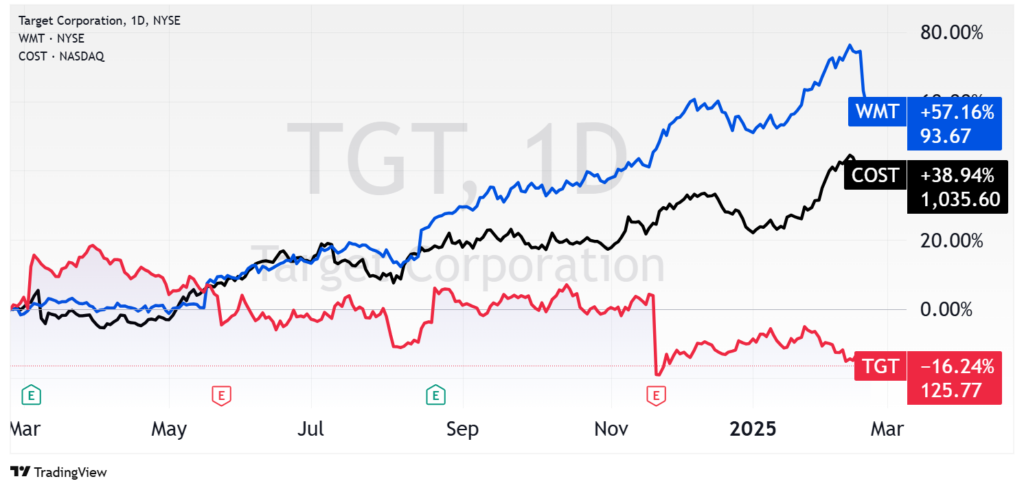

While retail titans Walmart (WMT) and Costco (COST) powered higher on strong consumer spending over the last year, one major competitor was left behind.

But LikeFolio data suggests a quiet turnaround is brewing. Here’s a look at the promising retail play the market is sleeping on…

The Retail Boom Left Target Behind

Consumers went all in on gift-giving during the 2024 holiday season, driving U.S. retail sales 3.8% higher from last year’s levels to a record $994.1 billion.

Walmart and Costco were first in line to reap the benefits. For the holiday quarter, Walmart posted $180.6 billion in revenue, notching 4.1% year-over-year growth (or $182.6 billion / $5.3% year-over-year growth on a constant currency basis), besting Wall Street expectations. For the month of December, Costco net sales saw a nearly 10% year-over-year boost to $27.52 billion.

Despite the robust retail environment, Target (TGT) remains an outlier.

While WMT and COST shares have gained 57% and 39% respectively, Target lags significantly behind… down 16% over the last year.

This sluggish performance presents a curious anomaly in an otherwise strong retail sector – and a hidden opportunity.

A Quiet Turnaround in the Making

Let’s be clear: Target has underperformed for a reason. The lingering impacts of inflation have made consumers more resourceful and cautious in their spending, often limiting purchases to essential items.

That hasn’t boded well for a company whose merchandise is largely discretionary products like apparel, home goods, and electronics.

Target has also suffered from rising operational costs as port strikes increased logistics expenses and health care/liability weighed on administrative costs.

But consumer transaction data is beginning to tell a different story.

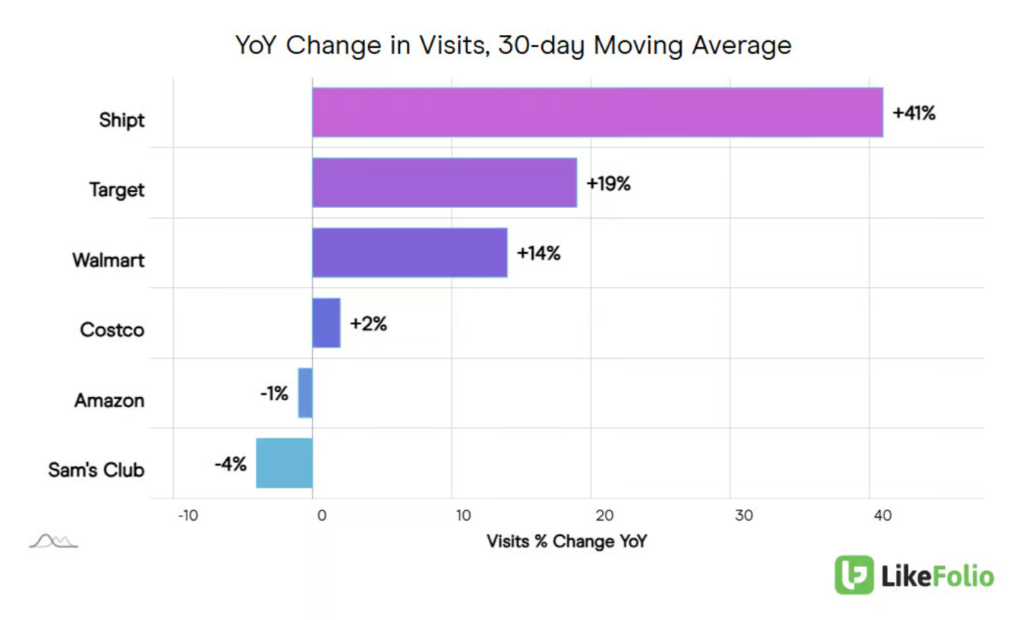

Accelerating Digital Traffic

LikeFolio’s predictive data reveals that both Target and its delivery subsidiary Shipt are gaining steam on the digital front.

