The online sports betting industry is heating up in a major way as college football and the NFL hit full stride.

According to the American Gaming Association (AGA), legal wagers on this year’s NFL games are on track to hit a record $35 billion – surging more than 30% from last year’s levels.

As this booming sector reaches a critical inflection point, the battle between DraftKings (DKNG) and FanDuel (FLUT) is front and center.

Both companies are fighting for market share, but new data reveals that DraftKings is pulling ahead – and fast.

The online gaming space is growing at an unprecedented pace, and every new football season brings a tidal wave of user activity. This time around, DraftKings is making all the right moves to dominate…

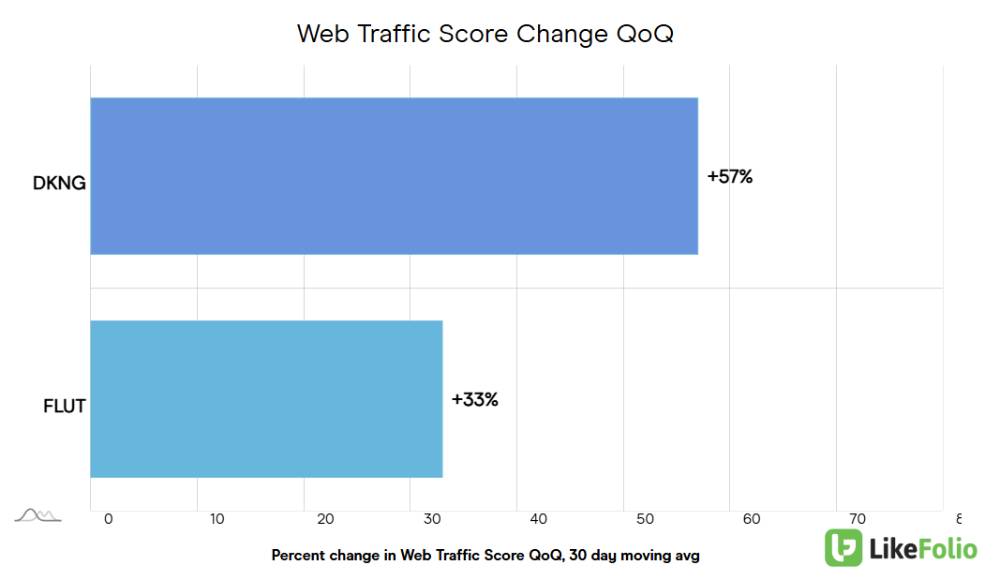

DraftKings Takes a Commanding Lead in Web Traffic

Look no further than LikeFolio’s web traffic data. DraftKings just posted an eye-popping 57% growth in web traffic quarter-over-quarter, compared to FanDuel’s 33% increase. This dramatic surge gives DraftKings a clear upper hand at a pivotal moment in the sports calendar.

It comes as DraftKings ramps up its marketing spend and strategically partners with major sports leagues, adding the WNBA to its list of official partners in July.

The influx of new and returning users as the football season kicks off is something the company is capitalizing on better than FanDuel, potentially setting the stage for a big revenue quarter.

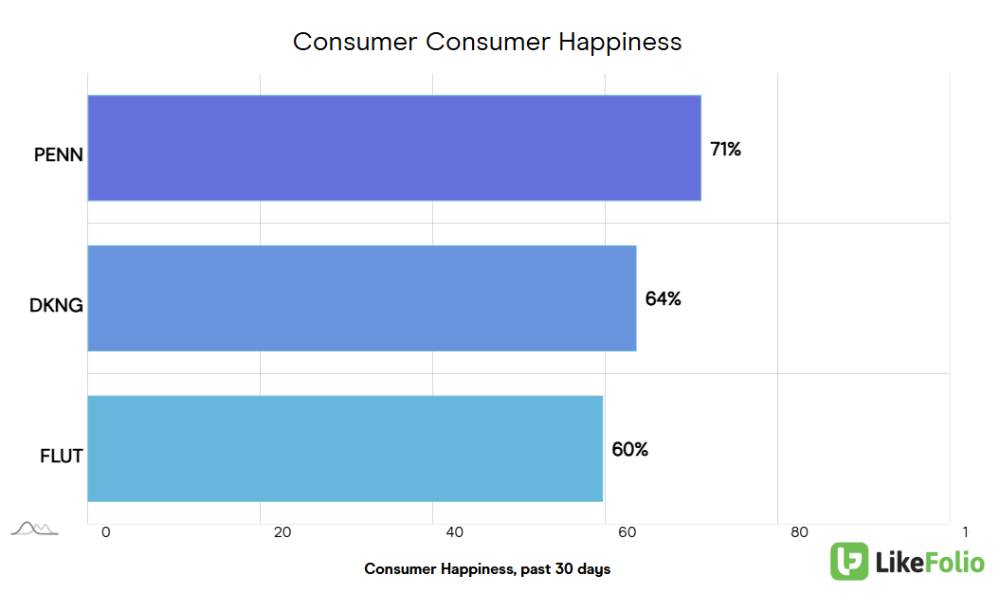

Fan Sentiment: Penn National Gaming Could Be a Dark Horse

While web traffic shows DraftKings’ ability to attract users, another key factor is Consumer Happiness, which could impact long-term retention.

Interestingly, Penn Entertainment (PENN) is leading the pack in customer satisfaction, with a 71% happiness score, compared to 64% for DraftKings and 60% for FanDuel.

Penn’s positive consumer sentiment could signal that it’s quietly positioning itself as a serious player in this fiercely competitive space.

With satisfaction levels this high, Penn is emerging as a potential disruptor, particularly if it can convert this goodwill into market share. DraftKings is winning the traffic war, but Penn’s strong user feedback should not be ignored.

The Stakes Are Sky-High

The stakes have never been higher in online sports betting. Football season is always a make-or-break moment for these platforms, but this year feels especially critical.

DraftKings is surging ahead, capturing more user attention and likely setting the stage for a blowout quarter. FanDuel is growing, but it’s clear the company has some catching up to do in the face of DraftKings’ superior performance.

MegaTrends members know just how profitable sports betting stocks can be. In December, LikeFolio’s unique intel scored them a 217% win on DKNG and 60% gains on FLUT. (Click here for more on how our system spots the winners – and how you can get in on the profits.)

As we move deeper into the NFL season, these trends will solidify. Traffic and sentiment are the leading indicators to watch.

Bottom line: DraftKings is sitting in the driver’s seat, but Penn’s Consumer Happiness could make it the sleeper contender no one saw coming.

This is the most crucial time of the year for the online gaming sector, and the race is far from over. We’ll be keeping close track of web traffic trends and customer feedback. These numbers will define who wins the season and who falls behind.

Until next time,

Andy Swan

Founder, LikeFolio