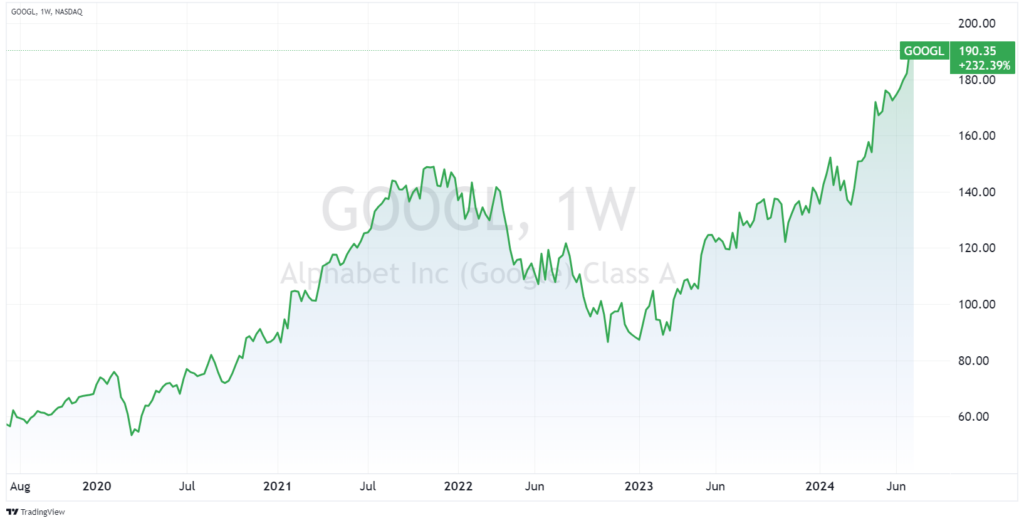

Alphabet Inc. (GOOGL) is having a tremendous year.

GOOGL shares have surged 63% from 2023; zoom out five years, and you’re looking at a 232% rally:

Investors can thank the company for ramping up advertising revenue (think Search and YouTube) and expanding its critical Cloud segment – both of which are helping drive GOOGL’s gains of late.

But we have one big question: Has the stock gotten ahead of itself?

Let’s dive in to answer that today…

The Uncontested King

Every second of every day, 99,000 queries are entered into a Google search bar, adding up to 5.9 million Google searches per minute – and 8.5 billion daily.

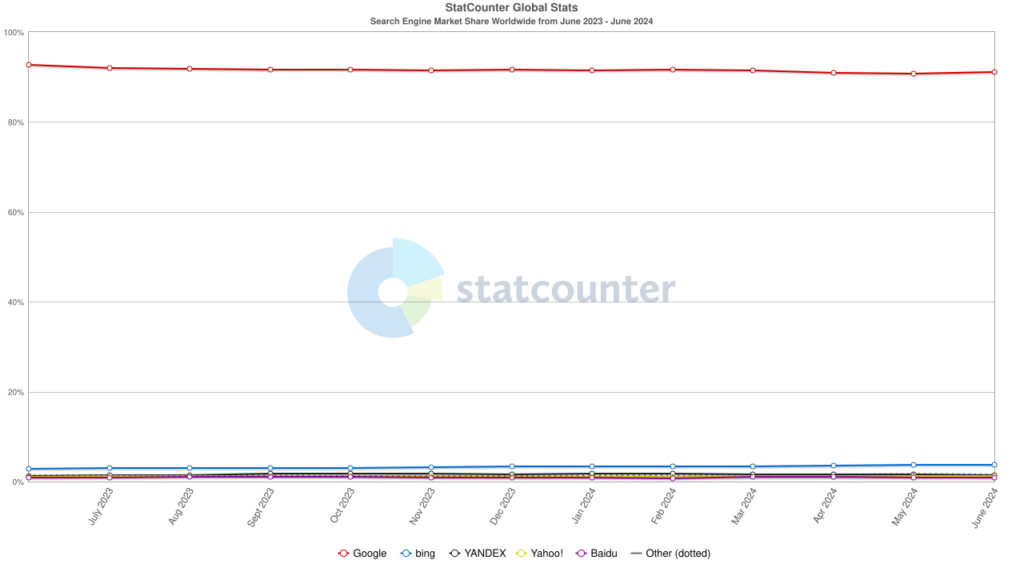

Google is THE global search engine.

