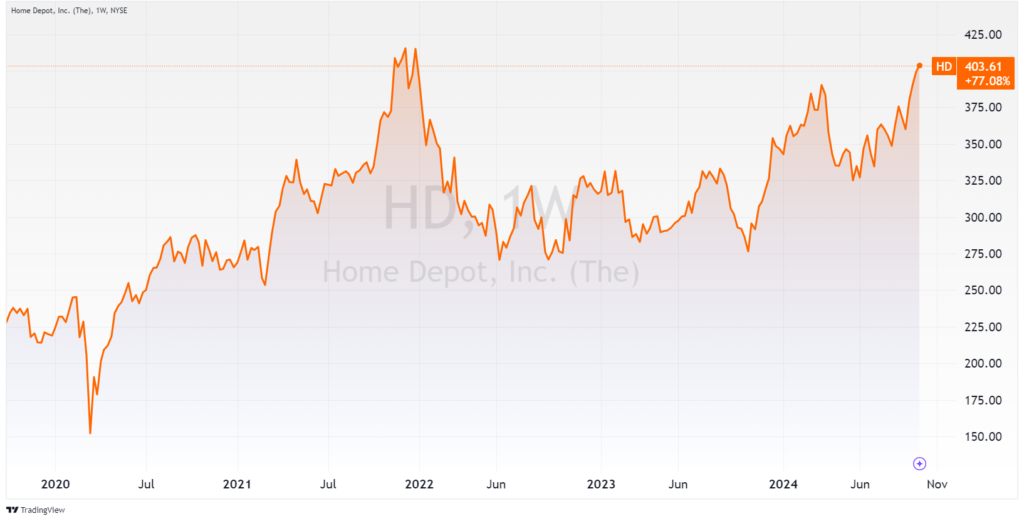

If you were to look at a chart of The Home Depot’s (HD) stock over the last five years, you’d have no idea the home buying environment hit generational lows last October.

HD shares are now trading near all-time highs, just under levels achieved during the height of the pandemic when consumers were in a home buying and home improvement frenzy.

This recent bullish action is driven by hopes of a home improvement turnaround. Is the market getting ahead of itself?

Trend Watch: Home Improvement Spending

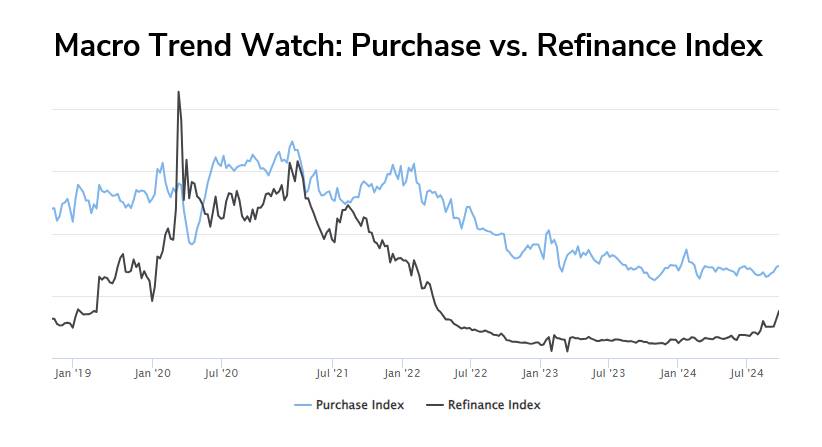

On the macro front, things are certainly looking better. Recent Fed rate cuts and sliding mortgage rates are two massive tailwinds tipping in home improvement retailers’ favor.

Consumers are refinancing at increasing clips, lowering monthly home payments, and in some cases, pulling out lump sums for needed improvements.

Mortgage applications jumped 11% for the week ending September 20, 2024, driven by lower interest rates, which reached their lowest level since July 2022.

Refinance applications surged 20% from the prior week and are now 175% higher year over year, making up 55.7% of all mortgage applications as homeowners look to lock in favorable rates.

Here’s where it gets promising for HD versus the competition.

