Earlier this week, Spotify (SPOT) proved that by integrating artificial intelligence (AI) into cost management, pricing strategy, and product experience, it can achieve sustainable profitability without sacrificing growth.

While Spotify is certainly a poster child for success, it’s NOT the only company that can do this.

In fact, we have one new name to add to your watchlist now…

Stock to Watch: The AI Company with an ODD Approach

Oddity Tech (ODD) is a relatively new IPO, going public in July 2023. But it’s already making big waves with its unique, AI-driven approach to beauty.

The “digital-first” company leverages AI to create personalized shopping experiences. Its cosmetic brands, Il Makiage and SpoiledChild, leverage algorithms and machine learning to match customers with products that suit their preferences.

For example, Il Makiage is kind of like an online beauty catalog… designed to tap into younger generations’ obsession with social media beauty discovery. Simply click on an image of a social media influencer whose look you’re going for, get a full debrief of the products that influencer used – tutorials and all – and buy the products you want straight from Il Makiage’s website.

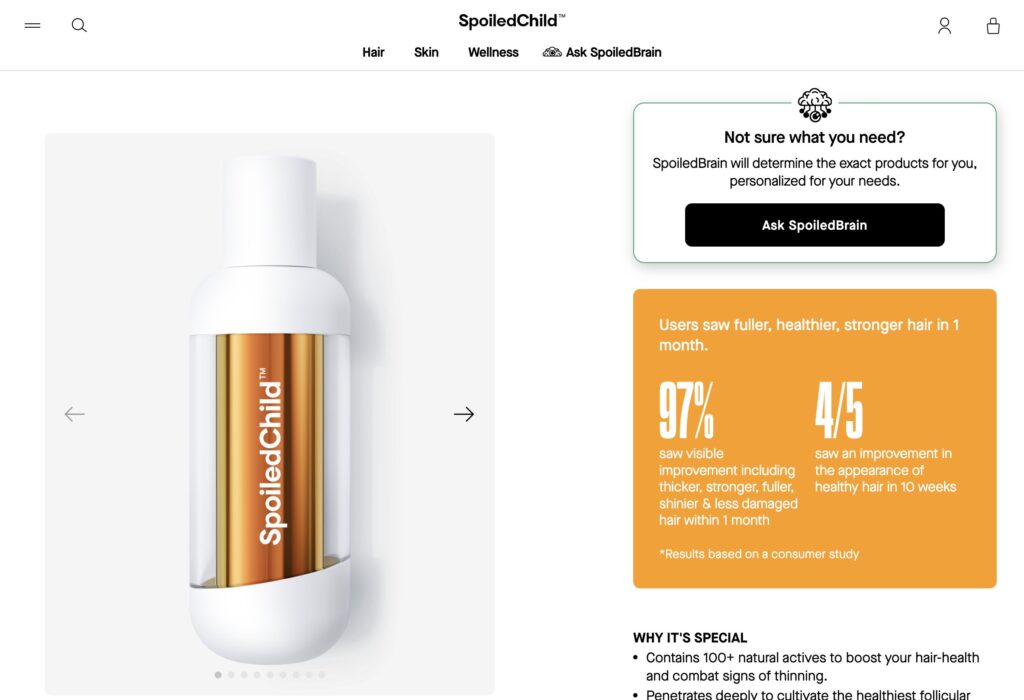

SpoiledChild specializes in hair and skincare – its SpoiledBrain AI bot gathers personalized information from each individual customer by asking simple questions, like “How oily versus dry is your hair?” and makes customized product recommendations that you can buy right then and there.

In addition to its beauty brands, Oddity also boasts its own supercomputer-powered bioengineering unit, Oddity Labs, where it’s working to develop new products, spanning from cosmetics to cancer therapeutics.

This AI-driven approach to beauty brands has proven extremely lucrative. In the third quarter of 2024, the company posted:

- 26% year-over-year revenue growth to $119 million

- Net income of $18 million

- $83 million in gross profit, up 25% year over year

- Adjusted EBITDA of $25 million, representing a 20% boost from the year prior

Anyone can read an earnings report. For us, what’s more impressive – and the real reason why ODD needs to be on your radar – is the forward-looking data we have on this name…

And that’s something you’ll only get from LikeFolio’s insights.