See the red line on the chart below? That’s Google’s share of the global search market: 91% as of June. Everyone else is at the very bottom…

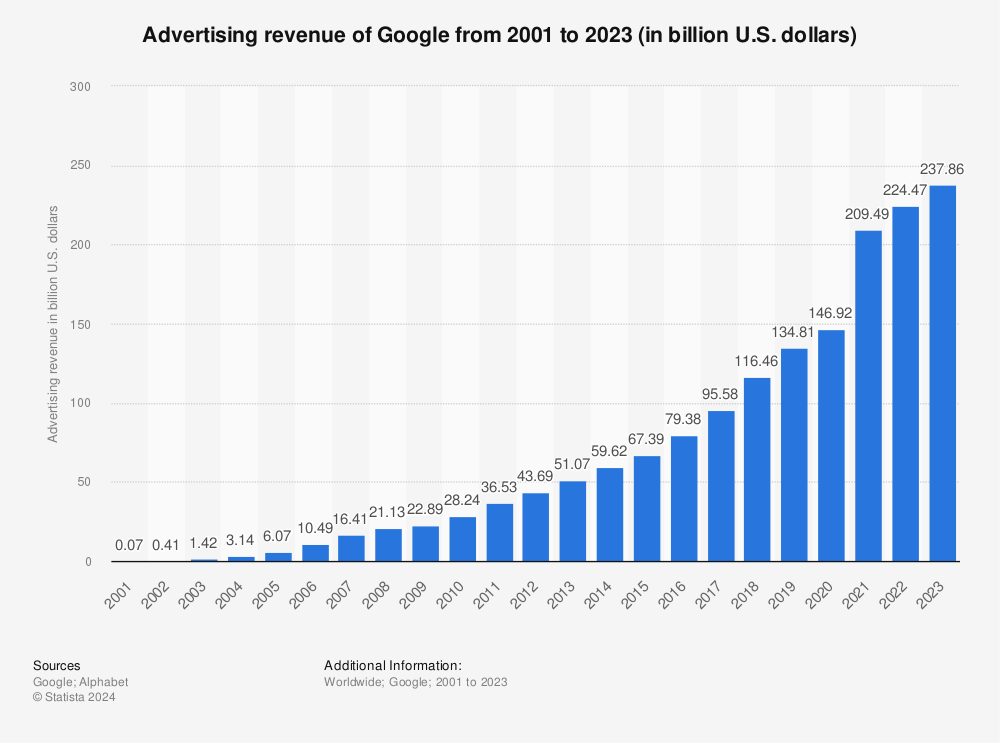

This dominant market presence contributes significantly to Google’s bottom line. Its Google Ads platform generated a whopping $237.86 billion in 2023.

This platform enables advertisers to display ads, product listings, and service offerings across a vast network that includes Google’s own properties, partner sites, and various apps.

(Search for just about anything on Google – “modelo chelada,” for example, if you’re feeling thirsty – and there’s a good chance the first few results came from its ads platform.)

The takeaway: Advertising is king at Google, driving nearly 80% of its revenue.

And it will continue to drive company growth in 2024. Take a look…

From the Election to the Olympics: Ad Spend Is Ramping

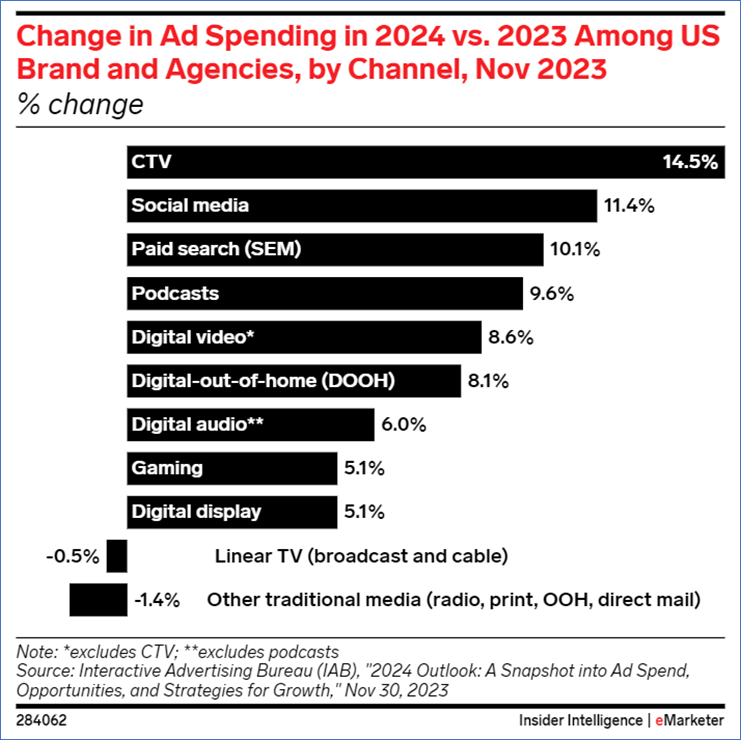

Paid search spend is expected to grow by 10% year over year. This plays directly into Google’s hand, with paid search being its primary driver of advertising revenue.

Digital ad spending overall is on track for 7.5% year-over-year growth in 2024 – and Connected TV (CTV) will be the fastest-growing medium of them all, with spending on track to surge 14.5% year over year. (Connected TV refers to TV devices that connect to the internet; seems obvious when you put it that way, but good to know all the same.)

