Whether it was Red’s Giant Hamburg in Springfield, Missouri, in 1947, or the In-N-Out Burger in Baldwin Park a year later that introduced America to the now-ubiquitous drive-thru is still up for debate.

(I’d give the credit to Harry and Esther Snyder of In-N-Out with their brilliant two-way speaker system invention, but that’s just me.)

What’s not up for debate is how the drive-thru revolutionized the American dining experience – weaving fast food into the very fabric of American culture and creating the $652.73 billion industry we know today.

There are now over 200,000 drive-thrus across the country where consumers can find affordable, high-quality food options ready nearly immediately.

But the fast-food heyday we’re having right now goes far beyond the drive-thru…

The key factors driving the fast-food industry’s growth in 2023:

- Economic Factors and Affordability

With grocery prices rising significantly – cereal and baked goods prices are up 29% since 2020 – fast food offers a competitive alternative for cash-strapped consumers, while loyalty programs enhance affordability.

- Convenience and Changing Dining Habits

According to the National Restaurant Association, sit-down dining decreased by as much as 14% between February 2020 and April 2023. But drive-thru dining? That increased 12% over the same time period. The post-pandemic return-to-work movement has only propelled fast food’s popularity further – with fast-food business openings up 10% in recent months.

- Technological Advancements and Automation

A massive industry shift toward automation and artificial intelligence (AI) is taking the convenience, affordability, and profit potential of fast-food restaurants to the next level.

⚠️ “99% of Public Investing in AI the Wrong Way” ⚠️

Landon and I just issued an urgent warning for Derby City Daily readers. Make sure you’re not one of the 99% by watching this now.

Chipotle (CMG) started using robots to streamline chip-making around this time last year. It’s now got robots whipping up guac, salads, and burrito bowls, too.

Starbucks (SBUX) has been riding the AI train since 2020 with its sights set on improving the customer experience.

And McDonald’s (MCD) is trying its hand at AI-run drive-thrus in select locations.

These three restaurant giants were all in the top 10 when it came to U.S. fast-food sales in 2022.

And in 2023, they’re each looking to integrate digital accessibility, drive-thru convenience, and compelling loyalty programs to win over consumers – and deliver profits to shareholders.

Today, you’ll get an exclusive look at how Chipotle, McDonald’s, and Starbucks stack up against each other as we show you how we’re playing these stocks from here…

No. 1: Chipotle 🌯

From its tortilla chip-maker “Chippy” to its guac-bot, “Autocado,” Chipotle is looking to streamline its fast-casual meal service with robotics so its human workers can focus on delivering a top-notch customer experience.

The company reported robust 14% sales growth in the second quarter, reaching $2.5 billion, with digital sales accounting for 38% of total sales.

Contributing notably to the sales momentum was the hot new menu item, Chicken al Pastor, which Chipotle rolled out globally in March for a limited time.

Folks couldn’t get enough while it was available – and they’re already begging Chipotle to bring it back.

Chipotle is making its commitment to enhancing customer convenience and accessibility clear.

