Google’s “Monopoly” Is Ripe for Disruption…

There’s a reason you’ve never heard anyone say “Just bing it.”

When we talk about searching for something on the internet, even if we are searching on Microsoft’s (MSFT) Bing, we say “just google it.”

Google (GOOGL) is THE global search engine, fielding 99,000 queries every second of every day.

It’s a name so synonymous with web search that it became a verb, entering the Merriam-Webster Dictionary in July 2006.

There’s something seriously impressive about that. I mean, here’s a company with such a chokehold on one (massive) corner of the market that it became part of our everyday vocabulary.

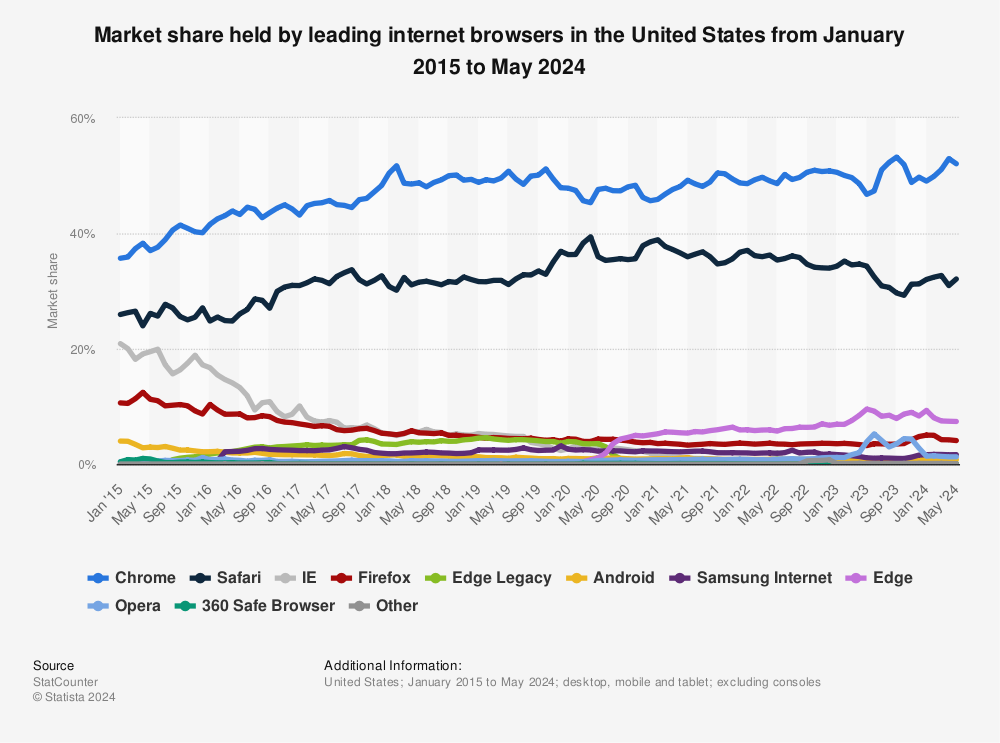

Google Chrome, its web browser, is near-equal in its dominance – boasting a commanding 65% share of the market.

Chrome’s market leadership far outpaces even the most formidable “big tech” peers. Apple’s (AAPL) Safari commands 18.17%, MSFT’s Edge claims just 5.21%, and Bing isn’t even on the board.

Despite this seemingly impenetrable stronghold, supremacy is never guaranteed, even for such a ubiquitous brand as Google.

Just this week, federal courts ruled against Google in a landmark antitrust suit, branding it a “monopolist” that unjustly elbowed out the search competition.

But even before that, emerging trends and changing market dynamics were converging against the internet king.

Here’s a look at how Google Chrome’s position came under threat – and the challengers coming for its throne…

Privacy Is the New Priority

You know those notifications that pop up on virtually every website you navigate to – asking you to accept cookies? Companies like Google use cookies to track your online behavior and deliver targeted ads.

Consumers have grown wise – and they want their privacy back.

Google has been promising to ditch third-party cookies in its Chrome browser for years in a bid to win back its “privacy first web” moniker. It was supposed to eradicate them in the second half of 2024. But not anymore.

In July, Google made a major about-face and canceled its years-long plans altogether.

“Instead of deprecating third-party cookies, we would introduce a new experience in Chrome that lets people make an informed choice that applies across their web browsing, and they’d be able to adjust that choice at any time,” Anthony Chavez, VP of Google’s Privacy Sandbox, explained.

Unless Google adapts to consumers’ evolving privacy preferences – and fast – Chrome may face significant challenges retaining its market share.

Especially considering the steep competition it faces from privacy-focused challengers…

The Rising Competition

While Google can’t seem to figure a way around third-party cookies, many other browsers have – and they’re gaining ground with consumers.

These privacy-focused browsers block third-party cookies and offer the robust privacy protections that have become increasingly important to users.

One name gaining favor for its focus on privacy and speed is Brave. It holds a modest 1% global market share but has attracted over 73 million monthly active users.

Brave blocks ads and trackers by default and rewards users with Basic Attention Tokens (BAT), a cryptocurrency built on the Ethereum (ETH) network, for viewing privacy-preserving ads. This unique value proposition appeals to privacy-conscious users and positions Brave as a potential disruptor.

Opera (OPRA) is another notable competitor investors should know.

Opera was the first to many features including tabs, full page zoom, and pop-up blocking. This browser also boasts numerous built-in features appealing to consumers, including ad blockers, VPNs (virtual private networks), and an AI assistant.

Publicly-traded OPRA poses a potential investment route against Chrome, delivering strong financial performance despite its low market share.

The company’s strategic positioning in AI capabilities, coupled with a significant dividend yield and a 24% increase in annualized ARPU (revenue per user), suggests potential for growth that could influence its market share positively in the future.

The Bottom Line

While Google Chrome remains the leading browser, its dominance is not assured. Emerging privacy trends, growing competition from browsers like Edge, Brave, and Safari, and Opera’s financial and technological strategies are disrupting the landscape – and posing a real threat to Google’s throne.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

NVDA at $100 Is a Gift (3 Reasons Why)

Nvidia is still a top opportunity – and at these prices, it looks too good to pass up…

LikeFolio Fear Index Update: How to Approach the Market from Here

Why stock prices crashed – and what LikeFolio data reveals about investor sentiment now…