It’s Week 5 of earnings season and all eyes are on the retail sector…

Headliners like Walmart (WMT), Target (TGT), Ross Stores (ROST), TJ Maxx (TJX), Foot Locker (FL), and Home Depot (HD) are all set to release key earnings reports this week that will set the tone for retail investing in 2023.

Between COVID-related government stimulus running dry, tax refunds coming in 9% lower this year, and persistent inflation, consumer buying power has taken a big hit.

And we expect that to be reflected in the numbers.

LikeFolio consumer data shows shopping trends are down across the board, with buzz around in-store and online shopping falling 9% quarter-over-quarter.

But as you’ll find out, not all retailers are suffering amid the consumer squeeze.

Your Week 5 Earnings Sneak Peek is here…

📅 Week 5 Earnings Sneak Peek

- On Holding (ONON): Reports Tuesday, May 16

- Home Depot (HD): Reports Tuesday, May 16

- Target (TGT): Reports Wednesday, May 17

On Holding (ONON): Reports Tuesday, May 16

Outlook: Bullish

Over the weekend, you got a preview of how LikeFolio consumer data was shaping up for On Holding (ONON) ahead of its Tuesday earnings report.

The Zurich-based shoemaker, specializing in high-quality athletic footwear and backed by tennis legend Roger Federer, has long been a favorite of our data guru, Megan Brantley… Who regularly sports her On’s around our Kentucky office.

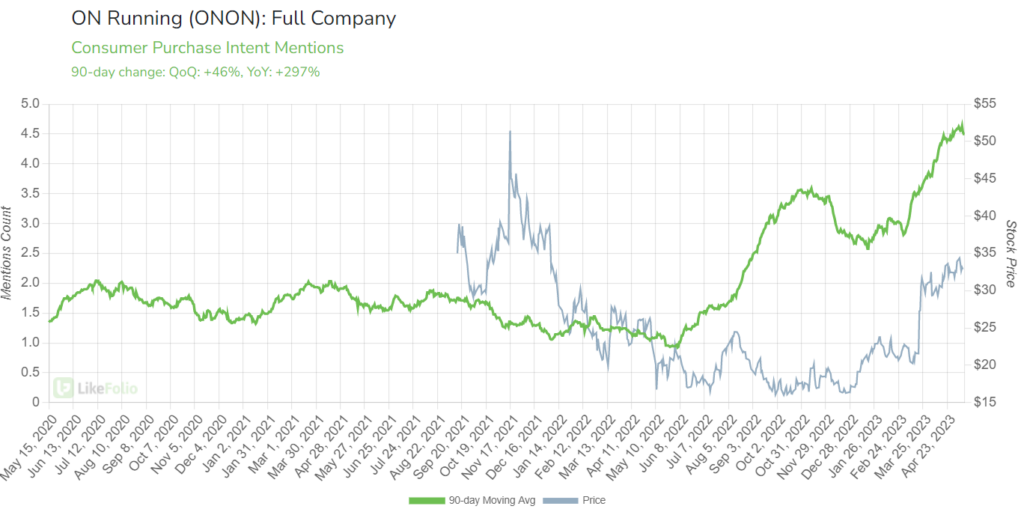

As of this morning, Purchase Intent mentions are accelerating at an impressive year-over-year clip — up 297% — which is a hugely positive indicator for ONON’s forward-looking guidance.

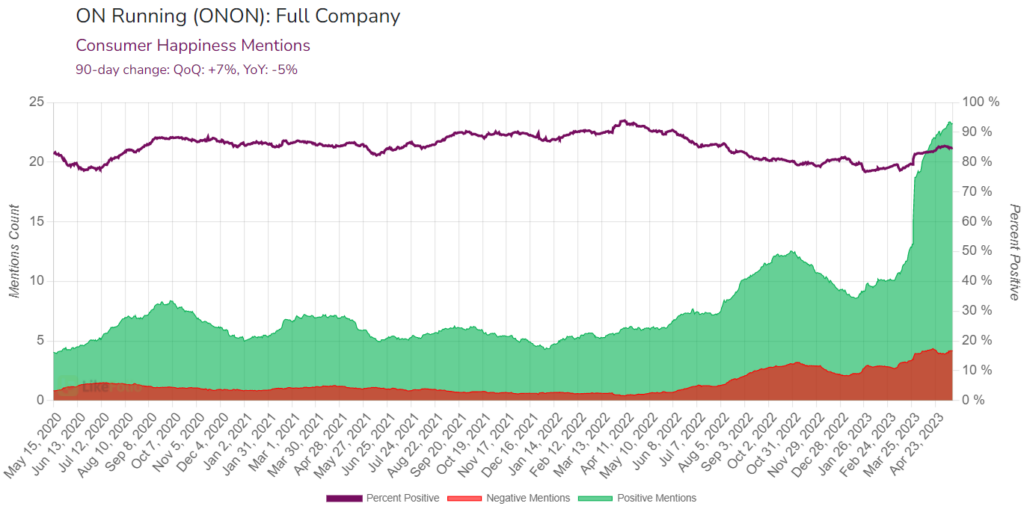

At the same time, we’re seeing an uptick in positive sentiment around On’s shoes on Twitter; Consumer Happiness mentions are currently pacing 7% higher quarter-over-quarter.

