As the New Year opened, we sensed opportunity.

Big opportunity.

After a rough 2022, investors and traders were looking for the best hand to play.

Our proprietary data told us so.

Mentions from folks buying (and trading) stocks were off to the strongest start we’d seen in years.

That kind of ramp-up in trading activity is a sign of growing consumer confidence in stocks – and the general economy. It’s also a sign of opportunity.

But all opportunities aren’t equal in scope…

And that’s where our proprietary metrics come into play.

We dug deep into our LikeFolio database and dug out five stocks we saw as having a high upside.

These five stocks shared a number of attributes.

But one trait, in particular, grabbed our interest.

All five were “oversold” – a description of a stock that’s trading way below its true worth.

A stock can remain oversold for a long time. Or it can “bounce” – rebound in price and rocket higher.

Knowing which is which is the key. And our proprietary system can do just that.

In early January, we spotlighted five “oversold” stocks that our data indicated were in the “poised-for-a-bounce” category.

These are five companies that our proprietary consumer metrics and macro trends said were poised for long-term growth.

They were:

- Shopify (SHOP)

- Fiverr (FVRR)

- Nvidia (NVDA)

- Amazon (AMZN)

- Paypal (PYPL)

Fast-forward five months, and three of those five have posted hefty gains.

As of this writing, Shopify is up a staggering 70% this year – and up 55% since our early-January recommendation in MegaTrends.

It just hit a 52-week high on May 10.

And we saw it coming.

When we tagged Shopify as a “high-value oversold stock” back in January, we ran through our checklist to find:

- High levels of Consumer Happiness – well above that of more established peers.

- Explosive demand growth – steeper than that of more established peers.

- And macro trend tailwinds – with real staying power.

Shopify checked off all the boxes.

So today, we’ll use Shopify to show you how to put the odds in your favor…

And how we use our tools to identify “oversold” stocks that are poised for a Shopify-like bounce…

Identifying High-Value, Oversold Stocks

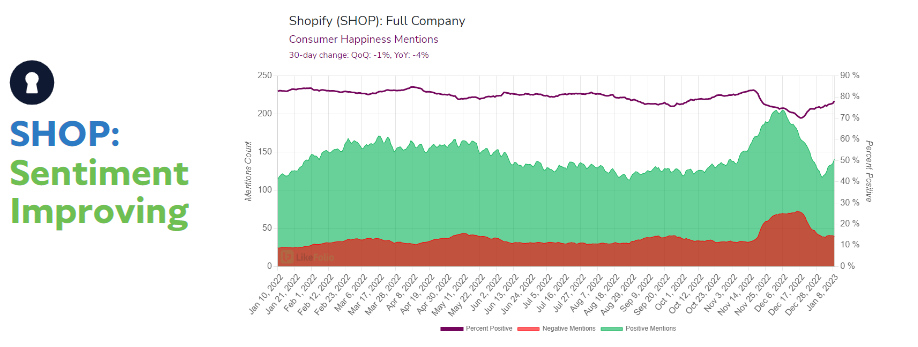

First and foremost, we saw Shopify’s Consumer Happiness levels were staging an impressive recovery – reaching 78% positive, which is extremely high for a digital service provider.

That “recovery” came after a spike in negative sentiment around Shopify late last year took on a political flavor – an offshoot of Shopify’s decision to maintain services to a “Libs of TikTok” account.

The relatively quick bounce back indicated the fallout had been resolved with little damage to long-term customer satisfaction.

Customers were clearly satisfied with the services Shopify was providing.

(And they still are: Shopify Consumer Happiness has gained four points since then, now sitting at a remarkable 82%.)

