🎥 Replay Now Available: Watch Last Night’s Big Earnings Season Event Here

Hey – Landon Swan with a quick note before we jump into the (admittedly awesome) story Andy put together for you today… The turnout for last night’s “Earnings Season Party” was incredible. Huge shout out to all you Derby City Daily readers who were able to make it and a big THANK YOU for helping us kick off our favorite time of year in style (Derby City style, that is).

I want to personally let you know that the replay of last night’s broadcast is now available for you to watch right here.

Watch that video, and Andy and I will show you how to trade ahead of the earnings reports of hundreds of companies during the next 40 days of earnings season so you can get in, get out, and get paid… dozens of times in the coming weeks.

Click here to watch the broadcast, and we’ll chat again soon.

Cheers,

People are willing to treat themselves to little indulgences and “affordable luxuries” when times get tough, and with 64% of Americans saying they are living paycheck to paycheck, that qualifies as tough times.

So, they start buying things like a $10 tube of lipstick to treat themselves and receive a temporary escape from everything that is going on.

But what if lipstick isn’t your speed?

What else are people turning to?

They’re turning to booze, as there’s always a few bucks to spare for a beer to take the edge off. (Or if you’re a Swan, a couple of fingers of bourbon typically does the trick.)

Because what we’ve learned is that the average consumer buys more low-cost luxuries in difficult times. (While wealthy, higher-end consumers are largely unaffected.)

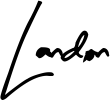

You can see the resilience in both the alcohol and beauty industries on the chart below, which aggregates all companies in a sector to give a high-level view of how they’re performing in the eyes of consumers:

Alcohol, beauty, travel, and even luxury are outperforming other areas of discretionary spending like home improvement, retail, streaming, and even going out to eat.

And thanks to our LikeFolio investing “edge,” we’re able to take this data a step further to decipher which companies in a given sector look like winners – and which ones are falling behind.

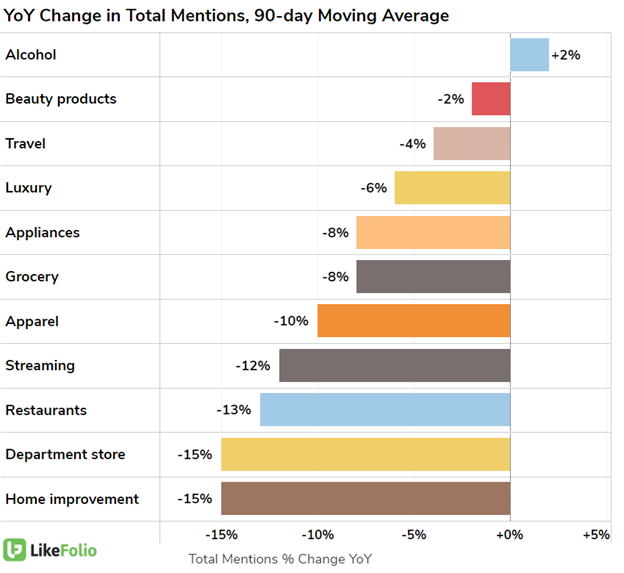

We leveraged that “edge” a few months back when we saw AB InBev (BUD) effectively positioning itself as an “affordable luxury” for many consumers.

We sent a bullish alert to our MegaTrends subscribers, and less than two months later, that forward-looking call is paying off with a double-digit gain:

We also highlighted BUD right here in Derby City Daily a few weeks later as a company that’s leveraging rising consumer interest in alcohol-free spirit options.

And now that AB InBev is slated to report earnings on May 4, and competitor Constellation Brands (STZ) is announcing its numbers as soon as tomorrow, we’re checking in to see how the companies in the alcohol space are performing…

Remember: The next 10 weeks of earnings season will offer some of the most lucrative trading opportunities of the year as hundreds of publicly-traded companies release their numbers, investors cast their “votes,” and stock prices make moves up to 30x greater than your average Thursday.

Go in prepared, and you’ll have the chance to make these 40 days of earnings season your most profitable of 2023.