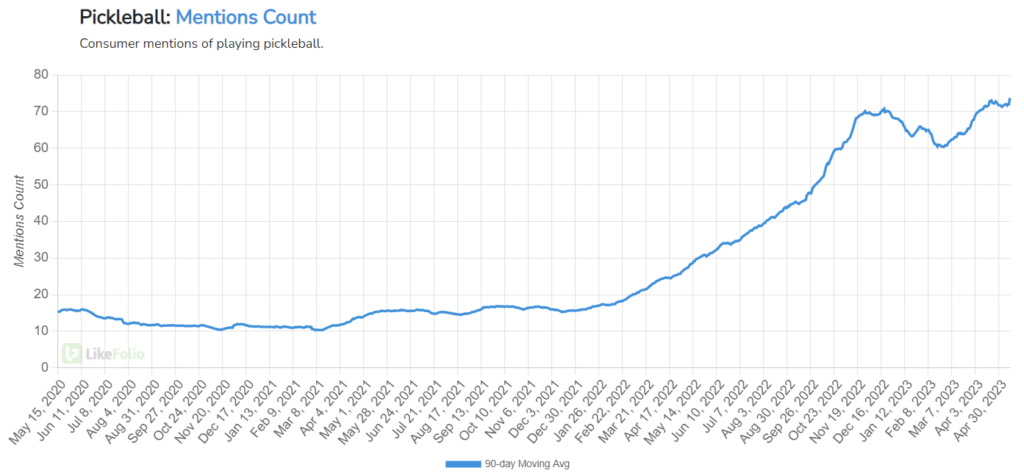

Not only is the premium shoemaker being bolstered by its luxury positioning and affluent audience… It’s also benefiting from one of the hottest consumer trends in the LikeFolio universe: pickleball.

The retro game is taking the world by storm, with social media buzz around the sport up 158% year-over-year.

And with many considering pickleball the “gateway” sport into (or easier version of) tennis, consumers are increasingly making a connection between On’s tennis-based shoes and pickleball activities.

We logged a big win with ONON last earnings season and are expecting positive revenue and a solid outlook from the company.

The question is: Will it be enough for the bulls that have sent this stock surging by over 90% year to date?

Home Depot (HD): Reports Tuesday, May 16

Outlook: Slightly Bearish

Last quarter, Home Depot (HD) missed expectations on its Q4 earnings report for the first time since 2019 – and shares quickly tumbled by 7%.

The company attributed the miss to declining lumber costs and weaved a tale of long-term confidence.