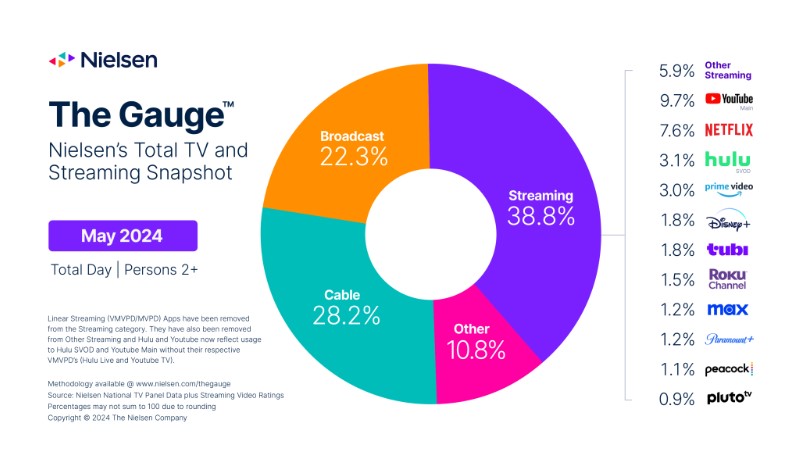

Google can participate in CTV ad spend via its YouTube TV streaming service. In fact, YouTube is the top video streaming service in the U.S. by viewership, according to Nielsen ratings, even topping Netflix (NFLX):

On a global scale, we’re talking about over 1 billion hours of YouTube content being watched on TVs each and every day.

Our Prediction: Ad spend will accelerate through the back half of the year, thanks to major events like the Olympics and Presidential Election – leading to a major boost in advertising demand.

Dentsu, a major ad-buying firm, expects the presidential election alone to contribute approximately $11 billion – or about one third – of the incremental ad spend on deck for 2024.

Make no mistake, this election will cause chaos, as you’ve learned. But it’s also creating some truly incredible opportunities for investors, from a surge in ad spending to the five specific money moves I outlined here.

So, Google has a huge opportunity in front of it in search and advertising.

But what about Google Cloud, the other piece of its pie?

Monetizing the Cloud

Right now, Google Cloud is playing third fiddle to larger industry leaders like Microsoft’s (MSFT) Azure and Amazon.com’s (AMZN) AWS. However, ALL three major cloud players show continued growth, according to web traffic data.

(Amazon Web Services leads with +10% YoY growth, followed by Microsoft Azure at +8.5% and Google at +7%.)

While Google Cloud only accounted for ~10% of company revenue in 2023, which seems small compared to Advertising’s near-80% slice, this segment contributes more each year.

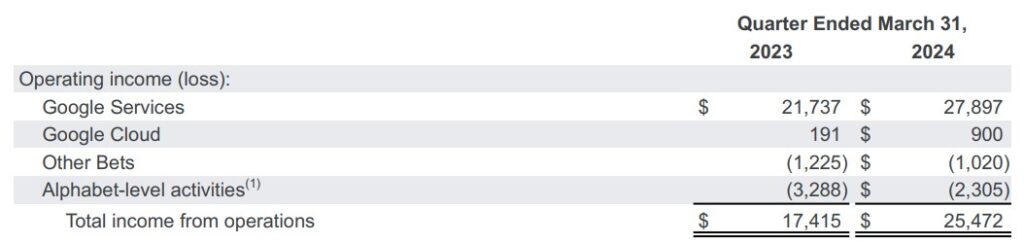

Perhaps most impressive is how Alphabet has been able to better monetize its Cloud segment: Operating income for its Cloud business more than quadrupled last quarter (hitting $900 million).

Looking Ahead: It’s All About AI

From here, pay attention to how Alphabet integrates artificial intelligence (AI) into its search feature.

Early on, we saw some hiccups, likely born from its new partnership with Reddit (RDDT), which created some… interesting summaries. But those seem to be improving. This should boost consumer engagement and contribute positively to ad targeting and corresponding spend.

We also see enormous opportunity for disruption, particularly in search as AI creates new avenues for consumers to seek out information.

To answer the question of whether you should be buying: As always, it’s up to you to decide – but we’re feeling bullish.

A bit of caution here is warranted. While near-term ad revenue from elevated spending may help support near-term growth, GOOGL’s long-term prospects may be hindered by growing competition and sky-high expectations.

Meta Platforms (META), for example, is proving to be the favorite for short-form video content – and this preference could eventually weigh on YouTube’s ad efficacy. And The Trade Desk (TTD) is capturing more and more ad dollars with its AI-powered ad platform.

Still, it’s pretty incredible to watch the AI boom push the S&P 500 to all-time highs. And if you’ve followed along with our insights, you’ve had no shortage of opportunities to ride this wave higher.

But before you buy shares of another AI stock, watch this eye-opening video that recently came across my desk.

In it, you’ll see another trader who was at the forefront of this mega trend issue a critical AI warning for the next 30 days. It’s worth watching if you own GOOGL, META, Nvidia (NVDA), or any other AI stock for that matter.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Boeing Lost in the Court That Matters Most: Public Opinion

Boeing is trending again this week – but a guilty plea won’t fix this litany of problems…

Cheers to This Independence Day Profit Opportunity

Owning America’s best-selling beer isn’t the only reason to love STZ… but it sure does help.