Thundering air shows, hot air balloon festivals, fireworks over downtown…

Around the LikeFolio headquarters in Louisville, Kentucky, you can’t even step into your neighborhood Kroger without tripping over mint julep glasses, fresh flowers, and ornate hats.

It all means the most exciting two minutes in sports and my personal favorite event of the year – the Kentucky Derby – is just under two weeks away.

The Derby is everything the Swan brothers love wrapped up in one action-packed weekend: The racing. The attire. The bourbon. The betting.

Especially the betting.

In 2022, the Kentucky Derby brought in a record-breaking $179 million in wagers – a staggering 17% increase over the previous year and a 9% increase from the previous wagering record set in 2019 (the last “normal” pre-COVID Derby).

Of course, only $501,135 of that $179 million was placed on the chestnut colt who won, the 80-1 underdog Rich Strike who shocked everyone in the biggest Derby upset since 1913.

But this year, the odds have changed – and there’s even more money at stake.

Sports betting is now legal in 33 states (plus Washington DC). And after two years of COVID-related obstacles, the iconic Kentucky Derby race is finally back to normal with a full crowd – and an even bigger betting pool.

That means investors can expect the next few weeks leading up to May 5 and 6, 2023, at Churchill Downs, to be an enormous catalyst for the industry at large.

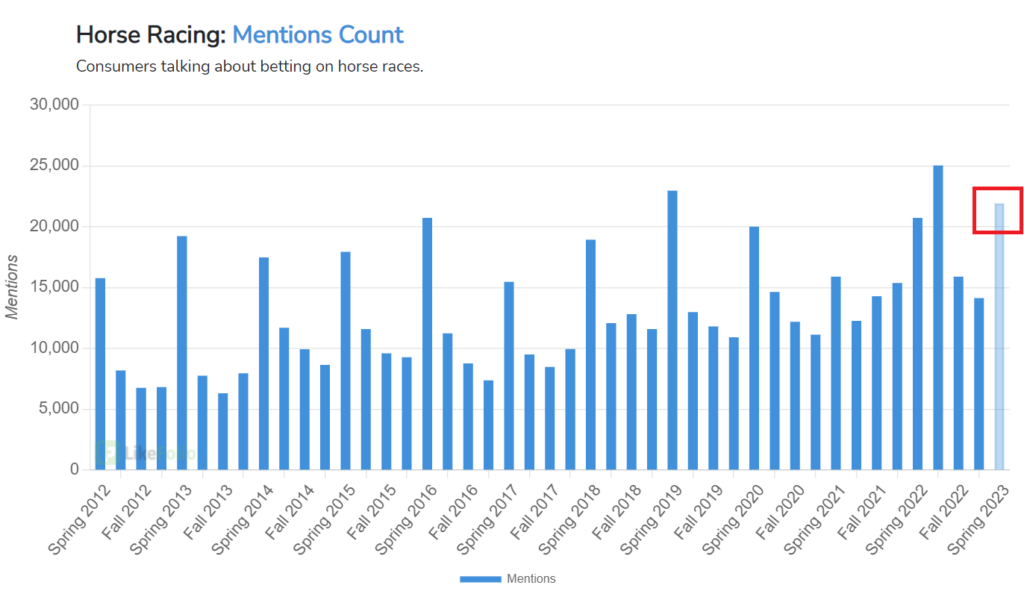

Social media chatter around betting on horse racing or planning to bet on a horse race is already up 28% quarter-over-quarter for the Spring of 2023:

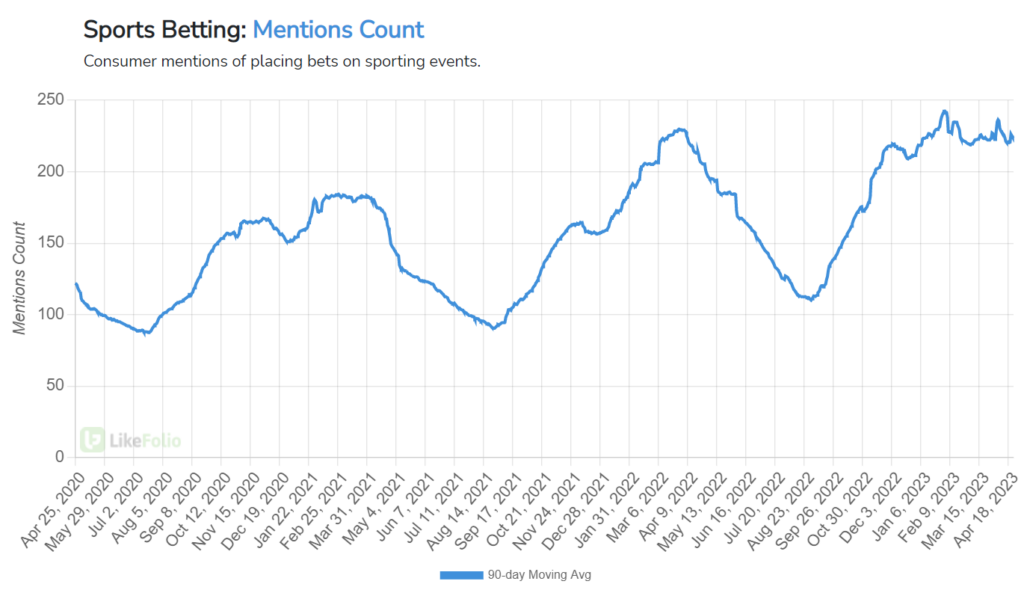

Online sports betting is trending at the highest organic level LikeFolio has ever recorded, up 17% year-over-year:

If sports betting macro trends prove predictive, 2023 could be the largest wagering event in Derby history.

