Netflix (NFLX) has successfully transformed its business model over the last two years by embracing a lower-cost ad tier model and enforcing password sharing.

These strategic moves led to millions of new accounts and a more diversified revenue stream.

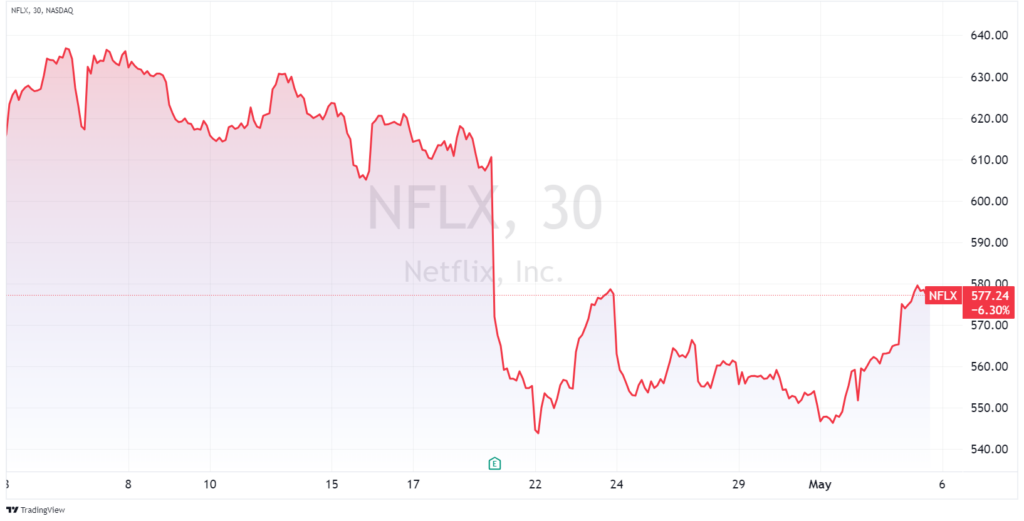

But on its last earnings call, Netflix noted that it expects paid net additions to be lower in the second quarter compared to the first quarter due to “seasonality.” Investors weren’t buying it. And when the market’s sky-high expectations were disappointed, our bearish earnings call proved right.

So where does Netflix go from here?

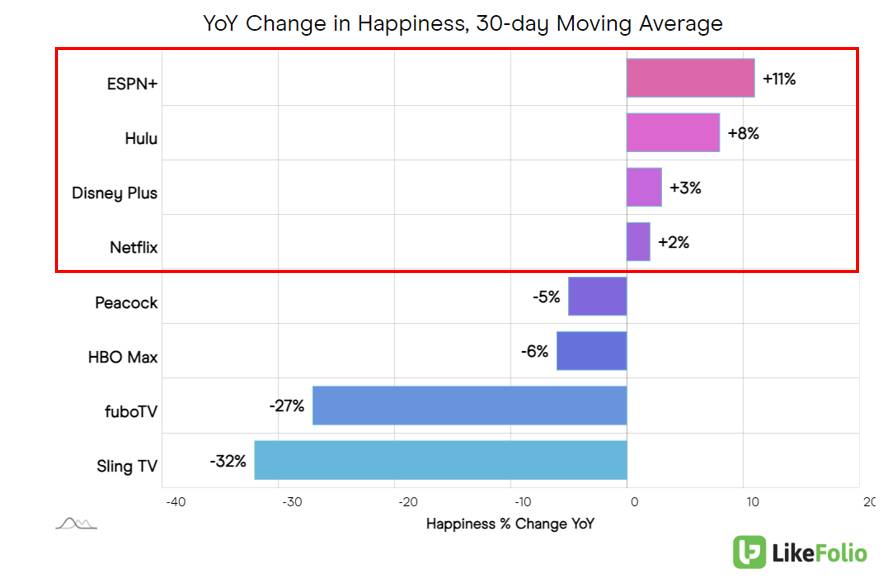

The answer could lie in the Consumer Happiness chart below, perhaps the best model to reference to understand which companies are poised for long-term success – and growth:

Two Streaming Tiers Have Emerged

Sensing a theme? It’s clear that two tiers have emerged in the streaming market:

It’s now Netflix and The Walt Disney Co. (DIS) versus everybody else.

