This weekend I volunteered to help out at a birthday party for the three-year-old son of a close friend. I knew I’d be wrangling sugared-up toddlers bouncing off the padded gym walls and diving into the massive foam pit – so I decided to fuel up with a pre-party caffeine run to Starbucks.

But as I customized my drink in the Starbucks app, I suddenly balked.

My Grande bevvy – which means “medium” for us normies – was going to cost me $6. That’s right… six bucks for a fancy cup of coffee.

It’s not that I can’t afford the expense… But I couldn’t justify it.

So I traded down.

Instead of my nitro cold brew with delicious sweet cream, I opted for a tall drip coffee for half the price.

Still, a splurge when I could just brew a cup at home but an expense I can justify for the convenience it provides… And a personal story worth sharing.

Millions of these decisions are being made all across the country as you read this.

Because the “trade-down effect” is real.

I traded down because of careful logic, a personal “cost-benefit” analysis – and a dollar consciousness that dates back to my college days, sticking with me even after becoming a successful investing pro.

But for a large-and-growing number of consumers, the “trade-down effect” is an outright necessity.

Faced with pesky inflation, growing job cuts, rising debt levels, and eroding savings, consumers across the board are having to “trade down” to more affordable menu items or brands.

It’s a macroeconomic shift that LikeFolio’s social media machine has been able to capture on a massive scale – and this dour shift in consumer behavior is likely to be “sticky,” meaning it’ll be with us for some time to come.

There’s plenty of evidence to show us that the tough choices stretched consumers make in the face of spiraling inflation will stick around long after those pricing pressures ease.

This shift will turn some companies into big winners – and transform others into tragic losers.

In this edition of the Derby City Stock Showdown, we’re going to show you one of each…

Trend Watch: Shrinking Consumer Spending Power

To fully grasp the factors driving the “trade-down effect,” let’s drill into the very real pressures facing consumers – starting with the double-whammy of rising debt and falling savings.

Inflation was easing from the 9.1% peak hit back in June but now looks like it’s reaccelerating. And pricing pressures are definitely grinding away at consumer confidence.

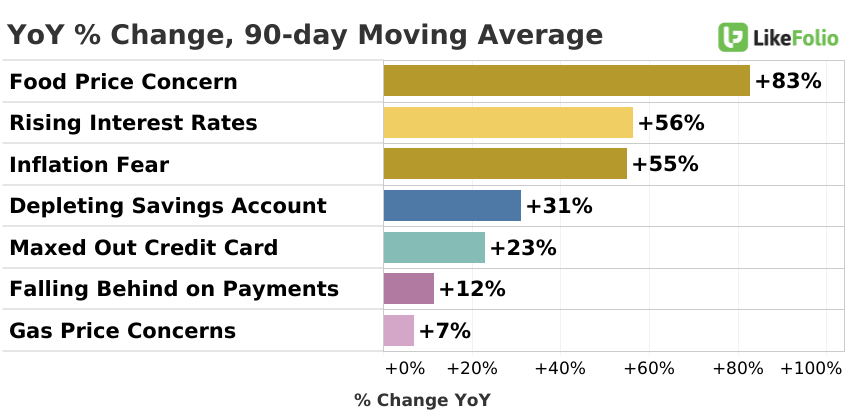

The very real fallout from expensive food, high prices at the gas pump, and more costly vehicle prices have the Average Joe feeling ill at ease, according to LikeFolio data:

A growing number of consumers are living paycheck to paycheck. And that includes more than half of Americans making more than $100,000 a year – a salary most of us thought was “safe” from inflation’s grasp.

Consumers ‘fessing up to being maxed out on credit are at all-time highs:

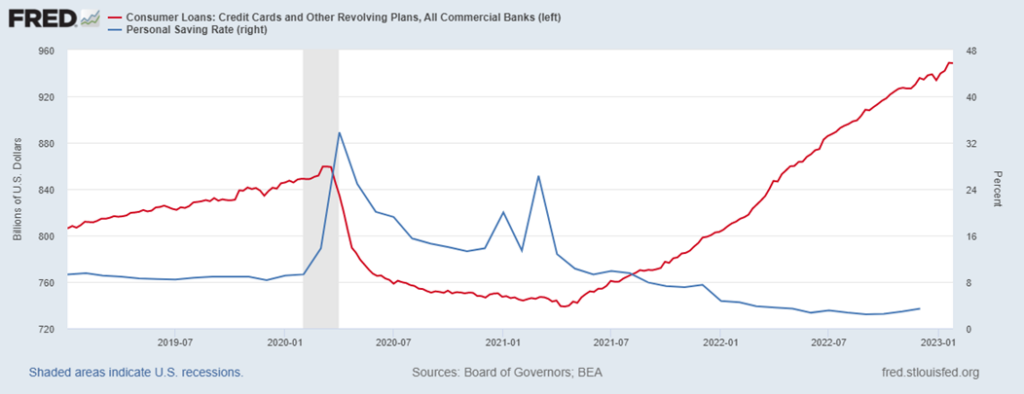

And credit agencies confirm LikeFolio’s macro trend findings: In early February, TransUnion reported that U.S. credit card debt rose nearly 18.5% year-over-year to hit a record high of $930.6 billion.