Landon and I will be your guides to masterfully trading this earnings season – and every earnings season after that – in a crash-course video presentation that you can watch right here.

Now, let’s talk booze…

Our Boozy Earnings Season Outlook

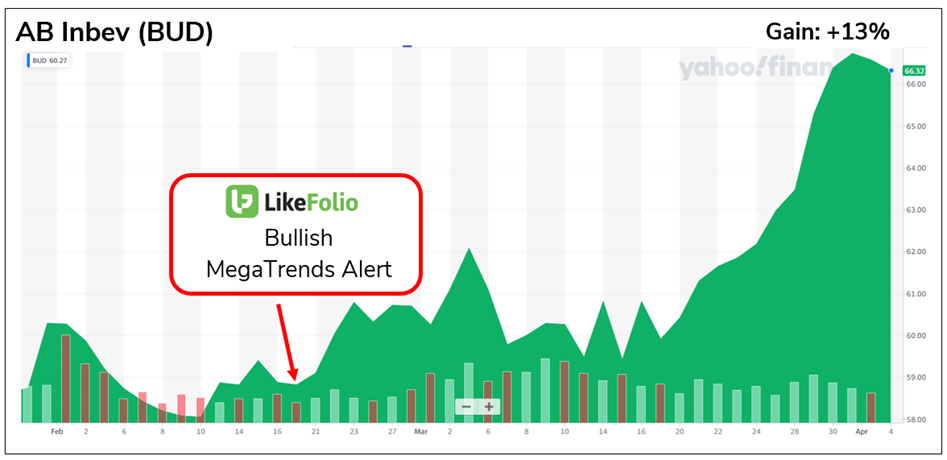

Here’s how LikeFolio consumer demand data ranks the four big booze players – BUD, STZ, Coors (TAP), and Boston Beer Co. (SAM):

What you’re seeing here is the year-over-year (YoY) change in Purchase Intent (PI) Mentions, which is the proprietary metric that tells us where consumers are spending their money – our measure of demand growth.

It shows domestic draft favorites Budweiser and Coors holding a significant edge over SAM and STZ in the eyes of consumers…

Yet another prime example of the consumer trade-down effect in action.

And I’ve seen it with my own eyes: At the local lunch spot near the LikeFolio office here in Louisville, you can order a pint of Bud Light for $4. A pint of Modelo (from Constellation’s lineup) will cost you double.

Fun fact: While Constellation owns Modelo here in the U.S., its biggest market, AB InBev owns the brand everywhere else it’s sold in the world.

Bud Light and Modelo are the No. 1 and No. 2 best-selling beers in America, in that order – so the price differential could have a real impact on Constellation’s bottom line as consumers with constricting wallets make the trade-down.

