Yesterday, Landon Swan (my brother and LikeFolio co-founder) introduced you to the “Trifecta Box,” our secret sauce for unlocking “10-bagger” profit opportunities. We find this when the following Big Three catalysts line up in favor of a company:

✔️ Strong Consumer Demand

✔️ High Consumer Happiness

✔️ Macro Trend Tailwinds

It’s a powerful system – and it works. So to kick Derby City Daily off with a bang, we handicapped three of our favorite stocks for 2023:

- My pick was digital marketing behemoth The Trade Desk (TTD)…

- Landon bet on OG artificial intelligence play Nvidia (NVDA)…

- And our senior research oracle Megan Brantley put her money on breakaway sports apparel player On Running (ONON).

All three of these companies tick the boxes for our “Trifecta” strategy, with one caveat: With each venture, one of the three areas could see a bit of improvement. By that I mean:

- The Trade Desk is keeping consumers happy with positive sentiment on the rise 12% from last quarter, and mobile search mentions – TTD’s specialty – up 200%… But so far this year, demand is a bit flattish.

- Nvidia demand, on the other hand, rose 17% this year, ignited by the huge upswell in AI intrigue – but consumer happiness? Needs to accelerate.

- And On Running shoes are leading the field, with demand up 128% from last year as high-end apparel mentions surge 144% and post-pandemic America gets back to being active. But consumer sentiment is waning 13% from the year prior.

The company I’m bringing you today features zero caveats. It’s hitting the mark on all three pieces of our “Trifecta” strategy with:

✔️ Surging demand for its beverages…

✔️ An army of hyper-enthusiastic consumers who are “casting votes” for its offerings…

✔️ And a wave of post-pandemic demand for “better-for-you” food and drink options propelling this company into a long-term winner.

If this was a hot summer day at the Ellis Park thoroughbred track, Celsius (CELH) would be the odds-on favorite in the field.

Its beverages are healthier than its rival’s energy drinks, which tend to be sugary calorie adders. And thanks to our predictive social media data, we anticipated this company’s breakout from the pack – long before Wall Street caught on. We even alerted our followers to the opportunity back on Jan. 24, 2022, when the stock was trading at just $43.92.

The stock price has DOUBLED since then.

But with a new distribution deal with PepsiCo putting its drinks in store coolers across the country as we speak, our system is telling us CELH has plenty of room left to run.

To show you why let’s take a quick run through our Trifecta Checklist…

Rising Consumer Demand ✅

When a consumer takes to Twitter to post about a product or a brand, our data-crunching tech captures their message in real-time, cross-references the 10,767 brands in our database, and checks for thousands of keywords to tell us whether or not that person spent their hard-earned cash.

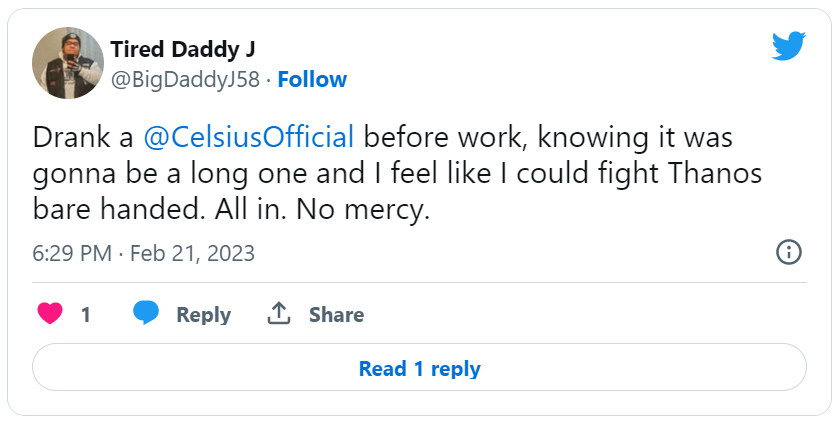

We’re talking about analyzing 2,777 posts per minute, just like the one below – each of which are sliced, diced, and analyzed to generate a proprietary metric we call “Purchase Intent (PI).”

Here, the phrase “Drank a @CelsiusOfficial” tells us that Tired Daddy J actually bought this specific brand of energy drink, and our database files it as a Purchase Intent Mention for Celsius. (But we can’t comment on whether the Thanos fight actually occurred.)

And with millions of daily posts providing precisely this kind of data, we’re able to measure that demand in real time.

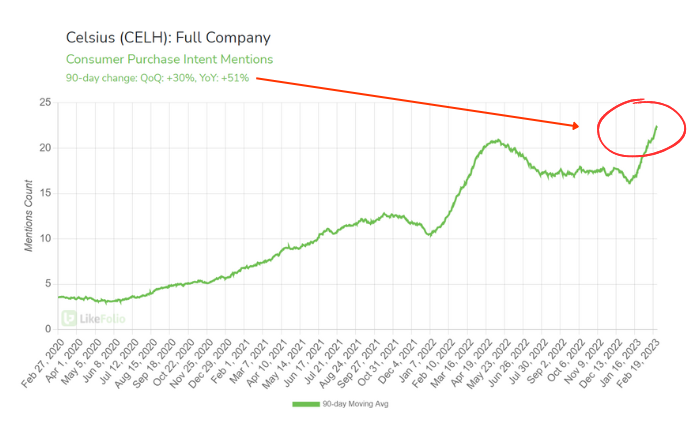

Right now, consumer PI mentions for Celsius-brand drinks are an impressive 51% higher than last year:

Demand is surging – which is awesome. But we then need to ask “once consumers purchase their beverage, are they happy with it?” LikeFolio data gives us insight into this as well – and here it shows us that folks are over-the-moon with Celsius’s “better-for-you” energy drink offerings…

Happy Consumers ✅

At the same time our social media database is figuring out consumer demand, it’s also measuring sentiment – and whether the Twitter poster is positive or negative about the brand.