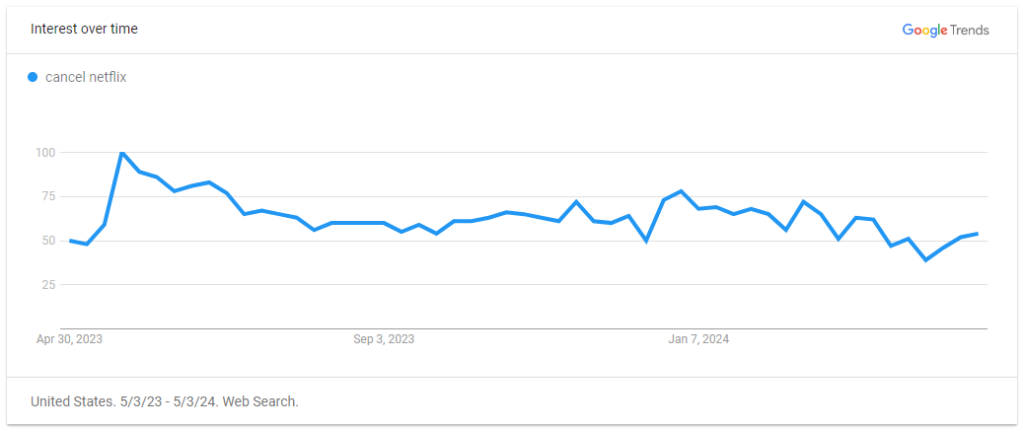

It’s not a stretch to say that consumers are looking for ways to save amid sticky inflation. If and when they drop one of their endless subscriptions, those rising sentiment levels – especially coupled with low cancellation rates – suggest Netflix (and Disney’s trifecta bundle) will be last to go.

In fact, Disney’s offerings look to be gaining some ground on Netflix’s dominance, thanks in part to its wide offerings and inclusion of live sports.

But Netflix has a trick up its sleeve…

This Next Move Could Define Netflix’s Trajectory

Netflix made its first significant venture into live sports broadcasting earlier this year by securing a 10-year agreement with WWE.

This partnership, valued at over $5 billion, will allow Netflix to stream WWE’s flagship show, Raw, and other major events like SmackDown and WrestleMania starting in January 2025.

It marks a strategic pivot from Netflix’s previous focus on sports documentaries to mainstream live sports, leveraging WWE’s unique blend of scripted entertainment and live action, which aligns with Netflix’s content expertise.

This move could be pivotal to stoke future growth.

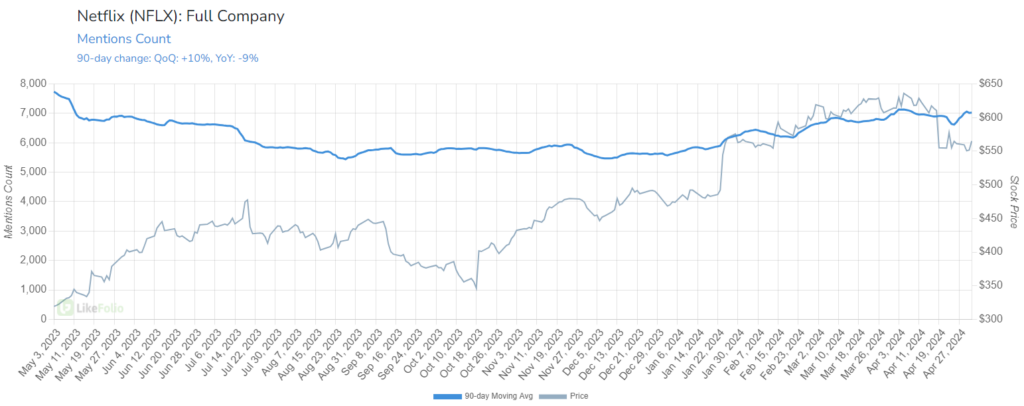

The Netflix brand is losing a bit of steam from a buzz growth perspective – mentions are down by 9% year over year – as its new, lower-cost model loses its shine and some consumers gear up for summer (and less TV).

We are neutral at these levels, thanks to the lack of apparent churn present in NFLX data and its executive focus on increased profitability. But we’re watching the data very closely.

If we see signs of signs of increasing cancellations or rising negative sentiment, the stock may have more room for downside.

The streaming landscape is rapidly evolving – and the battle for eyeballs could come down to the platform delivering the best live sports experience.

Welcome to the Great Live Sports Shakeup of 2024.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

SoFi Now Faces the Ultimate Loyalty Test

Investors are split over the future of this company. Where do you stand?

What the Market Is Still Getting Wrong About Tesla (Watch Now)

Don’t fall for the same mistake – because it could cost you a massive opportunity…