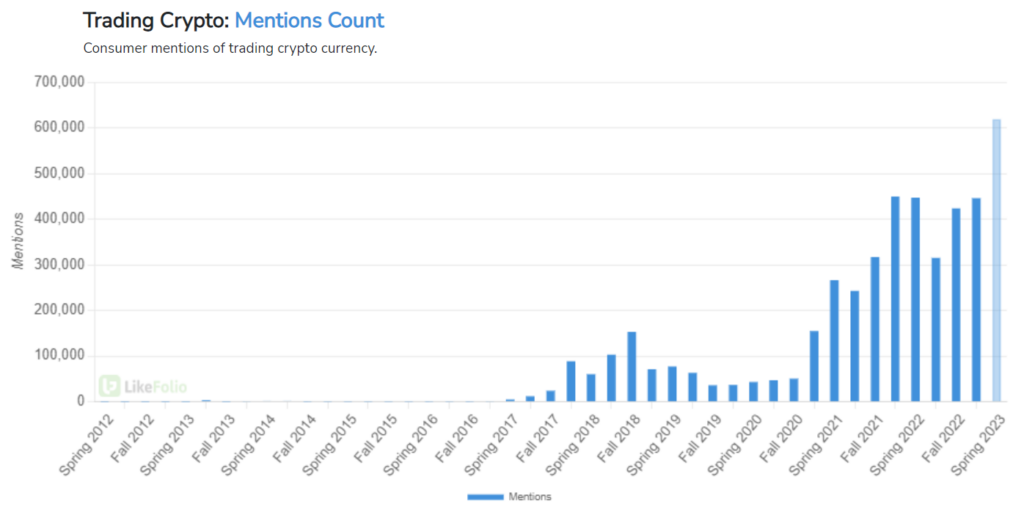

But that also means that when interest in crypto goes up, Coinbase reaps the benefits.

So far, LikeFolio data shows that mentions of trading crypto are trending 10% over last quarter’s levels:

Make no mistake: COIN is a high-risk, high-reward kind of investment. But it’s one that allows you to cash in on all the growth potential crypto offers without having to buy crypto directly.

Even better? COIN is handily outpacing BTC’s 55% year-to-date (YTD) gains, with shares now up 80% since the start of the year.

Stay tuned tomorrow, when we’ll be back with more investable opportunities from our consumer insights database.

Until next time,

Andy Swan

Co-Founder