Catching Fire with Consumers

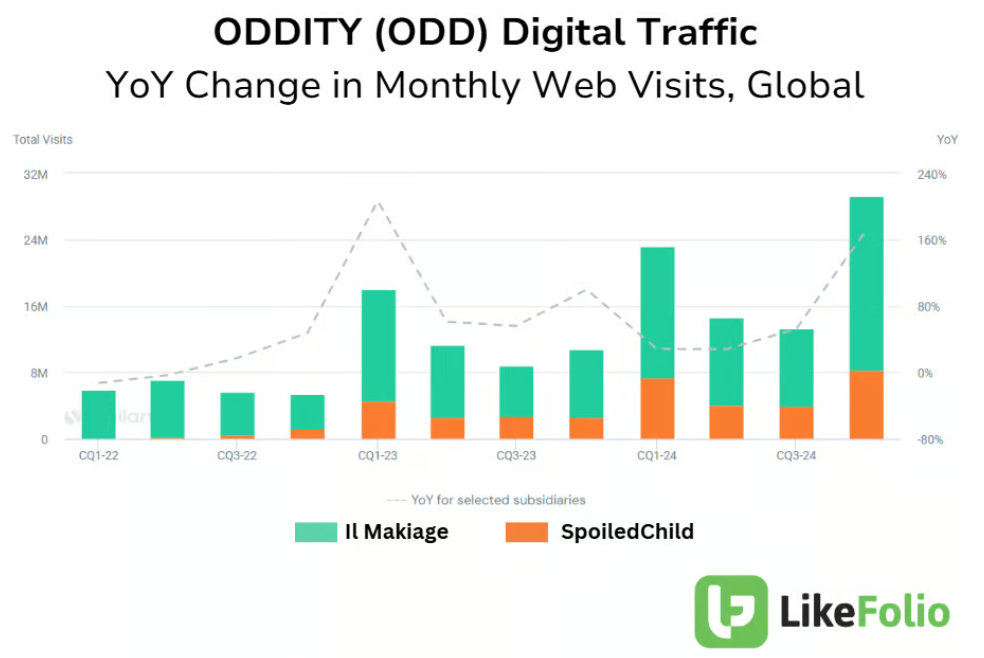

ODD caught our attention because it’s gaining serious steam on the consumer front…

You can see for yourself below how Oddity digital traffic skyrocketed in December:

That kind of digital traffic boost is a great tell of future demand… and sales.

What to Watch from Here: New Talent, New Products

In January, Oddity acquired AI modeling specialist Fionic1 in a bid to boost its already advanced tech. This move brought over Fionic1’s research and development talent, including Fionic1 co-founder, Asaf Nurick, to help advance Oddity’s AI capabilities.

We’re also preparing for two new product launches that are tackling large areas of consumer concern: acne and eczema.

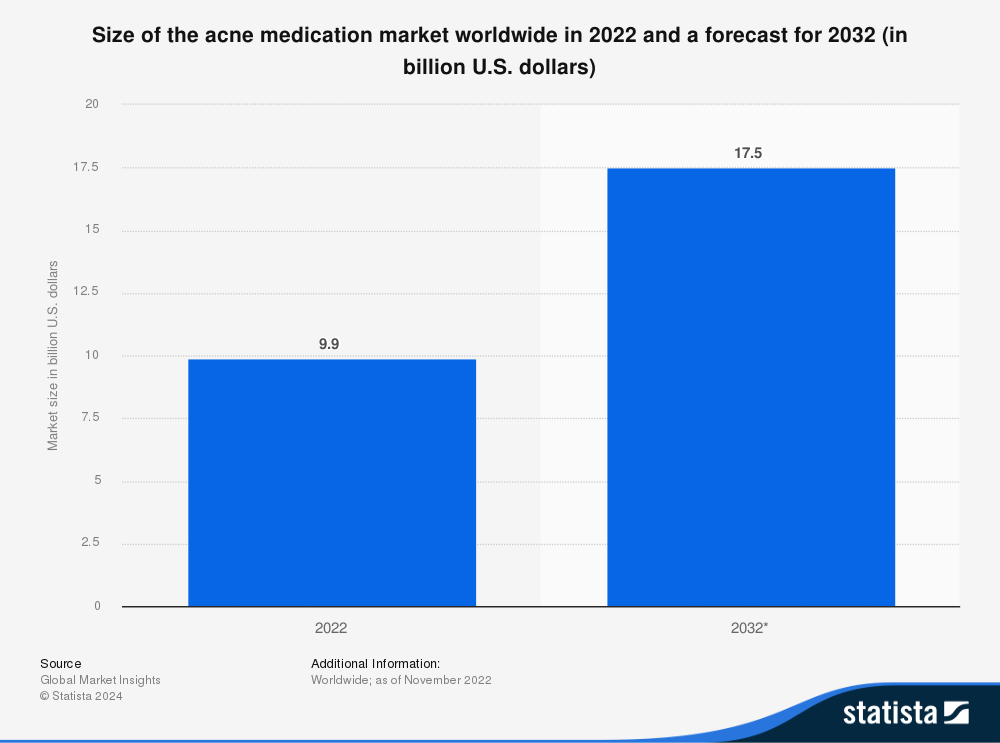

The global acne treatment market alone is on track to expand from $9.9 billion in 2022 to $17.5 billion in 2032.

Meanwhile, eczema affects an estimated 1 in 10 Americans.

On its last earnings call the company noted:

“Il Makiage and SpoiledChild will continue to drive growth from their existing products from a pipeline of new products and categories and from scaling Internationally. As you know, up to this point, we have been primarily focused on the US where we continue to see high growth runway. And unlike our competitors, we have zero exposure to China’s consumer slowdown. The next driver is new brands with Brand 3 and 4 ready to launch in the second half of next year [2025], while continuing to add additional brands to our future pipeline.”

Bottom line: ODD is one to watch as it expertly leverages technology and consumer trends to improve its products, build growth, and deliver real results.

We’ll be monitoring this name very closely for opportunities. Its next earnings aren’t until March, but we already anticipate a stellar report.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

SPOT Delivers a Big Earnings Win – and It Won’t Be the Last

Congrats! Our Spotify prediction was SPOT on. And the results point to a larger investing trend that we can play to our advantage…

Apple’s Contrarian AI Bet Could Deliver a Hefty Payoff

“Not first, but best.” In the wake of DeepSeek’s disruption, Apple’s contrarian approach to AI looks more lucrative than ever…