Starbucks (SBUX) is having one heck of a month – and we believe this could just be the beginning of the coffee giant’s troubles.

SBUX started November on a high note, rallying on a better-than-expected earnings report that featured:

- Record consolidated net revenues of $9.37 billion, up 11% year-over-year

- Earnings per share (EPS) of $1.06, handily beating the 97 cents Wall Street was expecting

- Comparable same-store sales growth of 8% (globally as well as in North America)

But the excitement was short-lived, and SBUX quickly reversed into a record 12-day slump that took the stock down about 12% from those November highs…

Despite the strong earnings performance – driven by higher-priced drinks – Starbucks’ forecast for fiscal 2024 was cautiously optimistic. The company projected modest same-store sales growth of 5% to 7%, a slight dip from its long-term forecast that indicated a tempering of expectations.

A third-party report then came out with slowing November sales data for Starbucks, suggesting its holiday sales season may be even more tepid than first thought.

Talk about a rollercoaster.

Starbucks hadn’t seen a decline like this in its 30-plus years of trading.

But while the immediate stock performance grabs headlines…

We believe Starbucks’ losing streak – as bad as it is – could be overshadowing even deeper, more systemic issues within the company.

From degrading consumer metrics to rising competition in China, our analysis suggests that Starbucks is facing more profound challenges that could shape its future.

Take a look at what SBUX is up against…

🔥 Trending Now: AI’s Biggest Prediction for 2024

For years, our consumer insights machine has helped investors like you find winners like Celsius (CELH), Roku (ROKU), and Crocs (CROX), long before they hit the mainstream. That same system got a major AI upgrade this year – and now, Landon and I are revealing its biggest predictions for 2024. You won’t want to miss this.

Degrading Consumer Metrics

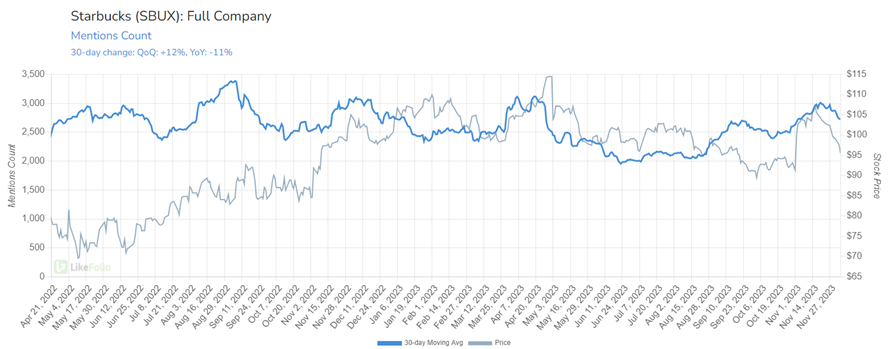

Data from LikeFolio paints a concerning picture for Starbucks. There’s been a significant 11% year-over-year drop in drink mentions among English speakers, suggesting a sluggish kick-off to the holiday drink season.

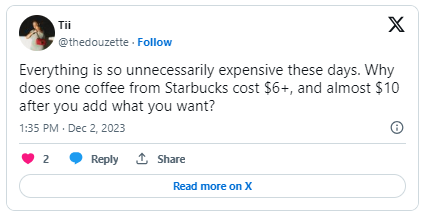

The company’s pricing strategy, which sees a grande (medium) holiday beverage priced around $6, could be contributing to this consumer hesitancy.

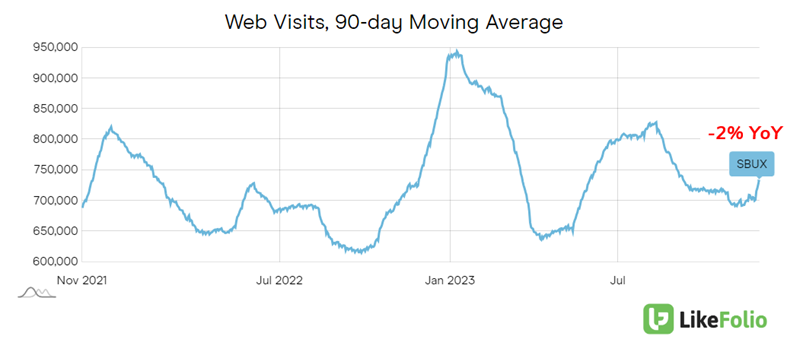

Meanwhile, web visits have declined by 2% year-over-year.

