I’ll admit that the first time I saw a Carvana (CVNA) vending machine, it triggered my imagination like I was a young boy again.

What a novel concept: a skyscraper-sized version of a vending machine… full of shiny – and very real – cars.

It’s the stuff of nine-year-old Andy’s dreams.

And a few weeks ago, I felt a familiar excitement come rushing back around Carvana. Only this time, it was the trader in me feeling giddy about the potential for profits when Carvana shares rocketed over 35% on its latest earnings report.

Carvana is on a roll right now. Its stock price is up over 200% just in the last three months.

And it’s not the only one.

CarMax (KMX), Carvana’s more traditional used-car peer, has staged a rally of its own – gaining nearly 40% over the same period.

And its upcoming earnings announcement tomorrow could only add fuel to the fire.

A bullish case can be made for both of these used car dealers. But for our money, one stands above as the better opportunity.

Find out which emerges victorious in a new Derby City Stock Showdown just in time for CarMax’s earnings report tomorrow…

The Bullish Case for CVNA

Let’s be clear: This 200% run for Carvana hasn’t been without its twists and turns.

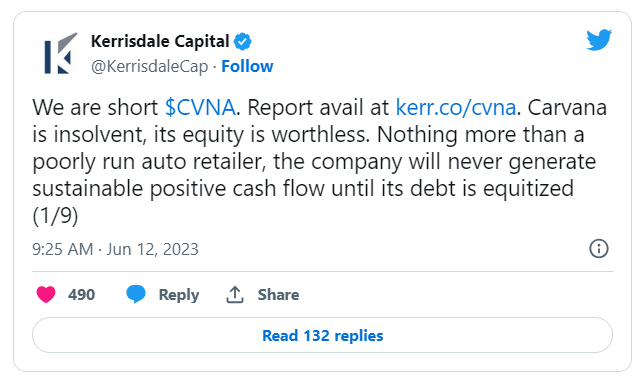

As recently as June 12, investment manager Kerrisdale Capital claimed that the used-car seller was insolvent and its equity was worthless in an attempted short-selling attack.

A similar tactic had worked just a few months prior when Kerrisdale accused C3.ai (AI) of “serious accounting and disclosure issues,” sending AI shares tumbling 12%.

This time… it had the opposite effect.

Carvana’s stock price actually increased – indicating that investors may see more upside potential in Carvana despite the short-seller’s claims.

That upside potential boils down to three things:

- Positive Second-Quarter Guidance

Carvana’s management provided strong guidance for the second quarter, which boosted investor confidence. More on that here.

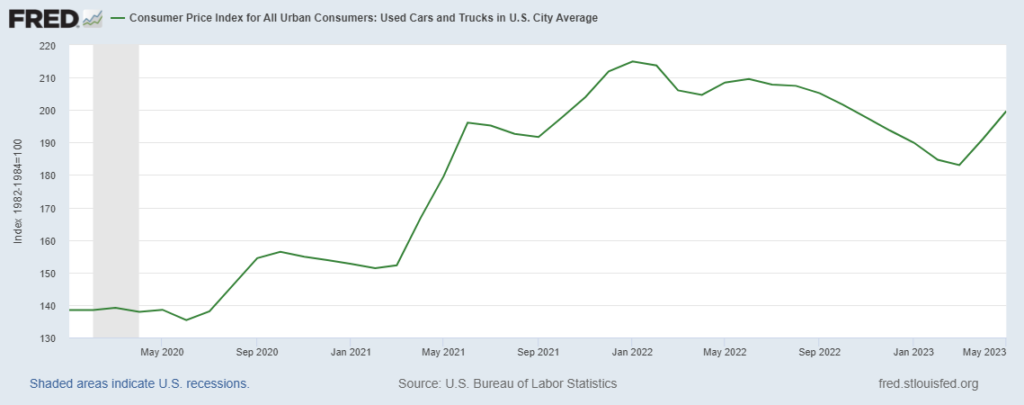

- Rebound in Used Car Prices

Used car prices have rebounded by nearly 10% over the last two months, according to the latest Consumer Price Index (CPI) report:

This trend helped Carvana make a profit on its inventory, contributing to the stock’s rise.

- Federal Reserve’s Interest Rate Decision

The Federal Reserve decided not to raise benchmark interest rates, which favored Carvana. Lower interest rates can make it less expensive for consumers to buy cars, potentially boosting Carvana’s future sales.

While there’s certainly a best-case bullish scenario for CVNA investors, the truth is, its “innovative” vending machine business model remains to be proven.

The company has yet to be profitable.

