At LikeFolio, we don’t just analyze market trends. We live and breathe them.

Sometimes, we even wear them.

Our watercooler conversations are as insightful as they are interesting, with something as harmless as a change in footwear sparking a deeper dive into the stocks we’re watching.

See, we’ve uncovered a number of profit opportunities in the lucrative sneaker space with the help of our consumer insights machine. An early call on On Holdings (ONON) is up 50% for our LikeFolio Investor subscribers, while a more recent recommendation from November has delivered 25% in a matter of weeks. (Find out how you can get access to our next kicks winner here.)

This time, a casual chat about a bearish Crocs (CROX) earnings call – the one that recently led our followers to a 135% win – culminated in a playful yet insightful debate about the best play in comfy shoes.

With Crocs no longer the king, Deckers Outdoor Corp. (DECK) has taken its place as the new consumer favorite.

But we wanted to know: Do we like DECK or hate CROX more?

It’s a lighthearted question with a serious undertone for investors.

We decided to let the data settle it – and bring our Derby City Daily readers the result…

A Tale of Two Charts

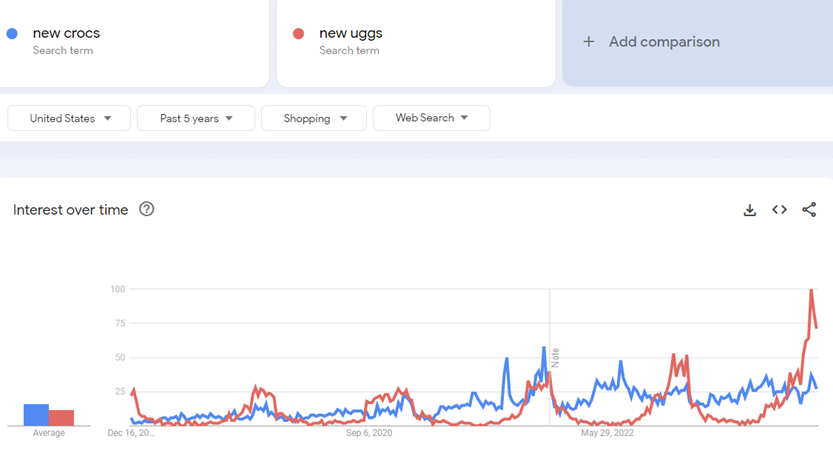

Google Trends search data paints a stark contrast between Deckers and Crocs:

Searches for “new uggs” (red line) are jumping off the chart, bursting through seasonal five-year highs, while “new crocs” searches (blue line) appear to sputter.

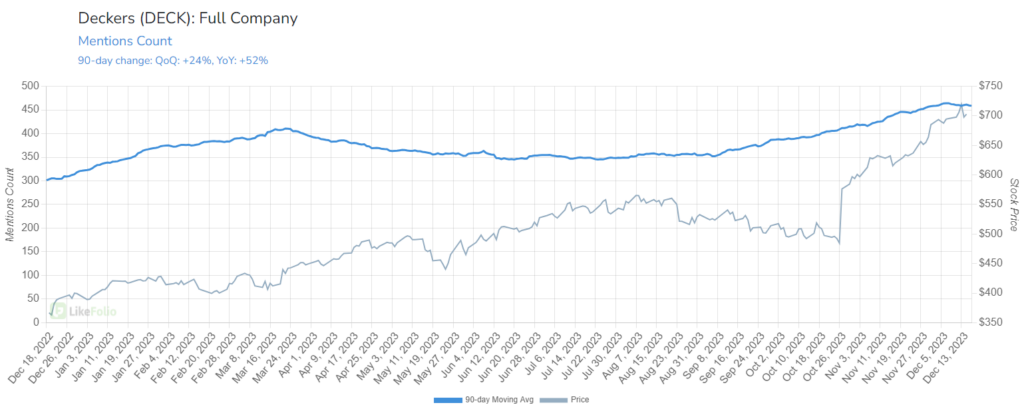

Overall mentions of Deckers and its brands are trending in the same direction – up by 52% year over year:

The only problem? The market knows it.

The Investment Dilemma: Trading Positions and Market Potential

DECK’s stock chart is a sight to behold, trending straight up (as you can see above), a clear indicator of its growing popularity and market strength.

In contrast, CROX, despite its unique market position and loyal customer base, is still trailing well below its previous highs.

Considering where each stock is trading, it’s tough to make a call:

- Deckers’ robust performance is hard to ignore, signaling a company aligned with consumer trends and market demands.

- On the other hand, CROX’s lower trading position could be seen as an opportunity for growth, appealing to investors looking for a potential rebound.

But we’re not about to leave you hanging without a resolution to this debate.

So let’s go to the tie-breaker…

The Unlikely Hero of the Season

The conversation at LikeFolio leans towards declaring DECK the winner because its flagship brand, Ugg, might just be the gift of the season.

This isn’t just a hunch.

Known for those brown “boots with the fur,” Uggs have consistently shown resilience in the market, appealing to a broad demographic with their comfort and style.

This year, they seem to have captured consumers- imaginations – and dollars – more than ever, with celebrity endorsements from the likes of superstar Cardi B to funnyman Seth Rogan.

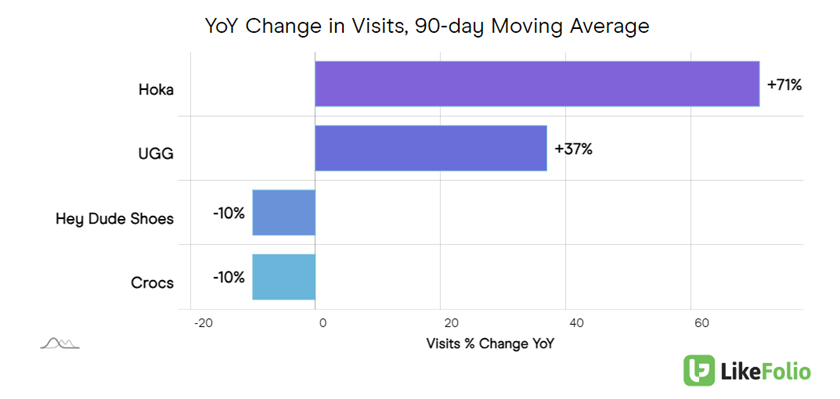

And Uggs aren’t the only shoes winning over consumers in DECK’s arsenal. Back in 2013, the company acquired the once-tiny French shoemaker that’s taken the world by storm: Hoka.

Found on virtually any “best of” running shoe list you can find, Deckers’ Hoka brand is growing at a similar – if not steeper – clip:

You can get the full rundown on Hoka here.

The Final Verdict

So, do we like DECK or hate CROX more?

While DECK shows undeniable strength, CROX’s lower trading position might offer a hidden opportunity for those willing to bet on a comeback.

But as the holiday season approaches, data appears more compelling for DECK as a play to the upside.

The company’s solid portfolio of trusted brands appears to be the clear winner in the hearts and minds of consumers – and this demand is likely to send shares even higher.

We’re keeping a close eye on both DECK and CROX. The market is dynamic, and today’s winner could be tomorrow’s underperformer.

LikeFolio Investor subscribers recently uncovered another contender in this space that’s racing ahead faster than we even thought possible. In just over a month, this stock has zoomed 25%, and has all the makings of a breakout.

More on how you can join in on those profits here.

Until next time,

Andy Swan

Founder, LikeFolio