And with more money up for grabs than ever before, we’ll show you the two investable opportunities you need to have on your radar…

Stock No. 1: DraftKings (DKNG)

DraftKings (DKNG) is well known for its fantasy football app but with sports betting legalization tearing through the U.S., it’s wasting no time expanding into other markets.

To pregame for a historic Kentucky Derby, the online sports betting company launched its first-ever horse racing product, DK Horse, in collaboration with “OG” Derby track-turned-sports-betting company, Churchill Downs (CHDN).

The standalone app is already available in twelve states, and DraftKings will continue to expand that reach in the lead-up to the Kentucky Derby on Saturday, May 6, 2023.

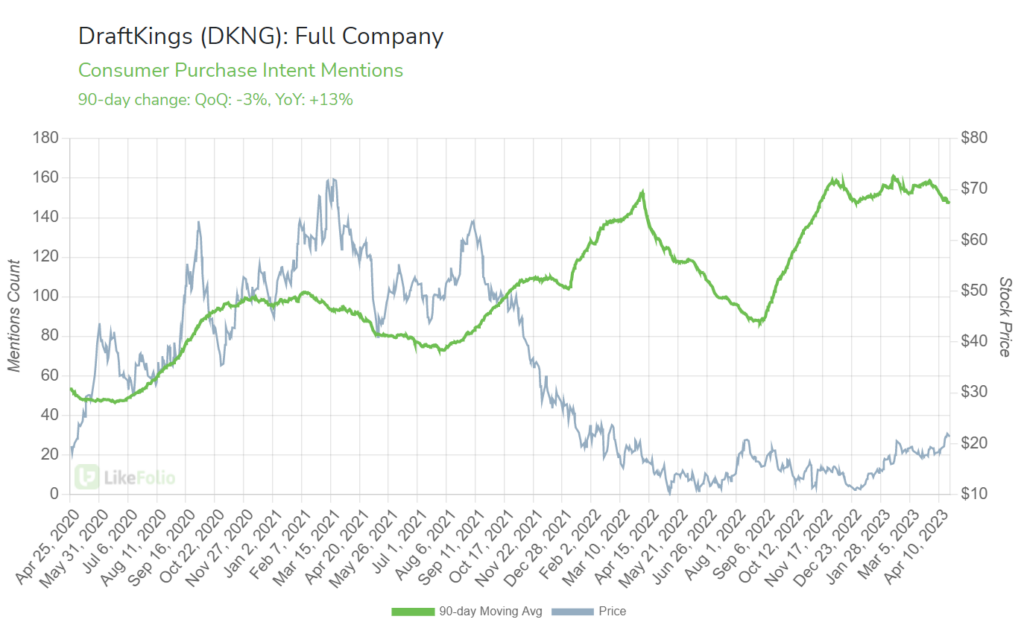

LikeFolio data shows DraftKings demand is on the rise, with Purchase Intent (PI) Mentions currently pacing 13% higher year-over-year (though growth has slowed down from prior explosive levels):

The standalone, DK Horse-branded app gives customers the ability to handicap races, wager, and stream videos of races all within their DK Horse account.

The partnership between DraftKings and Churchill Downs subsidiary, TwinSpires, aims to deliver an innovative, mobile customer experience, said Jason Robins, CEO and Chairman of the Board of DraftKings.

DK Horse will initially require customers to register and deposit funds into new accounts separately from their DraftKings Sportsbook, Casino, and daily fantasy sports apps.

We’ll be monitoring for elevated levels of consumer engagement and potential crossover into the DraftKings platform directly.

Since the start of the year, the DKNG share price has nearly doubled – from $11 to $22 as of yesterday.

Stock No. 2: FanDuel (PDYPF)

DraftKings competitor FanDuel, owned by Flutter Entertainment (PDYPF), has also inked a multi-year agreement with Churchill Downs: This time, allowing FanDuel Sportsbook customers to place pari-mutuel horse racing bets through the app using Churchill’s specialized horse racing technology.

A pari-mutuel bet is a type of pooled betting, where bets are placed together and the payoff is split among the top winning bettors.

FanDuel is also sponsoring Churchill Downs’ Starting Gate Rooftop Garden, an exclusive seventh-floor venue overlooking the track on Derby Day.

The garden, which offers access to upscale bars and food offerings, is an ideal vantage point for bettors to watch the horse race.