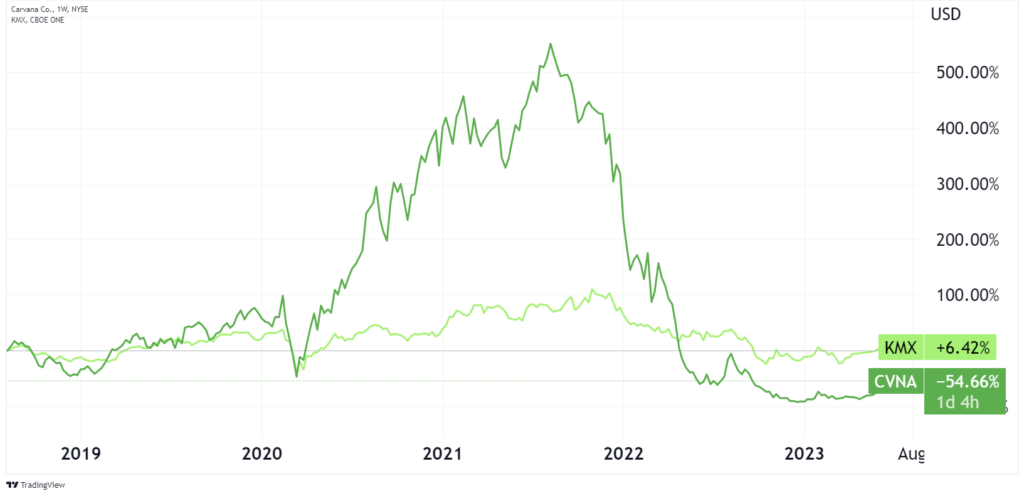

And if you zoom out to look at this stock’s performance over the last five years (the darker green line), you’ll see CVNA has taken investors for a nauseating rollercoaster ride…

…one that Carvana is just now starting to recover from.

The Bullish Case for KMX

KMX investors, on the other hand, have had a much smoother ride over the longer term (indicated by the light green line in the chart above).

And that rebound in used car prices I mentioned earlier should benefit CarMax as much as Carvana.

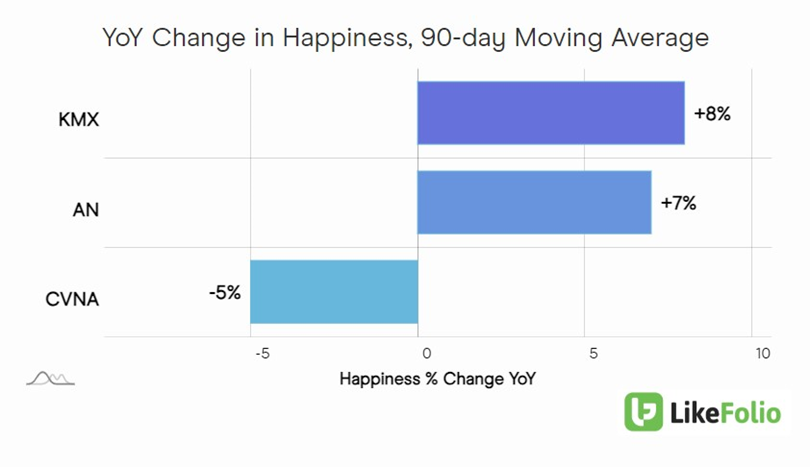

More importantly for CarMax, though, is that underlying consumer data supports an increasingly happy customer base.

KMX Consumer Happiness levels have improved by an impressive 8% year-over-year, whereas CVNA’s have slipped by 5%:

Consumers most often laud CarMax for its no-haggle policy, large selection of vehicles, and customer-friendly return policy and warranty.

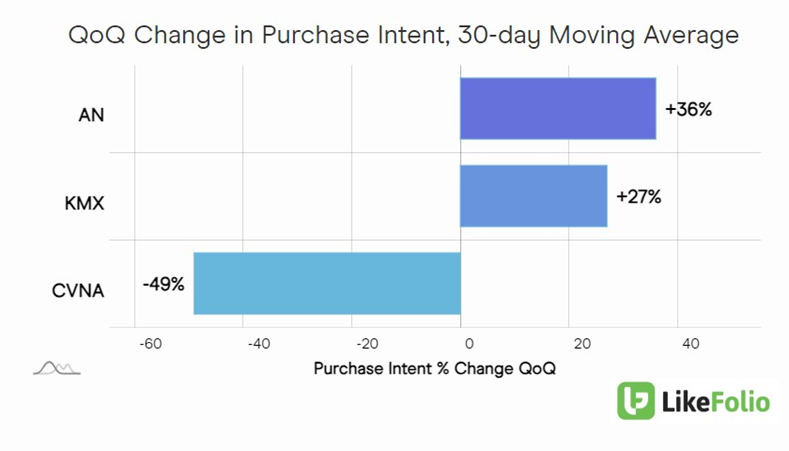

LikeFolio data is also capturing a notable uptick in consumer demand for CarMax over the last quarter. Purchase Intent mentions are up 27% quarter-over-quarter for KMX:

Carvana’s are down 49% on the same scale.

Last quarter, KMX shares popped after a strong earnings report featuring a bump in gross profit margin.

We’ll be watching to see if it can deliver another win tomorrow.

But based on the data, we’re feeling bullish.

🏆 The Verdict: CarMax wins this Derby City Stock Showdown. 🏆

Until next time,

Andy Swan

Founder, LikeFolio