It’s been a tough road if you’ve bet against this tech titan over the past few years…

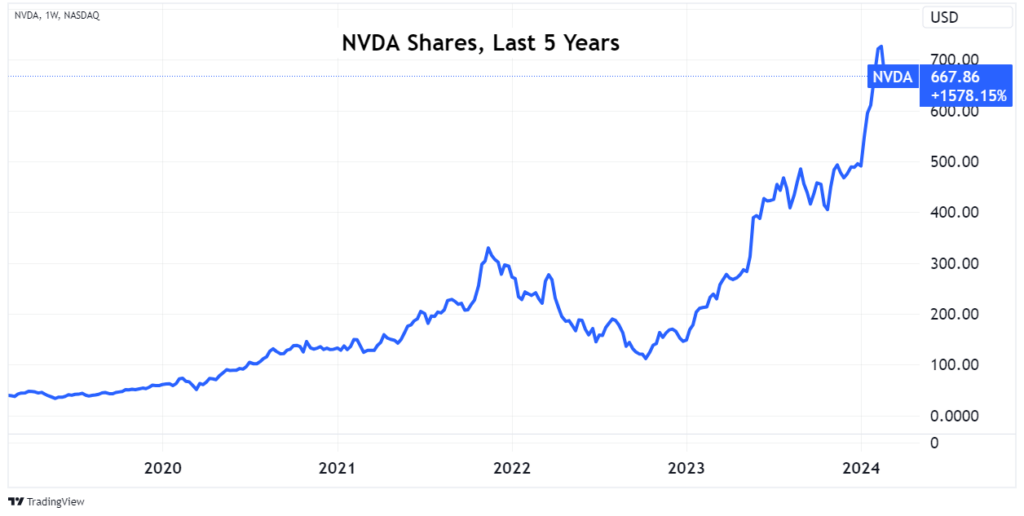

Nvidia (NVDA) shares have exploded by more than 1,500% since 2019.

It’s no wonder why: Nvidia has ridden nearly every major “mega” trend wave higher that we’ve covered since LikeFolio’s MegaTrends inception. And our subscribers have the profits to show for it, with four massive triple-digit trade wins in the bank.

- NVDA April 2020 Bullish Alert: +148.98%

- NVDA March 2022 Bullish Alert: +100.67%

- NVDA September 2022 Bullish Alert: +257.14%

- NVDA January 2023 Bullish Alert: +165.70%

(If you missed out on those Nvidia gains, don’t worry. Because the same system that helped us spot Nvidia is now targeting five tiny AI stocks with – get this – 1,000% potential. You need to see this.)

Nvidia is the ultimate disruptor. And at the heart of its success lies its transformation from a gaming-focused GPU manufacturer to a key driver of the AI revolution.

Just take a look at some of the trends Nvidia has harnessed and propelled on its march higher…

GPU Computing Revolution (Early 2000s onwards): Nvidia transformed GPUs (graphics processing units) from mere graphics rendering tools to powerful computing processors, marking the beginning of GPU-accelerated computing across various industries.

Deep Learning and AI Surge (2012 onwards): The company became pivotal in the early days of the artificial intelligence (AI) revolution, with its GPUs becoming the de facto standard for training deep learning models due to their computational efficiency.

Gaming and e-Sports Boom (2010s onwards): Nvidia’s GeForce GPUs have dominated the gaming industry, benefiting from the rise in PC gaming and e-sports.

Ray Tracing Technology Adoption (2018 onwards): Introduced real-time ray tracing GPUs, enhancing gaming and content creation realism with their ability to mimic real-world lighting in digital form.

Data Centers and Cloud Computing Expansion (Mid-2010s onwards): Nvidia’s GPUs became crucial for data centers, powering cloud computing and AI services.

Autonomous Vehicles and Robotics (Late 2010s onwards): The company ventured into autonomous vehicles (AVs) and robotics, offering GPU and AI platforms for these next-generation technologies. For example, its GPUs enable self-driving cars to interpret complex traffic data and virtual assistants to process human speech with remarkable accuracy.

Edge AI and IoT (2020s onwards): Nvidia adapted its technologies for edge computing (which involves processing data locally) and IoT (Internet of Things) applications, reflecting a move towards decentralized, intelligent computing.