High Consumer Happiness – check. ✅

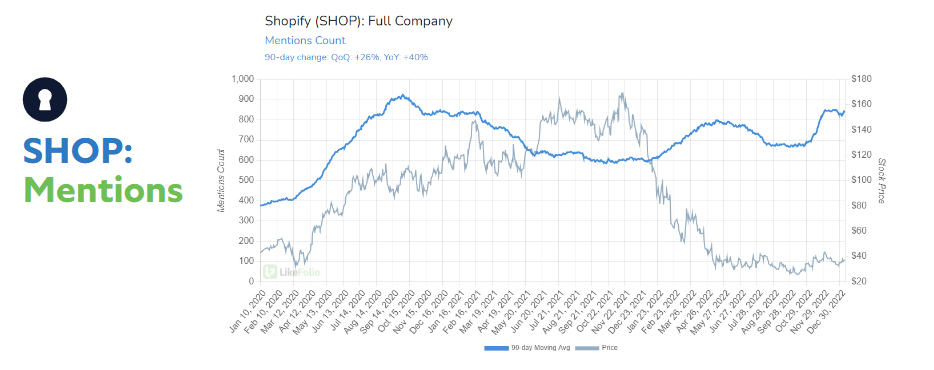

With a deeper dive, we saw that overall consumer mentions of using the checkout service, or merchant mentions of building an e-commerce website or transaction-fulfillment network, were rising quickly.

In fact, the buzz it was garnering at the time nearly equaled the peak-COVID levels from its last holiday boom, having increased by 26% quarter-over-quarter and 40% year-over-year.

So rising consumer demand – check. ✅

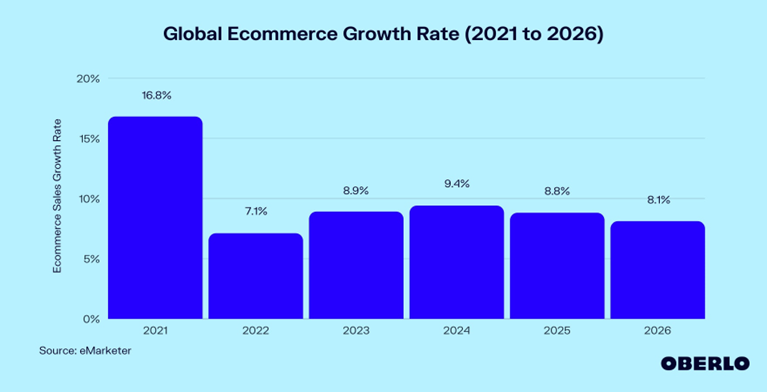

The last piece of the “trifecta” was our macro trend tailwind: e-commerce.

Global e-commerce is forecast to grow 8.9% this year with sales hitting $5.9 trillion. That’s up from 2022 and continues the sector rebound we’ve seen since the massive dip of 2021, says market researcher Oberlo.com.

As the chart above shows, that growth will continue in the years to come.

Also key: E-commerce’s share of overall retail sales will keep increasing – from 20.2% this year to 23.3% by 2026, Oberlo says.

That’s the overview story. But Shopify’s is even better.

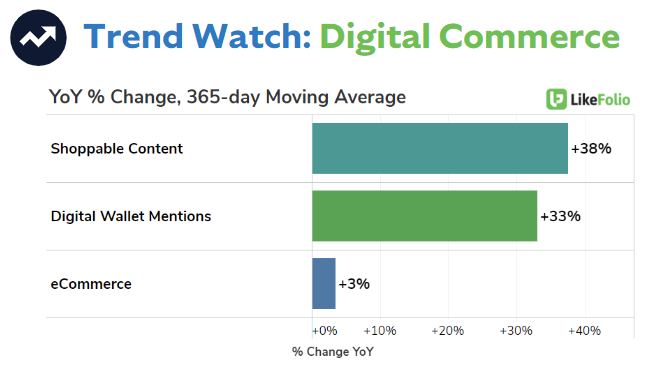

Because Shopify facilitates online marketplaces for small and medium-sized businesses, it benefits from increased digital wallet use.

It also provides multiple digital-service touchpoints that include transactions and shops within social media sites like Instagram, Facebook, TikTok, and Pinterest. So when we see more consumers purchasing products directly from social media platforms (what we call “shoppable content”), that also serves as a tailwind.

Using a longer-term 365-day moving average, we saw these digital commerce trends were all gaining year-over-year.