Consumers might’ve amassed a hefty bankroll during the COVID-19 pandemic thanks to stimulus checks, spiking wages, and base survival instincts.

But once the outlook brightened, those same consumers spent… and spent… and spent…

To the point that they’re now talking about depleted savings accounts at record rates:

In fact, according to the Federal Reserve Bank of St. Louis, the personal savings rate for Americans fell to 3.3% – the lowest personal savings rate since the Great Recession.

You can see both trends at play in the chart below:

Consumers are more vulnerable than they’ve been in years. And they know it.

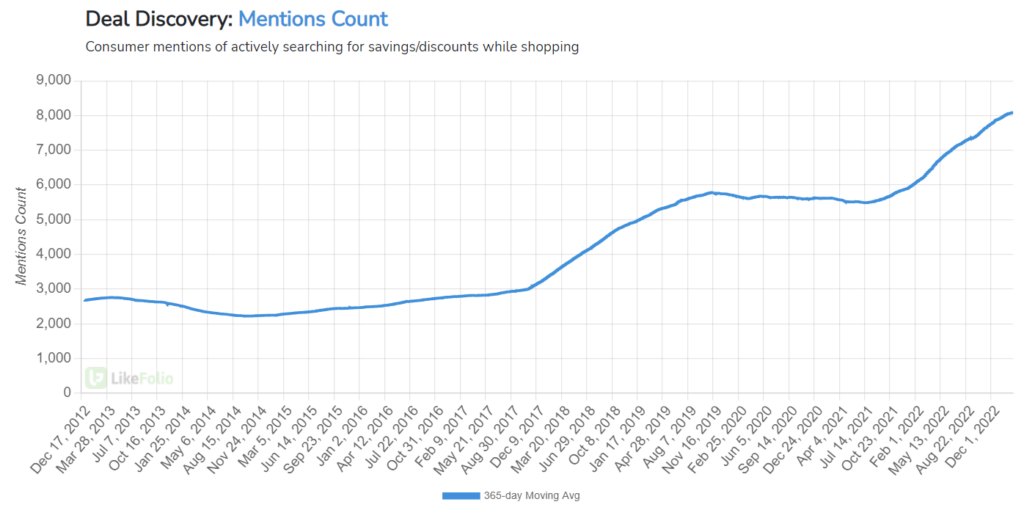

While they may not have the cash to pay off credit cards or restock their bank accounts, consumers are taking control where they’re able.

When it comes to the stuff they’re buying, they’re “trading down” to more affordable brands and products.

Deal hunting is at all-time highs, forcing many companies to mark down precious inventory to get consumers to pull the trigger:

This is impacting some upper-middle-class brands that traditionally operate with high price points… Especially companies operating in discretionary segments, like apparel and décor.

At the same time, however, we’re seeing high-end apparel trending a whopping 146% higher than last year.

So today, we’re doing a “showdown” between two big names in high-end designer apparel – stacking these two to spotlight the winner and the loser.

Stock No. 1: Nordstrom (JWN)

In January, Nordstrom (JWN) said weak sales and numerous markdowns hurt its results in the holiday season, noting: “While we continue to see greater resilience in our higher income cohorts, it is clear that consumers are being more selective with their spending given the broader macro environment.”

