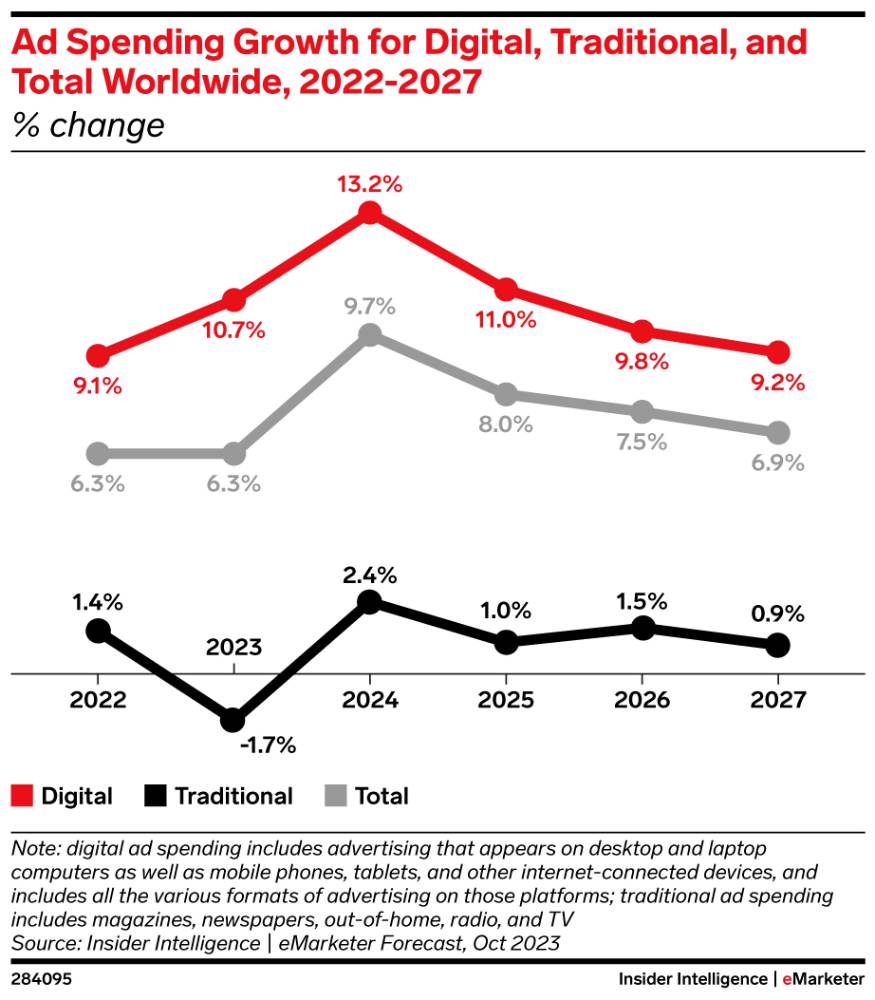

By all accounts, 2024 is set to be a banner year for advertising spend.

After a notably weak 2022, special events, including the Paris Olympics and a competitive U.S. election cycle, are providing an outsized boost.

META’s Ambitious Plans for Ad Dominance

Meta Platforms (META) is riding digital ad spend tailwinds better than most.

The company has serious ad ambition and prior results that show success. Like the ad market, it too had a tough run in 2022, when it went too far in on the metaverse (before the rest of the world was ready).

But META’s recent cost-cutting measures and advertising machine are clearly working.

It is by far the largest social media company globally, touting 3.27 billion daily active users across its owned apps.

The company has benefitted of late from increased ad spending from Chinese e-commerce and gaming companies targeting users here in the U.S. (hello, Temu). In the second quarter, Meta’s ad revenue grew by 22% year over year, besting Google’s (GOOGL) 11% and Snap’s (SNAP) 16%.

Earlier this month, META shares popped higher following beats across the board and stronger-than-expected guidance. Employee headcount continued to drop, boosting operating income 58% year over year and lifting operating margin to 38% (from 29% a year ago).

The stock is up 49% year to date (and more than 187% over the last five years).

AI Investments Pay Off

META continues to invest heavily in AI, with capital expenditure spend slated between $37 billion to $40 billion for the remainder of the year. This includes hundreds of thousands of Nvidia (NVDA) H100 graphics cards and equivalent GPUs.

