When you hear the word “AI stock,” your mind probably jumps immediately to Nvidia (NVDA).

When I say top AI chip stocks, once again, Nvidia probably grabbed the top spot in your mind, with rival Advanced Micro Devices (AMD) not far behind.

Each stock price has skyrocketed in 2023 – 214.65% for NVDA and 73.33% for AMD.

Those have certainly been the companies leading the pack, as consumers have been infatuated with the AI revolution.

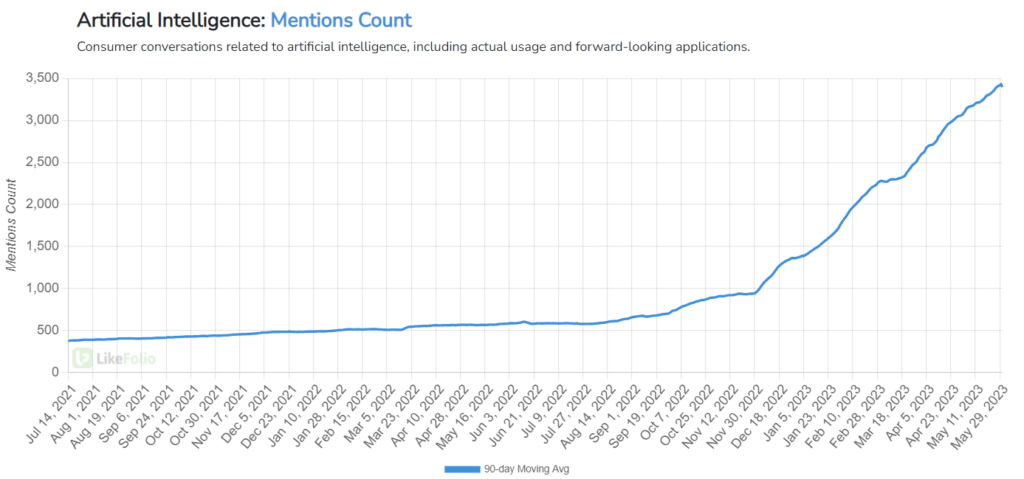

While it’s common to see this kind of “hockey stick chart” in a startup’s pitch deck, it’s pretty rare to see it actually play out in real life:

But markets are always in flux.

And at LikeFolio, we’re starting to see signs that things are beginning to shift for an “OG” tech player that could soon have a seat at the table with the most elite “AI All-Stars.”

Let me show you…

That OG of tech is Intel Corp. (INTC).

Intel is a familiar name that’s been around since 1968, known for its processors and PCs, and for being one of the largest semiconductor chipmakers in the world.

Well, Intel has invested heavily in AI in recent years – including with its $2 billion acquisition of deep-learning developer Habana Labs in 2019.

During its latest earnings call, Intel CEO Pat Gelsinger made clear his company plans to “build AI into every product that we build.”

Here’s how it fits into the current AI landscape – and why we’re excited about its potential.

The Current AI Landscape

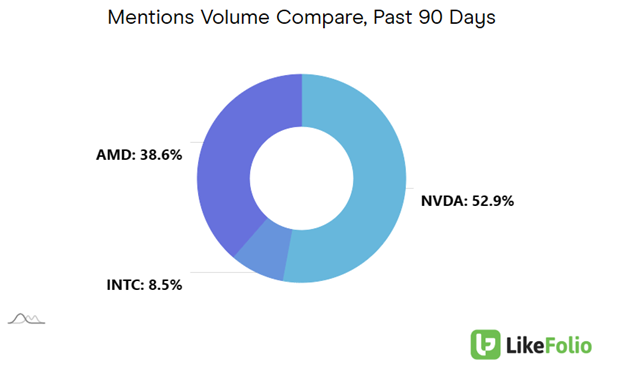

When it comes to the chipmakers getting the attention of the public, Nvidia is taking the lion’s share, claiming the majority of social media buzz compared to AMD and INTC:

