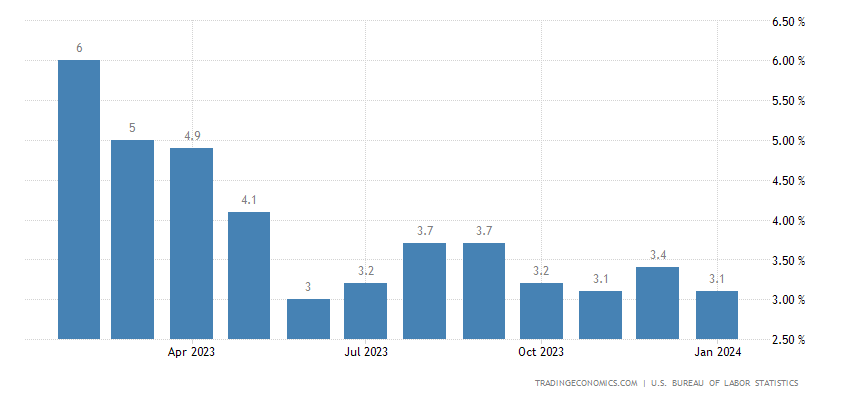

A new Consumer Price Index (CPI) report sent tremors through the stock market yesterday, pushing the S&P 500 Index down 1.4%.

We found out that U.S. consumer prices rose more than anticipated in January, with a 0.3% increase from the previous month and a 3.1% increase over the previous year.

Those figures surpassed economists’ forecasts, who were predicting a 0.2% month-over-month increase and a 2.9% annual increase. The core CPI, which excludes the more volatile costs of food and gas, also rose by 0.4% month-over-month and 3.9% year-over-year, suggesting underlying inflationary pressures remain persistent.

Inflation is still hot. Surprise, surprise.

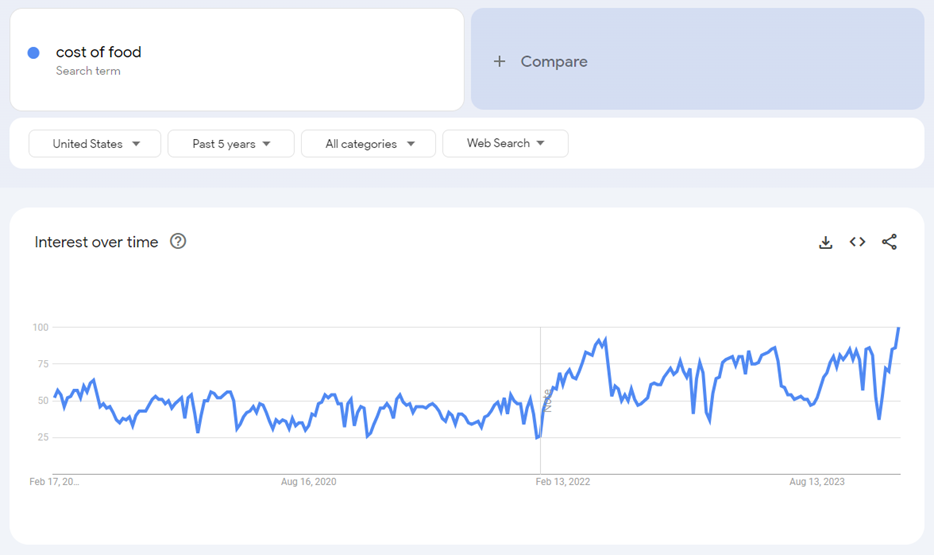

If you’ve been through the McDonald’s (MCD) drive-thru recently, you already know inflation is hot.

The fact is that food price concerns have been top-of-mind for consumers for a while now.

And this sustained pressure could have significant implications for consumer spending – and buying power – moving forward.

Here’s what we’re watching…

High-Level Takeaways

1. Inflation Remains Above Expectations: The CPI data for January indicates that inflation is still running hotter than expected, which could complicate the Federal Reserve’s efforts to bring inflation down to its 2% target.

2. Market Reactions and Fed Expectations: Following the report, market expectations for the Federal Reserve to hold rates steady at its next meeting increased significantly. This shift reflects a growing consensus that it might be too soon for the Fed to consider rate cuts, especially in light of persistent inflationary pressures.

3. Sector-Specific Inflation Dynamics: The report highlighted significant inflation in shelter costs, contributing to the higher core inflation reading. Conversely, prices for used cars and trucks continued their downward trend, while energy prices fell. Food prices, both at home and away from home, rose moderately.

Implications for Fed Rate Cuts

Given the higher-than-expected inflation figures, it’s likely that the Federal Reserve will adopt a cautious stance on adjusting interest rates.

The anticipation of ongoing inflationary pressures, as reflected in the core CPI, suggests the Fed may delay any rate cuts to later in the year, contrary to what many were expecting.

This is further supported by commentary from economists suggesting a “bumpy path ahead” for inflation, which may influence the Fed’s timeline for rate adjustments.

Implications for Consumer Spending

1. Impact on Disposable Income: Higher inflation, particularly in essential categories like shelter and food, may reduce consumers’ disposable income, potentially impacting their spending capacity on discretionary goods and services.

2. Consumer Sentiment: Persistent inflation can affect consumer sentiment, making households more cautious about spending, especially on big-ticket items that are not immediate necessities.

3. Sector-Specific Effects: While some sectors, like the automotive sector (with declining prices for used cars), may see a different impact, overall consumer spending trends could be moderated by the inflationary environment… especially if wage growth does not keep pace with inflation.

The Silver Lining

This all sounds pretty dismal. But when you have LikeFolio in your corner, you always have an advantage in the market, regardless of macroeconomic events or moves by the Fed.

Our “edge” comes from understanding consumer behavior – what “real Main Street people” are doing – before it becomes news on Wall Street.

Whether inflation goes up, down, or sideways, there are always big profit opportunities to be found in individual companies and assets.

We’ve made it our business to uncover them with a consumer insights machine capable of tapping into the collective consciousness of America.

Moving forward, we’ll be watching for any other potential ripple effects of lingering inflation on consumer spending – and members will be the first to know when we spot an opportunity.

That opportunity could come sooner than you think.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Shopify’s Pullback Is an Opportunity in Disguise

SHOP not only deserves its coveted position among the LikeFolio elite – but this sell-off could be an opportunity in disguise…

Welcome to the Great Live Sports Shakeup of 2024

A major shift in the sports broadcasting landscape is underway with massive implications for consumers and investors alike…