Robinhood Markets (HOOD) reports earnings tomorrow, February 12, after the market close.

While the rest of the market is left guessing, our data can tell you TODAY whether the stock could be in for a bullish – or bearish – surprise.

The fee-free trading platform has come a long way since the 2021 meme stock frenzy. Robinhood has been on an absolute tear over the last year, buoyed by a blitz of analyst upgrades and high-profile coverage – even landing a spot on Morgan Stanley’s “Financials’ Finest” list.

Shares are up +125% just since November 1…

And our paid-up members have reaped the benefits – banking 180% since we recommended HOOD last April.

Now, usually, we’re all for being the contrarians. It’s tough to maintain this kind of momentum. Expectations only get higher.

But we simply can’t ignore the compelling bullish data we’re seeing around Robinhood.

Here’s why we believe HOOD is gearing up for a blockbuster earnings report tomorrow that could send shares even higher…

Not Just for the Meme Stock Traders

Robinhood’s fee-free, user-friendly mobile app naturally caters to first-time – and often young – traders, making it a platform of choice for the social media savvy.

Today, however, the company is embracing growth opportunities beyond its core audience of younger investors.

Robinhood’s 3% cashback credit card with no annual or foreign transaction fees has been a huge hit. Initially for Gold customers only, the 10-karat gold Visa card has some of the best rewards in the industry.

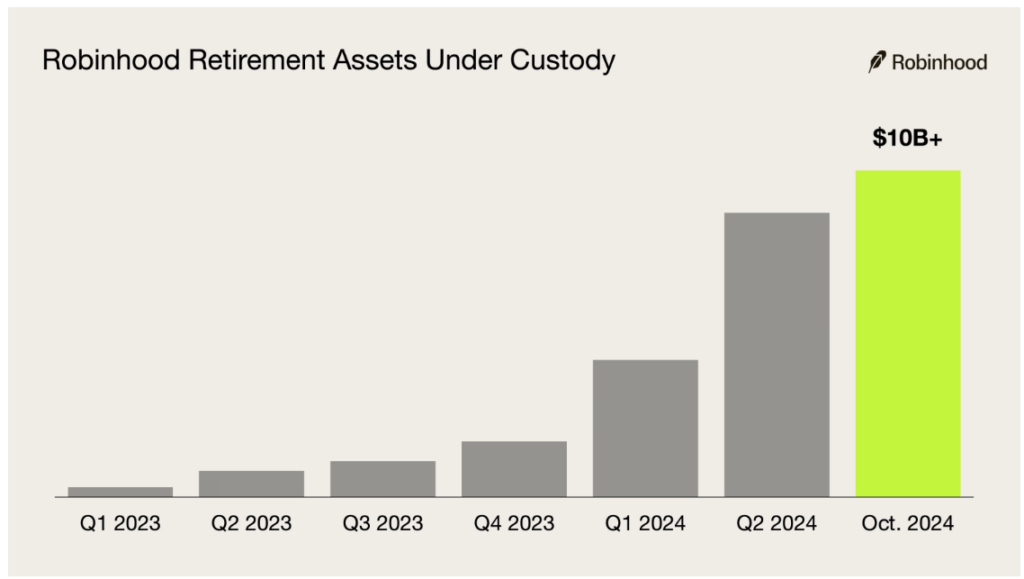

The company rolled out its own IRA offering in January 2023 with Robinhood Retirement. Since then, it has secured nearly 1 million funded retirement accounts, growing assets under custody to $10 billion as of October.

Robinhood is also tapping into opportunities in wealth and international brokerage with its $300 million acquisition of TradePMR in November, which will enhance tools for Registered Investment Advisors (RIAs) in 2025. In addition, upcoming AI-powered financial advice services aim to make personalized planning accessible to more users.

November added $5.6 billion in net deposits and 420,000 new funded accounts, bringing the total to 24.8 million, proving Robinhood’s ability to attract active traders.

Looking forward, Robinhood is building on its strengths and targeting new markets for growth in 2025, with plans to enter Asia and the recent launch of options trading for its U.K. customers.

Catering to the Crypto Bulls

Robinhood is also reaping the benefits of a cryptocurrency resurgence.

The company launched headfirst into crypto trading in 2018 and has expanded its exposure significantly in the years since. The platform supports buying and selling for Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and over a dozen other cryptocurrencies. It also supports trading on 11 spot Bitcoin ETFs (exchange-traded funds), making them available as soon as they were approved last January.

After a challenging year for banks and other traditional financial institutions, consumers are increasingly embracing Decentralized Finance (DeFi) apps like Robinhood’s that enable peer-to-peer financial transactions and eschew institutional intermediaries.