Web growth is far outpacing the most competent competitors – Walmart and Costco included. As you can see below, Target is beating out its competition with 19% year-over-year growth, while Shipt traffic gains 41%.

Last quarter, Target’s digital sales rose 10.8% year over year, with same-day services – powered by its Target Circle 360 membership and fulfilled by Shipt – expanding nearly 20%. This forward-looking LikeFolio data suggests that momentum has only accelerated.

Rising Interest in Target’s Annual Membership

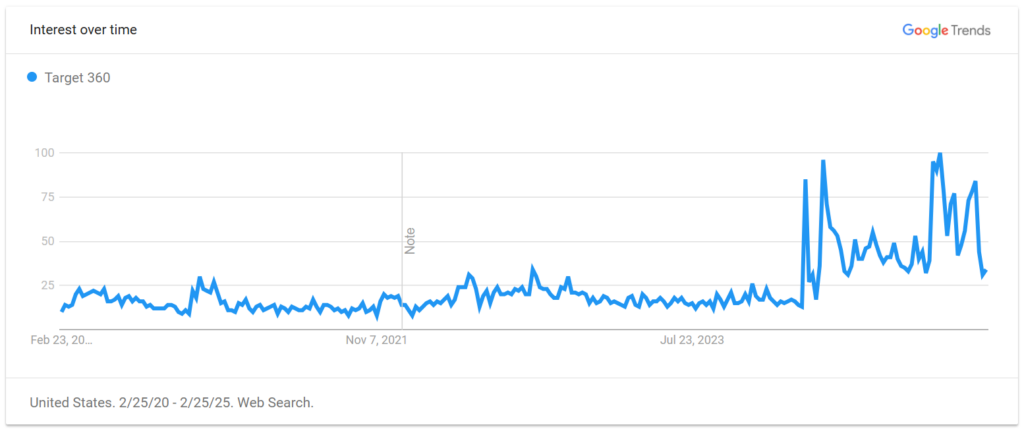

Looking ahead, consumer search trends show that Target’s 360 membership (that comes with an annual fee) is garnering significant interest on Main Street:

For $99 a year, Target Circle 360 subscribers get access to benefits like free same-day delivery, discounted prices, and an extended return period. This better positions Target alongside Amazon Prime (AMZN) and Walmart’s Plus membership program. Success here could be a game changer.

Leaning Into High-Demand Segments

Last quarter’s numbers also confirmed Target is gaining traction in high-demand segments and optimizing operations for long-term success.

The retailer is focused on categories that resonate with budget-conscious consumers: Sales in essentials and beauty remain strong, while food and beverage continue to outperform broader retail trends. Apparel, previously under pressure, saw renewed traction in the most recent quarter, particularly in affordable and athleisure segments.

Addressing the Ghosts of Target Past

Target leadership is making critical adjustments to address past challenges. On that last earnings call, CFO Jim Lee highlighted that Target has enhanced asset protection, improved supply chain logistics, and invested in AI-driven loss prevention systems, delivering a 50-basis-point improvement in gross margin related to its biggest pain point: inventory shrink.

With a more efficient framework in place, the company is on track to strengthen margins and improve overall profitability.

Target made strides here in the third quarter, delivering earnings of $1.85 per shares while investing in key growth areas. Operating income climbed 6.7% through the first three quarters, benefiting from disciplined cost management.

Target has also recalibrated its marketing strategy, adjusting its approach after previous controversy and boycotts related to its Pride collection and focus. Leadership has quietly refined its messaging, shifting emphasis back to core retail fundamentals.

Shifting Macroeconomic Trends

The economic and political landscape could offer additional tailwinds for Target. A potential shift back toward pro-business policies in a second Trump administration could introduce retail-friendly tax cuts and deregulation, boosting margins and consumer confidence.

Additionally, discussions around potential “DOGE dividends” could fuel discretionary spending, particularly among middle-class households – a key demographic for Target.

The Bottom Line

Target is showing signs of improvement, and the market still hasn’t caught on.

By focusing on operational efficiency, digital expansion, and a recalibrated brand strategy, Target is quietly positioning itself a business on the upswing, even as broader economic uncertainty lingers.

TGT’s fourth-quarter results are due next Tuesday, March 4, one week from today. Investors willing to take a contrarian view may find an underappreciated turnaround story with asymmetric upside potential.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

xAI’s Grok 3 Challenges AI Giants and Redefines the Game

DeekSeek Who? Grok 3 just redefined the AI race. Here’s a look at how it’s sweeping the competition – and the opportunities it’s creating…

Carvana’s Powerful Lesson: Don’t Bet Against the Consumer

We bet against this company too soon – and it taught us a powerful lesson that every investor should keep in mind…