As of our January analysis, shoppable content mentions were up 38%, digital wallet mentions were up 33%, and overall e-commerce chatter was up 3%.

(Since January, shoppable content mentions have accelerated, now trending 50% higher year-over-year on the same 365-day moving average.)

Macro trend tailwinds – check. ✅

With demand and happiness high – and e-commerce as relevant as ever – Shopify’s business appeared poised for unexpected levels of growth.

But what about Shopify’s stock price?

There, too, our proprietary metrics painted a picture of a very strong storyline.

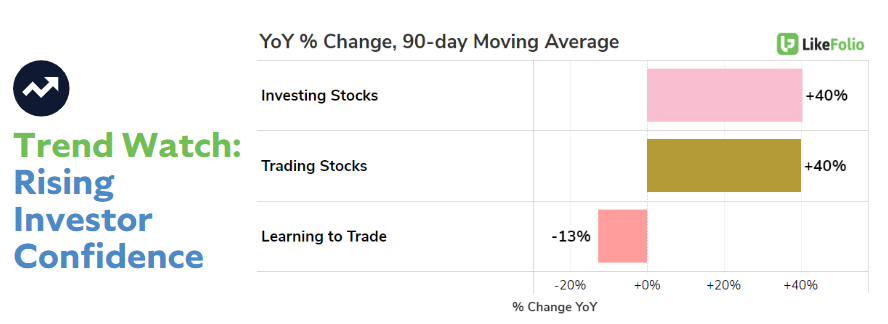

Timing is everything when identifying an “oversold” stock. And to start the New Year, mentions of investing (+40%) and trading (+40%) were rising significantly – an early sign of a shift toward a much more bullish long-term view.

At the same time, “learning to trade” mentions remained stifled, which was a fantastic insight. That told us that fewer “traders” were wading in – meaning the buyers of stocks were doing so with an eye toward holding long-term… And that stock gains were more likely to “stick.”

Rising investor confidence – check. ✅

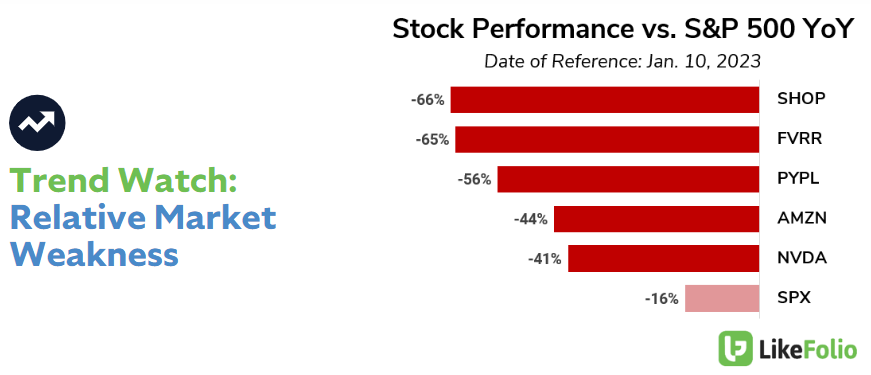

Then, there’s the S&P 500, a bellwether for investor sentiment. The S&P was down around 16% year-over-year at the time of our January 10 analysis.

But the five stocks we spotlighted were down 40% or more at that time. And Shopify was down the most at 66%.

These were stocks that had massively underperformed the broad market – pointing to a massive divergence…

A true “oversold” situation.

Relative market weakness – check. ✅

Like many other tech companies, SHOP shares lost tons of value between November 2021 and the end of 2022. From over $150 to just $30.

But just because shares of a company are way down doesn’t mean it’s “oversold.” And just because it’s “oversold” doesn’t mean it’s ripe for a rebound anytime soon.

Thanks to our consumer insights, we knew Shopify was both a rebound candidate – and a potential long-term winner.

We recommended SHOP to our MegaTrends subscribers back on January 18 at $39 per share. The 55% gain since then – and a recent 52-week high – shows that we were right.

We’ll be on the lookout for more “oversold” stocks like Shopify with big profit potential.

Until next time,

Andy Swan

Co-Founder