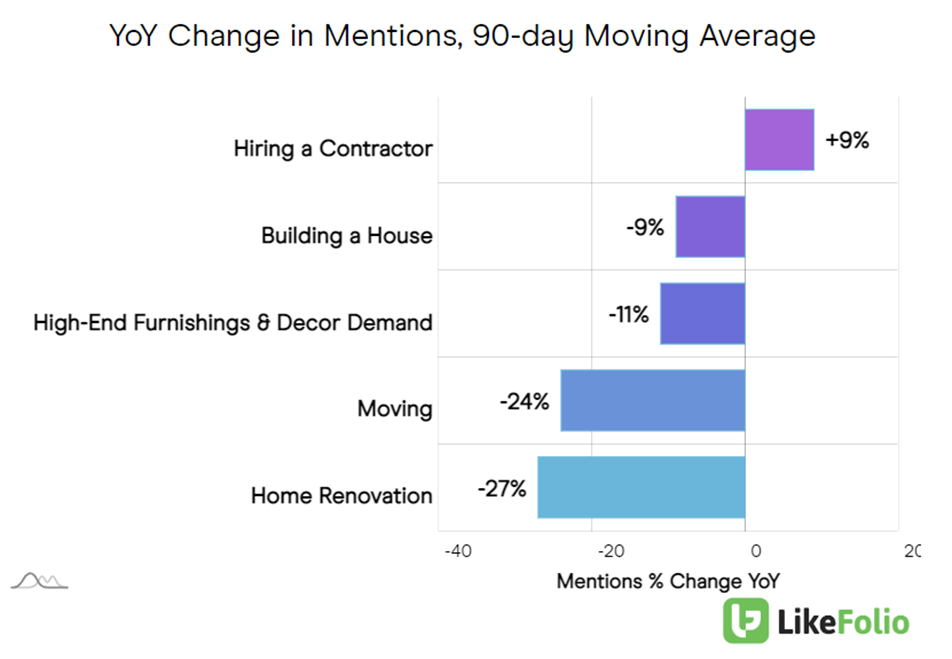

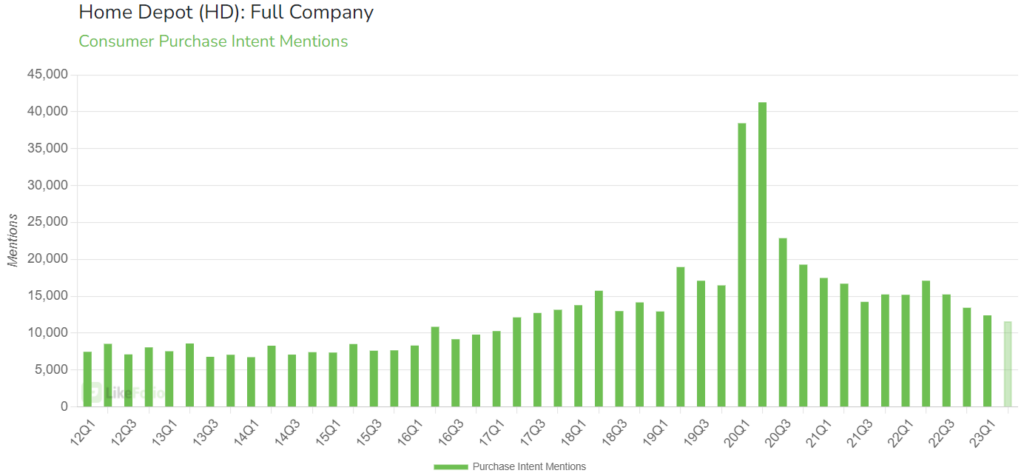

But the home renovation market has cooled significantly from pandemic-era highs

Mentions of building a new house (-9%), moving (-24%), completing DIY home renovation projects (-27%), and purchasing high-end furnishings/décor (-11%) are all down on a year-over-year basis.

And Home Depot Purchase Intent mentions have fallen to post-COVID lows over the same period.

To be clear, we like this company as a long-term investment. But short-term, HD could be in for a disappointing first-quarter report.

Target (TGT): Reports Wednesday, May 17

Outlook: Slightly Bearish

Department store mainstays Target (TGT) and Walmart (WMT) will report their first-quarter earnings this week.

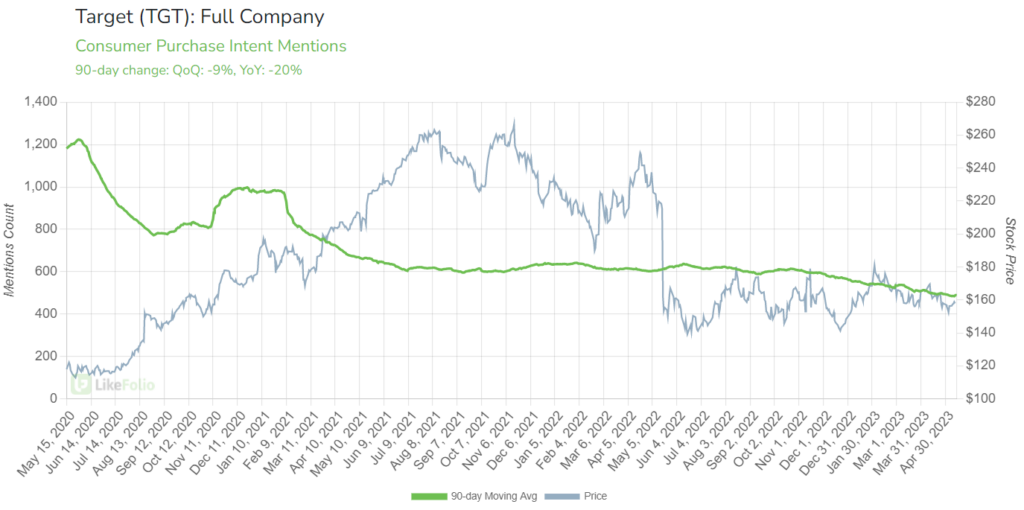

Target is up first on Wednesday, May 17, before the bell, and LikeFolio social media analysis shows weakening demand in 2023.

Purchase Intent mentions for TGT are down as much as 20% year-over-year, as of this writing:

We’re expecting a soft outlook.

But I also want to remind you of the larger narrative: We learned last quarter that the bar is much lower for retailers in 2023. And that means investors will be looking for any small win in these reports, even with conservative guidance.

Proceed with caution.

Walmart will report Thursday, May 18, before the market opens. And unlike Target, we’re completely neutral heading into its earnings report.

That said… If Target’s report the day prior sends WMT shares lower, there could be a strong play to get bullish into Walmart prior to its earnings call.

Keep your eyes on the retail market this week.

Until next time,

Andy Swan

Co-Founder