Even the most beloved brands can encounter hurdles and must continuously innovate to remain relevant.

Abercrombie & Fitch (ANF) wasn’t always the preppy fashion brand beloved by teens everywhere. The company actually started as a rugged outdoor apparel retailer – way back in 1892.

ANF hit a rough patch in the early 2000s due to controversial marketing and a disconnect with evolving consumer values.

But in 2023, Abercrombie’s made one heck of a comeback.

Shares of the mall staple have surged 250% year over year as it adapted to changing consumer trends – a testament to the power of rebranding, even after a century.

Crocs (CROX) is another classic tale of brand evolution.

The former “dad” shoe ascended the social media ranks to become the pinnacle of comfortable footwear. But as we showed you yesterday, the company now faces its own set of challenges.

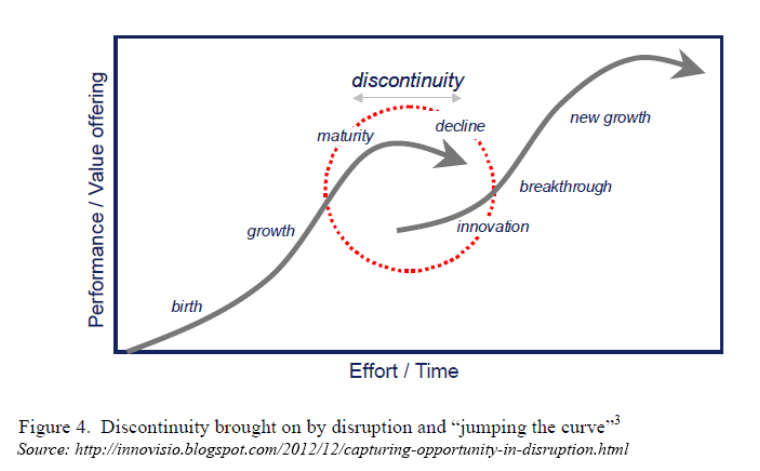

The once-decades-long brand trend cycle has drastically shortened in the era of social media and rapid design innovation.

Brands now have the potential to rise and fall within a remarkably brief timeframe.

For investors, this accelerated cycle means keeping a keen eye on emerging trends and being ready to adapt to the swiftly changing preferences of consumers.

Fortunately, social media tracking is our specialty.

With a real-time read on what’s hot – and what’s not – we can predict with remarkable accuracy which brands are on the verge of a breakout.

We’ve got our eye on one that’s on the cusp of revitalization in the competitive sportswear market.

The name we’re about to share appears to be in the “new growth” phase of the brand cycle, presenting a potential opportunity for investors today…

A Come-from-Behind Contender

More than 25 years after it burst onto the athletic apparel scene, Under Armour (UAA) is experiencing a resurgence in consumer interest as its sweat-and heat-wicking tops and bottoms regain appeal.

The company recently brought in former Marriott International (MAR) President Stephanie Linnartz as its new CEO replacing long-time leader and founder Kevin Plank.

Her digital background is expected to help boost UAA’s e-commerce business at a time when shoppers are gravitating to the DTC channels of trusted brands. The hire is paying early dividends with e-commerce returning to growth and accounting for more than one-third of the DTC business.

During the third quarter, Under Armour launched its “UA Rewards” loyalty program, giving consumers more ways to connect to the brand and earn rewards and other perks like early access to gear and events.

And it continues to take a page from the Nike (NKE) playbook by adding pro athletes to its endorsement roster.

Last month, Under Armour signed a multi-year deal with De’Aaron Fox of the NBA’s Sacramento Kings as its first signature athlete under the Steph Curry “Curry Brand,” which covers apparel and footwear from multiple sports, including basketball and golf.

These developments are paying off for UAA in the minds of consumers.

According to LikeFolio data, Under Armour is hitting the mark on all three pieces of our stock-picking trifecta – with growing demand, happy customers, and macro trend tailwinds…

- Mention Divergence Forming

Under Armour mention buzz has increased by 15% year over year on a 30-day moving average, marking a notable acceleration into the holiday season:

LikeFolio web data supports this strength in brand mention growth, with Under Armour web visits currently pacing 4% higher year over year.