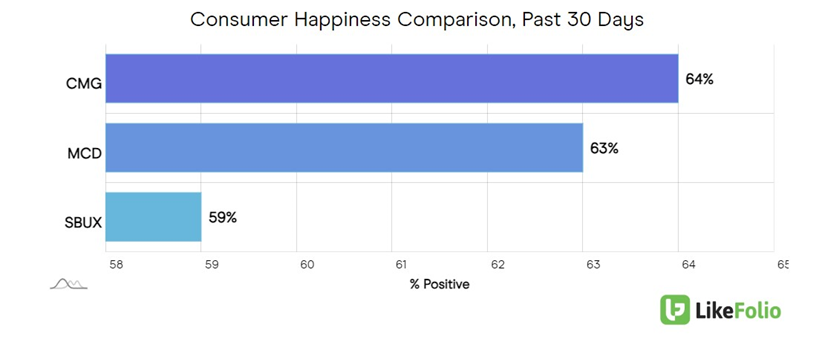

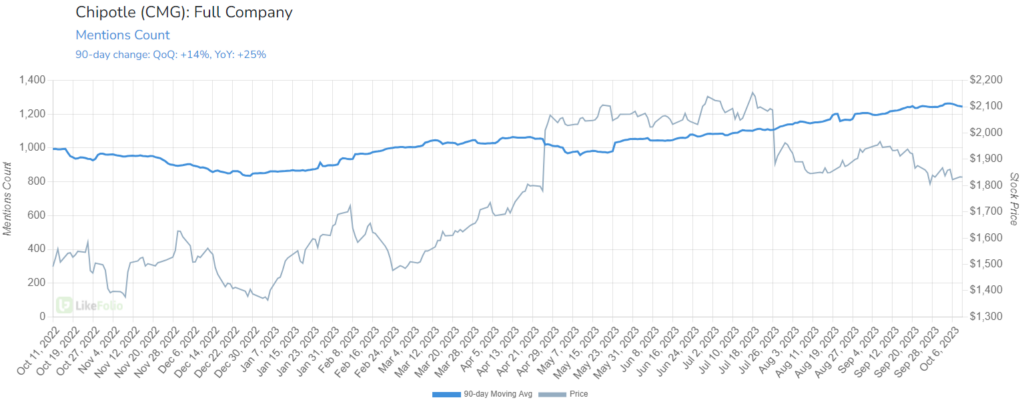

And we’re seeing that positive momentum reflected in our consumer data: Chipotle is leading the pack when it comes to Consumer Happiness (64%) and digital traffic.

Chipotle expanded its footprint significantly last quarter, opening 47 new restaurants, with 40 of those decked out with “Chipotlanes” – Chipotle’s version of a drive-thru.

And social media buzz is up an impressive 25% year over year, topping both McDonald’s and Starbucks.

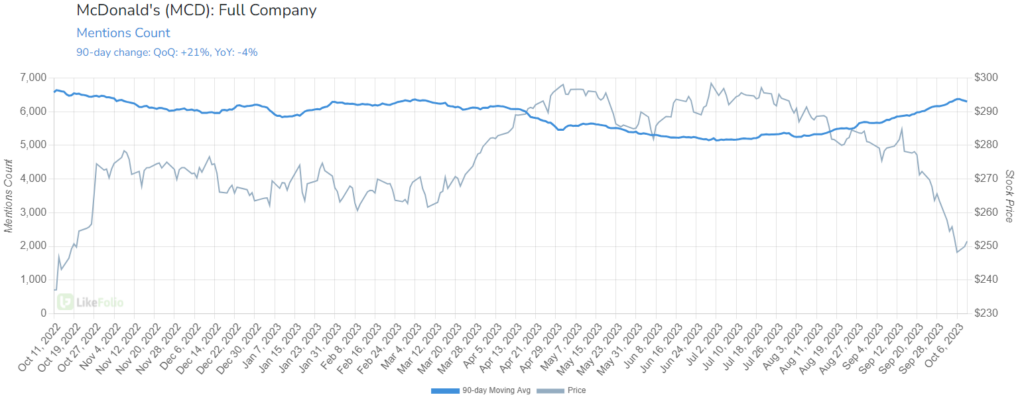

No. 2: McDonald’s (MCD) 🍟

McDonald’s is an “OG” of American fast-food: The brand’s been around since 1940.

With over 38,000 locations worldwide today, it’s impossible to avoid those iconic golden arches – we’ve all found ourselves in the Mickey D’s drive thru at some point or another.

But $23.2 billion in revenue in 2022 speaks for itself. McDonald’s is the undisputed King of Fast Food.

The company’s navigated a number of hits to its reputation over the years as folks questioned the quality of the food and where it came from.

But a much-needed move toward higher-quality ingredients in recent years, along with some savvy nostalgia-heavy marketing campaigns, are doing wonders for McDonald’s in 2023.

The company went big for Grimace’s birthday this year (June 12, if you were wondering) with a refreshed ad campaign that went viral on social media…

And the return of the coveted McDonald’s “Boo Buckets” of the ‘80s and ‘90s is drumming up excitement this October. (You can grab one on October 17.)

Those effective brand engagement campaigns I mentioned (like Grimace) helped drive same-store sales growth of 11.7% in the most recent quarter.

The company now only trails Chipotle by one point in Consumer Happiness, according to our data, which is impressive for the chain once synonymous with frozen beef. In fact, sentiment levels have been boosted 11 points from last month alone.

