Nvidia (NVDA) reports its second-quarter earnings tomorrow after the bell – and everyone is teeming with anticipation after its last unforgettable earnings performance.

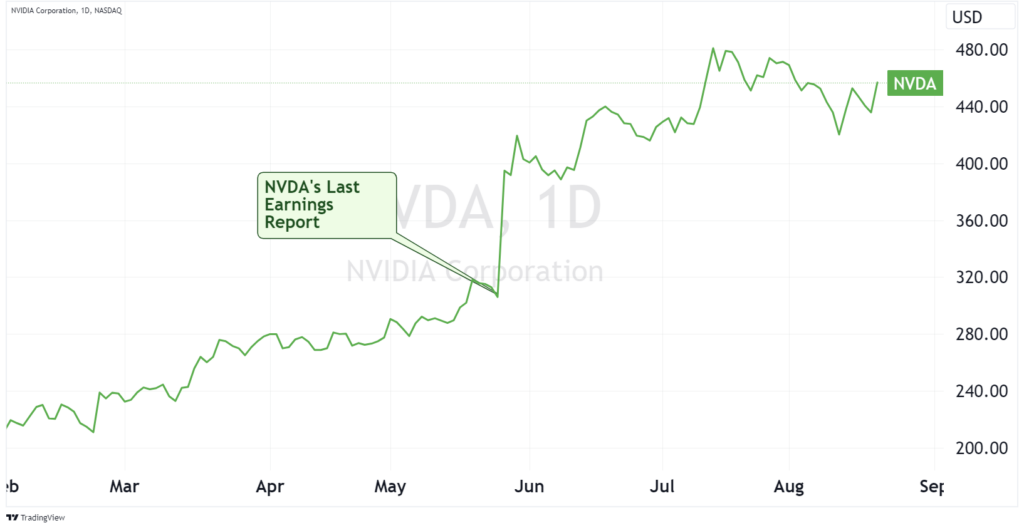

You remember, in May – when Nvidia upped its quarterly revenue guidance by a full 50%, and its stock price flew 25% higher in the blink of an eye?

That was the trigger that launched Nvidia into “The Trillion-Dollar Club,” putting it among an elite group of stock market leaders. Before then, only Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), and Amazon.com (AMZN) could claim market caps over $1 trillion.

And the catalyst behind Nvidia’s meteoric rise? Only the most significant “mega” trend we’re tracking in 2023: artificial intelligence.

📈 Miss out on the Nvidia rally? This $2 AI stock is only just getting started… and could turn into one of the biggest undercover AI opportunities of the decade. More here.

With all eyes on Nvidia and AI, Wednesday’s earnings report has our full attention. And we’re not the only ones.

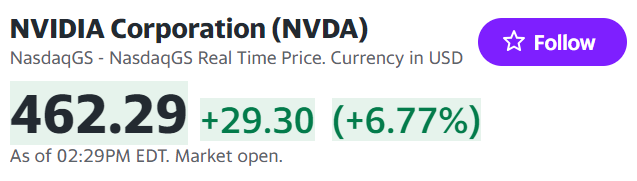

Nvidia’s stock price surged higher on Monday, gaining as much as 8% since Friday’s opening bell.

But underneath the surface, a “buy the rumor, sell the news” event could be in play.

“Buy the rumor, sell the news” is like a dance between anticipation and realization – where investors buy up stocks on positive rumors, then sell once the news is officially announced.

The tricky part is: Even if the news is great, the stock can plummet once it’s released.

We know the options market is pricing in a nearly 12% move on Nvidia’s earnings report, signaling high volatility and uncertainty in the days ahead.

Nvidia – and the AI “mega” trend that’s defined investing in 2023 – will be put to the test.

Here’s what you need to know to prepare for the risks – and opportunities – that come with this high-stakes earnings event…

“Buy the Rumor, Sell the News” Explained

The “buy the rumor, sell the news” phenomenon has baffled and fascinated market watchers for generations.

It’s driven by two of the most powerful human emotions: fear and greed.

- Expectations Already Priced in

The market often prices in anticipated good news, driving the stock price higher. Once the news is released, there’s no new catalyst to push the price further, leading to profit-taking.

- Overhyped News

If the news is good but not as extraordinary as expected, investors might decide to sell, even if the news is objectively positive.

- Short-Term Traders

Many traders buy shares leading up to significant news events with the plan to sell immediately after, leading to a sudden influx of selling right after the big event.

- Psychological Factors

The fear of missing out (FOMO), followed by the realization of gains, is a powerful combination that perpetuates these events. Understanding these psychological factors is key.

Nvidia’s Upcoming Report: What We Know

NVDA shares have soared nearly 200% in 2023 alone, and the excitement is building ahead of Wednesday’s eagerly awaited earnings report.

- Price Targets Boosted

KeyBanc and HSBC increased their price targets for NVDA this week, adding another $20 per share to the stock’s already impressive rally.

- Little Room for Disappointment

A rally like Nvidia’s leaves little room for any earnings-related disappointment. Anything less than a higher-than-expected forecast could trigger a significant drop in the stock.

- Supply Constraints

Reports of supply constraints on Nvidia’s AI chips could put limitations on its near-term sales forecast – but potential offsets in China add complexity to the earnings anticipation.

- High Expectations

Investors expect NVDA to beat quarterly revenue estimates after its last epic earnings performance. Shares have tripled in value this year – and are soaring higher as I write this.

The Bottom Line

The “buy the rumor, sell the news” phenomenon looms large over Nvidia’s earnings announcement. And the stage is set for a classic example of this market behavior. Investors and traders should tread carefully, with an awareness of market psychology.

And if the report does, in fact, spark a selloff… It could open a lifetime opportunity.

But you don’t have to wait until then when there are smaller AI players out there ready for their own breakout…

Our system pinpointed an “undercover” AI opportunity gaining serious momentum with consumers.

LikeFolio data shows demand for this company’s services gaining 75% year-over-year, while it leads its industry with a Consumer Happiness level of 90%.

At just $2, this stock might be “tiny,” but its upside is anything but.

Until next time,

Andy Swan

Founder, LikeFolio