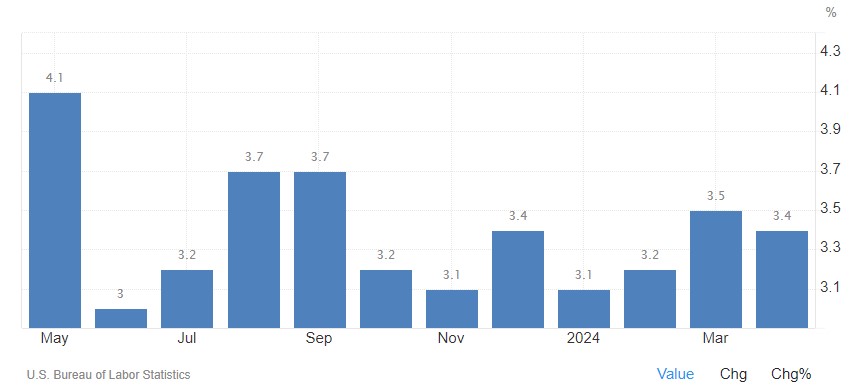

Inflation is cooling – at least, that’s the headline you’ll get from the mainstream media today after the Consumer Price Index (CPI) print for April came in with an annual inflation rate of 3.4%.

In layman’s terms, that means the price of basic goods and services that consumers depend on, like gas, clothes, medical care, and rent, are still too high.

The results were in line with expectations – and stocks headed higher today as Wall Street celebrated the news.

But make no mistake: Persistent inflation is still taking its toll on Main Street.

And that could have serious implications for investors.

Starbucks (SBUX), McDonald’s (MCD), and Tyson Foods (TSN) have all recently cautioned that low-income consumers are pulling back on spending and balking at high prices.

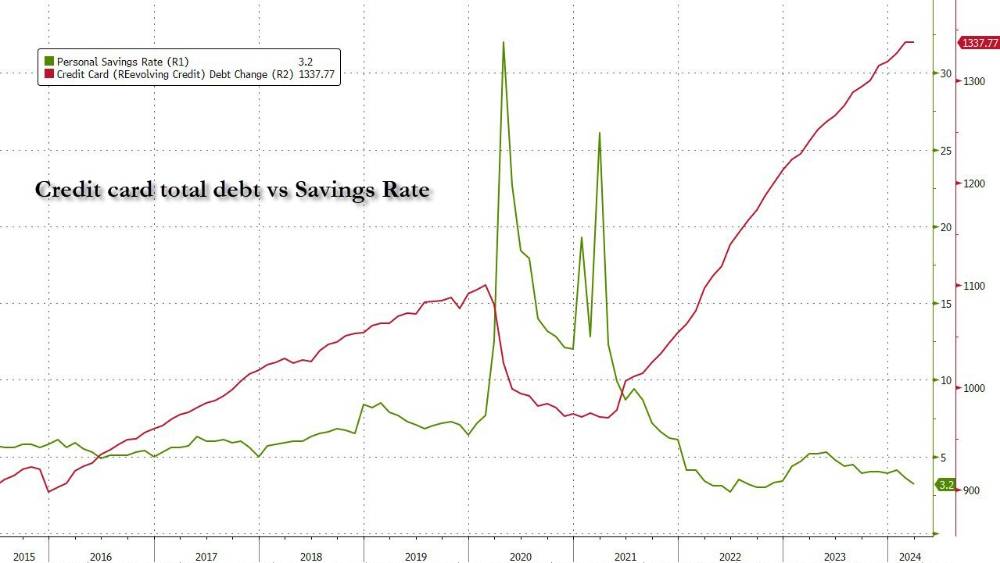

It’s no wonder why: As personal savings have plummeted, credit card debt has skyrocketed…

In fact, total household debt rose by $184 billion in the first quarter of 2024, reaching $17.69 trillion.

The low-income consumer is in serious trouble. And the middle class is starting to feel the pain, too.

Nike (NKE) and Lululemon (LULU) sounded the alarm on their earnings calls in March, suggesting deeper economic issues could be on the horizon.

“As you’ve heard from others in our industry, there has been a shift in the U.S. consumer behavior of late, and we’re navigating what has been a slower start to the year in this market,” explained Calvin McDonald, CEO of Lululemon.