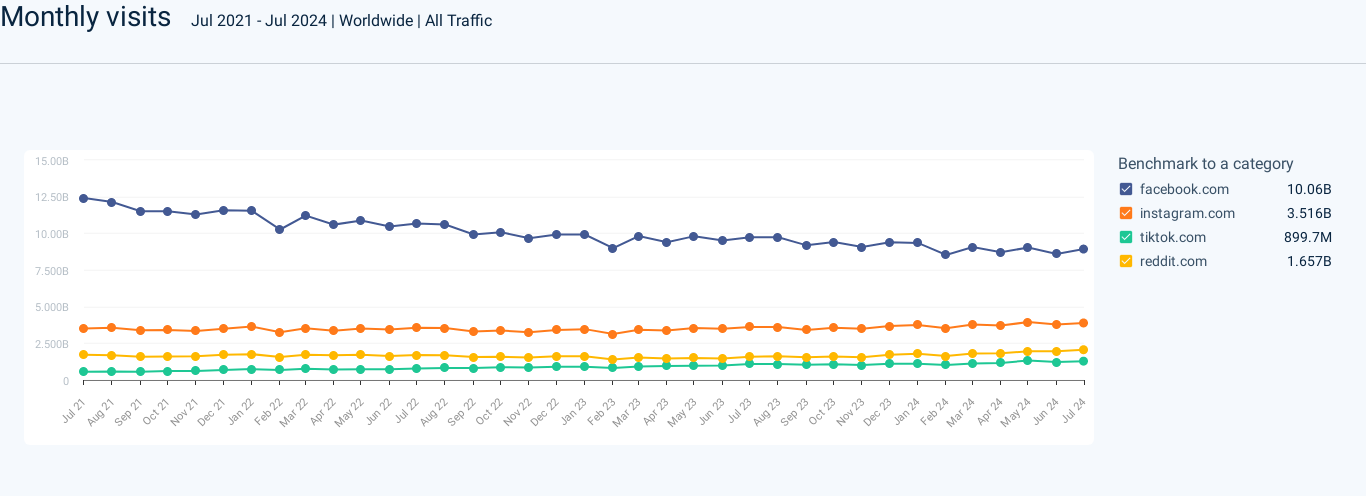

AI is critical beyond its AI assistant. Facebook and Instagram leverage AI to improve the quality of recommendations and keep users hooked on its platforms…

The more eyeballs on screens and the more effectively the company can really KNOW these eyeballs, the better the ad connection with brands.

Zuckerberg noted on the company’s earnings call:

“In the coming years, AI will be able to generate creative for advertisers as well — and will also be able to personalize it as people see it. Over the long term, advertisers will basically just be able to tell us a business objective and a budget, and we’re going to go do the rest for them.”

Web data shows Instagram in particular (orange line) continues to outperform and keep users engaged:

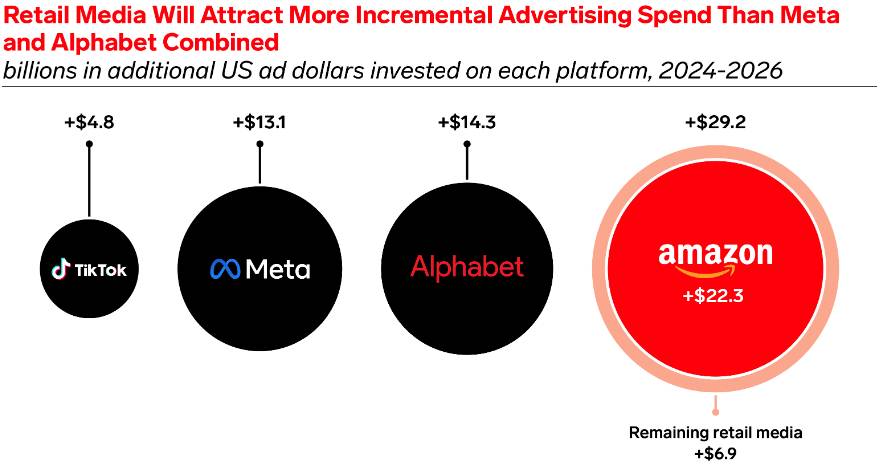

You can also see on the ad spend chart below just how big a piece of the advertising pie META commands and is projected to command.

Bottom line: META’s strong stock performance appears more than justified. If the company can deliver the type of advertising model Zuckerberg describes, the ad spend projection is likely to tilt even more into META’s favor.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

The Next 3 Stocks to Watch After Walmart’s Earnings Triumph

These consumer favorites could be the next to soar…

How Walmart Achieves $169 Billion in Sales in a Single Quarter

This retailer is undergoing a full-fledged brand renaissance. What’s next?