Reddit (RDDT) is known as the “front page of the internet” for a reason: Across its more than 100,000 active communities, you can get the latest breaking news, browse and share tasty memes, enjoy millions of adorable animal photos, read and consume original stories and artwork, converse with fellow superfans, find support for the most obscure problems, and even have your favorite show spoiled for you as it’s airing, if you so choose. (I’m not judging.)

On Reddit, the world is your oyster. It’s a hub for authentic conversations used by an average 82.7 million folks daily.

This uniquely engaged userbase makes Reddit an extremely valuable data source – we use it to feed LikeFolio’s consumer insight machine – and a veritable goldmine for training artificial intelligence (AI) models.

In fact, Reddit has positioned itself as a key player in the AI arms race by licensing all that user-generated data to companies like Alphabet (GOOGL) and OpenAI for AI training.

These strategic deals have enhanced Reddit’s technological edge and relevance in the AI sector while bringing in substantial revenue in the process. It’s one big reason this name is top of mind for us.

The company has garnered significant interest from consumers and investors alike since its public debut in March.

Now that the IPO dust has settled and its first earnings report is in, it’s time for an update to see where the opportunity sits now.

Spoiler alert: It looks like RDDT’s momentum is picking up serious steam. Take a look…

Reddit’s First Earnings Report

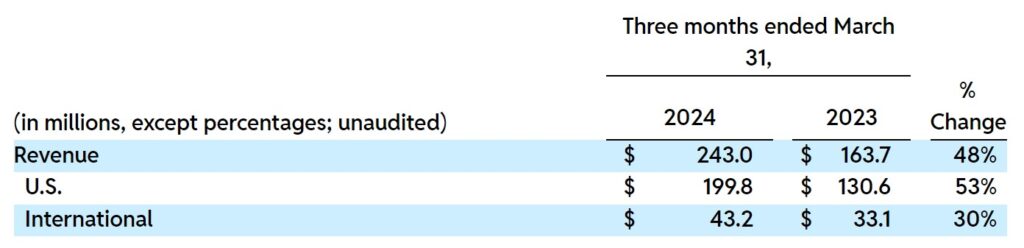

Reddit had a strong showing in its first quarterly earnings report post-IPO.

Revenue for the first quarter reached $243 million, a 48% increase from the previous year, well surpassing expectations of $212.8 million.

Industry-Leading Ad Revenue Growth

Ad revenue soared 39% year over year to $222.7 million, outpacing the growth of major competitors like Meta Platforms (META), Amazon.com (AMZN), and Alphabet (GOOGL). “Other revenue,” which includes those data licensing agreements we mentioned earlier, rocketed by more than 450% year over year.

Ad Revenue Growth Compare (Q1 2024):

| RDDT | +39% YoY 🔥 |

| META | +27% YoY |

| AMZN | +24% YoY |

| GOOG | +13% YoY |

Despite a net loss of $575.1 million, largely due to stock-based compensation expenses, Reddit’s revenue trajectory indicates robust growth backed by massive gains in user engagement.

Record User Engagement and Loyalty

Reddit’s average daily active users (DAUs) reached an all-time high of 82.7 million during the first quarter, gaining an impressive 37% year over year and handily beating the 76.6 million expected.

Those users were worth nearly $3 each. Average revenue per user (ARPU) increased to $2.94, up 8% from $2.72 a year ago.