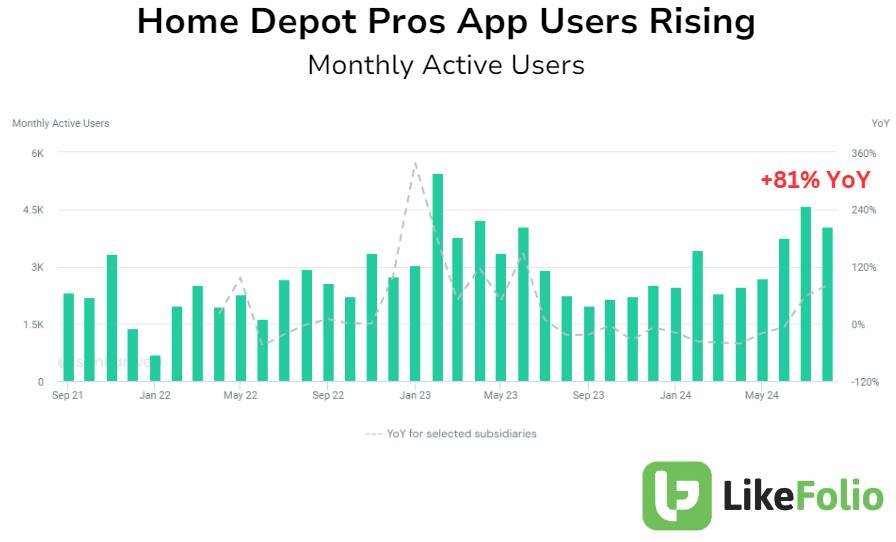

LikeFolio consumer metrics suggest an uptick in contractor activity, which benefits Home Depot more than its peer, Lowe’s (LOW).

Whereas Lowe’s caters to the DIY crowd, Home Depot is the preferred destination among professionals with a Volume Pricing Program that offers steep discounts on bulk orders and members-only benefits. Builders and contractors account for nearly half of Home Depot’s revenue (despite making up just 5% of its customers).

And LikeFolio data suggests HD is gaining significant traction with its biggest spenders: Home Depot Pros app monthly users were up 81% year over year in August, marking the first rapid uptick since the end of 2022:

Lowe’s is trying to win over some of these pros and create a more balanced customer base. Currently, Lowe’s generates around 25% of its revenue through this group – a pretty big divide stacked up against HD’s commanding lead.

If the average homeowner starts ratcheting up spending, too, Home Depot will be firing on all cylinders.

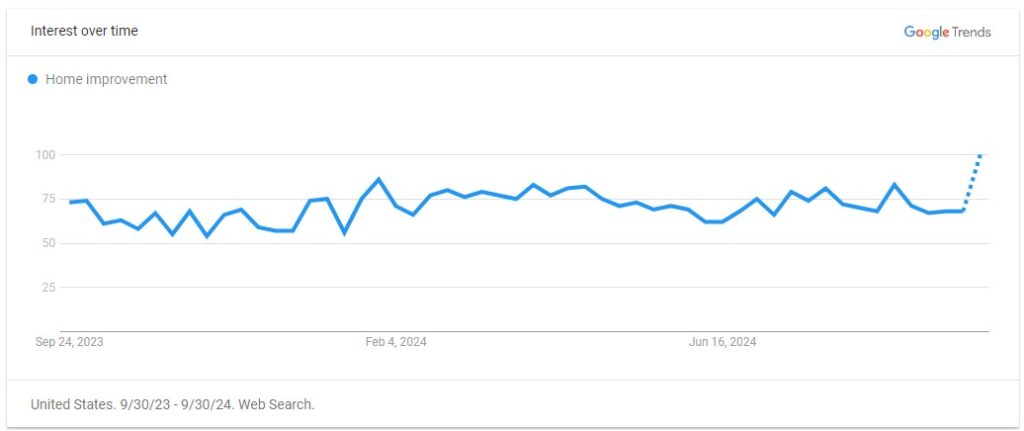

Last quarter, HD lowered its sales outlook and posted comp sales declines. The company reported that homeowners were delaying big projects in anticipation of lower interest rates, with many indicating they’d rather wait for a possible rate cut by the Federal Reserve in the next three to six months. And all signs point to this being exactly the case.

Overall interest in home improvement is spiking, according to consumer search trends:

It looks like there may indeed be light at the end of the tunnel.

We’ll be monitoring DIY and professional home improvement mentions to understand if this near-term consumer momentum has legs.

Bottom line: These renewed signs of life could be the fuel that sends HD to new highs.

Until next time,

Andy Swan

Founder, LikeFolio