Historically, companies at inflection points have either soared to new heights or faltered.

In 2004, Blockbuster operated over 9,000 stores. But by refusing to adapt to the rise of digital streaming services, the former titan of video eventually sank into irrelevance.

At the same critical juncture where Blockbuster failed, Netflix (NFLX) made a very different choice – pivoting its DVD-by-mail business to streaming and video on demand in 2007.

Fast forward to today, and streaming isn’t just the norm – it’s a global powerhouse industry worth $544 billion.

Netflix made the right decision.

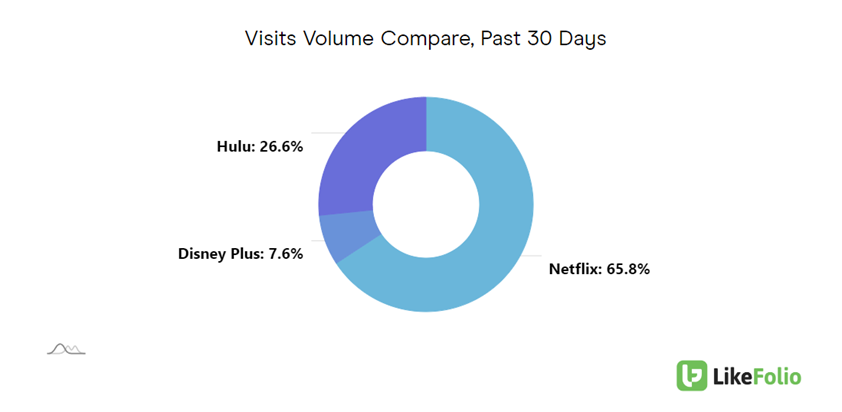

99% of American households subscribe to at least one streaming service, of which there are hundreds of options. Yet Netflix still reigns supreme with 260.28 million subscribers worldwide as of December 31, 2023 – the most of any other service by far.

But there was another, much more recent, make-or-break moment that got Netflix to this point.

See, not long ago, in 2022, Netflix was bleeding subscribers; its stock had plummeted to under $300 a share.

After years of rejecting advertisements on its platform, the company pivoted… and just in time.

How Ads Saved Netflix

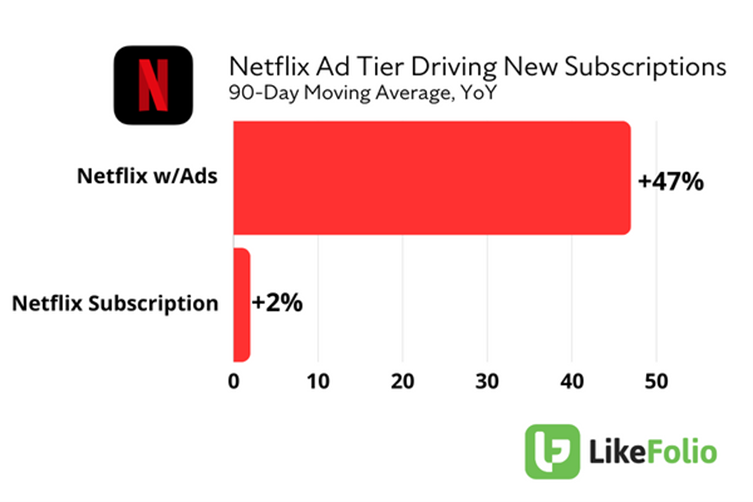

Netflix rolled out its lower cost “Basic with Ads” tier for $6.99 in the U.S. in November 2022, and you can see the immediate return on that investment on the chart below:

The ad-supported tier significantly contributed to Netflix’s revenue in the most recent quarter, marking a 12.5% increase in sales to $8.83 billion in Q4 of 2023.

This tier accounted for 40% of all Netflix signups in the markets where it was offered.

And LikeFolio data confirms continued traction in NFLX’s ad supported level.

While generic mentions of new Netflix subscriptions have risen by 2% year over year among English speakers, those talking about signing up for the ad-supported model specifically have surged as much as 47% from the year prior.

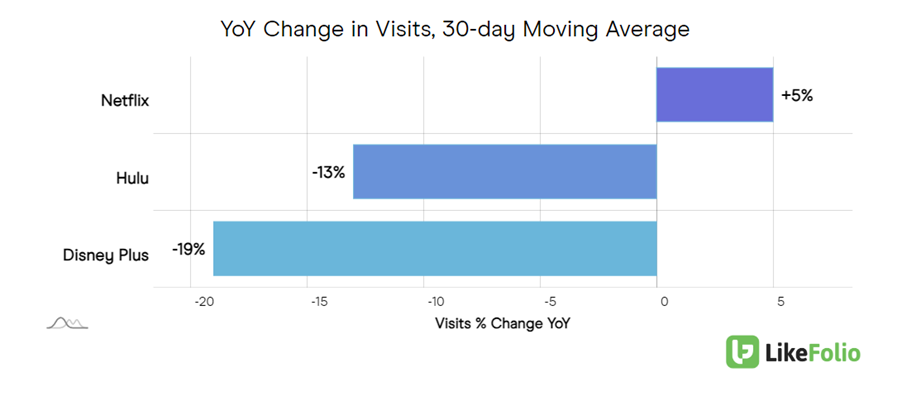

This is helping to lift NFLX above peers like Hulu and Disney+ (DIS), even though the company already held significant market share.

LikeFolio web metrics show this expansion in action for Netflix, with visits growing 5% year over year on a 30-day moving average – while those competing services record declines:

To be clear: Disney is aware it has catching up to do on the streaming front – and has big plans to get there.

In fact, Disney CEO Bob Iger looks to Netflix as the “gold standard” in streaming technology. And for good reason…

Wall Street Is Onto Netflix’s Success

Netflix received a slew of upgrades this month as analysts realized that the ad-tier isn’t just driving growth – it’s become an effective anti-churn mechanism.

We’ll be listening to what consumers are saying in real time to confirm if this is, in fact, the case.

But so far, Netflix looks like a beautiful case study on how to turn a business around.

Shares have more than doubled over the last year, and are climbing back toward their COVID-era highs… so we expect continued overperformance from this stock in 2024.

Netflix is the clear leader in the $544 billion streaming industry. But we’re always looking toward what comes next – because that’s where our real edge lies.

With a direct line to Main Street, we can show you an up-and-comer that’s harnessing the power of AI to deliver an unbeatable streaming experience. This player is handily beating Netflix in Consumer Happiness – by nearly 10 points. That’s a fantastic indicator of future growth. And Wall Street hasn’t even caught on yet. Check it out.

Until next time,

Andy Swan

Founder, LikeFolio

The Latest Free Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s hot this week…

This Beauty Stock Is Sitting Pretty

Take a look at a force to be reckoned with in the $646.2 billion global beauty industry…