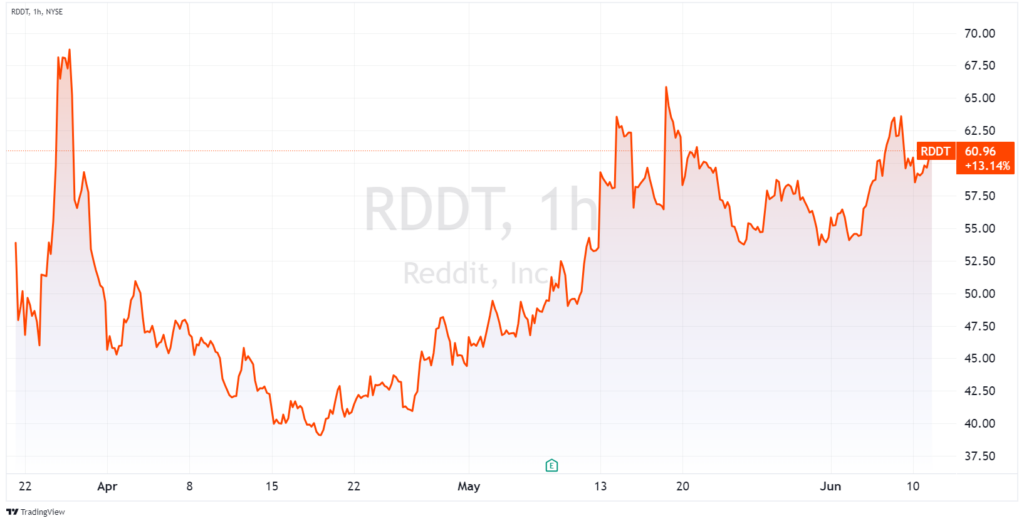

This user engagement and monetization growth highlights Reddit’s expanding influence and appeal. Wall Street agreed: Following the earnings report, RDDT surged 11% in premarket trading.

The company was smart to invite its most loyal “power users” to participate in its IPO – setting aside 8% of pre-IPO shares for this group. We believe this strategy has strengthened community engagement, fostering loyalty and potentially mitigating volatility related to stock performance.

Shares are currently trading around $61, maintaining a higher valuation compared to the IPO debut:

Massive International Growth Potential

U.S. users currently generate the majority of Reddit’s revenue. But nearly half of Reddit’s daily active users are international, presenting a significant opportunity for monetization.

International growth is a top priority for Reddit moving forward. The company is rolling out machine translation to help bridge the language gap.

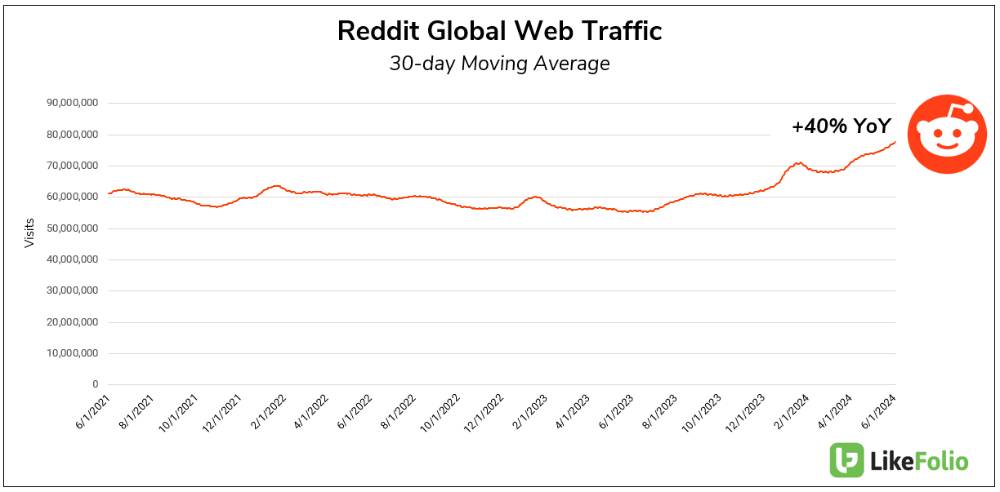

LikeFolio data suggests it’s making quick progress on this front.

Reddit global web visits are up by 40% year over year, a significant improvement from the previous year’s decline (-9%) and nearly more than double the traffic growth rate recorded last quarter (+21%).

Increased Brand Awareness

Reddit’s IPO supercharged its brand visibility and credibility as a consumer-facing business, which should continue to drive user engagement and attract more advertisers.