Keywords like “approve,” “love,” and “need” are fantastic positive indicators that show us consumers are raving about Celsius:

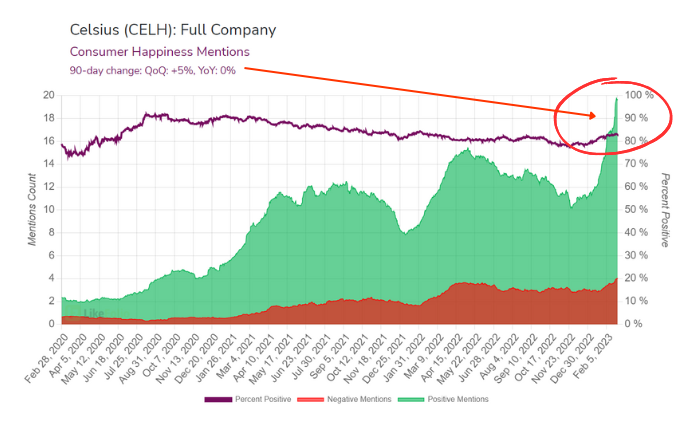

We call this metric “Consumer Happiness” – and for Celsius, Consumer Happiness Mentions are 83% positive on a 90-day moving average, meaning they are 5% above last quarter’s levels:

Macro Trend Tailwinds ✅

To truly “get” the scope of the opportunity here, we need to see and fully understand the big picture. Is Celsius merely a faddish craze that could run its course? Or is there a larger macroeconomic narrative that will maintain Celsius’ relevance – and keep its stock price running?

See, our database doesn’t just scan social media for companies and brands – it’s also crunching the numbers on big-picture trends.

And whether we’re talking work, school, travel, social gatherings, or errands, the fact is that folks are “on the go” much more than they were when the pandemic began.

Consumers are embracing their former, pre-pandemic routines in a big way. And they’re seeking out a bit of help with an energy-drink booster.

But not all energy drinks are created equal.

When consumers pull open that convenience-store cooler door, instead of grabbing another sugar-infused Red Bull, consumers are reaching out for “better-for-you” options that mesh with their health and wellness goals.

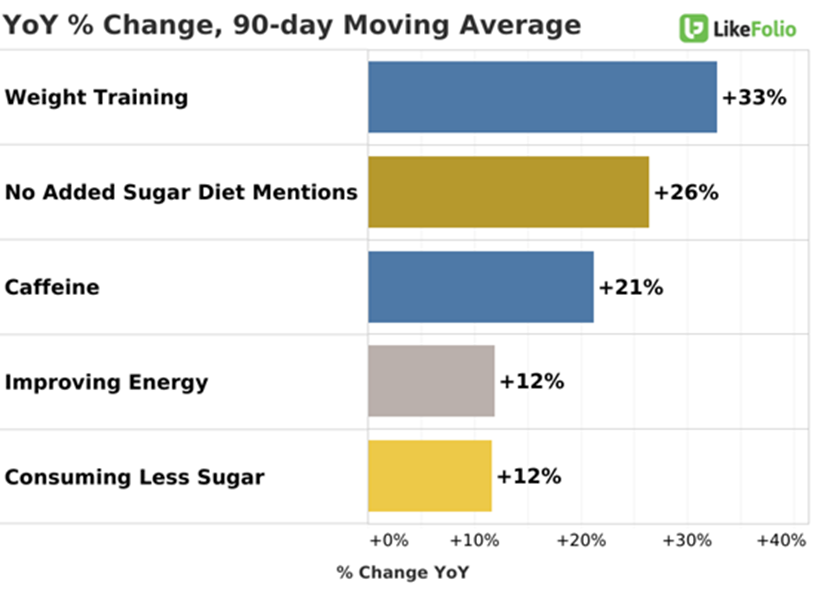

No added sugar, caffeine, and “improving-energy” mentions are all trending higher right now – and giving Celsius an added boost:

The Bottom Line 💰

When it comes to consumer demand and happiness, Celsius is flat-out killing it. And all those social-media boosts are fueling company growth. Celsius boasted third-quarter revenue of $188.2 million – nearly doubling what it did the year before.

It’s also Amazon’s second-best selling energy drink, putting it squarely ahead of Red Bull in market share.

In fact, Celsius is the No. 1 growth driver for the entire energy drink sector, claiming 29% of the category’s growth in the third quarter.

This is one high-energy “Trifecta” play you don’t want to miss out on.

Enjoy,

Andy Swan

Co-Founder