What’s Next for Nvidia in 2024

Looking ahead, Nvidia is set to continue its innovation streak – expanding its AI portfolio to include applications like generative AI for film production, AI surgical assistants, generative AI in drug discovery, and AI-enhanced retail experiences.

These advancements promise to revolutionize industries by making AI more accessible and efficient across the board.

Nvidia’s generative AI is expected to transform the film industry by reducing production costs and enabling more creators to produce high-quality content.

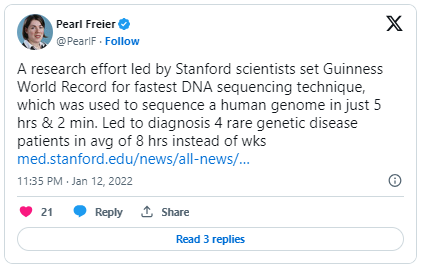

In health care, AI surgical assistants will augment surgeons’ capabilities, improving safety and outcomes in surgeries. For example, Stanford researchers were able to diagnose a patient in critical care in just five hours and two minutes – taking home the Guinness World Record – thanks to Nvidia-powered rapid DNA sequencing.

The company’s foray into generative AI drug discovery aims to expedite the development of new medications by leveraging vast health care datasets and automation.

And Nvidia’s enterprise solutions are set to empower businesses to harness their data more effectively, using generative AI to unlock insights from vast unstructured data stores. This will facilitate more personalized and efficient operations across various sectors, from retail to industrial design.

The applications are virtually limitless… and just getting started.

But let’s talk about TODAY.

All eyes are on Nvidia right now as the market braces for its earnings report, which is due just moments from now, at 5:00 p.m. ET. ⏰

Here’s what we’re watching…

The LikeFolio Perspective: Earnings and Beyond

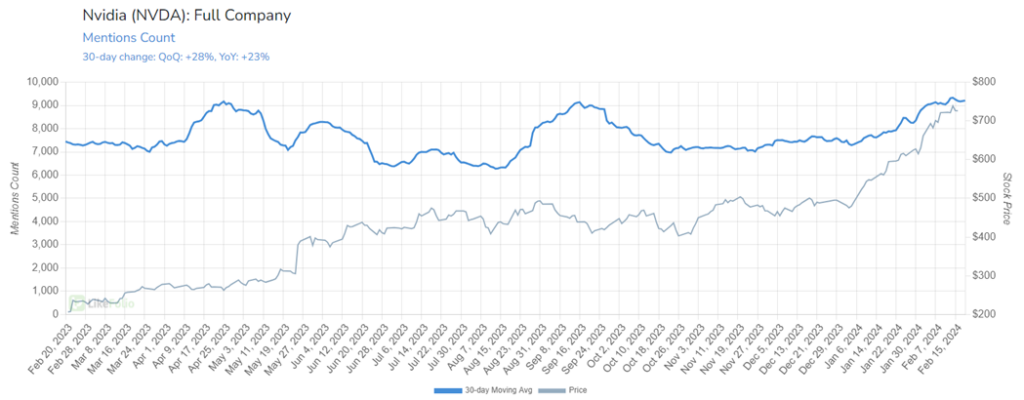

LikeFolio data shows continued buzz growth around NVDA: Mentions are up by 23% year over year and 28% quarter over quarter…

Consumer Happiness is growing too, gaining six points year over year…

While consumer sentiment around competitors Advanced Micro Devices (AMD) and Intel (INTC) lags behind.

But with a market cap of $1.72 trillion – that’s Trillion with a T – the bar is high for Nvidia.

Sky high.

Nvidia’s last two earnings reports have triggered near-term downtrends in the stock price. And with the more than 6% drawdown in share price we’ve seen this week, we are officially moving to a neutral position on NVDA earnings.

But here’s the real takeaway I want to leave you with:

No matter what Nvidia’s earnings are tonight – and no matter how the market reacts – this AI “mega” trend isn’t going anywhere. And neither is Nvidia’s incredible upside.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

This Stock Won the $17.3 Billion Super Bowl Spending Spree

Kansas City won the Super Bowl, but one stock dominated the big-game snacking frenzy…

This Trend Rocketed 14,000% in Just Two Years 🚀

The AI landscape is buzzing on the back of technology advancements that are sending chatter to all-time highs…