Last quarter, the company saw crypto trading volumes soar 112% year over year to $14.4 billion, while revenue from crypto transactions rose 165% to $61 million. New coins in Europe and staking services for Ethereum and Solana (SOL) continue to attract new crypto traders to its platform.

Consumer demand for DeFi apps is rising with no signs of slowing down. And demand for Robinhood’s services is surging along with it.

The Data Doesn’t Lie

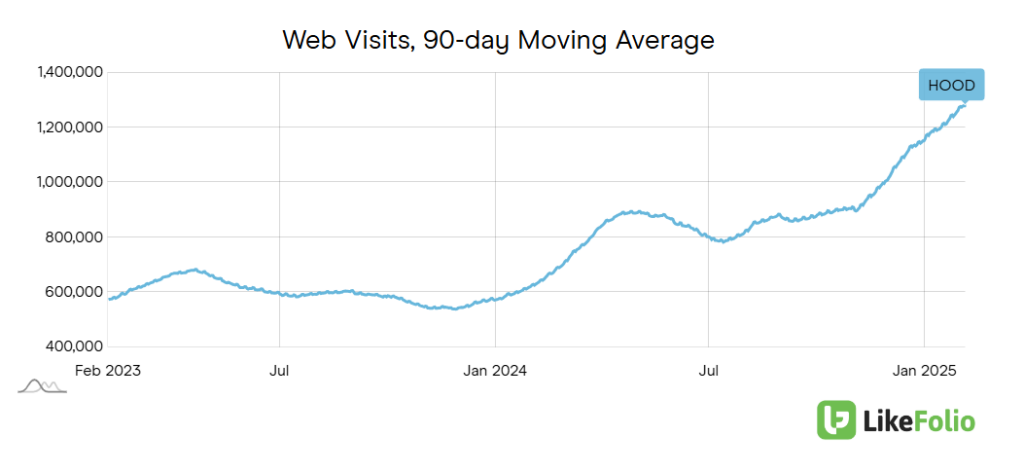

Check out the incredible growth we’re seeing in LikeFolio’s predictive demand metrics, and you’ll understand why we’re so confident in our bullish call.

🚀 HOOD digital traffic has more than doubled from last year’s levels, up 103% year over year:

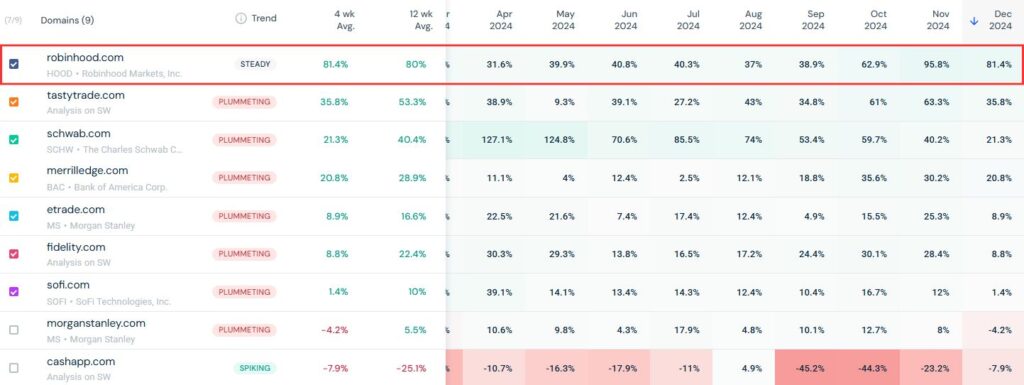

This kind of forward-looking consumer interest is particularly impressive when you stack Robinhood against other financial services peers like SoFi Technologies (SOFI), E-Trade, and Fidelity.

As you can see from the raw data below, HOOD is leading those competitors by a wide margin:

The Bottom Line

With DeFi interest soaring, disruptive products getting launched, and indisputably bullish LikeFolio data, we think HOOD could easily burst higher on tomorrow’s fourth-quarter earnings announcement.

Earnings Season Pass members are going in armed with our exact trade instructions – a bullish Coin Flip that will have them cashing out 100%-plus profits on Friday if the stock heads higher on earnings, like we expect it to.

We invite all our Derby City Daily readers to join in on the action by becoming a subscriber today.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

New to Our Watchlist: Oddity Is Not Your Average AI Stock

This stock might be new to the market, but it’s already catching fire with consumers, according to LikeFolio data…

SPOT Delivers a Big Earnings Win – and It Won’t Be the Last

Congrats! Our Spotify prediction was SPOT on. And the results point to a larger investing trend that we can play to our advantage…