Overall buzz is up from last quarter, too: +21%.

The company has maintained its value proposition with affordable meal initiatives across the globe – like Germany’s McSmart Menü and the UK’s Saver Meal deals.

But it all comes down to a thriving digital strategy: Digital sales accounted for nearly 40% of system-wide sales in the company’s top markets, supported by a strong base of over 52 million active loyalty members. (Its mobile app had been downloaded 127 million times as of January.)

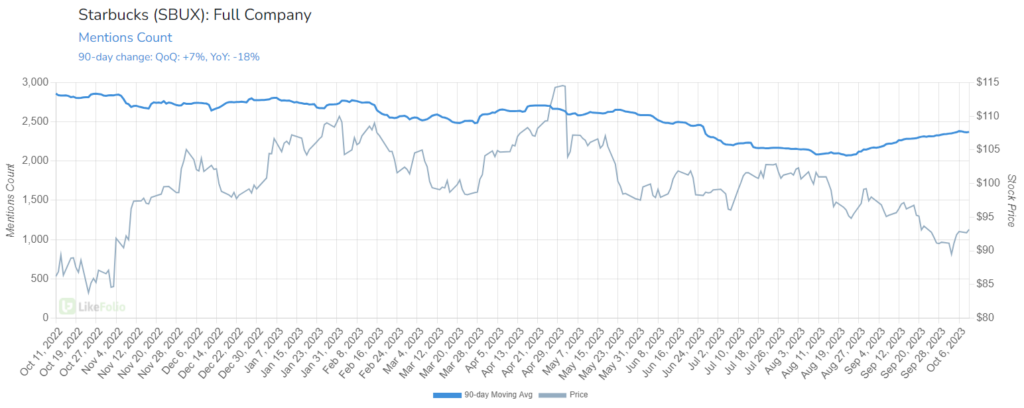

No. 3: Starbucks (SBUX) ☕

Now, let’s talk about Starbucks – which reports its critical fourth-quarter and full-year earnings on November 2.

Right now, Starbucks trails in the all-important Consumer Happiness metric at just 59% as rising costs ding consumer sentiment around the coffee chain.

Last quarter, Starbucks reported a 12% increase in net sales for a record $9.2 billion – but still slightly missed revenue expectations.

Despite the growth, Starbucks’ 7% rise in North American same-store sales suggests a cautious consumer spending pattern that potentially reflects broader economic concerns.

Interestingly, Americans’ tastes have shifted away from the traditional piping hot cup of joe – and cold beverages now dominate U.S. beverage orders, accounting for three-quarters of the total. We’ll be watching to see how Starbucks keeps pace with this larger trend.

But for now, Starbucks mentions are declining 18% on a year-over-year basis.

And stacked against our other players, Starbucks looks comparatively weak.

Playing It from Here

- LikeFolio data suggests McDonald’s may prove to be the best long-term growth play here, as consumers trade down and sentiment rises.

- Metrics also support continued upward trajectory for Chipotle.

- Not so much for Starbucks: With particularly low Happiness, this name gives us the most pause for long-term investors.

But that doesn’t mean we can’t make money from SBUX.

That upcoming earnings report I mentioned? You can bet we’ll be playing that for a profit.

We did it last season with Starbucks (and dozens of other stocks).

And we’ll do it again this time around.

Because whether the data’s leaning bullish, bearish, or neutral just a few short weeks from now, Landon and I will find the best way to trade – and deliver it straight to our Earnings Season Pass subscribers.

Week 1 of Earnings Season Pass kicks off this Sunday, so you’re just in time to join us for the most important moneymaking season of the year.

Until next time,

Andy Swan

Founder, LikeFolio

Hungry for More?

Check out these mouthwatering opportunities from Derby City Insights…

Fast-Food Fortunes: One of These Stocks Could Be Our Next Big Winner

This eye-opening chart reveals the winners and losers in fast-food…

From Chicken to Taco Tuesday: One Fast-Food Icon Is Winning at the Drive-Thru

And it can make you a lot of money…

How Inflation-Proof Hot Dogs Made Costco a Beacon of Value

Find out the secret to Costco’s success, even in challenging times…