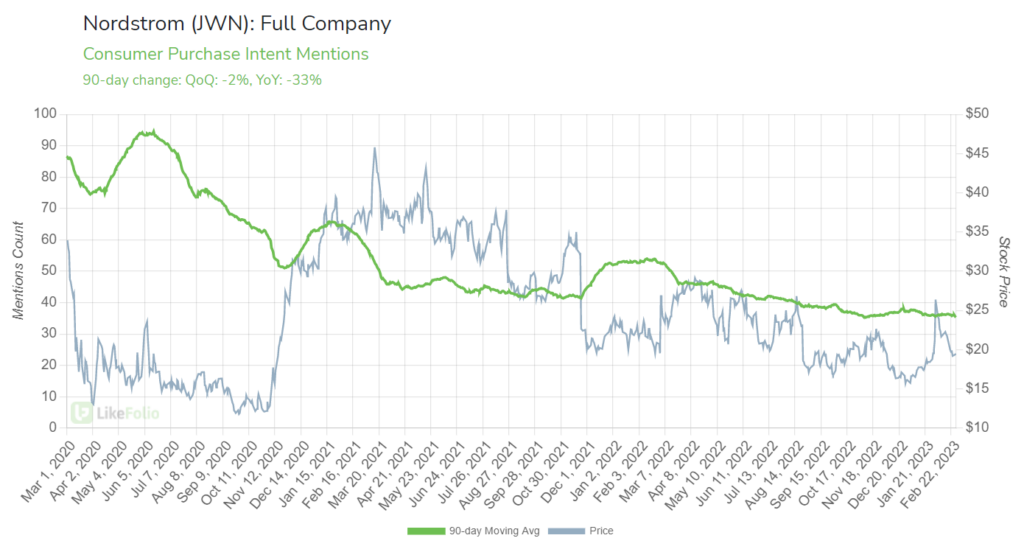

You can see this rejection of Nordstrom’s offerings when it comes to Consumer Purchase Intent (PI) Mentions, which are down 33% from last year:

While Nordstrom shares rallied in February on the hope an activist investor could make over the company’s board and supercharge the brand, LikeFolio data reminds us that there are bigger issues – like reluctant consumers.

Since hitting $27.15 on Feb. 3, the JWN stock price has fizzled to $19 as temporary buzz fades.

Nordstrom is slated to report earnings tomorrow, Mar. 2, and we’ll be watching the results closely.

NORDSTROM (JWN) VERDICT: LOSER 👎

Stock No. 2: Rent the Runway (RENT)

Rent the Runway (RENT) is a subscription-based fashion venture where you can rent designer apparel for a fraction of what it would cost to purchase outright – say, at a department store like Nordstrom.

Some folks have dubbed it “the closet in the cloud” – a great nickname for a company whose game plan seems perfectly matched for a market where you’ve got consumers with expensive tastes but shrinking budgets.

Brand mentions for Rent the Runway are rising (up 50% from last year) as consumers continue to prioritize experiences in a post-COVID economy… And need that “perfect outfit” for the occasion.

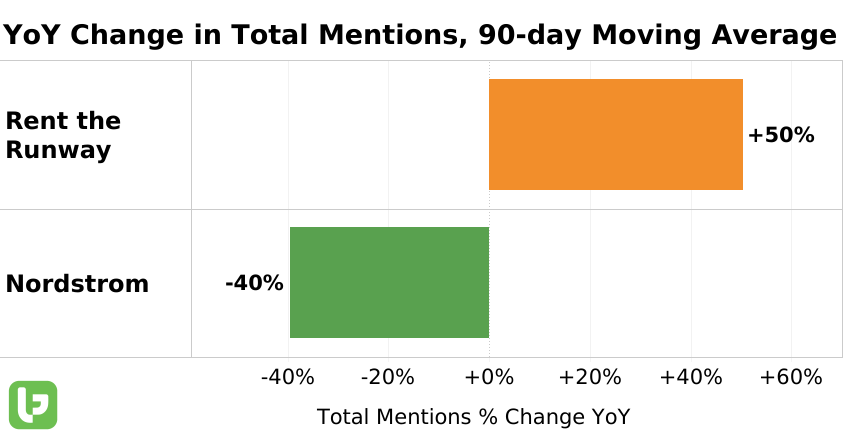

Compare RENT’s uptrend in social media buzz to Nordstrom’s, whose total mentions have fallen 40% over the same period:

Web visits to renttherunway.com are pacing higher too, up 22% from the same time last year:

This tells us that Rent the Runway customers acquired in 2022 are sticking around to add new clothing items to their cart – and that others are likely signing up for new subscriptions.

User retention, a crucial success metric for a subscription-based business like Rent the Runway, is also growing: Repeat web users grew by 5% in the last quarter.

And that’s translating to real revenue. Rent the Runway beat revenue expectations in its Q3 2022 earnings report with 31% year-over-year growth.

RENT THE RUNWAY (RENT) VERDICT: WINNER 👍

The Bottom Line 💰

Even in this trade-down economy, consumers crave high-end apparel – but they want it in a sustainable way. And clothing rental services like Rent the Runway give them a way to stay on-trend for less.

Stay tuned: We’ll be back with still more Derby City Stock Showdowns.

All the best,

Megan Brantley

VP of Research, Derby City Daily