Travel momentum is fading among the populace at large, but one segment is bolstering profits for a handful of players: premium travelers.

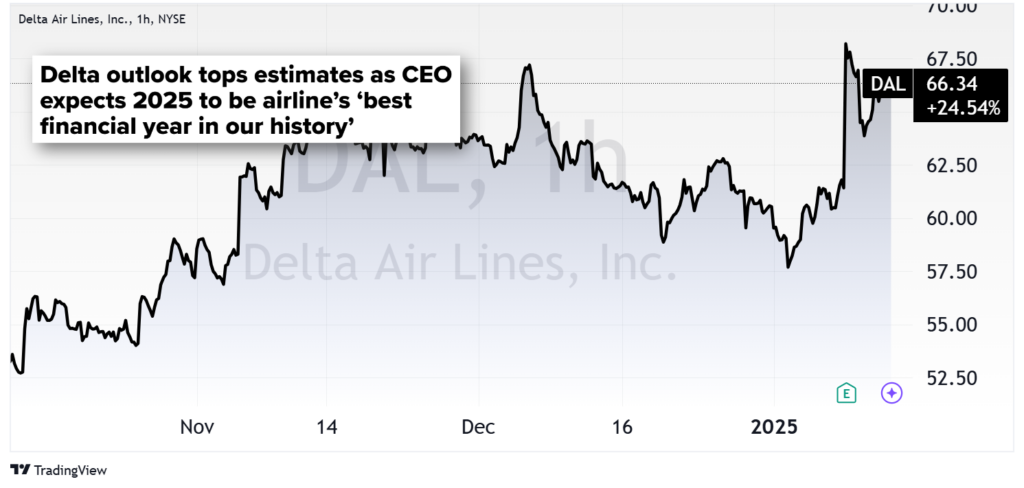

We saw this key trend in action from Delta Air Lines (DAL) last week when it reported fourth-quarter earnings. Its stock popped nearly 10%, one of the strongest single-day performances for the airline in months.

Delta called out two very valuable nuggets:

No. 1: Business travel is back – and growing.

Corporate sales increased by 10% year over year in the quarter, and company leadership sees this trend continuing, noting, “We surveyed the corporate traveler every year, the corporate travel managers. I think the number was 90% expected to exceed or meet last year’s spend.” Business travelers bleed into the premium travel mix.

No. 2: Premium travelers are seriously boosting margins.

Premium revenue outpaced main cabin performance throughout the year, up 8% year over year. As Delta increases capacity 3% to 4% in 2025, 85% of those seats will be in premium cabins. In its latest earnings report, Delta reported operating margins of 12%, benefiting from the higher yields generated by premium cabin demand and other efficiency measures.

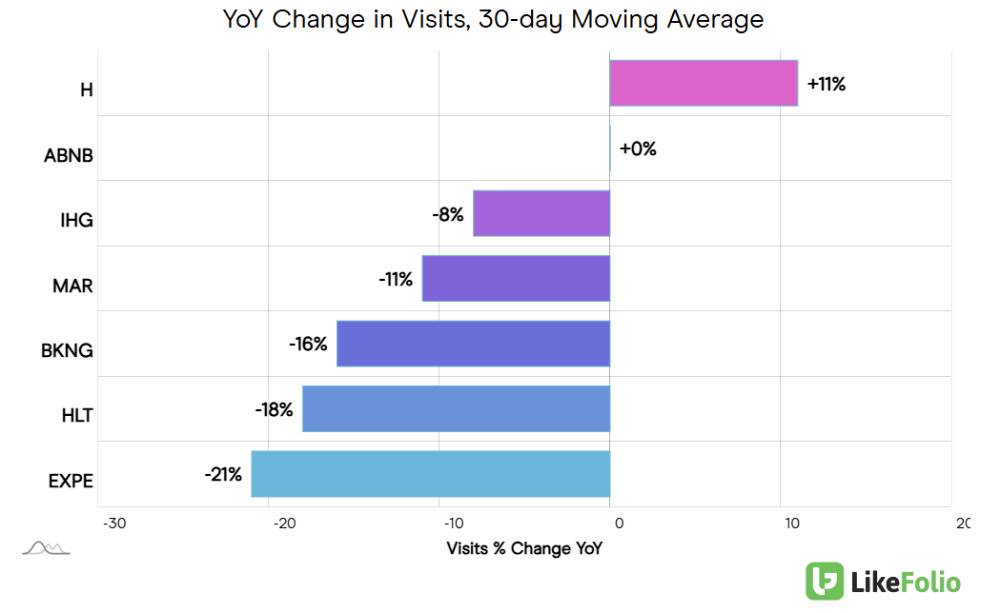

With this knowledge, we pulled data for booking sites and lodging companies next to answer an important question:

Does this premiumization theme spill into the lodging segment as well?

Data Deep Dive: One Travel Leader Emerges

Indeed, it does. Check out the year-over-year change in web visits over the last month from names like Hyatt Hotels (H), Airbnb (ABNB), Hilton (HLT), and other big competitors in the lodging space:

The key takeaway: Hyatt is logging the strongest forward-looking booking demand (+11%) compared to peers as its bet on premium travelers pays off.

At the end of 2023, approximately 70% of its rooms were categorized as “luxury and upper upscale.”

This focus on high-end lodging is set to continue as Hyatt leverages acquisitions, high-value destinations, and exclusive amenities to cater to premium travelers seeking personalized experiences.

Take a look:

Luxury Property Expansion

Hyatt is adding over 50 luxury and lifestyle hotels globally by 2026, with growth focused on high-demand leisure markets like Portugal, Mexico, and the Caribbean, appealing to affluent travelers.

Acquisition-Fueled Growth

Recent additions like Mr & Mrs Smith and Dream Hotel Group bring boutique and luxury properties into Hyatt’s portfolio, increasing its presence in exclusive destinations and offering travelers unique, premium experiences.

Asset-Light Model

Hyatt is focusing on management and franchise agreements instead of direct property ownership. This approach has doubled its luxury rooms and tripled its resort offerings since 2017, scaling operations while reducing capital intensity.

Luxury Amenities Driving Demand

Hyatt’s offerings include private villa accommodations, bespoke dining experiences, and high-end spa facilities, catering to travelers seeking exclusivity and personalized service. Programs like private culinary classes and immersive cultural activities further enhance appeal.

The Bottom Line

Hyatt’s focus on luxury properties and exclusive offerings aligns with growing global demand for high-margin, premium travel experiences.

If other brands CAN’T capitalize on “premium” offerings, we may see some near-term turbulence ahead.

Earnings season is upon us – and if DAL’s bullish surprise taught us anything, it’s that investors are paying close attention to travel stocks and rewarding those who are successfully tapping into the premiumization trend.

Last quarter, we booked some huge profits trading travel stocks with Earnings Season Pass, including:

- +200% on United Airlines (UAL)

- +100% on Booking.com (BKNG)

- +225% on Expedia (EXPE)

- +100% on Carnival (CCL)

Hyatt is due to report earnings on Thursday, February 13, and Earnings Season Pass members will receive our full analysis and trade recommendation, hand-picked based on the latest LikeFolio data.

Get excited for more big travel wins to come this quarter.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

TTD: Your Key to Untapped Streaming Profits

Right now, streaming faces a massive monetization gap – and TTD is in prime position to fill it…

Lululemon Crushed Christmas – Here’s Your Next Window of Opportunity

See how LULU finished the holiday season strong. Plus: Has the government already cashed out its Bitcoin?