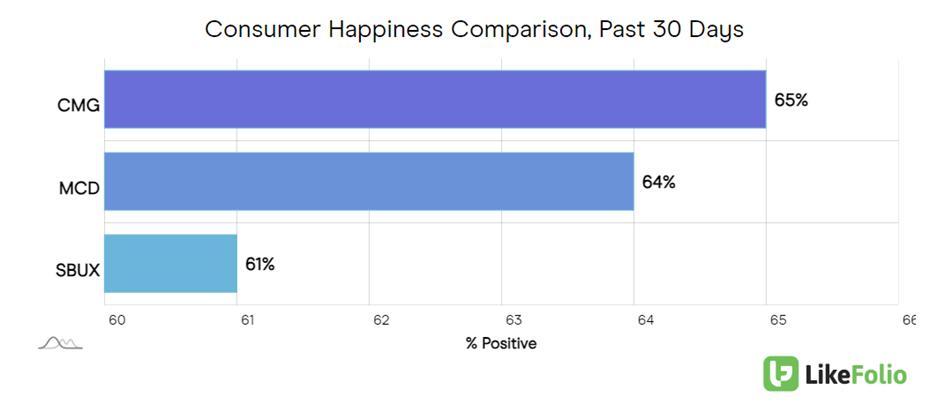

Although Consumer Happiness levels are stable, they lag behind those of companies with more robust pricing power, like McDonald’s (MCD) and Chipotle (CMG).

This suggests a weakening grip on consumer engagement and loyalty that may not be recoverable.

As the “too expensive” complaints mount, the company faces more systemic threats beyond the consumer…

Labor Union Challenges and Corporate Governance Shifts

Beyond the consumer, escalating labor union challenges led by the Strategic Organizing Center (SOC) are causing turmoil for Starbucks.

The SOC’s bold move to nominate three directors to Starbucks’ board amidst ongoing disputes over worker pay and conditions is more than a mere corporate skirmish; it’s a significant shift in the company’s labor relations.

With around 360 of its U.S. cafes moving towards unionization, Starbucks is not only facing legal and financial risks, but also a potential overhaul in its corporate governance. This situation is further complicated by the still-fresh leadership of CEO Laxman Narasimhan, who took up the mantle in March, and recent changes to proxy-voting rules.

Rising Competition in China

Starbucks also faces rising competition in China, its second-largest market. The company is quickly losing ground to up-and-comer, Luckin Coffee, which has overtaken Starbucks in just a few short years.

Luckin now operates more than 10,000 stores in the region compared to Starbucks’ 6,480.

Luckin’s rapid growth can be attributed to its aggressive expansion strategy, affordable pricing, and a business model centered around mobile ordering. This approach has particularly resonated with the mass market and younger consumers in China, a country traditionally known for its tea culture.

The Bottom Line

The current downturn in Starbucks’ stock is not just a market reaction to a bad run; it’s a recalibration reflecting deeper issues within the company.

The combined impact of labor union challenges, increased competition in China, shifting consumer sentiment, and a cautious financial outlook suggest a need for a more measured approach to Starbucks’ valuation.

While the company has demonstrated resilience in the past, the current landscape, as indicated by recent forecasts and market data, does not strongly support an overly optimistic outlook for Starbucks in the near term.

We’re steering clear of SBUX… and suggest you do the same.

While Starbucks may be one to avoid, we never like to leave you hanging – so here’s a winner to leave you with.

Compared to Starbucks’ measly 61% Consumer Happiness, this tiny $3 player rocks an impressive 85%, all while demand for its service ticks higher and higher.

More on this Main Street favorite here.

Until next time,

Andy Swan

Founder, LikeFolio

Why Nvidia Can Go Higher Still

Here’s how NVDA’s growth drivers and future prospects are looking today, after an epic 1,250% ride…

Stock Showdown: Who Will Win the Last-Mile Delivery Race?

These companies could deliver big dividends in the last-mile delivery race…

2024 Prediction: Tiny Weight-Loss Player to Deliver “Mega” Profits

Find out how to invest in one of the new year’s most lucrative opportunities…