The partnership will provide FanDuel with branding opportunities and access to upper-class clientele, as tickets to the rooftop venue are likely to be among the most expensive available.

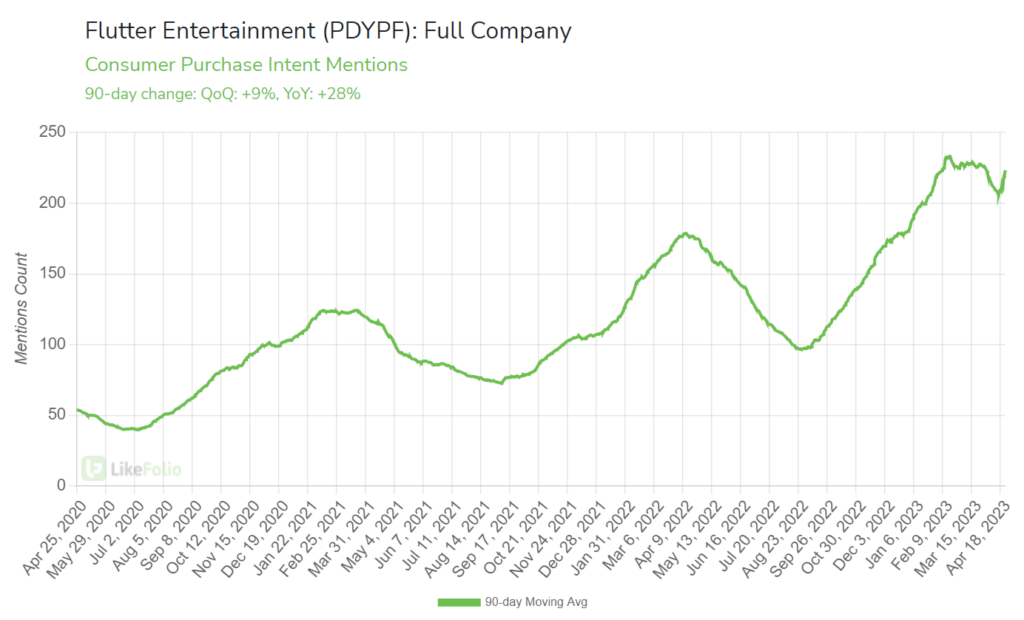

FanDuel is currently leading the sports-betting pack when it comes to demand growth, with PDYPF Purchase Intent Mentions climbing 28% year-over-year and 9% quarter-over-quarter:

Like DraftKings, PDYPF stock has performed well in 2023, logging sizable 45% gains year-to-date (YTD).

Here’s how we’re playing it from here.

DraftKings or FanDuel: Placing Your Wager

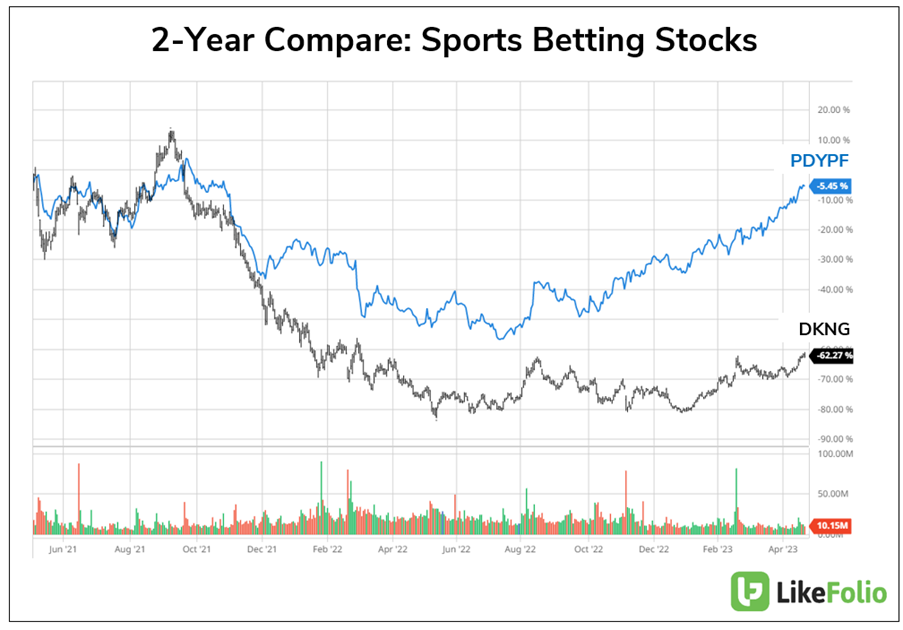

FanDuel and DraftKings are recording near-term bullish momentum in their stock prices, though both are trading below levels from two years ago:

And while LikeFolio data gives FanDuel a near-term edge, we believe DraftKings may prove the more tantalizing opportunity for long-term investors considering its higher Consumer Happiness score – if it can continue to garner momentum.

Until next time,

Andy Swan

Co-Founder