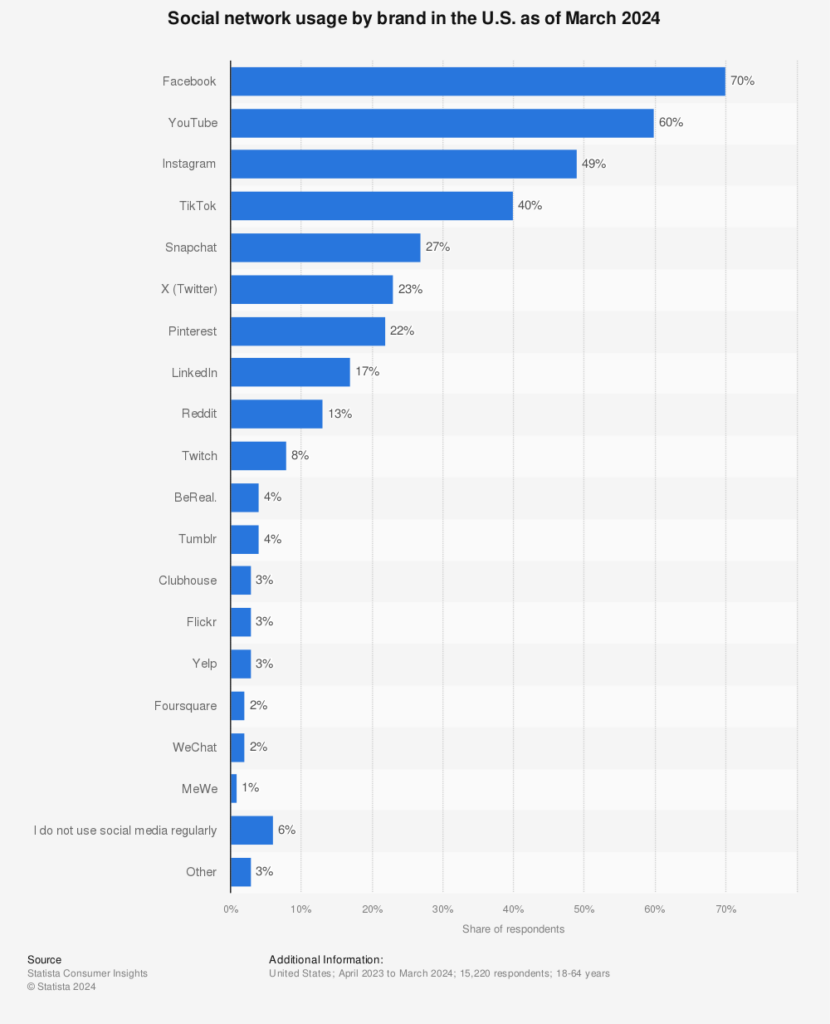

And the company still has plenty of room for improvement on this front, considering it still trails larger competitors like META in consumer adoption:

The Bottom Line

Reddit’s data stream is an important part of the LikeFolio Data Engine that helps us identify opportunities on Main Street before they become Wall Street news.

Turns out, users are constantly chatting about products and services of publicly traded companies.

We processed 1,193,582 positive matches to our brand-mapping database in the last 24 hours alone.

Impressive, right? Our Social Heat Score then distills those millions of data points into big-money stock picks. You can see how it all works here.

While Reddit’s score isn’t a “buy” just yet, its successful IPO and robust earnings report make it a must-watch player in the tech and digital advertising space.

Cathie Wood’s ARK Invest fund has been increasing its Reddit position, signaling a serious vote of confidence. And AI partnerships have only enhanced its value proposition.

Impressive revenue gains, increased user engagement, and positive market reception position Reddit well for continued success.

From here, we’ll be monitoring for continued user growth (web traffic), international expansion, and revenue diversification.

We like what we see from Reddit so far.

And look if you are looking for that next “buy,” our Social Heat Score recently triggered a profit alert on another social media stock after consumer buzz surged 88% year over year. To find out how you can join for access to that opportunity (and many more), go here now.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

The Two Real Winners of the Musk-Nvidia AI Chip Story

While the media attacks Musk, we’ll focus on the real winners…

Did Dollar Tree Make the Worst Acquisition in History?

See how an enormous win turned into a tumultuous loss for America’s discount retailer…