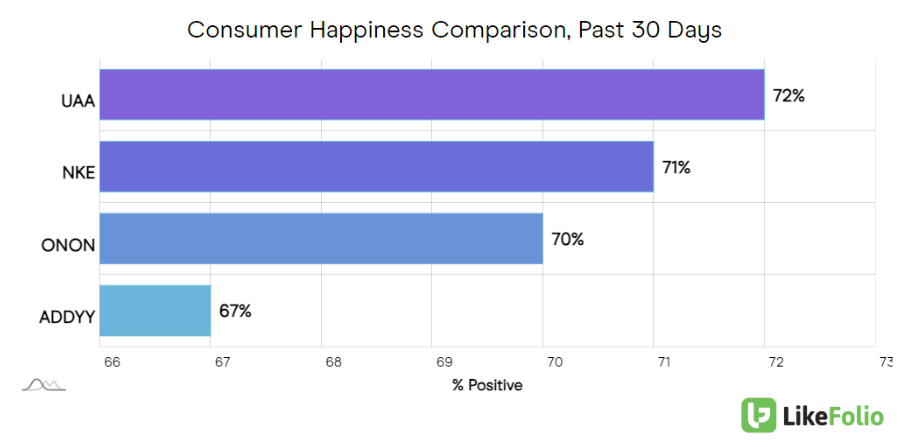

- Superior Happiness Ratings

UAA Consumer Happiness levels have increased by 5% on a year over year basis to 72%, placing the brand above other athletic retail brands:

Part of this sentiment improvement is driven by high marks for its Curry branded shoes (77% positive) and its Project Rock collection (75% positive).

Considering the influx of copycats and knockoffs that have since hit the market, this shows that the UAA brand has staying power and perceived value to a wide range of athletes and athleisure wearers alike.

- Trend Watch: Leaning into the Athletic Footwear Market

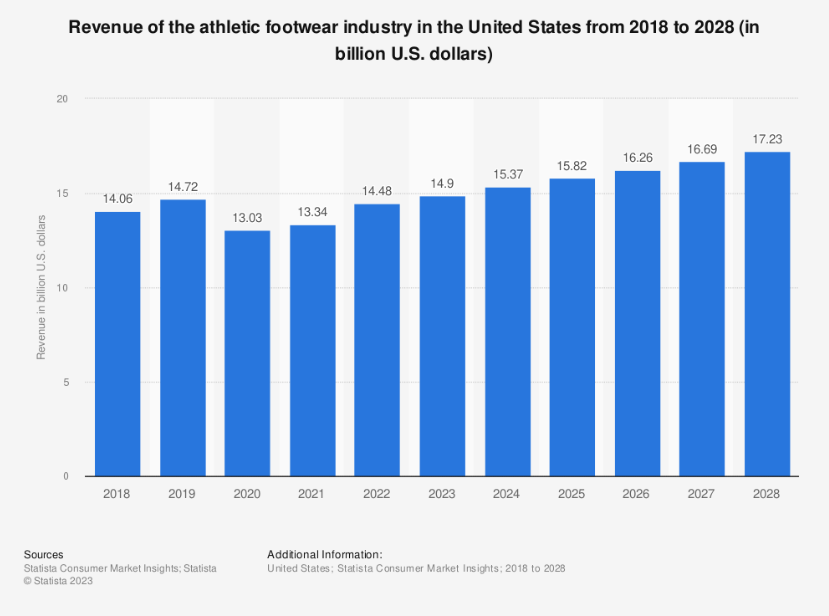

Footwear is a lucrative business.

Revenue in the U.S. “athletic footwear” market segment is projected to grow steadily over the next five years to exceed $17 billion by 2028.

Under Armour underscored that footwear is a top priority moving forward: “Above all else, our single most significant growth opportunity is footwear.”

This focus on footwear involves both building on its existing performance footwear base and expanding into the sports style segment, recognizing that this is a multi-year journey requiring significant investment and innovation.

Keep an eye on this rising “It” brand – it may just surprise the market. But not you.

As the market rallies ahead of the new year, there’s one opportunity that – if played right – could make your year.

Landon and I are calling it our biggest prediction of 2024, even recording a special broadcast to bring you the details. Watch it here.

Until next time,

Andy Swan

Founder, LikeFolio