If Nike (NKE) unveils a strong earnings report this Thursday, it may have an unlikely trio to thank because of a renewed enthusiasm for its brand – Ben Affleck, Matt Damon, and Marlon Wayans.

The A-listers were featured in “Air,” the silver screen origin story of the Air Jordan brand. Released on April 5, the movie has received critical acclaim and a 7.5 out of 10 rating on IMDB if you need something to add to your watchlist.

Going hand in hand with the increase in attention, LikeFolio is capturing a sizable uptick in Nike consumer demand. Purchase Intent is up sharply on a quarter-over-quarter basis (+54%) and hovering near a three-year high:

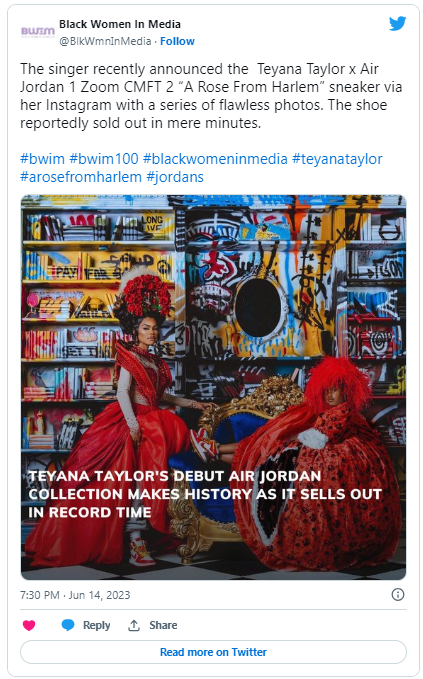

Recent product launches including sneakers inspired by another NBA star, Luka Dončić, and the Teyana Taylor Air Jordan brand collection – which sold out in minutes – have no doubt helped.

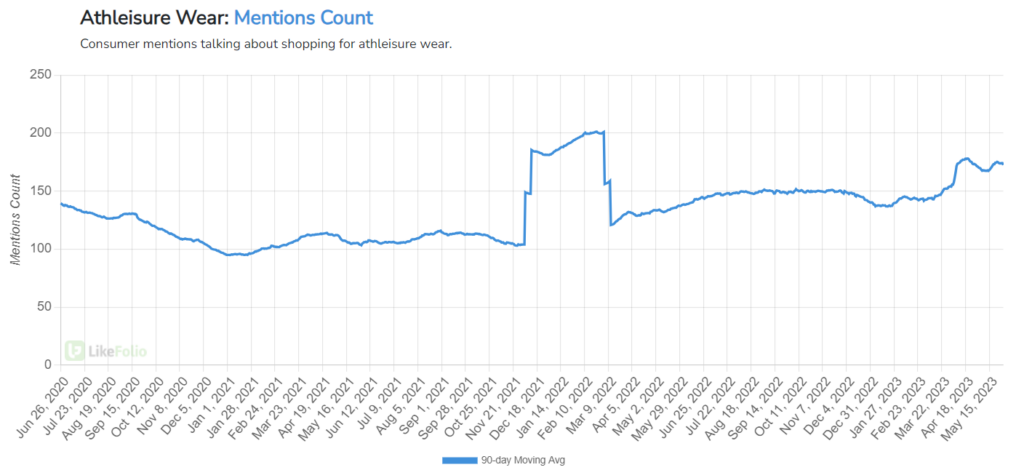

We suspect the surge in demand also relates to a surprising 2023 comeback for athleisure wear. Casual work attire trends and social acceptance of athletic gear have consumers shopping for comfy-yet-chic sweats and summer outfits again.

Mentions of the trend are pacing 26% higher year-over-year:

On the investor side, Nike shares are running today in large part because traders are anticipating a consensus-topping performance.

Nike has a low bar to clear on Thursday: Wall Street is expecting just 3% revenue growth and a 24% drop in profits. The sneaker king could easily hurdle those forecasts.

In fact, the company has comfortably beaten Wall Street EPS estimates in each of the first three quarters of fiscal year 2023.

Game on for Nike?

Not so fast.

Before you jump in, check out this key metric throwing up a red flag…

Consumer Demand Is Climbing but…

…sentiment is weakening.

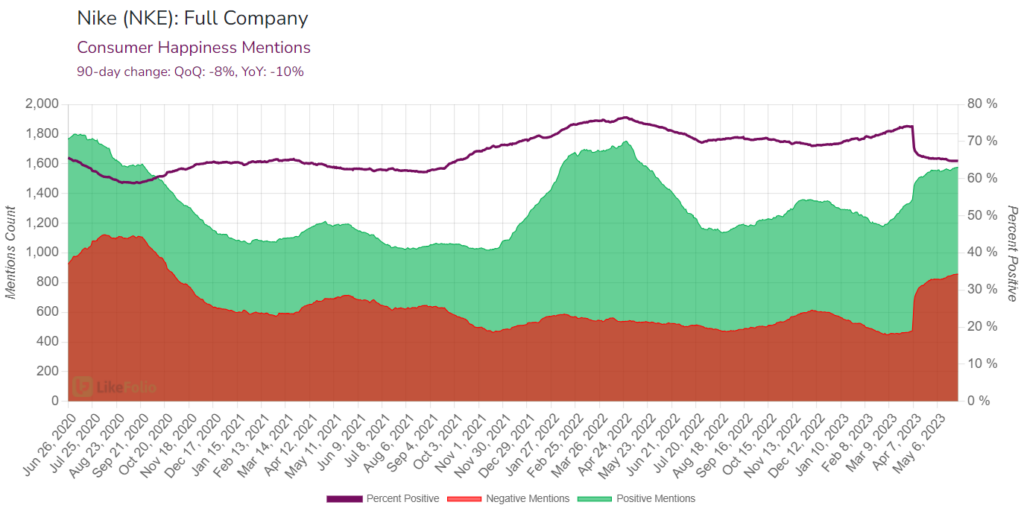

While we’re encouraged by the uptick in NKE consumer demand and the rebirth of athleisure wear, LikeFolio data shows Consumer Happiness mentions have tanked 10% year-over-year:

You can see from the chart above how consumer sentiment turned starkly negative in April and has yet to improve.

The main reason will sound familiar to those following the Bud Light saga with us…

Nike hired transgender influencer Dylan Mulvaney to promote women’s sports bras – and calls to boycott Nike soon followed.

After the stark impact Bud Light’s partnership had on AB InBev’s (BUD) financials and stock, taking one side or the other on NKE feels risky.

The consumer backlash that took hold for most of Nike’s reporting period is hard to ignore.

Putting these forces together, we are neutral on Nike earnings for FY Q4.

The company will undoubtedly reassert its sneaker dominance over time, so we are still in the NKE ball game long-term.

But for now, it’s best to sit this quarter out…

And check out this sneaker brand instead.

Until next time,

Andy Swan

Founder, LikeFolio