The Spring 2024 Consumer Sentiment Survey by Alvarez & Marsal (A&M) found further proof: Households earning $150,000 to $200,000 reported the highest rates of planning to pull back on purchases.

(Though, interestingly enough, experiences remain a top priority.)

We’re keeping a close eye on this trend – watching for other potential victims in discretionary names that cater to these demographics under pressure, along with any bright spots where spending remains resilient.

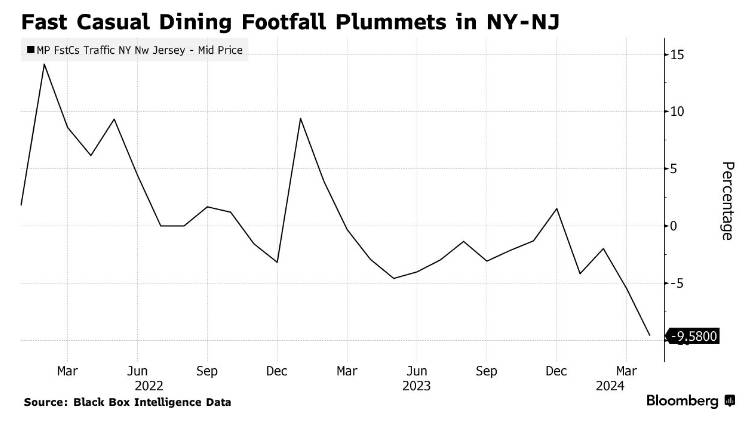

One Segment in Trouble: Fast-Casual Dining

The fast-casual dining sector could be among the hardest hit as persistent inflation erodes purchasing power and makes dining out less affordable.

Recent data shows a dramatic decline in foot traffic for fast-casual dining establishments in the NY-NJ region in particular, dropping by approximately 9.58% as of March 2024:

Higher prices for food, labor, and utilities are squeezing restaurant margins, often resulting in higher prices for consumers.

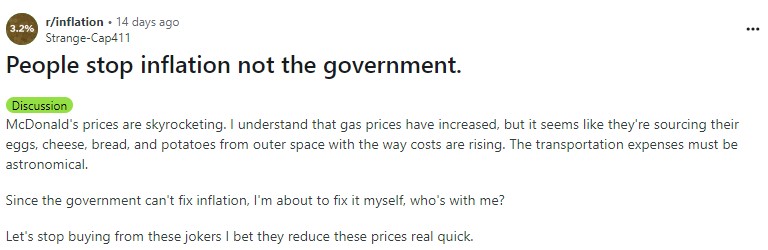

Posts like the one below voicing concern over the “skyrocketing” prices at fast-food restaurants have become the norm on social media:

That rising household debt I mentioned earlier only compounds these issues…

Not only does it limit consumer spending on non-essential items like dining out, but rising credit card and auto loan delinquencies indicate growing financial distress, prompting consumers to cut back on discretionary spending.

We humans are nothing if not adaptable, and you can bet consumers are changing their behaviors to accommodate tighter budgets. The more folks opt to cook at home, the less foot traffic comes through fast-casual dining establishments.

And when consumers do dine out, they increasingly seek value-oriented options, posing a challenge for mid-priced fast-casual businesses.

There’s a light at the end of this tunnel for the fast-casual dining names that can adapt to this new reality – both with innovative, value-oriented menu options and by improving operational efficiency through cost control and technology adoption.

Investors should prioritize companies with strong financial health, low debt levels, and robust cash flows.

At the end of the day, the brands that differentiate through quality, convenience, or sustainability may be more resilient in attracting customers.

But why sift through thousands of stocks on your own to separate the winners from the losers when you could get real-time trade alerts from yours truly? As soon as our consumer insights machine flags a stock ready to break out, our members get a notification straight to their inbox.

You’re free to join in on the profits here.

Remember: At LikeFolio, our “edge” comes from understanding consumer behavior – what “real Main Street people” are doing – before it becomes news on Wall Street.

Regardless of the macro environment, there are always big profit opportunities in individual companies and assets. Like this one right here.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Royal Caribbean Is Cruising – But This Stock Could Pop Next

The competition for billions of traveler dollars is on. And while RCL leads, another stock looks ready to set sail…

Biden’s War on Elon, Bitcoin’s Path to $100k, and Our Next Big Opportunity

In this new Q&A, you’ll get answers to your most pressing questions and find out what comes next…