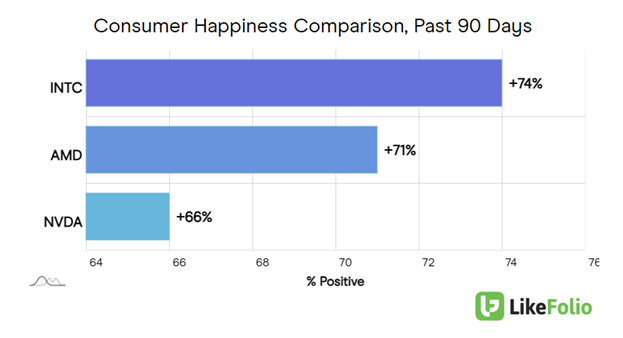

But it’s Intel with the happiest customers.

LikeFolio data reveals that Intel has the highest Consumer Happiness level of the three major players – and by a considerable margin…

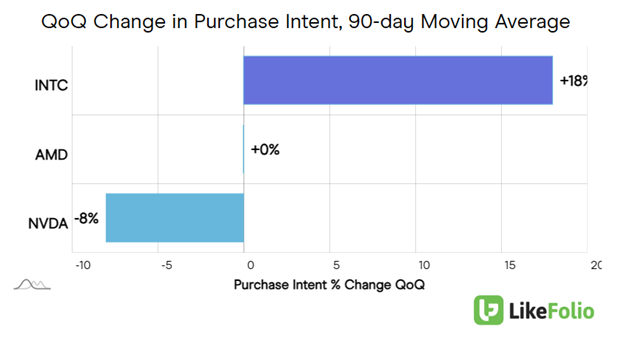

…and when it comes to overall demand, Intel is starting to catch up with its rivals.

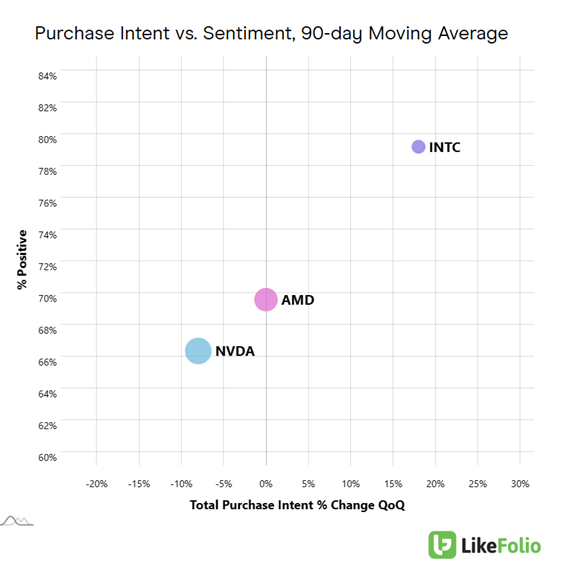

Over the past 90 days, we’ve seen a shift in Purchase Intent mentions, as demand for Intel chips surges and Nvidia begins to lag:

The “hot stock” of today doesn’t always remain the hot stock of tomorrow.

Oftentimes, all it takes to shift fortunes is a small change in momentum.

It’s too early to say for sure, but we’re starting to see some early signs that NVDA’s massive outperformance of INTC in 2023 could be due for a reversal.

Notice which stock occupies the most lucrative positioning in the Outlier Grid below? It’s INTC, in the top right spot:

💡 The LikeFolio Outlier Grid reveals potential opportunities by comparing Purchase Intent growth (x-axis) against Consumer Happiness (y-axis). Tomorrow’s big winners are often found in the top right quadrant, which constitutes ideal bullish positioning.

Identifying massive upside and getting in early on investable opportunities is what we are all about.

Because in addition to adding INTC to your moneymaking watchlist, there’s also something else you can take action on…

Another AI player gaining serious momentum with consumers, with demand mentions soaring 78% year-over-year as we speak.

This $3 stock has everything we look for in an opportunity ready for liftoff.

But unlike the elite “AI All-Stars” we showed you today, this one’s still flying under the radar for most investors with a market cap of less than $1 billion – and all its growth still ahead of it.

Check it out here… before Wall Street catches wind.

Until next time,

Andy Swan

Founder, LikeFolio