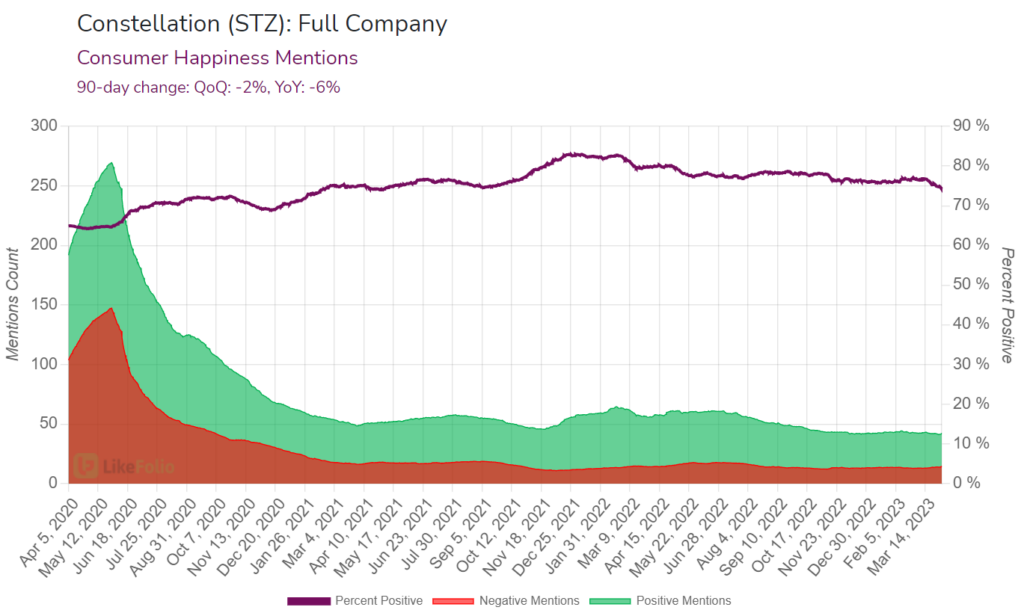

In fact, we’re seeing this price disparity take a toll on Contellation’s Consumer Happiness levels.

While Modelo is logging significant demand growth for Constellation (+25% YoY), positive sentiment around the Modelo Especial brand has slipped by 13 points on a year-over-year basis, and that’s led to a six-point loss for Constellation’s overall sentiment:

Looking ahead, we think the momentum in BUD was warranted, but it’s worth mentioning that our database picked up a fast drop in consumer sentiment over the past few days, due to politicized backlash over a new partnership:

We’ll be keeping a close eye on this metric for any real and lasting impact.

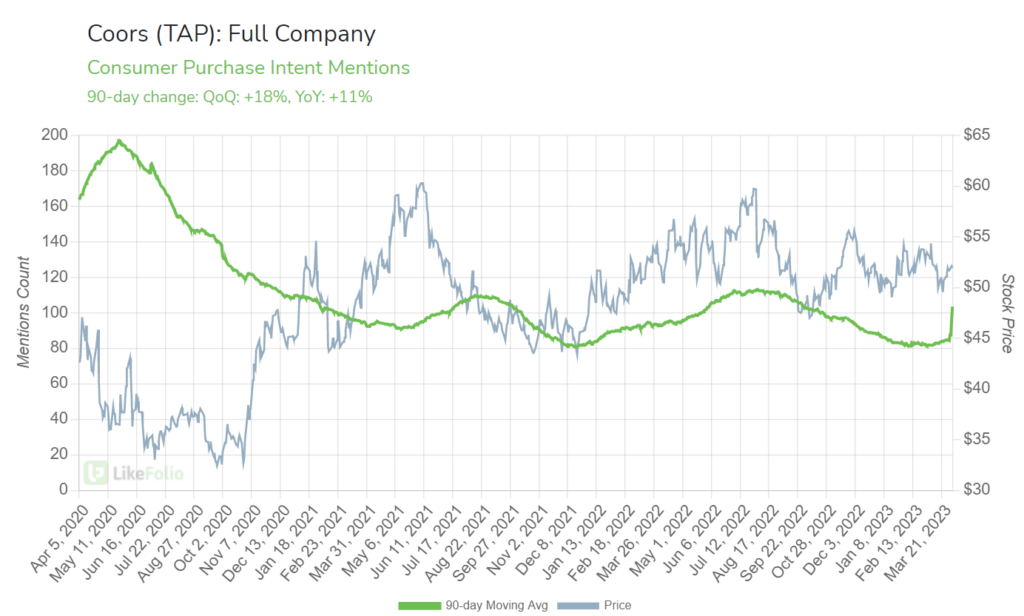

Over the longer term, TAP could be the silent winner: Earnings aren’t until May but early insights suggest this company may be on track for an upside surprise, considering the spike we’ve seen in consumer demand:

As far as STZ and SAM, declining consumer metrics and relative underperformance compared to their peers have us staying away.

It helps to have an edge – especially during earnings season.

And that’s what you get right here in Derby City Daily.

Speaking of which… Don’t forget to catch the replay of last night’s earnings season event right here.

With STZ reporting tomorrow, the April-to-June earnings season is officially underway – and this is one Swan Brother team-up you simply can’t afford to miss.

Until next time,

Andy Swan

Co-Founder